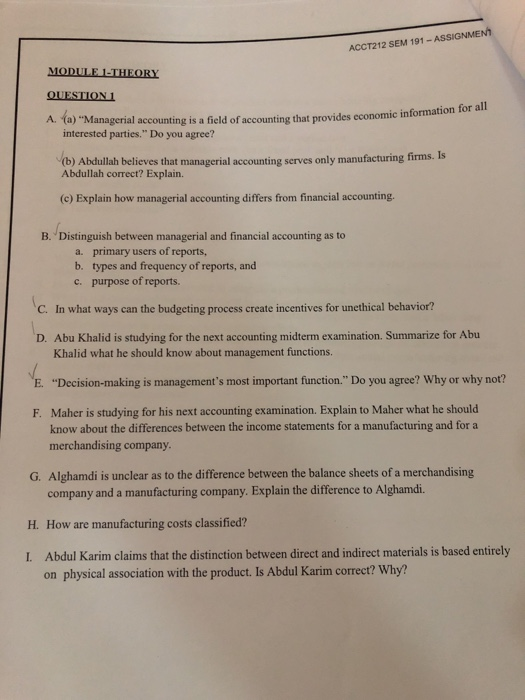

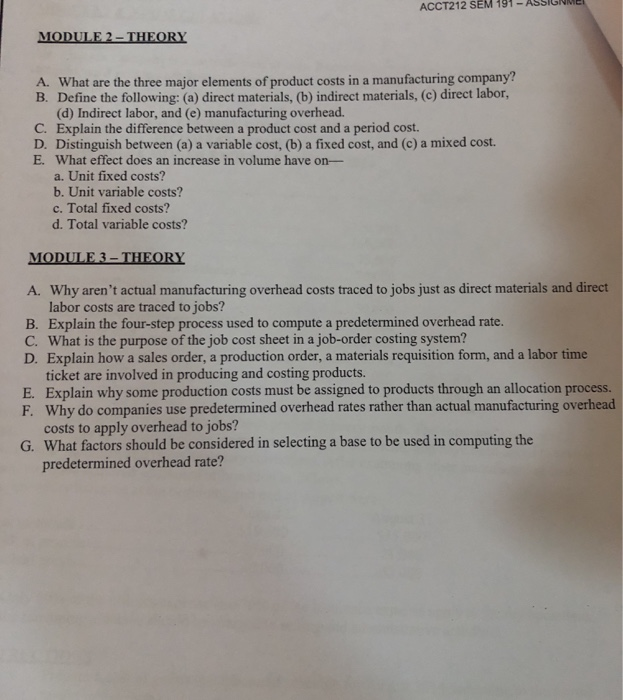

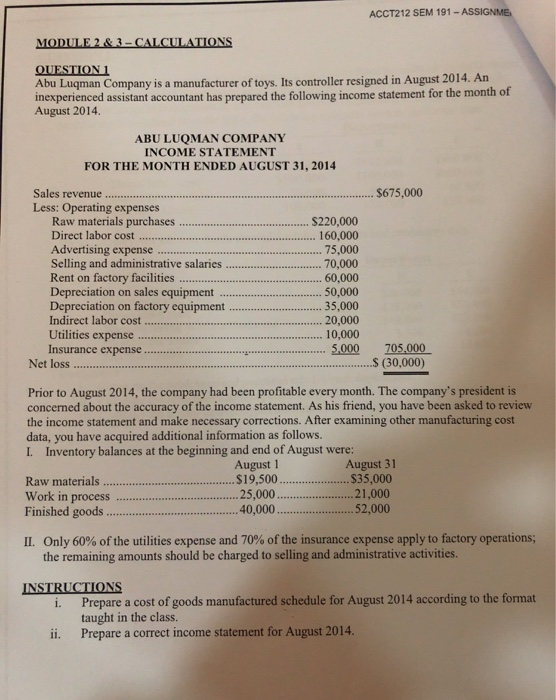

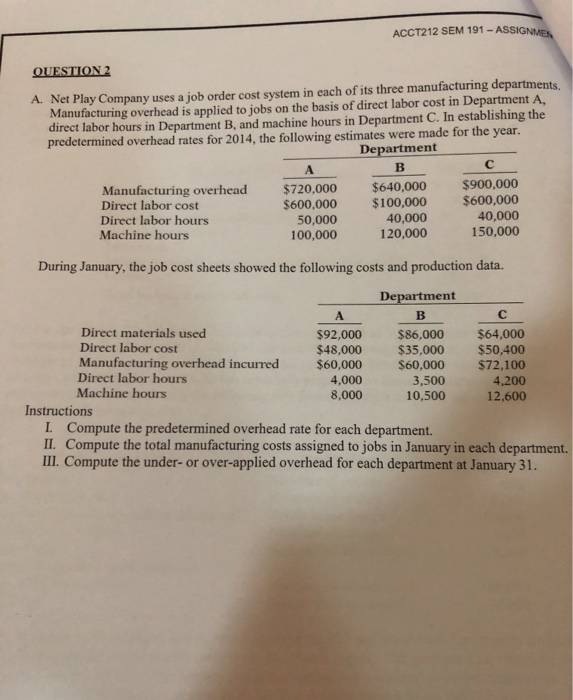

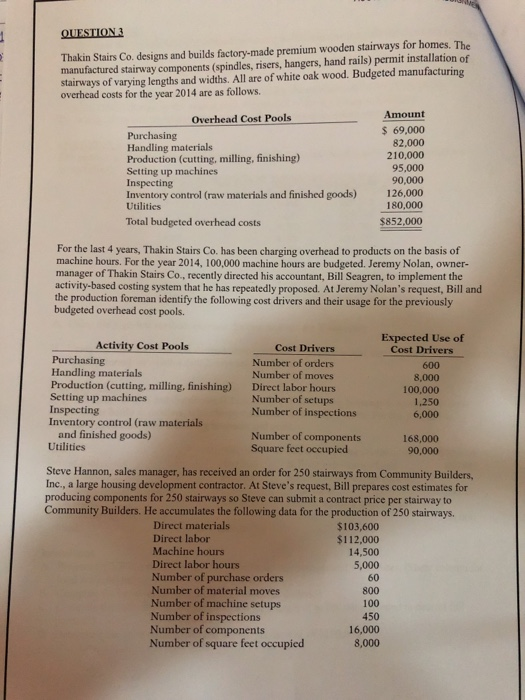

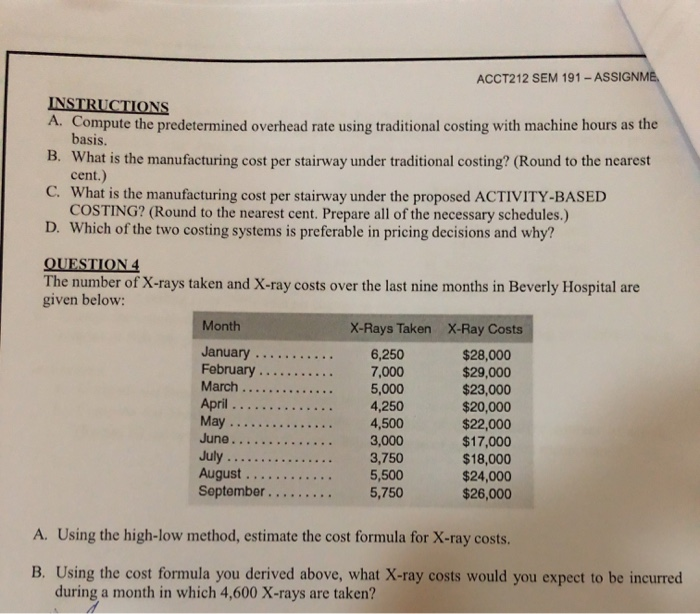

ACCT212 SEM 191 - ASSIGNMENT MODULE THEORY QUESTIONI A. a) "Managerial accounting is a field of accounting that provides economic informa interested parties." Do you agree? (b) Abdullah believes that managerial accounting serves only manufacturing firms.is Abdullah correct? Explain. (c) Explain how managerial accounting differs from financial accounting. B. Distinguish between managerial and financial accounting as to a. primary users of reports, b. types and frequency of reports, and c. purpose of reports. C. In what ways can the budgeting process create incentives for unethical behavior? D. Abu Khalid is studying for the next accounting midterm examination. Summarize for Abu Khalid what he should know about management functions. E. "Decision-making is management's most important function." Do you agree? Why or why not? F. Maher is studying for his next accounting examination. Explain to Maher what he should know about the differences between the income statements for a manufacturing and for a merchandising company. G. Alghamdi is unclear as to the difference between the balance sheets of a merchandising company and a manufacturing company. Explain the difference to Alghamdi. H. How are manufacturing costs classified? 1 Abdul Karim claims that the distinction between direct and indirect materials is based entirely on physical association with the product. Is Abdul Karim correct? Why? ACCT212 SEM 191 - ASSIUNI MODULE 2 THEORY A. What are the three major elements of product costs in a manufacturing company! B. Define the following: (a) direct materials, (b) indirect materials, (c) direct labor, (d) Indirect labor, and (e) manufacturing overhead. C. Explain the difference between a product cost and a period cost. D. Distinguish between (a) a variable cost, (b) a fixed cost, and (c) a mixed cost. E. What effect does an increase in volume have on- a. Unit fixed costs? b. Unit variable costs? c. Total fixed costs? d. Total variable costs? MODULE 3 - THEORY A. Why aren't actual manufacturing overhead costs traced to jobs just as direct materials and direct labor costs are traced to jobs? B. Explain the four-step process used to compute a predetermined overhead rate! C. What is the purpose of the job cost sheet in a job-order costing system? D. Explain how a sales order, a production order, a materials requisition form, and a labor time ticket are involved in producing and costing products. E. Explain why some production costs must be assigned to products through an allocation process. F. Why do companies use predetermined overhead rates rather than actual manufacturing overhead costs to apply overhead to jobs? G. What factors should be considered in selecting a base to be used in computing the predetermined overhead rate? ACCT212 SEM 191 - ASSIGNME MODULE 2 & 3 - CALCULATIONS QUESTION 1 Abu Luqman Company is a manufacturer of toys. Its controller resigned in August 2014. An inexperienced assistant accountant has prepared the following income statement for the month of August 2014 ABU LUQMAN COMPANY INCOME STATEMENT FOR THE MONTH ENDED AUGUST 31, 2014 $675,000 Sales revenue ...... Less: Operating expenses Raw materials purchases Direct labor cost ......... Advertising expense .. Selling and administrative salaries ..... Rent on factory facilities Depreciation on sales equipment ..... Depreciation on factory equipment Indirect labor cost .............. Utilities expense ................... Insurance expense................ Net loss.......... ................ $220,000 160,000 75,000 70,000 60,000 50,000 35,000 20,000 10,000 5,000 705,000 .... (30,000) Prior to August 2014, the company had been profitable every month. The company's president is concerned about the accuracy of the income statement. As his friend, you have been asked to review the income statement and make necessary corrections. After examining other manufacturing cost data, you have acquired additional information as follows. I. Inventory balances at the beginning and end of August were: August 1 August 31 Raw materials .......... .$19,500 ............. .$35,000 Work in process..... 25,000. 21,000 Finished goods ....... .40,000. 52,000 II. Only 60% of the utilities expense and 70% of the insurance expense apply to factory operations, the remaining amounts should be charged to selling and administrative activities. INSTRUCTIONS 1. Prepare a cost of goods manufactured schedule for August 2014 according to the format taught in the class. ii. Prepare a correct income statement for August 2014. ACCT212 SEM 191 - ASSIGNMEN QUESTION 2 A. Net Play Company uses a job order cost system in each of its three manufacturing departments Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department A. direct labor hours in Department B, and machine hours in Department C. In establishing the predetermined overhead rates for 2014, the following estimates were made for the year. Department Manufacturing overhead Direct labor cost Direct labor hours Machine hours $720,000 $600,000 50,000 100,000 $640,000 $100,000 40,000 120,000 $900,000 $600,000 40,000 150,000 During January, the job cost sheets showed the following costs and production data. Department Direct materials used $92,000 $86,000 $64,000 Direct labor cost $48,000 $35,000 $50,400 Manufacturing overhead incurred $60,000 $60,000 $72,100 Direct labor hours 4,000 3,500 4,200 Machine hours 8,000 10,500 12,600 Instructions I Compute the predetermined overhead rate for each department. II. Compute the total manufacturing costs assigned to jobs in January in each department. III. Compute the under-or over-applied overhead for each department at January 31. QUESTION 3 Thakin Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood. Budgeted manufacturing overhead costs for the year 2014 are as follows. Overhead Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Total budgeted overhead costs Amount $ 69,000 82.000 210,000 95,000 90,000 126,000 180,000 $852,000 For the last 4 years, Thakin Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2014, 100.000 machine hours are budgeted. Jeremy Nolan, owner- manager of Thakin Stairs Co., recently directed his accountant, Bill Seagren, to implement the activity-based costing system that he has repeatedly proposed. At Jeremy Nolan's request, Bill and the production foreman identify the following cost drivers and their usage for the previously budgeted overhead cost pools. Activity Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Cost Drivers Number of orders Number of moves Direct labor hours Number of setups Number of inspections Expected Use of