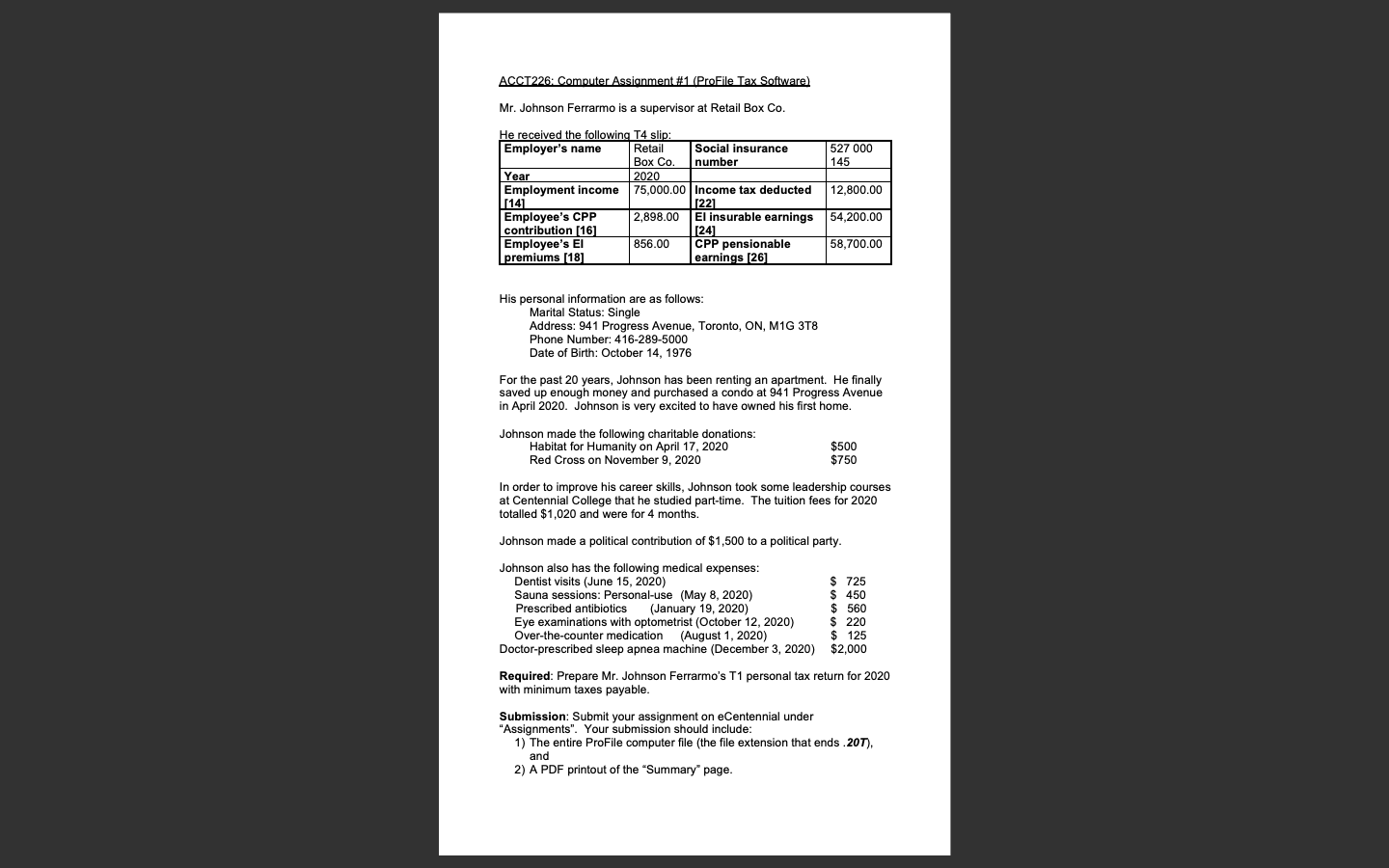

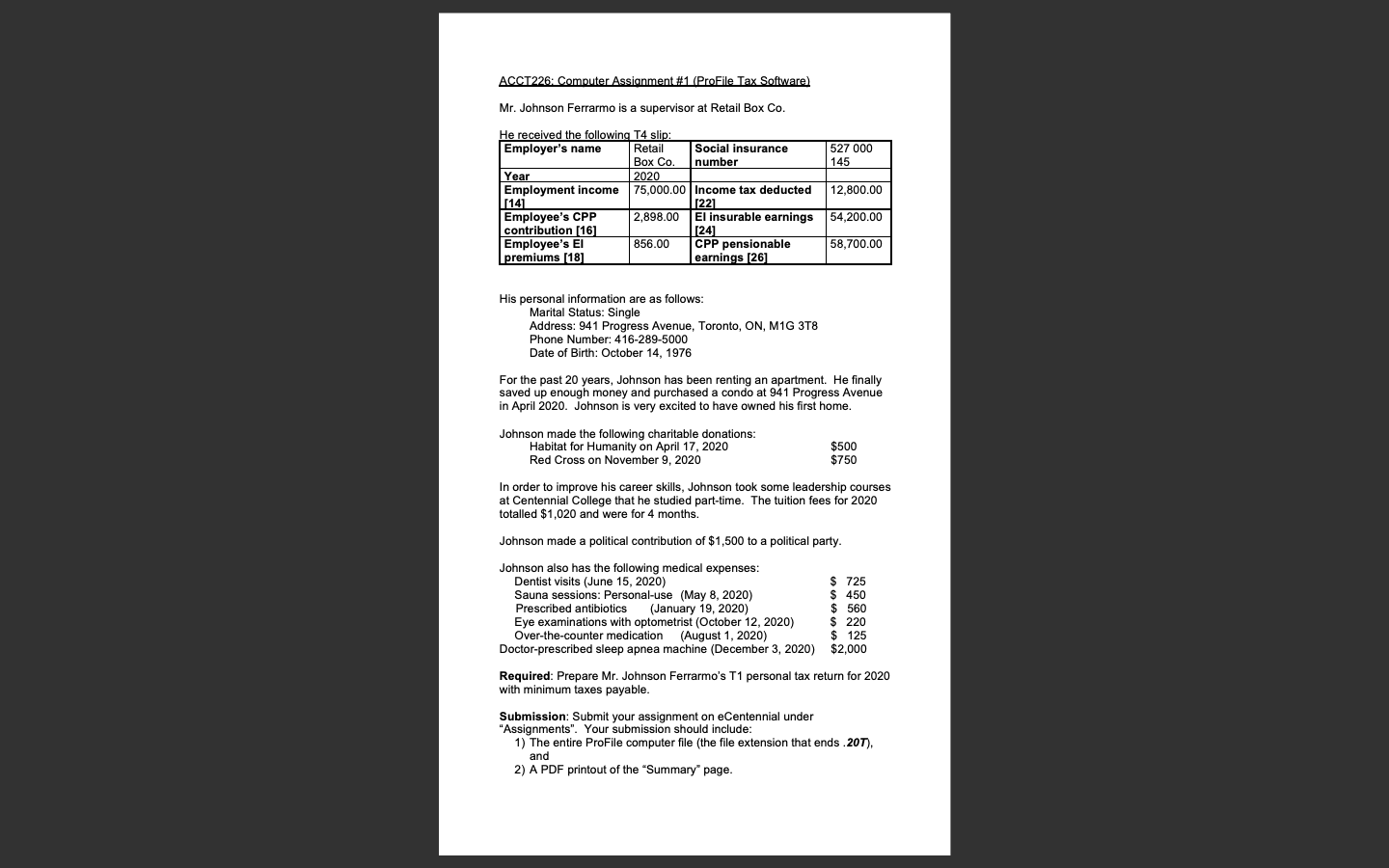

ACCT226: Computer Assignment #1 (ProFile Tax Software) Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. 527 000 145 12,800.00 He received the following T4 slip: Employer's name Retail Social insurance Box Co. number Year 2020 Employment income 75,000.00 Income tax deducted (141 1221 Employee's CPP 2,898.00 El insurable earnings contribution (16) (24 Employee's El 856.00 CPP pensionable premiums (18) earnings [26] 54,200.00 58,700.00 His personal information are as follows: Marital Status: Single Address: 941 Progress Avenue, Toronto, ON, M1G 3T8 Phone Number: 416-289-5000 Date of Birth: October 14, 1976 For the past 20 years, Johnson has been renting an apartment. He finally saved up enough money and purchased a condo at 941 Progress Avenue in April 2020. Johnson is very excited to have owned his first home. Johnson made the following charitable donations: Humanity on April 17, 2020 Red Cross on November 9, 2020 $500 $750 In order to improve his career skills, Johnson took some leadership courses at Centennial College that he studied part-time. The tuition fees for 2020 totalled $1,020 and were for 4 months. Johnson made a political contribution of $1,500 to a political party. Johnson also has the following medical expenses: Dentist visits (June 15, 2020) $ 725 Sauna sessions: Personal use (May 8, 2020) $450 Prescribed antibiotics (January 19, 2020) $ 560 Eye examinations with optometrist (October 12, 2020) $ 220 Over-the-counter medication (August 1, 2020) $ 125 Doctor-prescribed sleep apnea machine (December 3, 2020) $2,000 Required: Prepare Mr. Johnson Ferrarmo's T1 personal tax return for 2020 with minimum taxes payable Submission: Submit your assignment on eCentennial under "Assignments". Your submission should include: 1) The entire ProFile computer file (the file extension that ends.20T), and 2) A PDF printout of the "Summary page. ACCT226: Computer Assignment #1 (ProFile Tax Software) Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. 