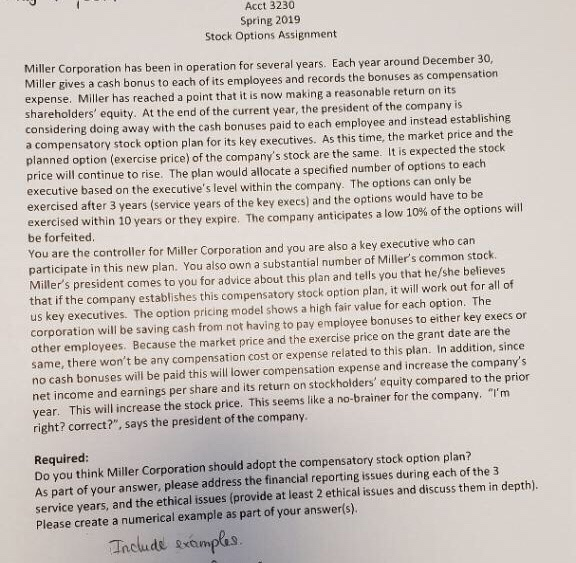

Acct 3230 Spring 2019 Stock Options Assignment Miller Corporation has been in operation for several years. Each year around December 30 Miller gives a cash bonus to each of its employees and records the bonuses as compensation expense. Miller shareholders' equity. At the end of the current year, the president of the company is considering doing away with the cash bonuses paid to each employee and instead establishing has reached a point that it is now making a reasonable return on its compensatory stock option plan for its key executives. As this time, the market price and the planned option (exercise price) of the company's stock are the same. It is expected the stock price will continue to rise. The plan would allocate a specified number of options to each cutive based on the executive's level within the company. The options can only exercised after 3 years (service years of the key execs) and the options would have to be exercised within 10 years or they expire. The company anticipates a low 10% of the options will be forfeited You are the controller for Miller Corporation and you are also a key executive who can participate in this new plan. You also own a substantial number of Miller's common stock Miller's president comes to you for advice about this plan and tells you that he/she believes that if the company establishes this compensatory stock option plan, it will work out for all of us key executives. The option pricing model shows a high fair value for each option. The corporation will be saving cash from not having to pay employee bonuses to either key execs or other employees. Because the market price and the exercise price on the grant date are the same, there won't be any compensation cost or expense related to this plan. In addition, since no cash bonuses will be paid this will lower compensation expense and increase the company's net income and earnings per share and its return on stockholders' equity compared to the prion year. This will increase the stock price. This seems like a no-brainer for the company, "I'm right? correct?", says the president of the company be Required Do you think Miller Corporation shouid adopt the compensatory stock option plan? As part of your answer, please address the financial reporting issues during each of the 3 service years, and the ethical issues (provide at least 2 ethical issues and discuss them in depth) Please create a numerical example as part of your answer(s) Tnclude so mp Acct 3230 Spring 2019 Stock Options Assignment Miller Corporation has been in operation for several years. Each year around December 30 Miller gives a cash bonus to each of its employees and records the bonuses as compensation expense. Miller shareholders' equity. At the end of the current year, the president of the company is considering doing away with the cash bonuses paid to each employee and instead establishing has reached a point that it is now making a reasonable return on its compensatory stock option plan for its key executives. As this time, the market price and the planned option (exercise price) of the company's stock are the same. It is expected the stock price will continue to rise. The plan would allocate a specified number of options to each cutive based on the executive's level within the company. The options can only exercised after 3 years (service years of the key execs) and the options would have to be exercised within 10 years or they expire. The company anticipates a low 10% of the options will be forfeited You are the controller for Miller Corporation and you are also a key executive who can participate in this new plan. You also own a substantial number of Miller's common stock Miller's president comes to you for advice about this plan and tells you that he/she believes that if the company establishes this compensatory stock option plan, it will work out for all of us key executives. The option pricing model shows a high fair value for each option. The corporation will be saving cash from not having to pay employee bonuses to either key execs or other employees. Because the market price and the exercise price on the grant date are the same, there won't be any compensation cost or expense related to this plan. In addition, since no cash bonuses will be paid this will lower compensation expense and increase the company's net income and earnings per share and its return on stockholders' equity compared to the prion year. This will increase the stock price. This seems like a no-brainer for the company, "I'm right? correct?", says the president of the company be Required Do you think Miller Corporation shouid adopt the compensatory stock option plan? As part of your answer, please address the financial reporting issues during each of the 3 service years, and the ethical issues (provide at least 2 ethical issues and discuss them in depth) Please create a numerical example as part of your answer(s) Tnclude so mp