Cost Drivers 600 8,000 100,000 1.250 6,000 Number of components Square feet occupied 168,000 90,000 Steve Hannon, sales manager, has received an order for 250 stairways from Community Builders Inc., a large housing development contractor. At Steve's request, Bill prepares cost estimates for producing components for 250 stairways so Steve can submit a contract price per stairway to Community Builders. He accumulates the following data for the production of 250 stairways, Direct materials $103,600 Direct labor $112.000 Machine hours 14,500 Direct labor hours 5,000 Number of purchase orders Number of material moves 800 Number of machine setups 100 Number of inspections Number of components 16,000 Number of square feet occupied 8,000 450 ACCT212 SEM 191 - ASSIGNME INSTRUCTIONS A. Compute the predetermined overhead rate using traditional costing with machine hours as the basis. B. What is the manufacturing cost per stairway under traditional costing? (Round to the nearest cent.) C. What is the manufacturing cost per stairway under the proposed ACTIVITY-BASED COSTING? (Round to the nearest cent. Prepare all of the necessary schedules.) D. Which of the two costing systems is preferable in pricing decisions and why? QUESTION 4 The number of X-rays taken and X-ray costs over the last nine months in Beverly Hospital are given below: Month X-Rays Taken X-Ray Costs January ... 6,250 $28,000 February 7,000 $29,000 March .... 5,000 $23,000 4,250 $20,000 May .......... 4,500 $22,000 June.......... 3,000 $17,000 July ................ 3,750 $18,000 August ... 5,500 $24,000 September .... 5,750 $26,000 April ......... A. Using the high-low method, estimate the cost formula for X-ray costs. B. Using the cost formula you derived above, what X-ray costs would you expect to be incurred during a month in which 4,600 X-rays are taken? ACCT212 SEM 191 - ASSIGNMENT MODULE THEORY QUESTIONI A. a) "Managerial accounting is a field of accounting that provides economic informa interested parties." Do you agree? (b) Abdullah believes that managerial accounting serves only manufacturing firms.is Abdullah correct? Explain. (c) Explain how managerial accounting differs from financial accounting. B. Distinguish between managerial and financial accounting as to a. primary users of reports, b. types and frequency of reports, and c. purpose of reports. C. In what ways can the budgeting process create incentives for unethical behavior? D. Abu Khalid is studying for the next accounting midterm examination. Summarize for Abu Khalid what he should know about management functions. E. "Decision-making is management's most important function." Do you agree? Why or why not? F. Maher is studying for his next accounting examination. Explain to Maher what he should know about the differences between the income statements for a manufacturing and for a merchandising company. G. Alghamdi is unclear as to the difference between the balance sheets of a merchandising company and a manufacturing company. Explain the difference to Alghamdi. H. How are manufacturing costs classified? 