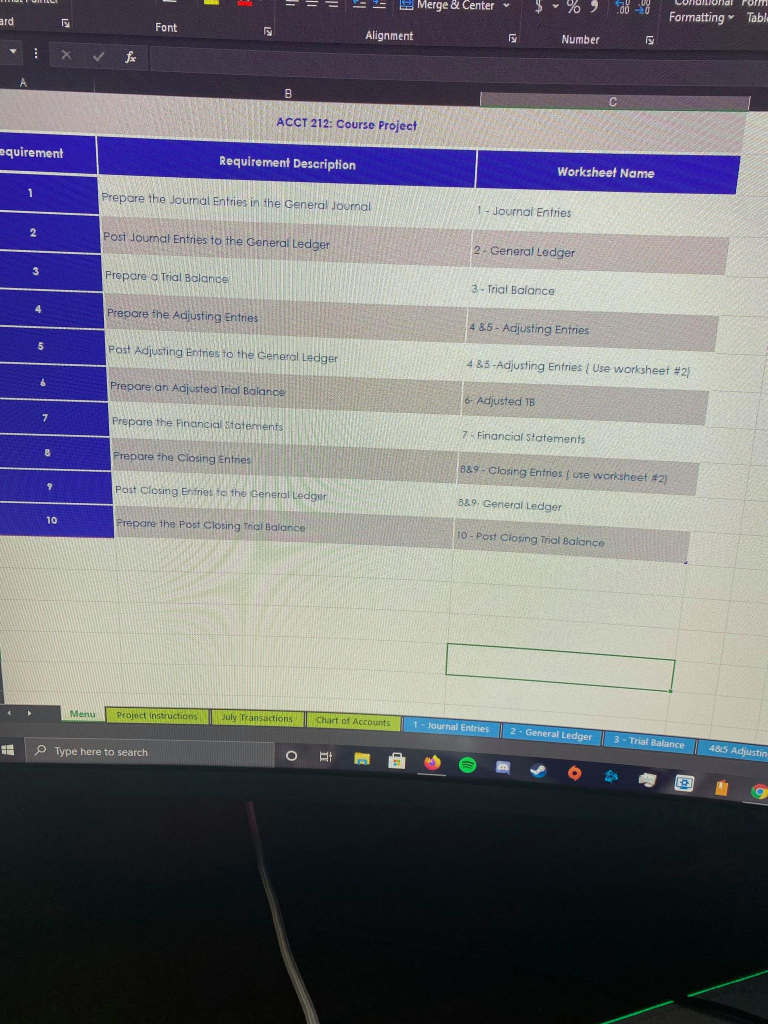

ACCT212 Course Project

Peters Pool Corporation Ledger

DID NOT REALIZE MY PROFESSOR SENT THE ANSWER SHEET TO ME. wow.

