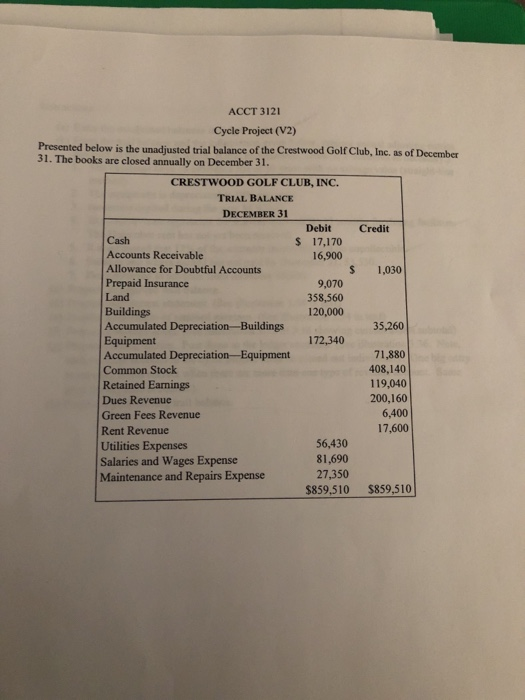

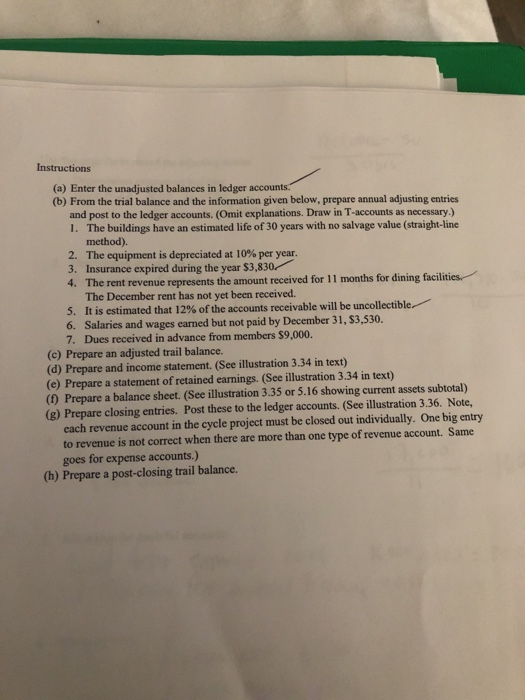

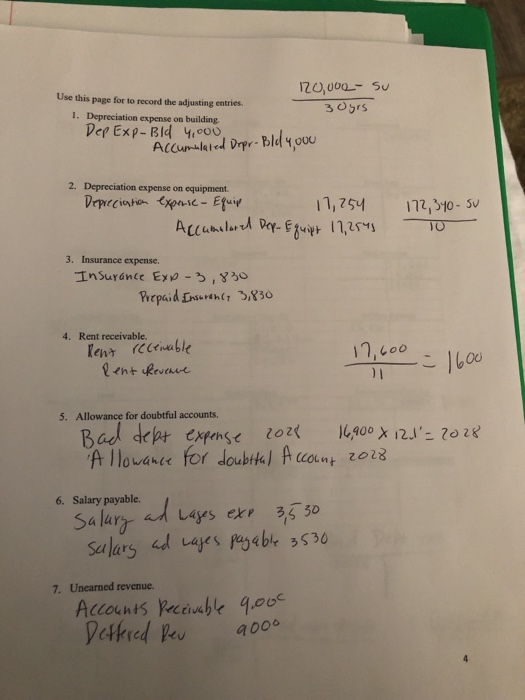

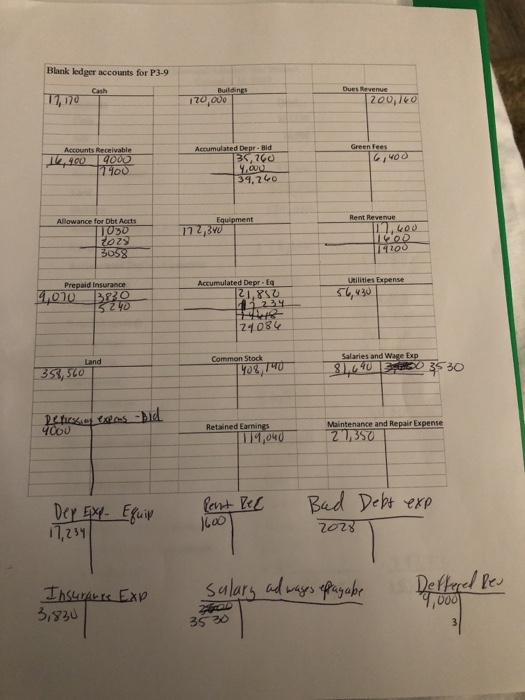

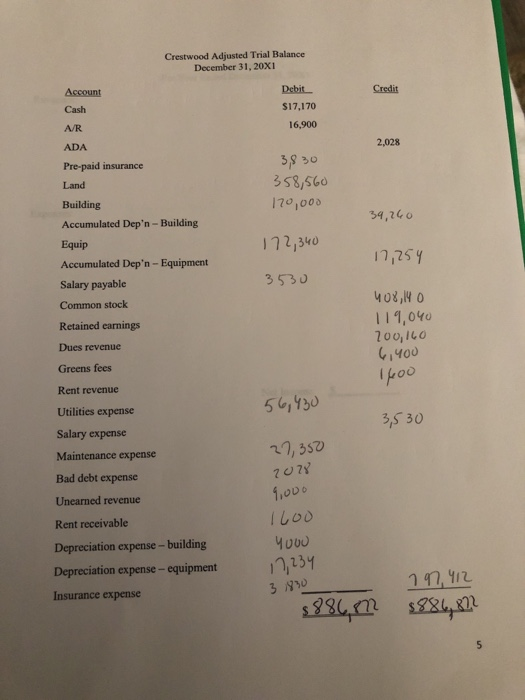

ACCT 3121 Cycle Project (V2) Presented below is the unadjusted trial balance of the Crestwood Golf Club, Inc. as of December 31. The books are closed annually on December 31. CRESTWOOD GOLF CLUB, INC TRIAL BALANCE DECEMBER 31 Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Common Stock Retained Earnings Dues Revenue Green Fees Revenue Rent Revenue Utilities Expenses Salaries and Wages Expense Maintenance and Repairs Expense $ 17,170 16,900 S 1,030 9,070 358,560 120,000 35,260 172,340 71,880 408,140 119,040 200,160 6,400 17,600 56,430 81,690 27,350 $859,510 $859,510 Instructions (a) Enter the unadjusted balances in ledger account (b) From the trial balance and the information given below, prepare annual adjusting entries and post to the ledger accounts. (Omit explanations. Draw in T-accounts as necessary.) 1. The buildings have an estimated life of 30 years with no salvage value (straight-line method). 2. The equipment is depreciated at 10% per year. 3. Insurance expired during the year $3,830 4. The rent represents t revenue represents the amount received for 11 months for dining facilities The December rent has not yet been received. 5. It is estimated that 12% of the accounts receivable will be uncon Salaries and wages earned but not paid by December 31, $3,530. 7. 