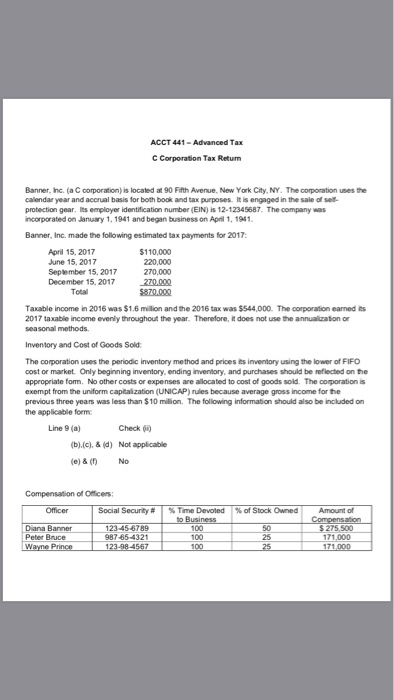

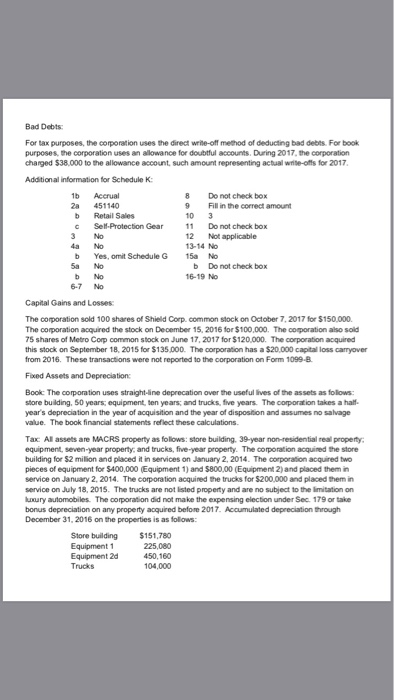

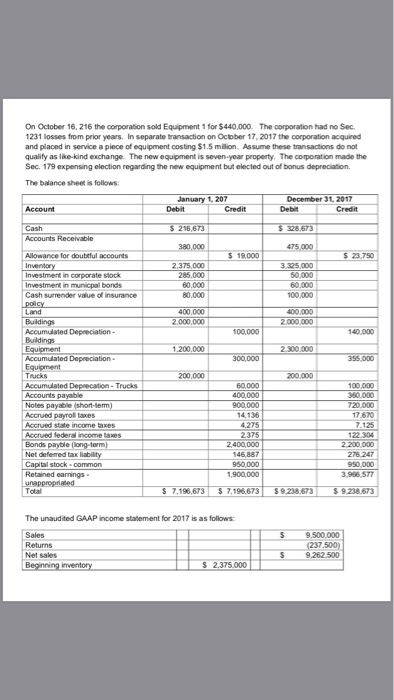

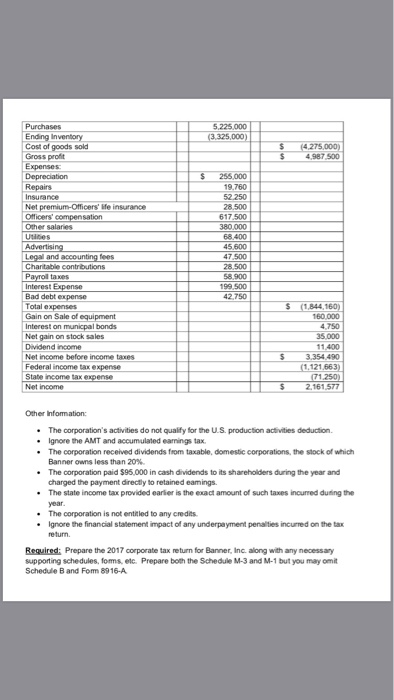

ACCT 441-Advanced Tax C Corporation Tax Retum Banner, Inc. (a C corporation) is located at 90 Fifth Avenue, New York City, NY. The corporation uses the calendar year and acorual basis for both book and tax purposes. It is engaged in the sale of sef protection gear. Its employer identification number (EIN) is 12-12345687. The company was incorporated on Janury 1,1941 and began business on April 1, 1941 Banner, Inc. made the following estimated tax payments for 2017: April 15, 2017 June 15, 2017 Seplember 15, 2017 December 15, 2017 $110,000 220,000 270,000 270,000 $870,000 Total Taxable income in 2016 was $1.6 million and the 2016 tax was $544,000. The corporation earned ts 2017 taxable income evenly throughout the year. Therefore, it does not use the annualization or seasonal methods Inventory and Cost of Goods Sold The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market Only beginning inventory, ending inventory, and purchases should be reflected on the appropriate fomm. No other costs or expenses are allocated to cost of goods sold. The coporation is exempt from the uniform capitalization (UNICAP) rules because average gross income for the previous three years was less than $10 million. The following information should also be included on the applicable form: Line 9 (a) Check 0 (b)(c), & (d) Not applicable (e) & ( No Officer Social Security # | %Tme Devoted %ofStock Owned Amount of Diana Banner Peter Bruce 123-45 6789 987-85-4321 50 25 275 500 171,000 100 ACCT 441-Advanced Tax C Corporation Tax Retum Banner, Inc. (a C corporation) is located at 90 Fifth Avenue, New York City, NY. The corporation uses the calendar year and acorual basis for both book and tax purposes. It is engaged in the sale of sef protection gear. Its employer identification number (EIN) is 12-12345687. The company was incorporated on Janury 1,1941 and began business on April 1, 1941 Banner, Inc. made the following estimated tax payments for 2017: April 15, 2017 June 15, 2017 Seplember 15, 2017 December 15, 2017 $110,000 220,000 270,000 270,000 $870,000 Total Taxable income in 2016 was $1.6 million and the 2016 tax was $544,000. The corporation earned ts 2017 taxable income evenly throughout the year. Therefore, it does not use the annualization or seasonal methods Inventory and Cost of Goods Sold The corporation uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market Only beginning inventory, ending inventory, and purchases should be reflected on the appropriate fomm. No other costs or expenses are allocated to cost of goods sold. The coporation is exempt from the uniform capitalization (UNICAP) rules because average gross income for the previous three years was less than $10 million. The following information should also be included on the applicable form: Line 9 (a) Check 0 (b)(c), & (d) Not applicable (e) & ( No Officer Social Security # | %Tme Devoted %ofStock Owned Amount of Diana Banner Peter Bruce 123-45 6789 987-85-4321 50 25 275 500 171,000 100