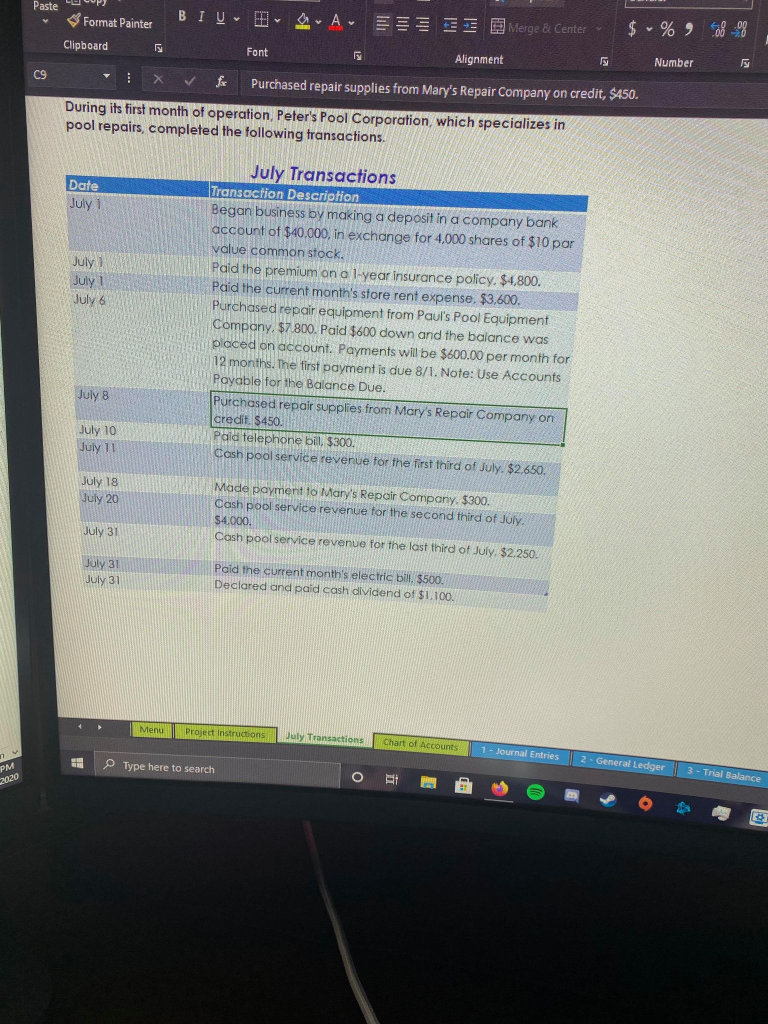

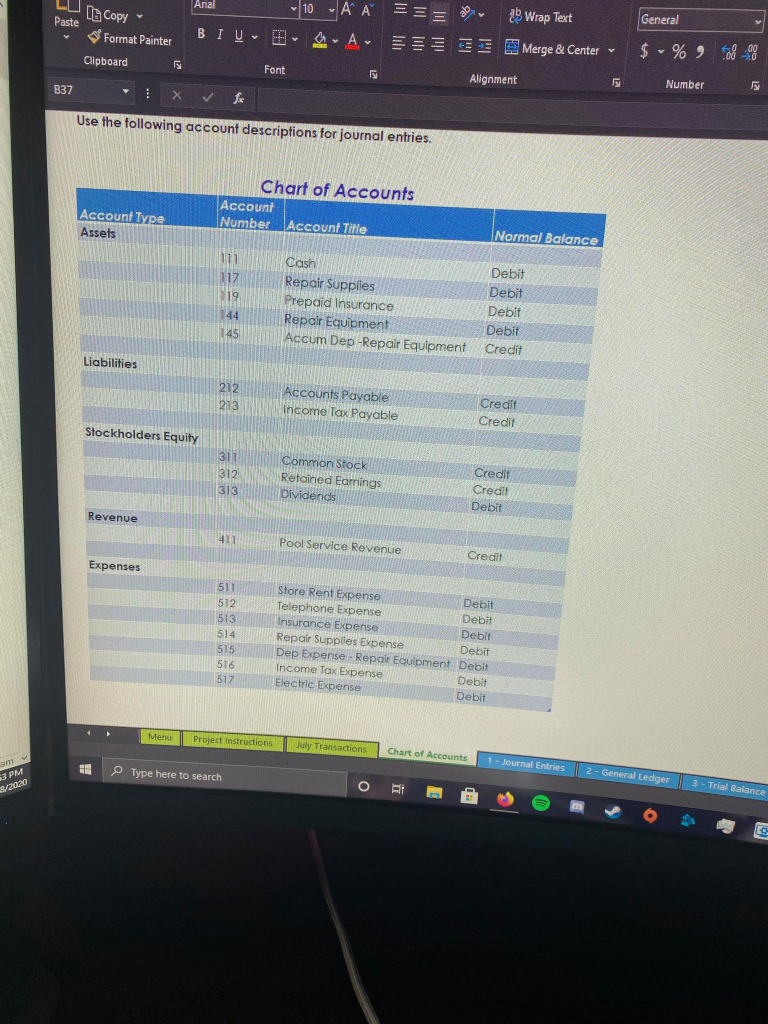

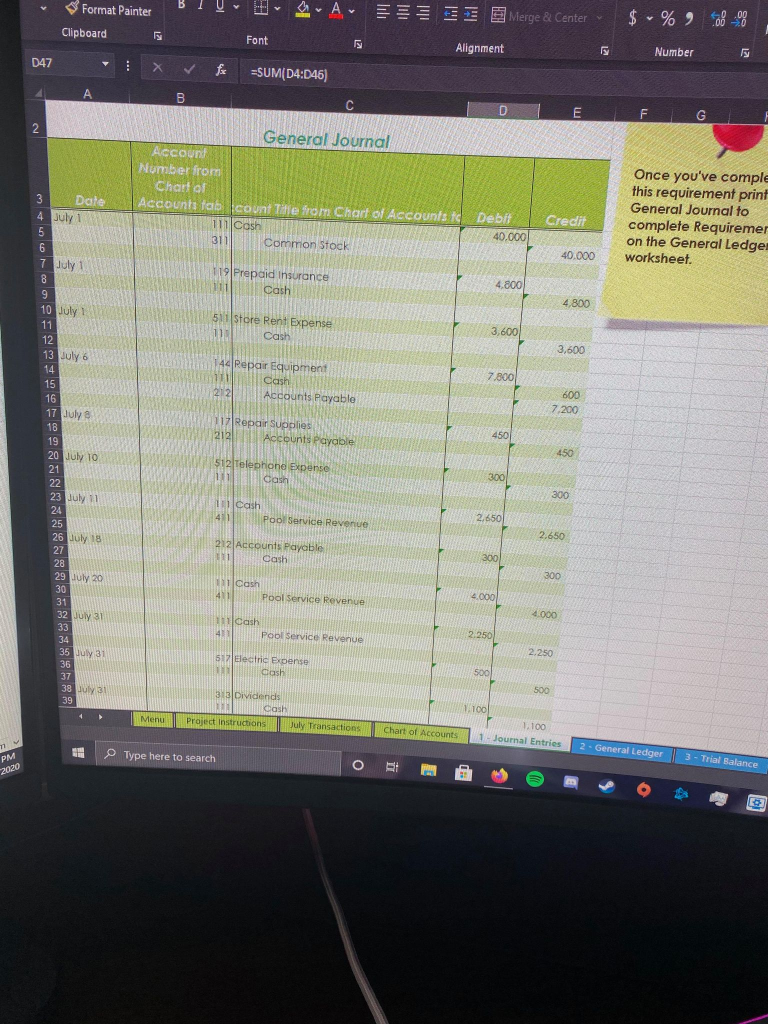

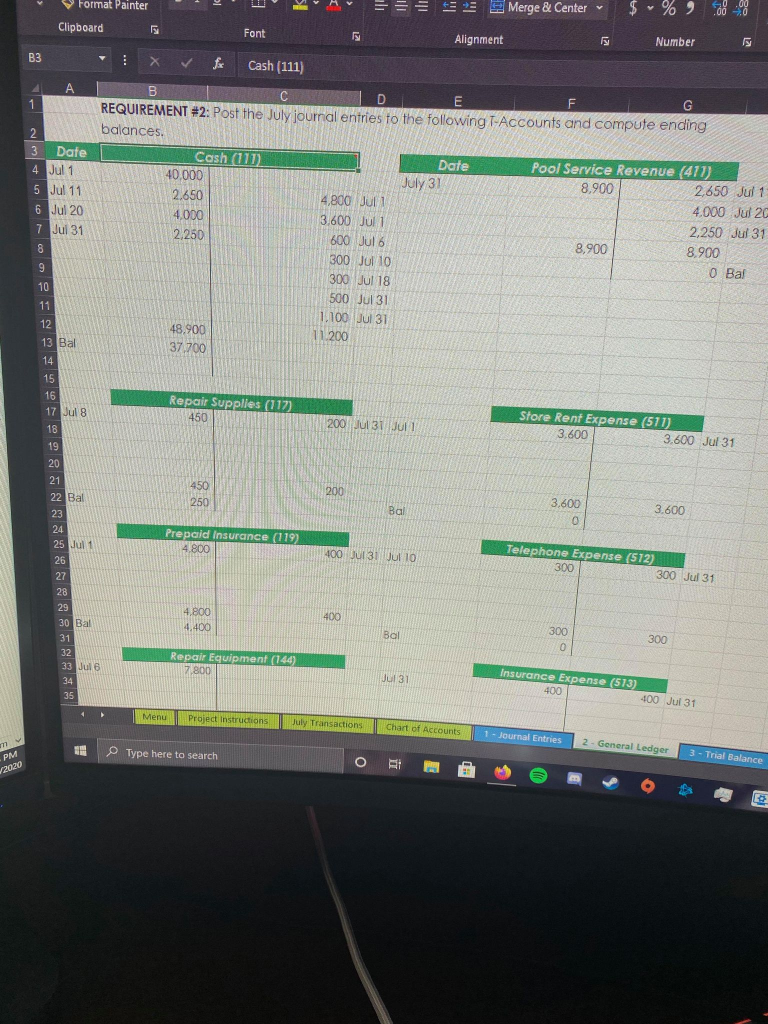

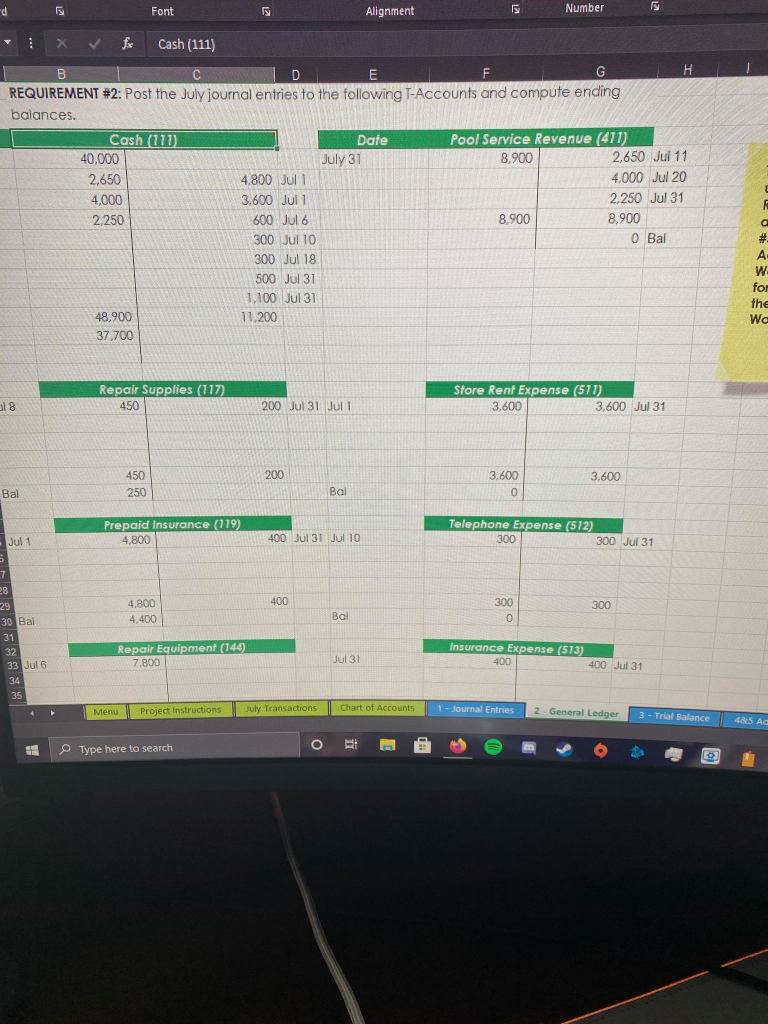

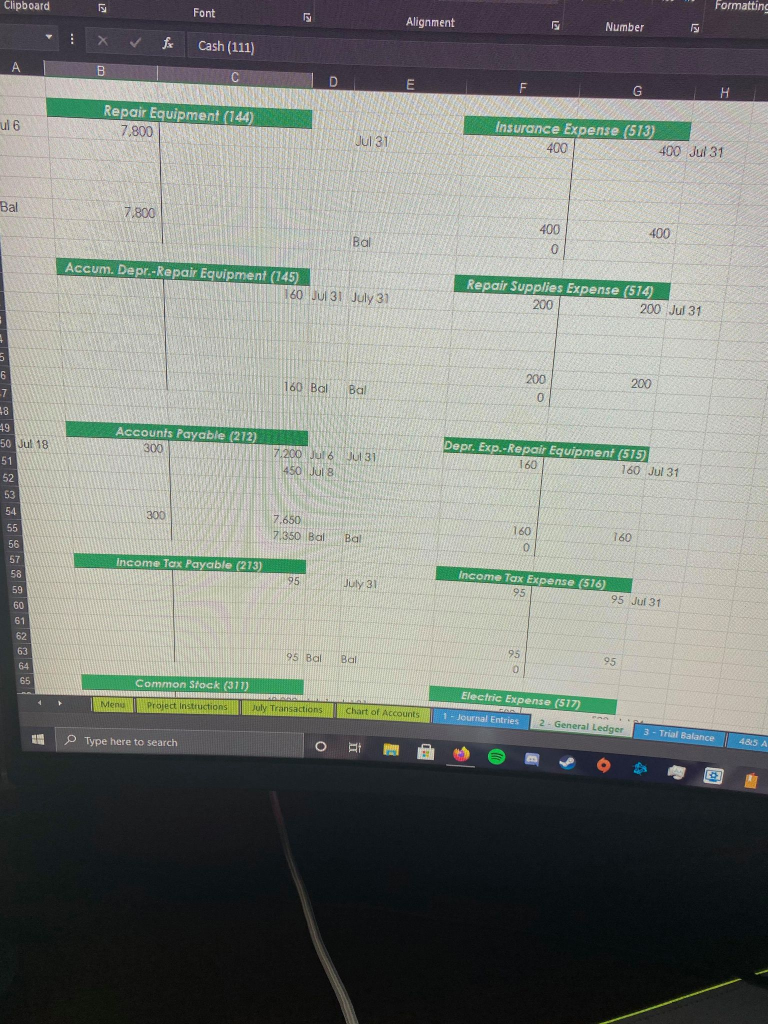

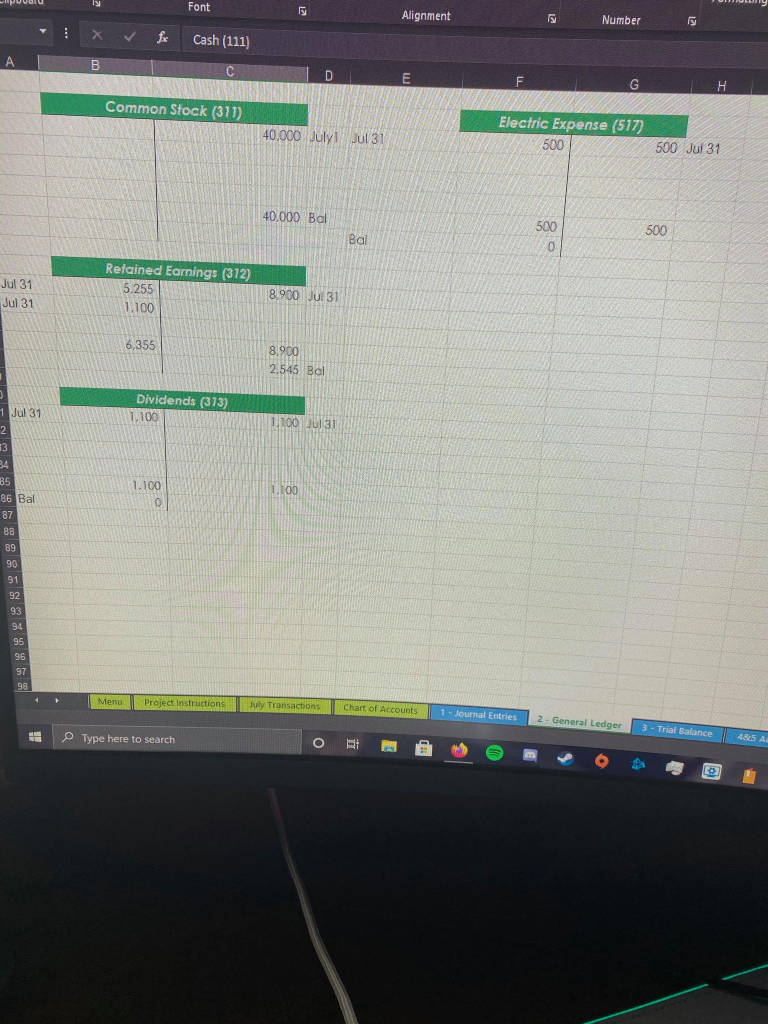

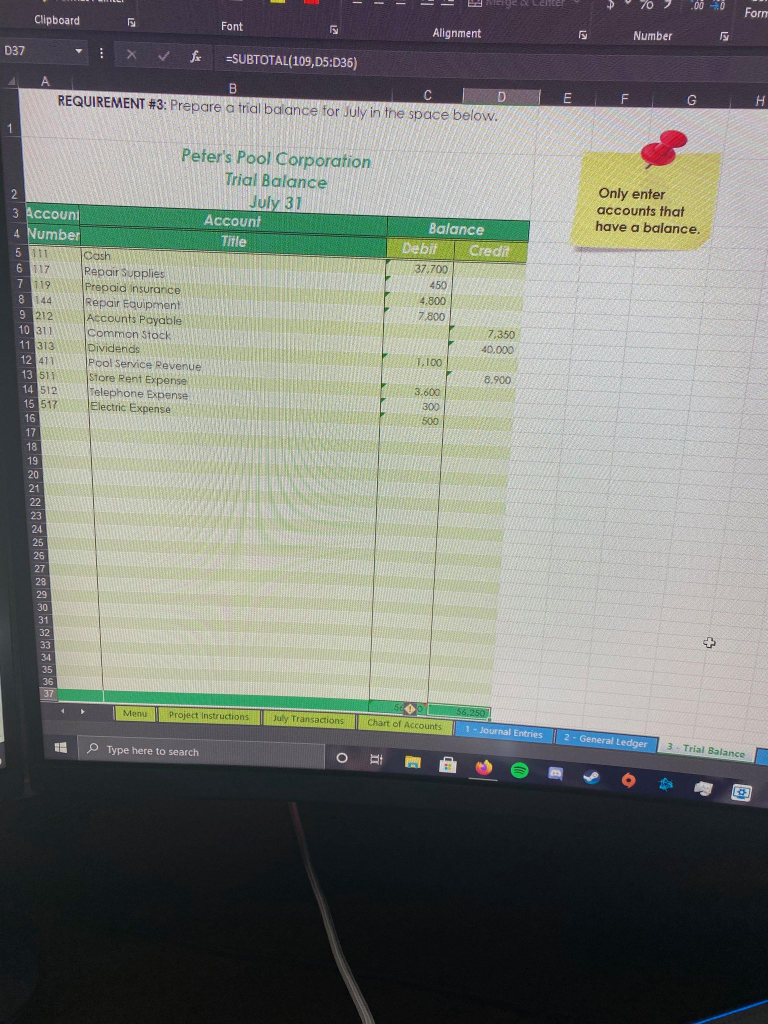

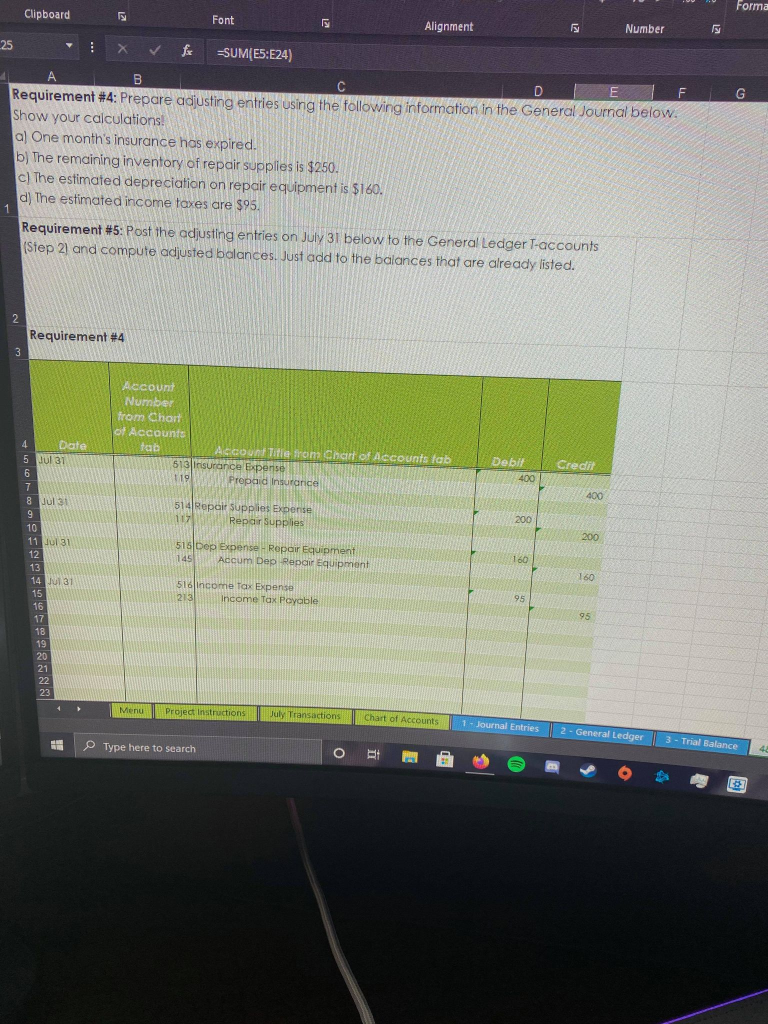

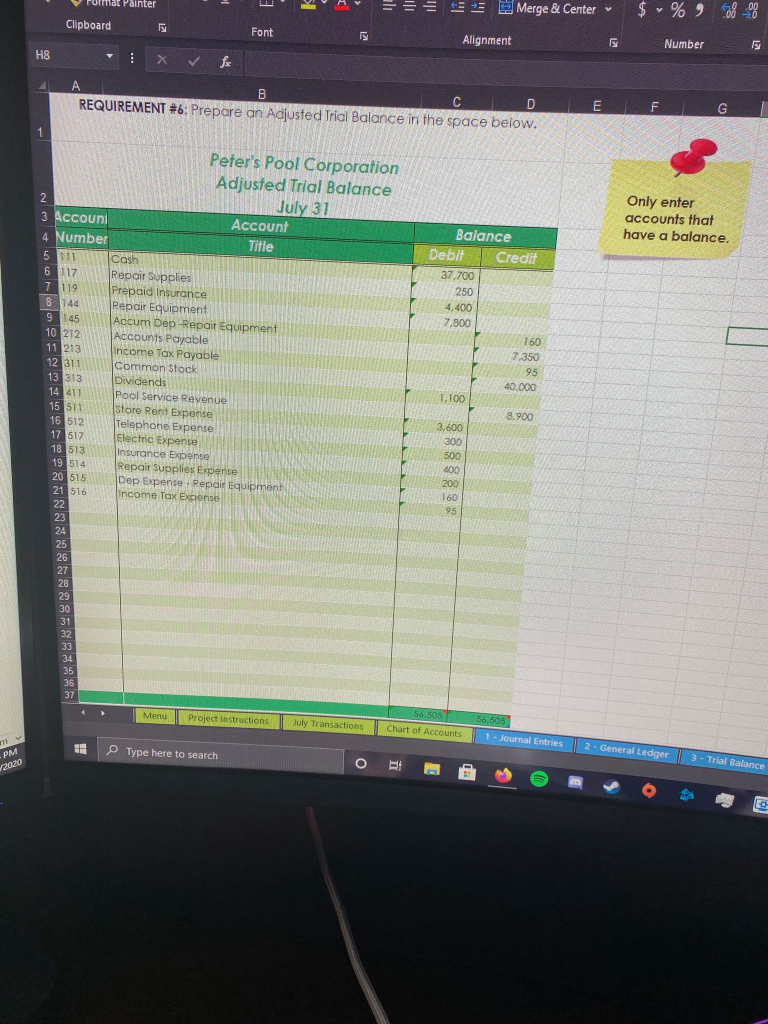

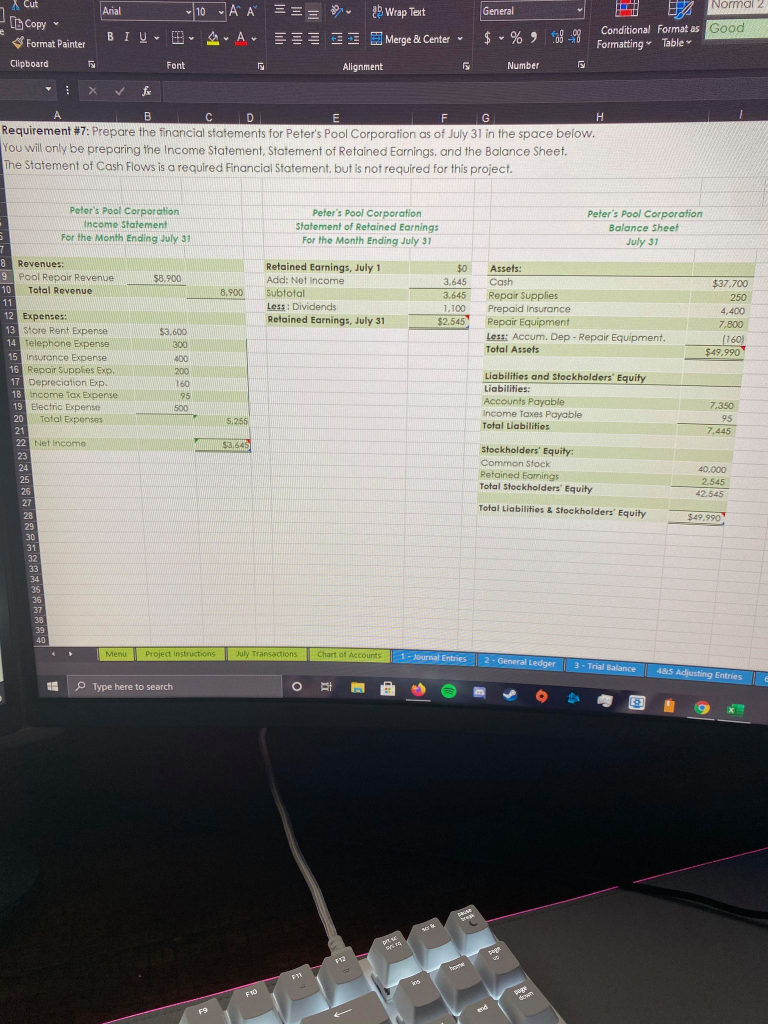

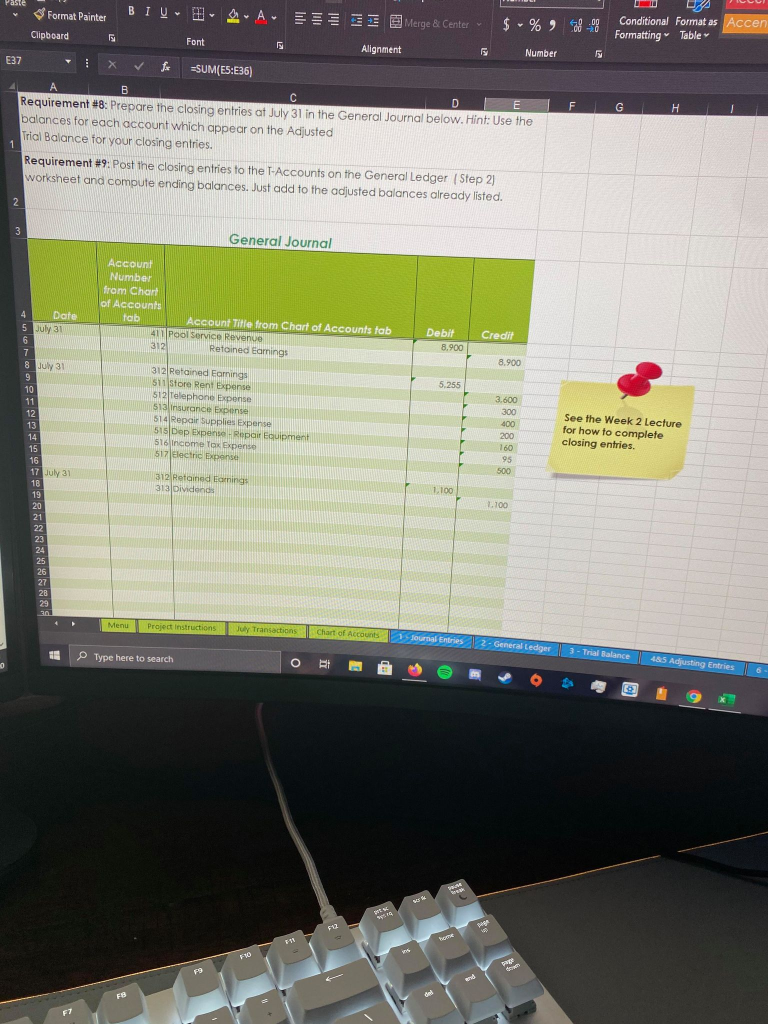

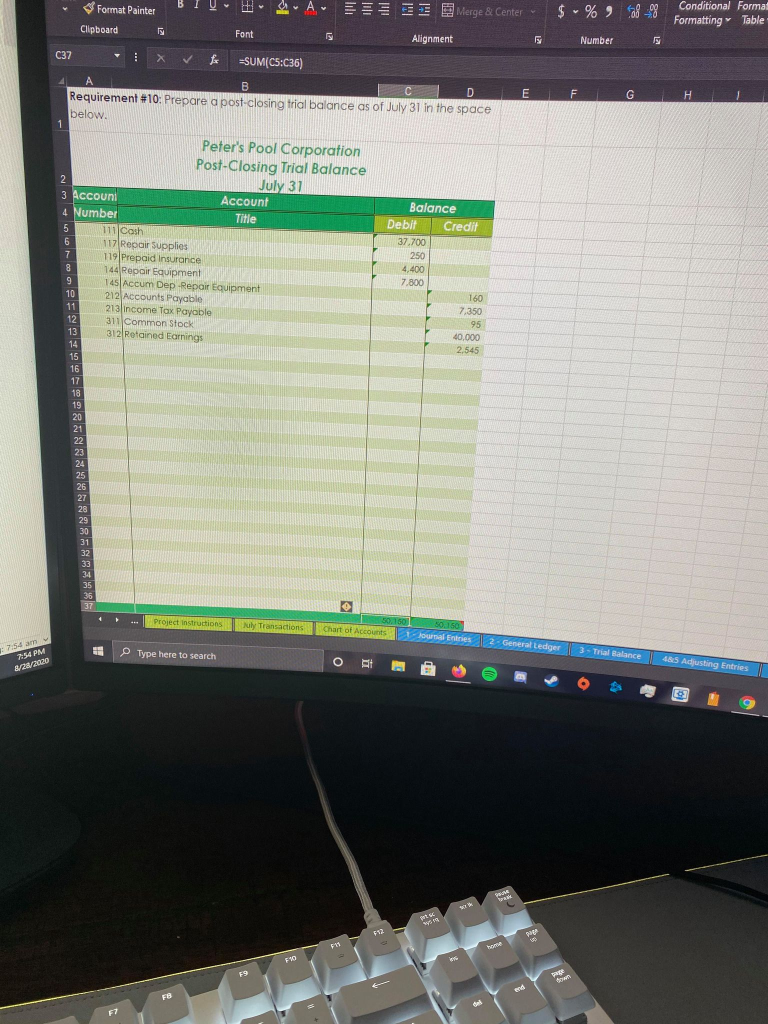

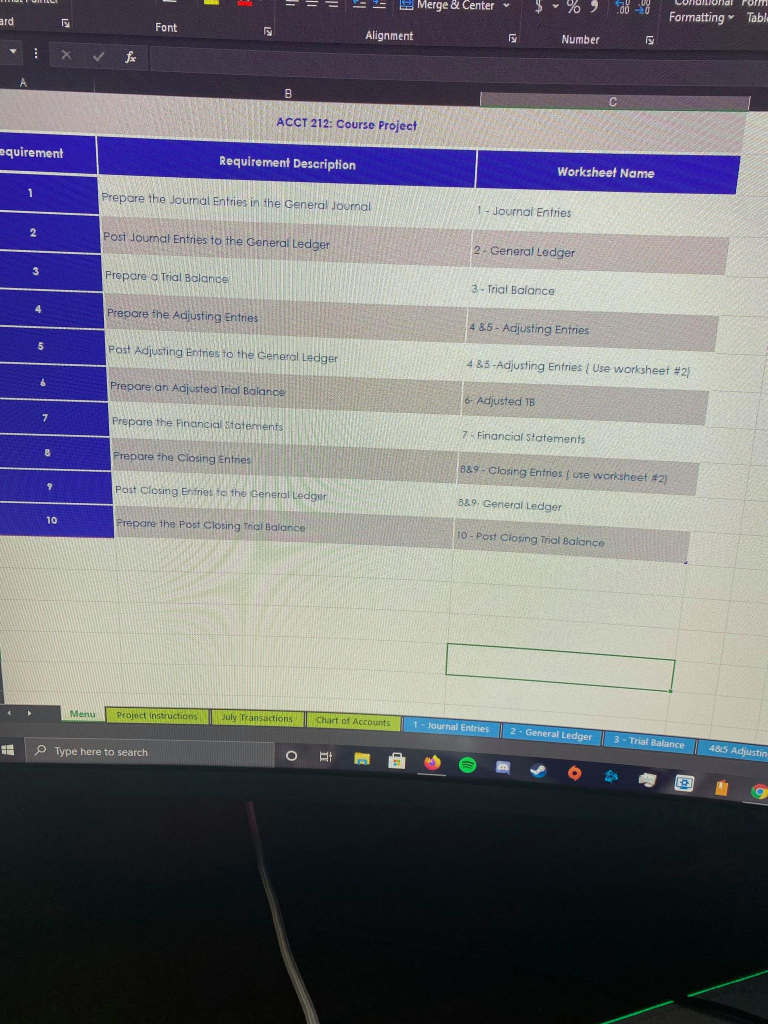

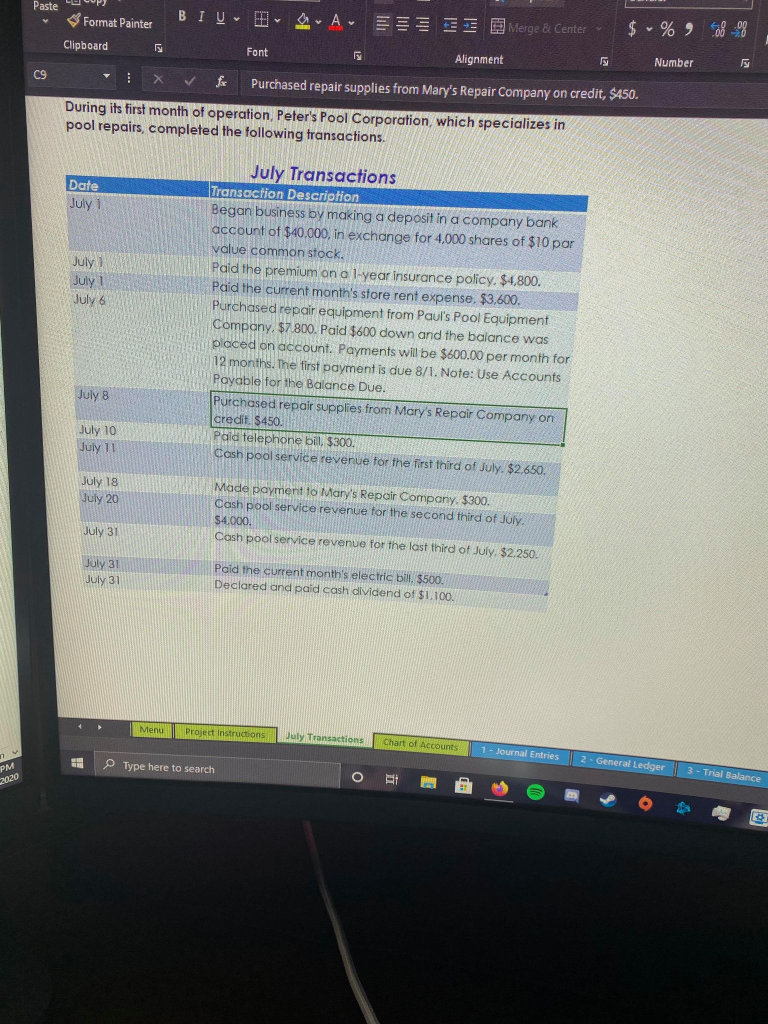

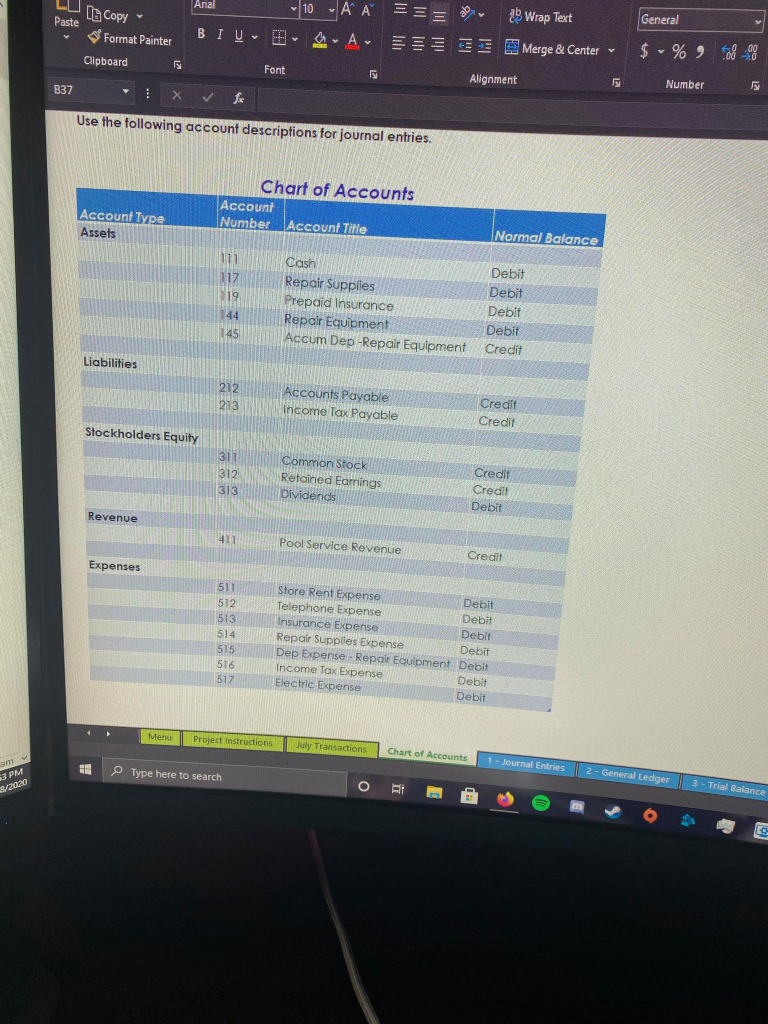

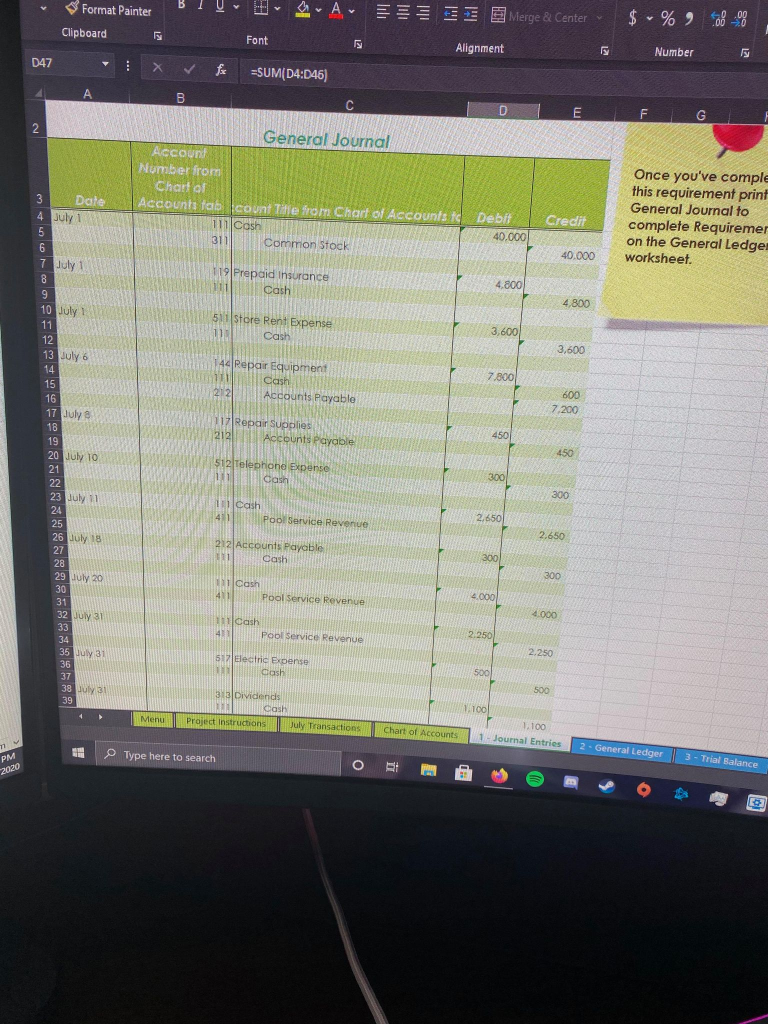

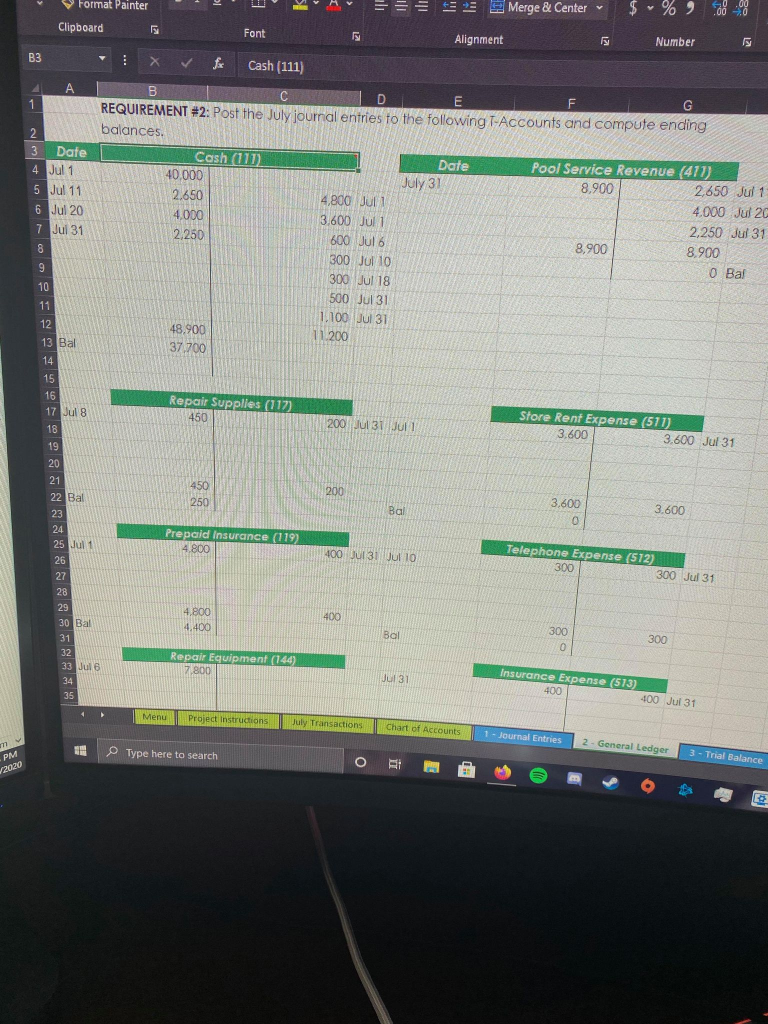

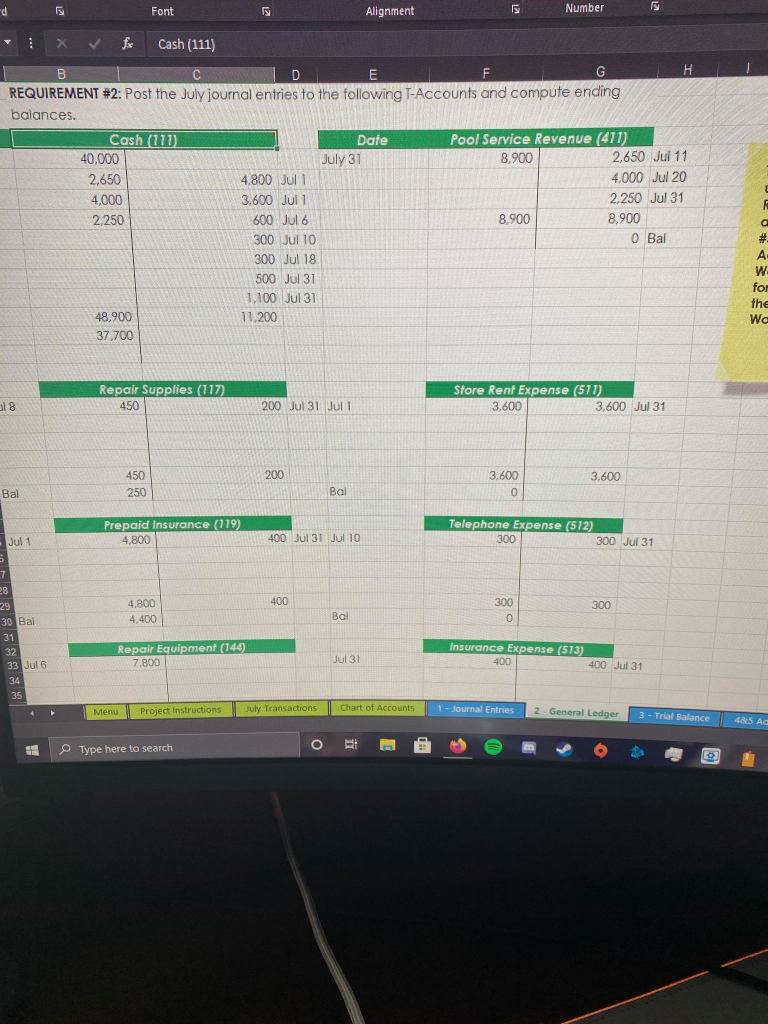

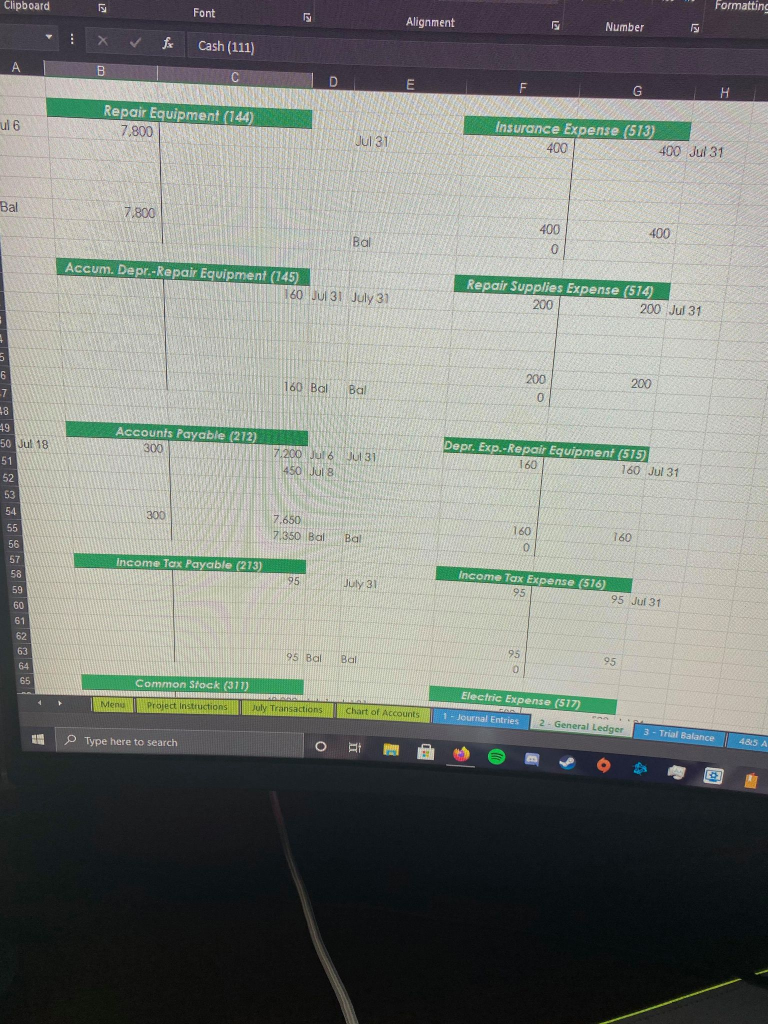

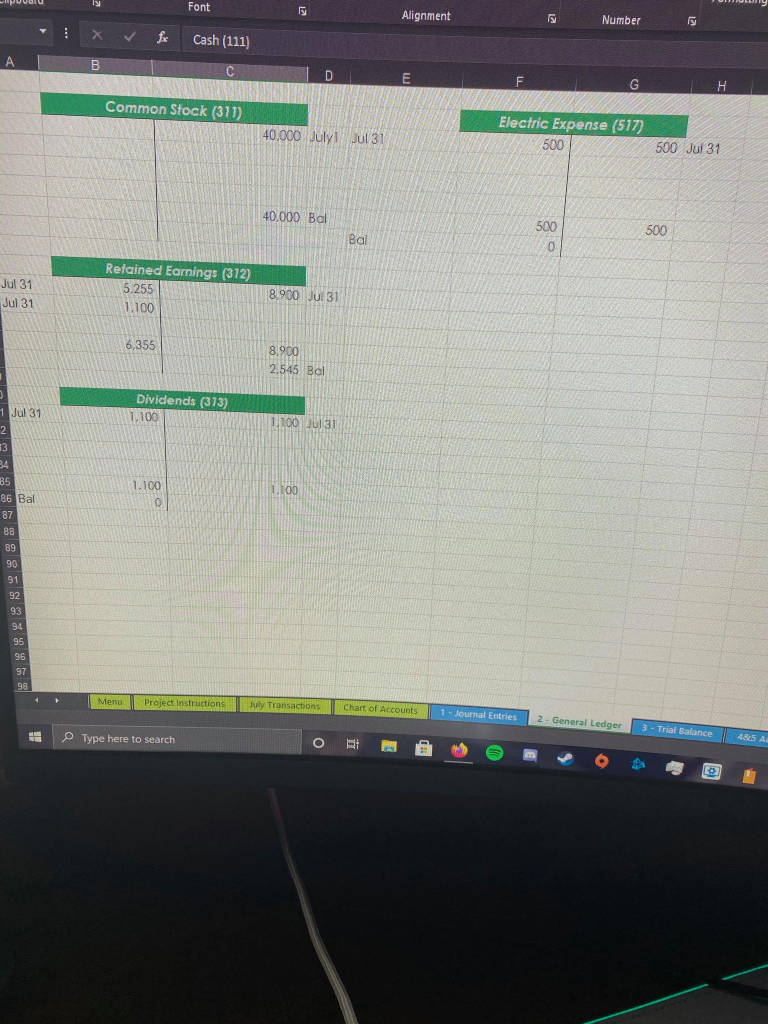

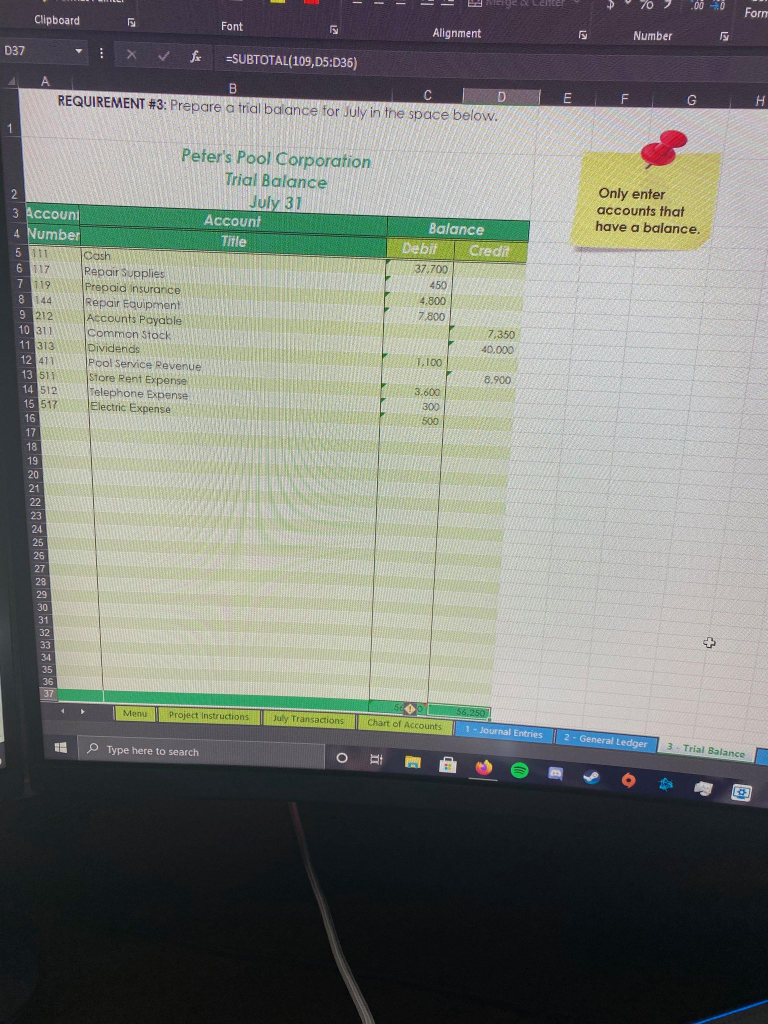

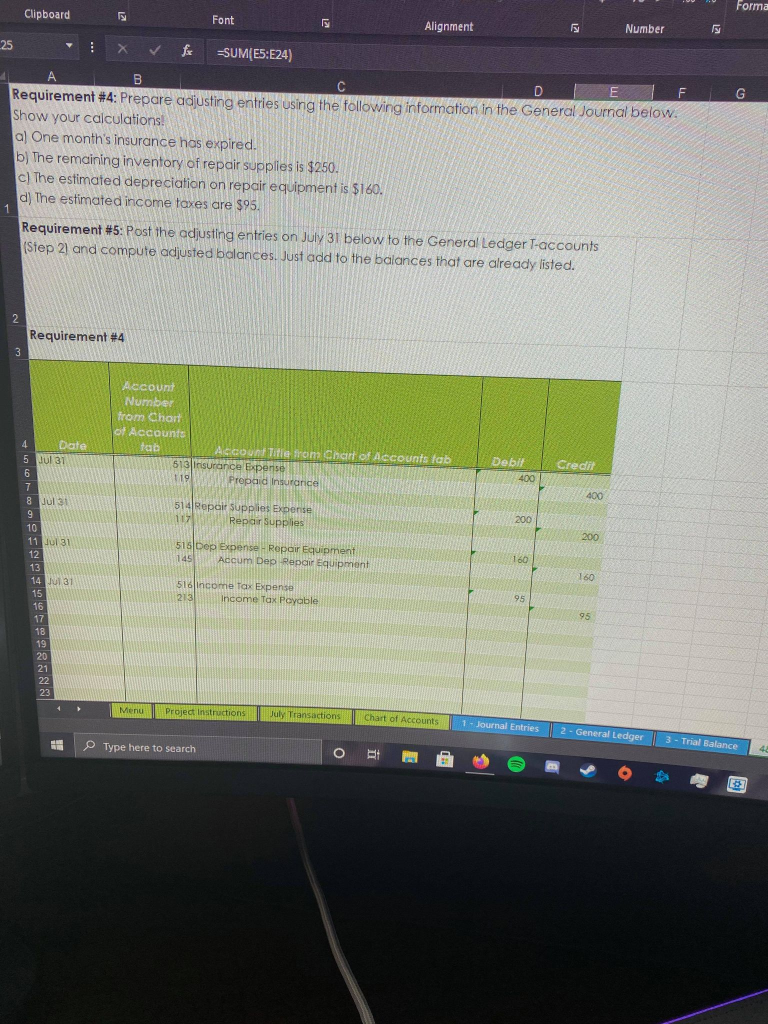

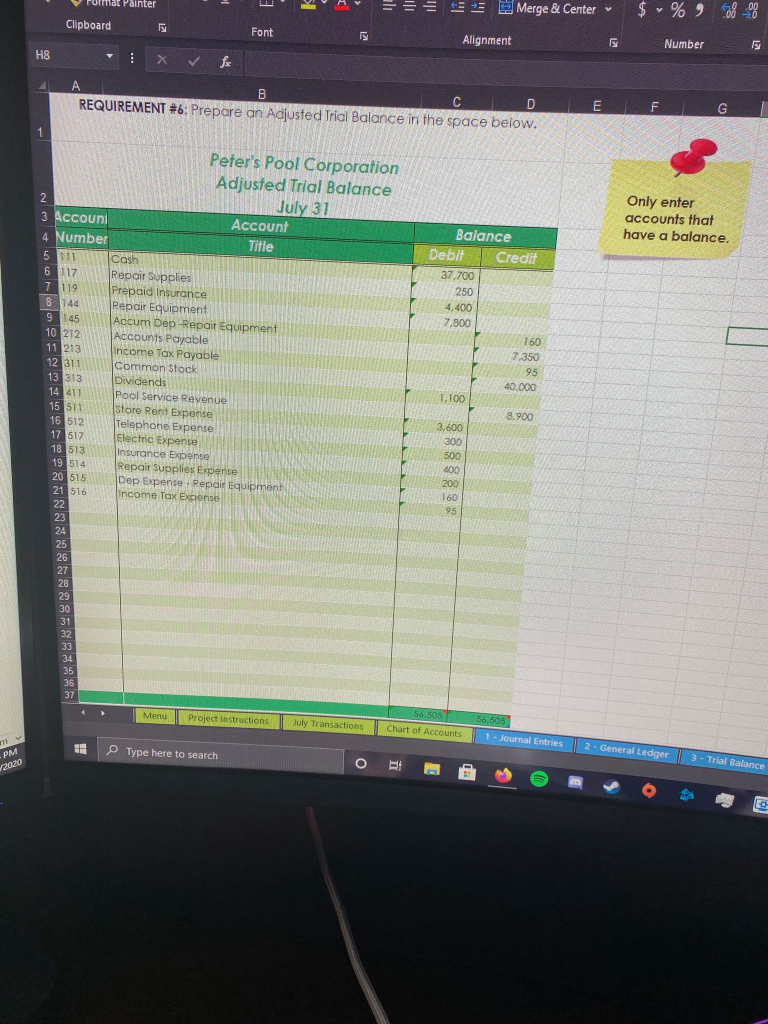

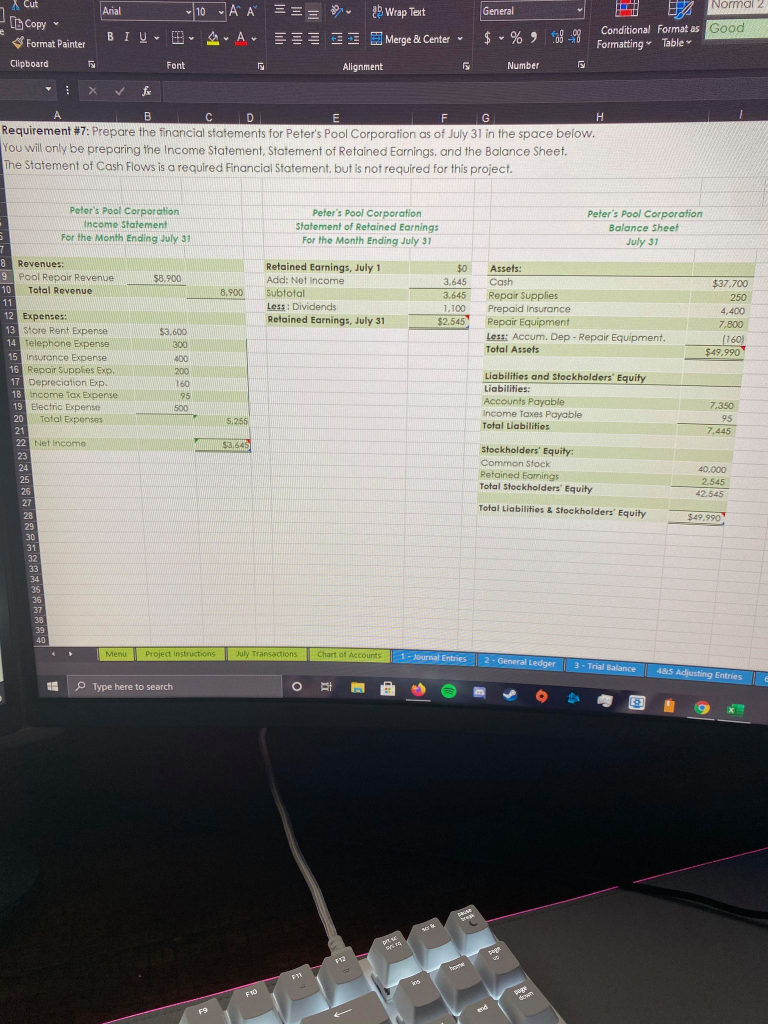

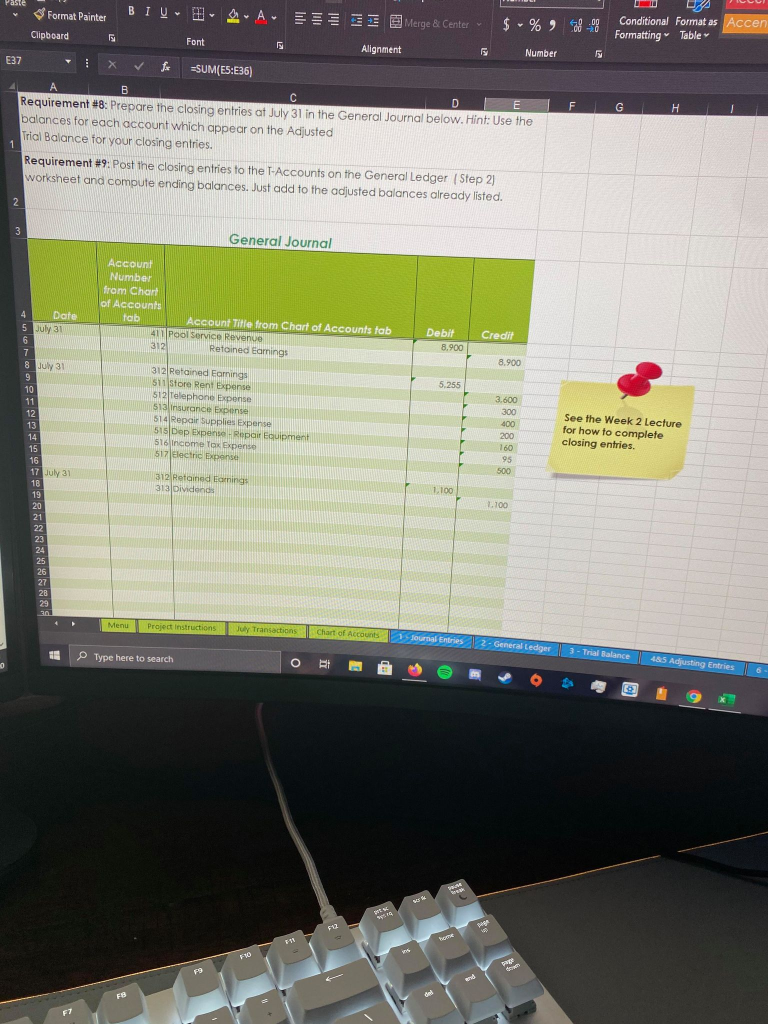

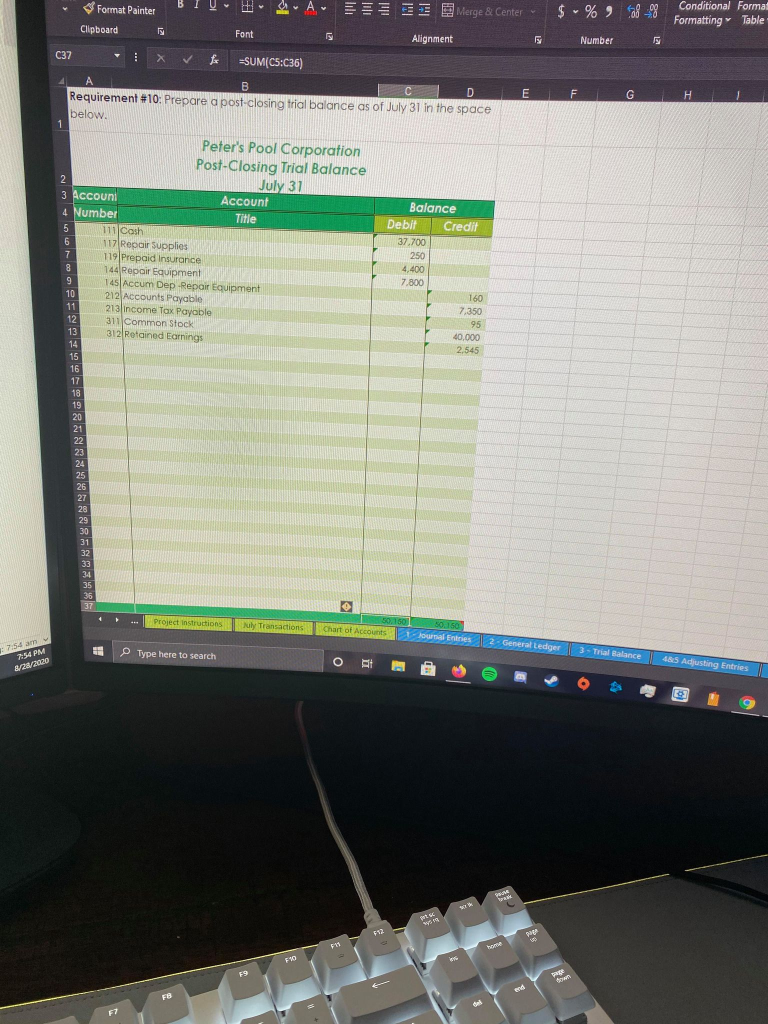

Merge & Center % 9008 ronal Form ard Formatting Table Font Alignment Number A B ACCT 212: Course Project equirement Requirement Description Worksheet Name 1 Prepare the Journal Entries in the General Journal 1 - Journal Entries 2 Post Journal Entries to the General Ledger 2- General Ledger 3 Prepare a Trial Balance 3 - Trial Balance 4 Prepare the Adjusting Entries 4 85 - Adjusting Entries 5 Post Adjusting Entries to the General Ledger 485-Adjusting Entries Use worksheet #2) Prepare an Adjusted Trial Balance 6- Adjusted TB 7 Prepare the Financial Statements 7 - Financial Statements 8 Prepare the Closing Entries 889 - Closing Entries ose worksheet #2) 9 Post closing Entries to the General Ledger 889. General Ledger 10 Prepare the Post Closing Trial Balance 10 - Post Closing Tral Balance Menu Project instructions July Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance E Type here to search 485 Adjustin Paste Format Painter BI - B Merge & Center $ -% % Clipboard Font Alignment Number C9 Purchased repair supplies from Mary's