6. Dues received in advance from members $9,000. (c) Prepare an adjusted trail balance. (d) Prepare and income statement. (See illustration 3.34 in text) (e) Prepare a statement of retained earnings. (See illustration 3.34 in text) (0 Prepare a balance sheet. (See illustration 3.35 or 5.16 showing current assets subtotal) (g) Prepare closing entries. Post these to the ledger accounts. (See illustration 3.36. Note, each revenue account in the cycle project must be closed out individually. One big entry to revenue is not correct when there are more than one type of revenue account. Same goes for expense accounts.) (h) Prepare a post-closing trail balance Use this page for to record the adjusting entries. 1. Depreciation expense on building. Der Exp-Bld 4000 20,000-Su 3 ors 2. Depreciation expense on equipment. 3. Insurance expense. 4. Rent receivable. .loo lent Reveawe 5. Allowance for doubtful accounts, Oware for doubtta) A wount o 6. Salary payable. a lur 7. Unearned revenue Accounts Recusble 9.00 Blank ledger accounts for P3-9 Cash Accumulated Depr-Bld ,700 1100 39,260 Allowance for Dbt Accts Rent Revenue ko I100 Prepaid Insurance Accumulated Depr-Eq Utilities Expense 2408 Land Common Stock Salaries and Wage Exp 530 4000 Retained Earnings Maintenance and Repair Expense 111,040 Pt exp 1 1,231 3,330 35 26 Crestwood Adjusted Trial Balance December 31, 20X1 Credit Cash S17,170 A/R 16,900 ADA 2,028 38 30 3S8,56o 170,o03 Pre-paid insurance Land Building 34,24o 1n,25 408, 0 Accumulated Dep'n- Building Equip 2,340 Accumulated Dep'n-Equipment Salary payable 353u Common stock Retained earnings Dues revenue Greens fees Rent revenue Utilities expense Salary expense Maintenance expense Bad debt expense Unearned revenue 1 11,040 0o,10 Y00 poo 5 6,130 3,5 30 27,3sv .ODo lLoo You nl3y 3 930 Rent receivable Depreciation expense- building Depreciation expense equipment Insurance expense