1 Abdul Karim claims that the distinction between direct and indirect materials is based entirely on physical association with the product. Is Abdul Karim correct? Why? ACCT212 SEM 191 - ASSIUNI MODULE 2 THEORY A. What are the three major elements of product costs in a manufacturing company! B. Define the following: (a) direct materials, (b) indirect materials, (c) direct labor, (d) Indirect labor, and (e) manufacturing overhead. C. Explain the difference between a product cost and a period cost. D. Distinguish between (a) a variable cost, (b) a fixed cost, and (c) a mixed cost. E. What effect does an increase in volume have on- a. Unit fixed costs? b. Unit variable costs? c. Total fixed costs? d. Total variable costs? MODULE 3 - THEORY A. Why aren't actual manufacturing overhead costs traced to jobs just as direct materials and direct labor costs are traced to jobs? B. Explain the four-step process used to compute a predetermined overhead rate! C. What is the purpose of the job cost sheet in a job-order costing system? D. Explain how a sales order, a production order, a materials requisition form, and a labor time ticket are involved in producing and costing products. E. Explain why some production costs must be assigned to products through an allocation process. F. Why do companies use predetermined overhead rates rather than actual manufacturing overhead costs to apply overhead to jobs? G. What factors should be considered in selecting a base to be used in computing the predetermined overhead rate? ACCT212 SEM 191 - ASSIGNME MODULE 2 & 3 - CALCULATIONS QUESTION 1 Abu Luqman Company is a manufacturer of toys. Its controller resigned in August 2014. An inexperienced assistant accountant has prepared the following income statement for the month of August 2014 ABU LUQMAN COMPANY INCOME STATEMENT FOR THE MONTH ENDED AUGUST 31, 2014 $675,000 Sales revenue ...... Less: Operating expenses Raw materials purchases Direct labor cost ......... Advertising expense .. Selling and administrative salaries ..... Rent on factory facilities Depreciation on sales equipment ..... Depreciation on factory equipment Indirect labor cost .............. Utilities expense ................... Insurance expense................ Net loss.......... ................ $220,000 160,000 75,000 70,000 60,000 50,000 35,000 20,000 10,000 5,000 705,000 .... (30,000) Prior to August 2014, the company had been profitable every month. The company's president is concerned about the accuracy of the income statement. As his friend, you have been asked to review the income statement and make necessary corrections. After examining other manufacturing cost data, you have acquired additional information as follows. I. Inventory balances at the beginning and end of August were: August 1 August 31 Raw materials .......... .$19,500 ............. .$35,000 Work in process..... 25,000. 21,000 Finished goods ....... .40,000. 52,000 II. Only 60% of the utilities expense and 70% of the insurance expense apply to factory operations, the remaining amounts should be charged to selling and administrative activities. INSTRUCTIONS 1. Prepare a cost of goods manufactured schedule for August 2014 according to the format taught in the class. ii. Prepare a correct income statement for August 2014. ACCT212 SEM 191 - ASSIGNMEN QUESTION 2 A. Net Play Company uses a job order cost system in each of its three manufacturing departments Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department A. direct labor hours in Department B, and machine hours in Department C. In establishing the predetermined overhead rates for 2014, the following estimates were made for the year. Department Manufacturing overhead Direct labor cost Direct labor hours Machine hours $720,000 $600,000 50,000 