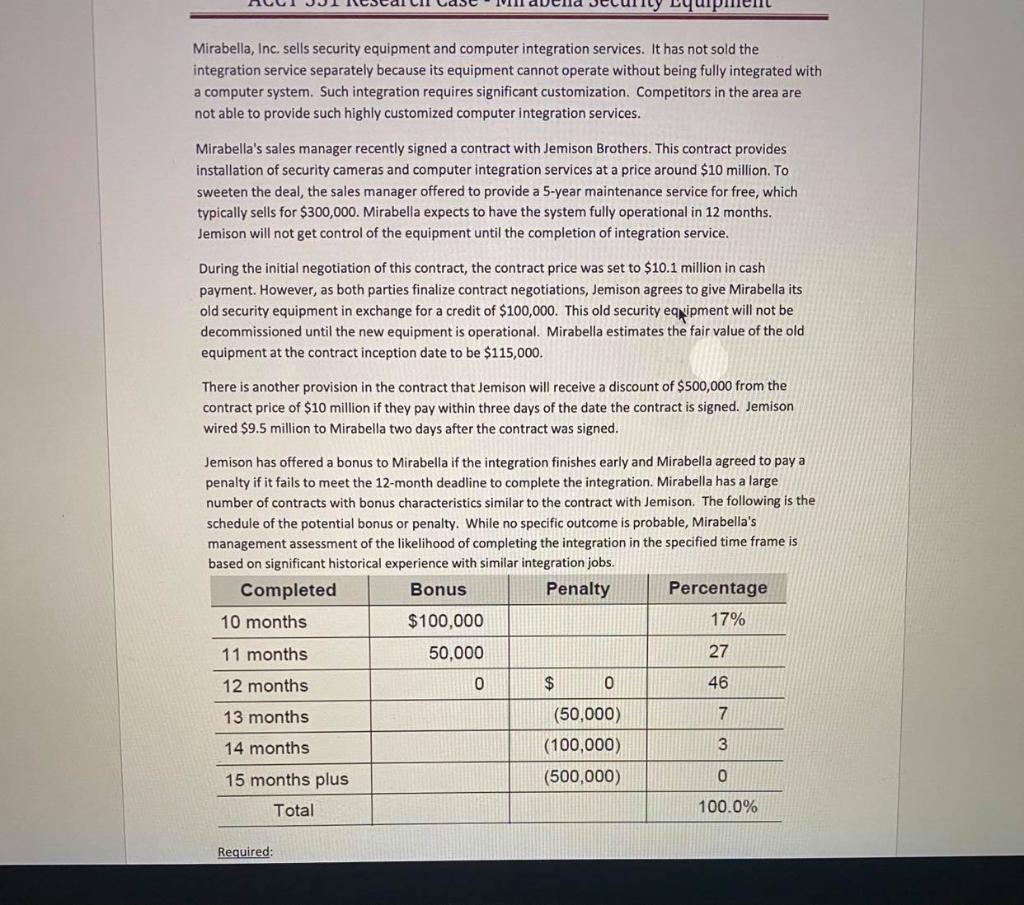

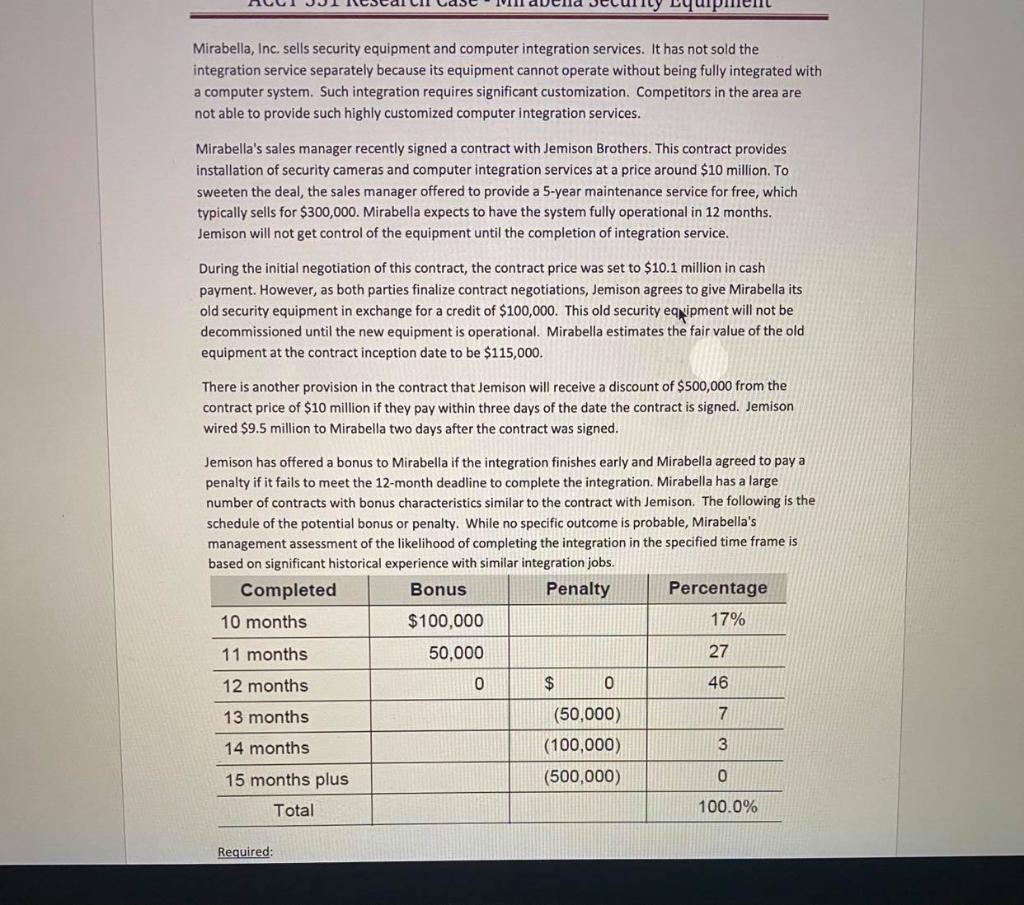

ACCT 351 Research Case - Mirabella Security Equipment Analyze steps 1 through 5 of the revenue recognition standards, i.e., identify the contract, identify the performance obligations, and determine the transaction price. Then allocate the transaction price among performance obligations, and finally discuss how and when revenue should be recognized. In your analysis of each step, provide references to the ASC codification codes to support your conclusion and journal entries. Prepare a report that is three pages MAX, including necessary tablet journal entries, and calculations. There is no need to have a separate reference page if you properly cite the ASC codes (e.g., according to ASC 606-10-25-19, a contract contains multiple performance obligations if ... This contact has X performance obligations because ...) * Journal entries are required for step 5. You need to discuss how (at one time or over a period of time) and when revenue is recognized for each performance obligation. Mirabella, Inc. sells security equipment and computer integration services. It has not sold the integration service separately because its equipment cannot operate without being fully integrated with a computer system. Such integration requires significant customization. Competitors in the area are not able to provide such highly customized computer integration services. Mirabella's sales manager recently signed a contract with Jemison Brothers. This contract provides installation of security cameras and computer integration services at a price around $10 million. To sweeten the deal, the sales manager offered to provide a 5-year maintenance service for free, which typically sells for $300,000. Mirabella expects to have the system fully operational in 12 months. Jemison will not get control of the equipment until the completion of integration service. During the initial negotiation of this contract, the contract price was set to $10.1 million in cash payment. However, as both parties finalize contract negotiations, Jemison agrees to give Mirabella its old security equipment in exchange for a credit of $100,000. This old security equipment will not be decommissioned until the new equipment is operational. Mirabella estimates the fair value of the old equipment at the contract inception date to be $115,000. There is another provision in the contract that Jemison will receive a discount of $500,000 from the contract price of $10 million if they pay within three days of the date the contract is signed. Jemison wired $9.5 million to Mirabella two days after the contract was signed. Jemison has offered a bonus to Mirabella if the integration finishes early and Mirabella agreed to pay a penalty if it fails to meet the 12-month deadline to complete the integration. Mirabella has a large number of contracts with bonus characteristics similar to the contract with Jemison. The following is the schedule of the potential bonus or penalty. While no specific outcome is probable, Mirabella's management assessment of the likelihood of completing the integration in the specified time frame is based on significant historical experience with similar integration jobs. Completed Bonus Penalty Percentage 10 months $100,000 17% 11 months 50,000 27 12 months 0 $ 0 46 13 months (50,000) 7 14 months (100,000) 3 15 months