Repair Company on credit, $450. During its first month of operation, Peter's Pool Corporation, which specializes in pool repairs, completed the following transactions. Date July 1 July July 1 July & July Transactions Transaction Description Began business by making a deposit in a company bank account of $40.000, in exchange for 4,000 shares of $10 por value common stock. Paid the premium on a 1-year insurance policy. $4,800. Paid the current month's store rent expense, $3,600 Purchased repair equipment from Paul's Pool Equipment Company, $7 800. Paid $600 down and the balance was placed on account. Payments will be $600.00 per month for 12 months. The first payment is due 8/1. Note: Use Accounts Payable for the Balance Due. Purchased repair supplies from Mary's Repair Company on credit. $450. Paid telephone bil. $300. Cash pool service revenue for the first third of July. $2,650, July 8 July 10 July 11 July 18 July 20 Made payment to Mary's Repair Company. $300. Cash pool service revenue for the second third of July. $4,000. Cash pool service revenue for the last third of July, $2.250. July 31 July 31 July 31 Paid the current month's electric bil. $500. Declared and paid cash dividend of $1.100. Menu Project Instructions July Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance Type here search PM 20:20 O Anal La Copy Paste - 10 AA === 29 Wrap Text BIU - A Merge & Center General Format Painter $ - %, og Clipboard Font Alignment B37 Number fix Use the following account descriptions for journal entries. Chart of Accounts Account Number Account Title Account Type Assets Normal Balance 111 117 119 Cash Repair Supplies Prepaid Insurance Repair Equipment Accum Dep Repair Equipment 144 Debit Debit Debit Debit Credit 145 Liabilities 212 213 Accounts Payable Income Tax Payable Credit Credit Stockholders Equity 311 312 313 Common Stock Retained Earnings Dividends Credit Credit Debit Revenue 411 Pool Service Revenue Credit Expenses 511 512 513 514 515 516 517 Store Rent Expense Debit Telephone Expense Debit Insurance Expense Debit Repair Supplies Expense Debit Dep Expense Repair Equipment Debit Income Tax Expense Debit Electric Expense