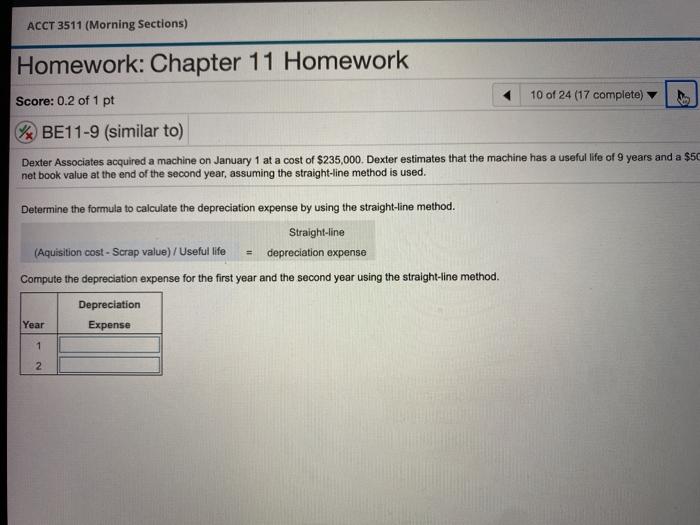

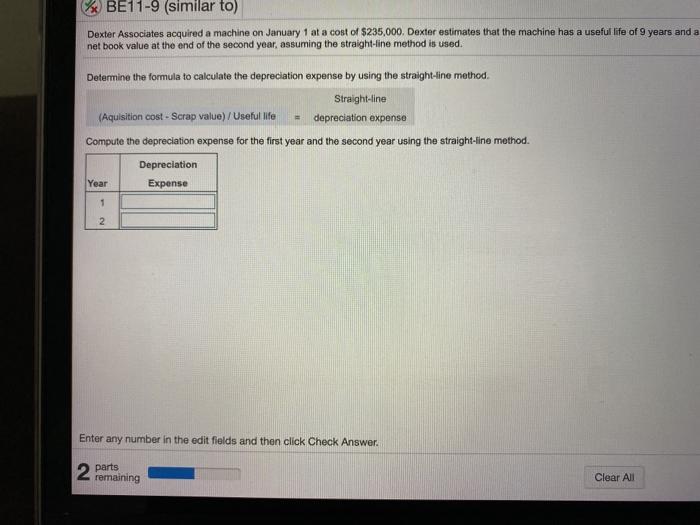

ACCT 3511 (Morning Sections) Homework: Chapter 11 Homework Score: 0.2 of 1 pt 10 of 24 (17 complete) BE11-9 (similar to) Dexter Associates acquired a machine on January 1 at a cost of $235,000. Dexter estimates that the machine has a useful life of 9 years and a $50 net book value at the end of the second year, assuming the straight-line method is used. Determine the formula to calculate the depreciation expense by using the straight-line method. Straight-line (Aquisition cost - Scrap value) / Useful life depreciation expense Compute the depreciation expense for the first year and the second year using the straight-line method. Depreciation Year Expense 1 2 Save apter 11 Homework 10 of 24 (17 complete) HW Score: 62.76%, 18. 2 of 29 pt Question Help on January at a cost of 5235,000 Doctor estimates that the machine has a tota lo of 9 years and a $50,500 residual valus. Compute the depreciation expense for the fint two years and determine and year, assuming the straight-line method is used depreciation expense by using the straighting method Strahtine depreciation expense the first year and the second year using the straight line method and then click Check Answer Clear All Check Anuwe BE11-9 (similar to) Dexter Associates acquired a machine on January 1 at a cost of $235,000. Dexter estimates that the machine has a useful life of 9 years and a net book value at the end of the second year, assuming the straight-line method is used. Determine the formula to calculate the depreciation expense by using the straight-line method Straight-line (Aquisition cost - Scrap value) /Useful life = depreciation expense Compute the depreciation expense for the first year and the second year using the straight-line method. Depreciation Expense Year 1 2 Enter any number in the edit fields and then click Check Answer 2 Pernaining Clear All er 11 Homework Save 10 of 24 (17 complete) HW Score: 62.76%, 18.2 of 29 pts Question Help anuary 1 at a cost of $235,000. Deder estimates that the machine has a useful life of 9 years and a $50,500 residual value. Compute the depreciation expense for the first two years and determine the ar, assuming the straight-line method is used eciation expense by using the straight-line method. Straight-line preciation expense First year and the second year using the straight-line method. then click Check Answer Check Answer Clear All