plus (500,000) 0 Total 100.0% Required: ACCT 351 Research Case - Mirabella Security Equipment Analyze steps 1 through 5 of the revenue recognition standards, i.e., identify the contract, identify the performance obligations, and determine the transaction price. Then allocate the transaction price among performance obligations, and finally discuss how and when revenue should be recognized. In your analysis of each step, provide references to the ASC codification codes to support your conclusion and journal entries. Prepare a report that is three pages MAX, including necessary tablet journal entries, and calculations. There is no need to have a separate reference page if you properly cite the ASC codes (e.g., according to ASC 606-10-25-19, a contract contains multiple performance obligations if ... This contact has X performance obligations because ...) * Journal entries are required for step 5. You need to discuss how (at one time or over a period of time) and when revenue is recognized for each performance obligation. Mirabella, Inc. sells security equipment and computer integration services. It has not sold the integration service separately because its equipment cannot operate without being fully integrated with a computer system. Such integration requires significant customization. Competitors in the area are not able to provide such highly customized computer integration services. Mirabella's sales manager recently signed a contract with Jemison Brothers. This contract provides installation of security cameras and computer integration services at a price around $10 million. To sweeten the deal, the sales manager offered to provide a 5-year maintenance service for free, which typically sells for $300,000. Mirabella expects to have the system fully operational in 12 months. Jemison will not get control of the equipment until the completion of integration service. During the initial negotiation of this contract, the contract price was set to $10.1 million in cash payment. However, as both parties finalize contract negotiations, Jemison agrees to give Mirabella its old security equipment in exchange for a credit of $100,000. This old security equipment will not be decommissioned until the new equipment is operational. Mirabella estimates the fair value of the old equipment at the contract inception date to be $115,000. There is another provision in the contract that Jemison will receive a discount of $500,000 from the contract price of $10 million if they pay within three days of the date the contract is signed. Jemison wired $9.5 million to Mirabella two days after the contract was signed. Jemison has offered a bonus to Mirabella if the integration finishes early and Mirabella agreed to pay a penalty if it fails to meet the 12-month deadline to complete the integration. Mirabella has a large number of contracts with bonus characteristics similar to the contract with Jemison. The following is the schedule of the potential bonus or penalty. While no specific outcome is probable, Mirabella's management assessment of the likelihood of completing the integration in the specified time frame is based on significant historical experience with similar integration jobs. Completed Bonus Penalty Percentage 10 months $100,000 17% 11 months 50,000 27 12 months 0 $ 0 46 13 months (50,000) 7 14 months (100,000) 3 15 months plus (500,000) 0 Total 100.0% Required