100,000 $640,000 $100,000 40,000 120,000 $900,000 $600,000 40,000 150,000 During January, the job cost sheets showed the following costs and production data. Department Direct materials used $92,000 $86,000 $64,000 Direct labor cost $48,000 $35,000 $50,400 Manufacturing overhead incurred $60,000 $60,000 $72,100 Direct labor hours 4,000 3,500 4,200 Machine hours 8,000 10,500 12,600 Instructions I Compute the predetermined overhead rate for each department. II. Compute the total manufacturing costs assigned to jobs in January in each department. III. Compute the under-or over-applied overhead for each department at January 31. QUESTION 3 Thakin Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood. Budgeted manufacturing overhead costs for the year 2014 are as follows. Overhead Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Total budgeted overhead costs Amount $ 69,000 82.000 210,000 95,000 90,000 126,000 180,000 $852,000 For the last 4 years, Thakin Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2014, 100.000 machine hours are budgeted. Jeremy Nolan, owner- manager of Thakin Stairs Co., recently directed his accountant, Bill Seagren, to implement the activity-based costing system that he has repeatedly proposed. At Jeremy Nolan's request, Bill and the production foreman identify the following cost drivers and their usage for the previously budgeted overhead cost pools. Activity Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Cost Drivers Number of orders Number of moves Direct labor hours Number of setups Number of inspections Expected Use of Cost Drivers 600 8,000 100,000 1.250 6,000 Number of components Square feet occupied 168,000 90,000 Steve Hannon, sales manager, has received an order for 250 stairways from Community Builders Inc., a large housing development contractor. At Steve's request, Bill prepares cost estimates for producing components for 250 stairways so Steve can submit a contract price per stairway to Community Builders. He accumulates the following data for the production of 250 stairways, Direct materials $103,600 Direct labor $112.000 Machine hours 14,500 Direct labor hours 5,000 Number of purchase orders Number of material moves 800 Number of machine setups 100 Number of inspections Number of components 16,000 Number of square feet occupied 8,000 450 ACCT212 SEM 191 - ASSIGNME INSTRUCTIONS A. Compute the predetermined overhead rate using traditional costing with machine hours as the basis. B. What is the manufacturing cost per stairway under traditional costing? (Round to the nearest cent.) C. What is the manufacturing cost per stairway under the proposed ACTIVITY-BASED COSTING? (Round to the nearest cent. Prepare all of the necessary schedules.) D. Which of the two costing systems is preferable in pricing decisions and why? QUESTION 4 The number of X-rays taken and X-ray costs over the last nine months in Beverly Hospital are given below: Month X-Rays Taken X-Ray Costs January ... 6,250 $28,000 February 7,000 $29,000 March .... 5,000 $23,000 4,250 $20,000 May .......... 4,500 $22,000 June.......... 3,000 $17,000 July ................ 3,750 $18,000 August ... 5,500 $24,000 September .... 5,750 $26,000 April ......... A. Using the high-low method, estimate the cost formula for X-ray costs. B. Using the cost formula you derived above, what X-ray costs would you expect to be incurred during a month in which 4,600 X-rays are taken