527 000 145 12,800.00 He received the following T4 slip: Employer's name Retail Social insurance Box Co. number Year 2020 Employment income 75,000.00 Income tax deducted (141 1221 Employee's CPP 2,898.00 El insurable earnings contribution (16) (24 Employee's El 856.00 CPP pensionable premiums (18) earnings [26] 54,200.00 58,700.00 His personal information are as follows: Marital Status: Single Address: 941 Progress Avenue, Toronto, ON, M1G 3T8 Phone Number: 416-289-5000 Date of Birth: October 14, 1976 For the past 20 years, Johnson has been renting an apartment. He finally saved up enough money and purchased a condo at 941 Progress Avenue in April 2020. Johnson is very excited to have owned his first home. Johnson made the following charitable donations: Humanity on April 17, 2020 Red Cross on November 9, 2020 $500 $750 In order to improve his career skills, Johnson took some leadership courses at Centennial College that he studied part-time. The tuition fees for 2020 totalled $1,020 and were for 4 months. Johnson made a political contribution of $1,500 to a political party. Johnson also has the following medical expenses: Dentist visits (June 15, 2020) $ 725 Sauna sessions: Personal use (May 8, 2020) $450 Prescribed antibiotics (January 19, 2020) $ 560 Eye examinations with optometrist (October 12, 2020) $ 220 Over-the-counter medication (August 1, 2020) $ 125 Doctor-prescribed sleep apnea machine (December 3, 2020) $2,000 Required: Prepare Mr. Johnson Ferrarmo's T1 personal tax return for 2020 with minimum taxes payable Submission: Submit your assignment on eCentennial under "Assignments". Your submission should include: 1) The entire ProFile computer file (the file extension that ends.20T), and 2) A PDF printout of the "Summary page