Question

ACCT110 Accounting Principles I Memo: Analyze Basic Financial Statements Assignment This assignment is worth 5% of your grade Deadline Due by the end of Week

ACCT110 Accounting Principles I

Memo: Analyze Basic Financial Statements Assignment

This assignment is worth 5% of your grade

Deadline

Due by the end of Week 5 at 11:59 pm, ET.

Outcomes

Completing this Assessment will help you to meet the following:

Course Outcomes

Analyze basic financial statements using computerization.

Interpret and apply Generally Accepted Accounting Principles (GAAP) to analyze, record, and report financial information for a service business using computerization.

Institutional Outcomes

Quantitative and Scientific Reasoning - Follow established methods of inquiry and mathematical reasoning to form conclusions and make decisions.

Directions

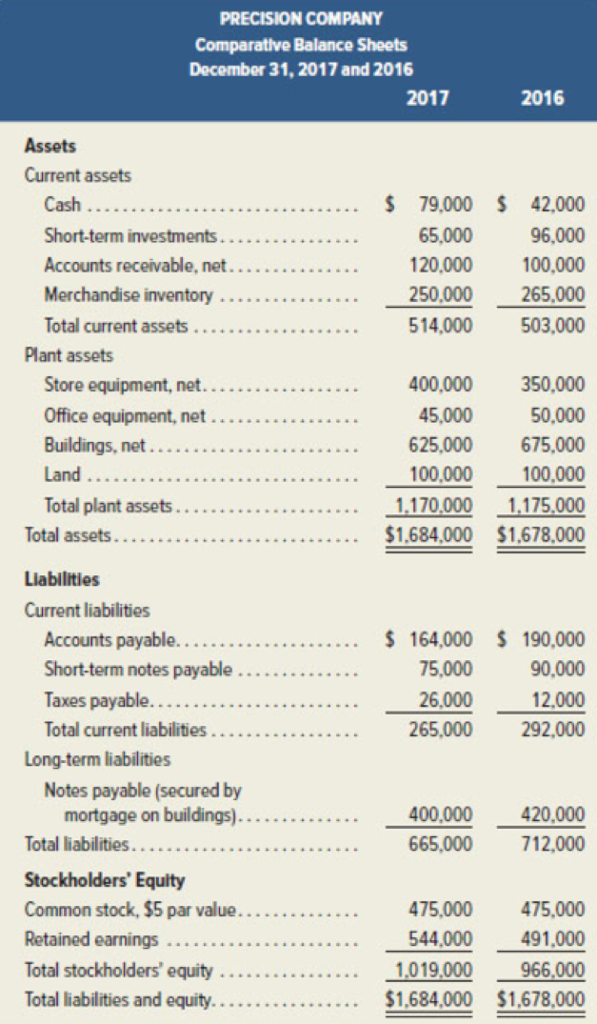

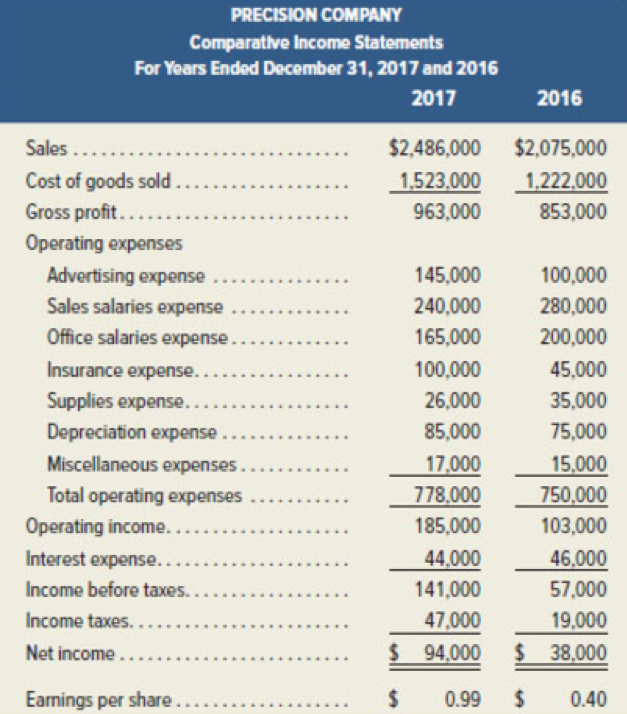

Precision company wishes to expand but needs a $300,000 loan. The bank requests that Precision prepare a balance sheet and key financial ratios. Precision has kept formal records and is able to provide financial statements as of December 31, 2017. The industry debt ratio averages 45.00%. The industry return on assets is 2.0%.

You represent Ideal Bank and will present your findings in a memo to report the ratios for Precision, and identify the conclusion of your opinion reached from your analysis of the companys financials. The memo is to be copied and distributed to the VP of Ideal Bank, so a well-written and detailed memo is crucial. Your memo will be crucial to bank leaders decision to lend Precision the $300,000.

Make sure you use complete sentences. Check your work for proper spelling, grammar and punctuation. There is no set format. However, to receive full credit, you must fully answer each requirement below.

Required:

Use the financial statements below of Precision Co. to complete the requirements.

1a. Compute Precisions return on total assets for 2017 (Return on total assets is defined in your textbook).

1b. Identify and explain its building block category for financial statement analysis.

2a. Compute Precisions debt ratio for 2017 (Debt ratio is defined in your textbook).

2b. Identify and explain its building block category for financial statement analysis.

3. Based on the debt ratio, return on total assets, and your analysis of the financial statements, do you think Precision Co. qualifies for a $300,000 bank loan? Why or why not? Explain your decision.

| Precision Company |

|

|

Memorandum

To: Recipient Name

From: Your Name

CC: CC Name

Some of the sample text in this document indicates the name of the style applied, so that you can easily apply the same formatting again. To get started right away, just tap any placeholder text (such as this) and start typing.

View and edit this document in Word on your computer, tablet, or phone. You can edit text; easily insert content such as pictures, shapes, or tables; and seamlessly save the document to the cloud from Word on your Windows, Mac, Android, or iOS device.

Want to insert a picture from your files or add a shape, text box, or table? You got it! On the Insert tab of the ribbon, just tap the option you need.

Find even more easy-to-use tools on the Insert tab, such as to add a hyperlink or insert a comment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started