Debit Menu Project Instructions July Transactions Chart of Accounts 1 - Journal Entries am 3 PM EE Type here to search 2 - General Ledger O 3 - Trial Balance ES Format Painter A Merge & Center 000 .00 Clipboard Font Alignment Number D47 f =SUM(D4:046) . B D E F G 2 General Journal Account Number from Charta Accounts tab count Title from Chart of Accounts is Debit 111 Cash 40.000 311 Common Stock Credit Once you've comple this requirement print General Journal to complete Requiremer on the General Ledge worksheet. 40.000 19 Prepaid Insurance 1111 Cash 4.800 4.800 51 Store Rent Expense 11 Cash 3,600) 3,600 144 Repair Equipment 111 Cash 2121 Accounts Payable 7.800 600 7.200 117 Repair Supplies 212 Accounts Payable 450 3 Daile 4 July 1 5 6 7 July 1 8 9 10 July 11 12 13 July 6 14 15 16 17 July 18 19 20 Jul 10 21 22 23 July 24 25 26 July 18 27 28 29 July 20 30 31 32 July 31 33 34 35 July 31 36 37 38 July 31 39 450 512 Telephone Expense 111 Cash 300/ 300 11 cash 4 Pool Service Revenue 2,650 2.650 212 Accounts Payable Cash 300 300 Cash 411 Pool Service Revenue 4.000 4.000 Cash 411 Pool Service Revenue 2.250 2.250 517 Electric Expense Cash 500 500 3 3 Dividends Cash Project Instructions Menu 1.100 1.100 Chart of Accounts 1 - Journal Entries July Transactions 2 - General Ledger EH 72 PM 2020 Type here to search 3 - Trial Balance O Format Painter =====Merge & Center $ $ % Clipboard Font Alignment Number B3 v 1 Cash (111) B D E F G REQUIREMENT #2: Post the July journal entries to the following T-Accounts and compute ending balances Date July 31 2 3 Date 4 Jul 1 5 Jul 11 6 Jul 20 7 Jul 31 8 9 Cash (111) 40.000 2,650 4,000 2,250 4,800 Jul 1 3.600 Jul 1 600 Jul 6 300 Jul 10 300 Jul 18 500 Jul 31 1.100 Jul 31 11.200 Pool Service Revenue (411) 8.900 2,650 Jul 1 4.000 Jul 20 2,250 Jul 31 8.900 8.900 0 Bal 10 11 12 13 Bal 14 48.900 37.700 Repair Supplies (117) 450 200 Jul 31 Jull Store Rent Expense (511) 3.600 3.600 Jul 31 15 16 17 Jul 8 18 19 20 21 22 Bal 23 24 25 Jul 1 26 27 28 450 250 200 Bal 3.600 0 3.600 Prepaid Insurance (119) 4.800 400 Jul 31 Jul 10 Telephone Expense (512) 300 300 Jul 31 4.800 4.400 400 Bal 29 30 Bal 31 22 32 33 Jul 34 300 0 300 