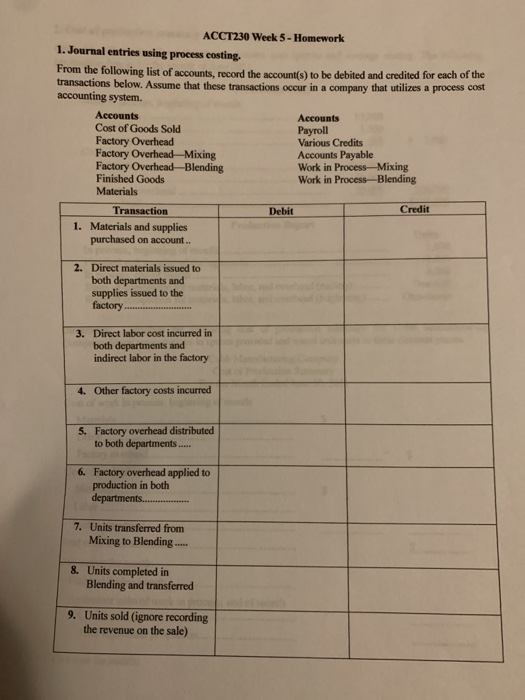

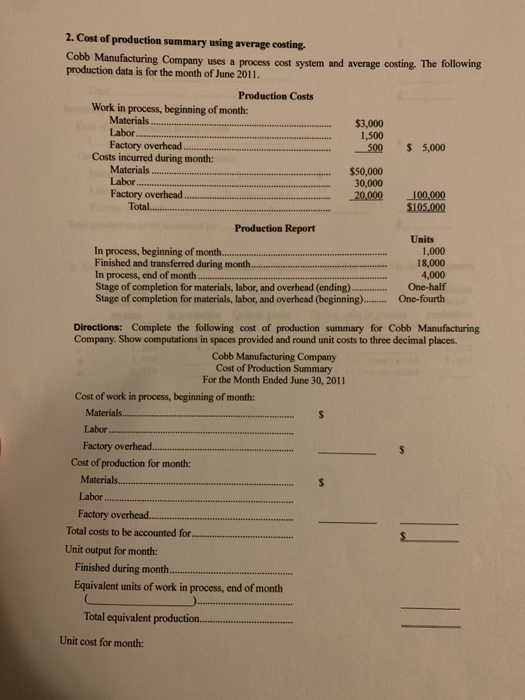

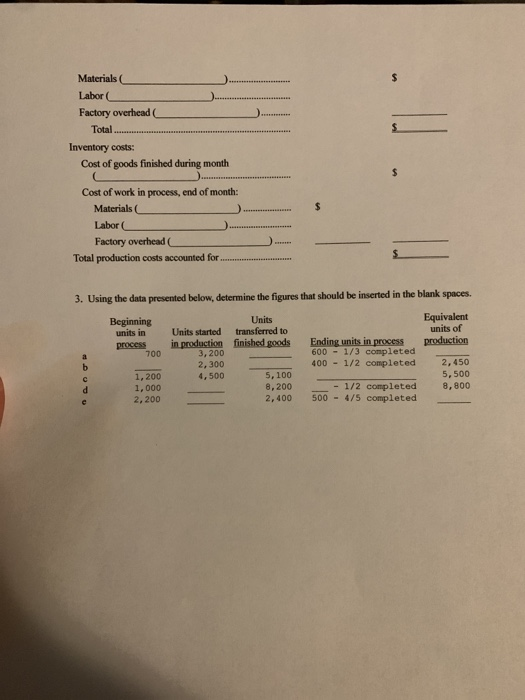

ACCT230 Week 5 - Homework 1. Journal entries using process costing. From the following list of accounts, record the account(s) to be debited and credited for each of the transactions below. Assume that these transactions occur in a company that utilizes a process cost accounting system. Accounts Accounts Cost of Goods Sold Payroll Factory Overhead Various Credits Factory Overhead Mixing Accounts Payable Factory Overhead-Blending Work in Process-Mixing Finished Goods Work in ProcessBlending Materials Transaction Debit Credit 1. Materials and supplies purchased on account... 2. Direct materials issued to both departments and supplies issued to the factory 3. Direct labor cost incurred in both departments and indirect labor in the factory 4. Other factory costs incurred 5. Factory overhead distributed to both departments..... 6. Factory overhead applied to production in both departments... 7. Units transferred from Mixing to Blending ..... 8. Units completed in Blending and transferred 9. Units sold (ignore recording the revenue on the sale) 2. Cost of production summary using average costing. Cobb Manufacturing Company uses a process cost system and average costing. The following production data is for the month of June 2011 Production Costs Work in process, beginning of month: Materials $3,000 Labor 1,500 Factory overhead 500 $ 5,000 Costs incurred during month: Materials $50,000 Labor 30,000 Factory overhead 20,000 100.000 Total S105.000 Production Report In process, beginning of month. Finished and transferred during month. In process, end of month Stage of completion for materials, labor, and overhead (ending) Stage of completion for materials, labor, and overhead (beginning).. Units 1.000 18,000 4,000 One-half One-fourth Directions: Complete the following cost of production summary for Cobb Manufacturing Company. Show computations in spaces provided and round unit costs to three decimal places. Cobb Manufacturing Company Cost of Production Summary For the Month Ended June 30, 2011 Cost of work in process, beginning of month: Materials.. $ Labor Factory overhead. Cost of production for month: Materials. $ Labor Factory overhead. Total costs to be accounted for Unit output for month: Finished during month Equivalent units of work in process, end of month Total equivalent production. Unit cost for month: Materials Labor Factory overhead Total... Inventory costs: Cost of goods finished during month Cost of work in process, end of month: Materials Labor Factory overhead Total production costs accounted for 3. Using the data presented below, determine the figures that should be inserted in the blank spaces. Beginning units in process 700 Equivalent units of production Units Units started transferred to in production finished goods 3,200 2,300 4,500 5, 100 8,200 2,400 Ending units in process 600 - 1/3 completed 400 - 1/2 completed a b d 1,200 1,000 2,200 2,450 5,500 8,800 - 1/2 completed 500 - 4/5 completed