Answered step by step

Verified Expert Solution

Question

1 Approved Answer

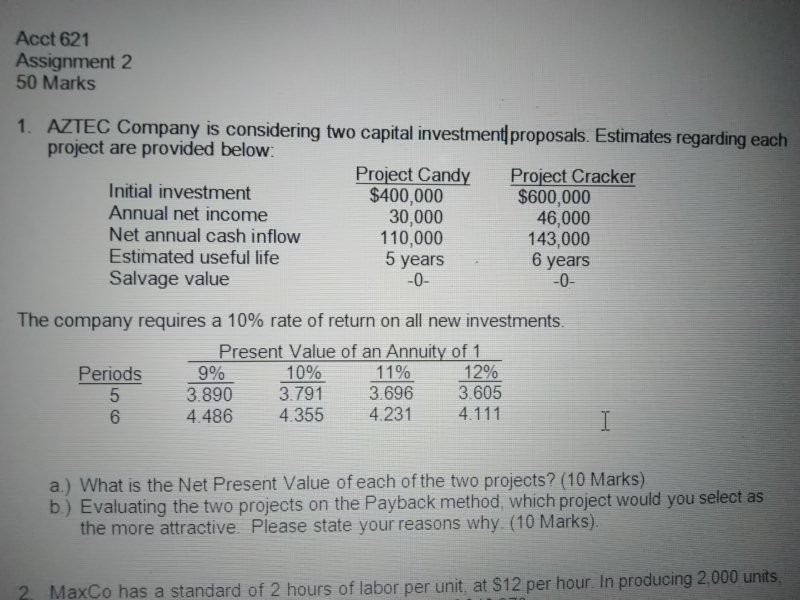

Acct 621 Assignment 2 50 Marks 1. AZTEC Company is considering two capital investment proposals. Estimates regarding each project are provided below: Project Candy Project

Acct 621 Assignment 2 50 Marks 1. AZTEC Company is considering two capital investment proposals. Estimates regarding each project are provided below: Project Candy Project Cracker Initial investment $400,000 $600,000 Annual net income 30,000 46,000 Net annual cash inflow 110,000 143,000 Estimated useful life 6 years Salvage value -0- 5 years The company requires a 10% rate of return on all new investments. Present Value of an Annuity of 1 Periods 9% 10% 11% 12% 5 3.890 3.791 3.696 3.605 6 4.486 4.355 4.231 4.111 I a.) What is the Net Present Value of each of the two projects? (10 Marks) b) Evaluating the two projects on the Payback method, which project would you select as the more attractive. Please state your reasons why (10 Marks). 2 MaxCo has a standard of 2 hours of labor per unit, at $12 per hour. In producing 2,000 units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started