Repair Equipment (144) 7.800 Jul 31 Insurance Expense (573) 400 400 Jul 31 35 Menu Project instructions July Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger Type here to search 3 - Trial Balance m PM 2020 RE d 5 Font Number Alignment X Bac Cash (111) B E F G H REQUIREMENT #2: Post the July journal entries to the following T-Accounts and compute ending balances. Cash (110 Date Pool Service Revenue (411) 40.000 July 31 8.900 2,650 Jul 11 2,650 4.800 Jul 1 4.000 Jul 20 4,000 3.600 Jul 1 2.250 Jul 31 2,250 600 Jul 6 8.900 8.900 300 Jul 10 0 Bal 300 Jul 18 500 Jul 31 1.100 Jul 31 48.900 11.200 37,700 a # . W for the Wa Repair Supplies (117) 450 Store Rent Expense (511) 3.600 3,600 Jul 31 18 200 Jul 31 Jul 1 200 450 250 3.600 0 3.600 Bal Bal Prepaid Insurance (119) 4,800 Telephone Expense (512) 300 300 Jul 31 400 Jul 31 Jul 10 400 Jul 1 5 7 28 29 20 30 Bal 31 32 33 Jul 6 34 35 4.800 4.400 300 0 300 Bal Repair Equipment (144) 7.800 Insurance Expense (573) 400 400 Jul 31 Jul 31 Menu Project Instructions July Transactions Chart of Accounts 1 - Journal Entries 2 General Ledger 3- Trial Balance 485 Ad Type here to search O Clipboard Font Formatting Alignment Number Cash (111) A B D E F G H ul 6 Repair Equipment (144) 7.800 Jul 31 Insurance Expense (513) 400 400 Jul 31 Bal 7.800 400 0 400 Bal Accum. Depr.-Repair Equipment (145) 160 JUL 31 July 31 Repair Supplies Expense (514) 200 200 Jul 31 200 5 6 -7 48 49 160 Bol 200 Bal 0 50 Jul 18 Accounts Payable (212) 300 7.200 Jul 6 Jul 31 450 Jul 8 Depr. Exp.-Repair Equipment (515) 160 160 Jul 31 300 51 52 53 54 55 56 57 58 58 CA 59 7,650 7.350 Bal Bal 160 0 160 Income Tax Payable (213) 95 July 31 Income Tax Expense (516) 95 95 Jul 31 60 61 62 63 95 Bal Bal 64 95 0 95 65 Common Stock (311) Project Instructions July Transactions Menu Chart of Accounts Electric Expense (517) 1 - Journal Entries 2 - General Ledger 3- Trial Balance Type here to search 485 19 Font Alignment Number ly Cash (111) B D E F G H Common Stock (311) 40,000 July1 Jul 31 Electric Expense (517) 500 500 Jul 31 40.000 Bal 500 500 Bal 0 Jul 31 Jul 31 Retained Earnings (312) 5.255 1.100 8.900 Jul 31 6,355 8.900 2,545 Bal Dividends (313) 1.100 1.100 JUI 31 1 Jul 31 2 23 34 85 1.100 0 1.100 86 Bal 87 88 89 90 91 3 92 93 94 95 96 97 98 Menu Project Instructions Jully Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance Type here to search o 5 70 .000 Clipboard Forn Font Alignment Number D37 fx -SUBTOTAL(109,D5:036) A B C D REQUIREMENT #3: Prepare a trial balance for July in the space below. E F G H Only enter accounts that have a balance. Balance Debil Credi 37,700 450 4.800 7.800 7,350 40.000 1.100 8.900 3.600 300 500 Peter's Pool Corporation Trial Balance 2 July 31 3 Accouni Account 4 Number Title 5 111 Cash 6 117 Repair Supplies 7 119 Prepaid Insurance 8 144 Repair Equipment 9 212 Accounts Payable 10 311 Common Stock 11 313 Dividends 12 411 Pool Service Revenue 13 511 Store Rent Expense 14 512 Telephone Expense 15 517 Electric Expense 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Menu Project Instructions July Transactions Chart of Accounts 56.250 1 - Journal Entries | 2 - General Ledger Type here to search 3 Trial Balance O Forma Clipboard Font Alignment Number 25 -SUM{E5:E24) G B C D F Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $250. c) The estimated depreciation on repair equipment is $160. d) The estimated income taxes are $95. 1 Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. 2 Requirement #4 3 Account Number from Chort of Account tab Account Title from Chart of Accounts tab 513 Insurance Expense 110 Prepaid Insurance Debil Credit 400 400 514 Repair Supplies Expense 1171 Repair Supplies 200 200 516 Dep Expense - Repair Equipment 145 Accum Dep Repair Equipment 160 4 Date 5 Jul 31 6 7 8 Jul 31 9 10 11 Jul 31 12 13 14 NI31 15 16 17 18 19 20 21 22 23 160 516 Income Tax Expense 213 Income Tax Payable 95 95 Menu Project Instructions July Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance Type here to search 4 O ES Format Painter * = Merge & Center $ -% 9 Clipboard Font Alignment Number H8 E F G Only enter accounts that have a balance, A B C D REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. 1 Peter's Pool Corporation Adjusted Trial Balance 2 July 31 3 Accouni Account Balance 4 Number Title Debit Credit 5 111 Cash 37.700 6 117 Repair Supplies 250 7 119 Prepaid Insurance 4,400 8 144 Repair Equipment 7.800 9 145 Accum Dep-Repair Equipment 760 10 212 Accounts Payable 7.350 11 213 Income Tax Payable 12 311 Common Stock 95 40.000 13 313 Dividends 1,100 14 411 Pool Service Revenue 15 511 8.900 Store Rent Expense 16 512 3,600 Telephone Expense 300 17 517 Electric Expense 500 18 513 Insurance Expense 400 19 514 Repair Supplies Expense 200 20 515 Dep Expense - Repair Equipment 160 21 516 Income Tax Expense 95 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 56,505 Menu Project Instructions July Transactions Chart of Accounts 56.505 1 - Journal Entries 2 - General Ledger 3 - Trial Balance Type here to search -PM 2020 Cut Arial ] General - [ Copy ~ -10 AA === 5 Wrap Text SAEE E Merge & Center BIU $ -% 0-0 H Normal 2 Conditional Format as Good Formatting Table Format Painter Clipboard Font F Alignment Number fx H A B C D E E F G Requirement #7: Prepare the financial statements for Peter's Pool Corporation as of July 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earnings, and the Balance Sheet The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Peter's Pool Corporation Statement of Retained Earnings For the Month Ending July 31 Peter's Pool Corporation Balance Sheet July 31 8.900 Retained Earnings, July 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, July 31 $0 3,645 3.645 1.100 $2,545 Assets: Cash Repair Supplies Prepaid Insurance Repair Equipment Less: Accum. Dep-Repair Equipment Total Assets $37,700 250 4,400 7.800 (160) $49.990 Peter's Pool Corporation Income Statement For the Month Ending July 31 7 8 Revenues: 9 Pool Repair Revenue $8.900 10 Total Revenue 11 12 Expenses: 13 Store Rent Expense $3.600 14 Telephone Expense 300 15 Insurance Expense 000 16 Repair Supplies Exp. 200 17 Depreciation Exp. 160 18 Income Tax Expense 95 19 Electric Expense 500 20 Total Expenses 21 22 Net Income 23 24 25 26 27 28 29 30 31 32 33 34 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities 5.255 7,350 95 7.445 $3.645 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity 40,000 2.545 42 545 Total Liabilities & Stockholders' Equity $49.990 36 37 38 39 40 Menu Project instructions July Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 485 Adjusting Entries FE Type here to search O F11 F10 D F9 Paste Format Painter BIU - A Merge & Center $ - % Conditional Format as Accen Formatting Table Clipboard 5 Font F Alignment Number E37 fa =SUM(E5:E36) D F G H B C Requirement #8: Prepare the closing entries at July 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Just add to the adjusted balances already listed. 2 3 General Journal Account Number from Chart of Account: tab Account Title from Chart of Accounts tab Pool Service Revenue 312 Retoined Earnings Debit 8.900 Credit 8.900 4 Date 5 July 31 6 7 8 July 31 9 10 11 12 13 14 15 16 5.255 312 Retained Eomings S store Rent Expense 512 Telephone Expense 513 Insurance Expense 514 Repair Supplies Expense 515 Dep Expense - Repair Equipment 516 Income Tax Expense 517 Electric Expense 3.600 300 400 200 160 95 500 See the Week 2 Lecture for how to complete closing entries. 17 July 31 312 Retained Eamings 313 Dividends 1.100 1.100 18 19 20 21 22 23 24 25 26 27 2B 29 30 Menu Project Instructions July Transactions Chart of Accounts 1 Journal Entries 2 - General Ledger 3 - Trial Balance FR Type here to search o El 485 Adjusting Entries 6 NEW F12 peg FO 79 FB F7 Format Painter BIOHA E Merge & Center $ -% -99 Conditional Format Formatting Table Clipboard Font Alignment Number C37 X -SUM(CS:C36) E F G H B C D Requirement #10: Prepare a post-closing trial balance as of July 31 in the space below. Peter's Pool Corporation Post-Closing Trial Balance 2 July 31 3 Accouni Account 4 Number Title 5 111 Cash 6 117 Repair Supplies 7 119 Prepaid Insurance 8 144 Repair Equipment 9 145 Accum Dep-Repair Equipment 10 212 Accounts Payable 11 213 Income Tax Payable 12 311 Common Stock 13 312 Retained Earnings 14 15 16 17 18 19 20 21 22 Balance Debit Credit 37.700 250 4,400 7.800 160 7,350 95 40,000 2,545 24 25 26 27 28 29 30 31 32 33 37 Project instructions Nily Transactions 50.150 Chart of Accounts 50.150 - Journal Entries Entries 2 - General Ledger 3 - Trial Balance F 7:54 am 7:54 PM 8/21/2020 Type here to search O 465 Adjusting Entries NES w1 712 9 F 590 se end FB set F7