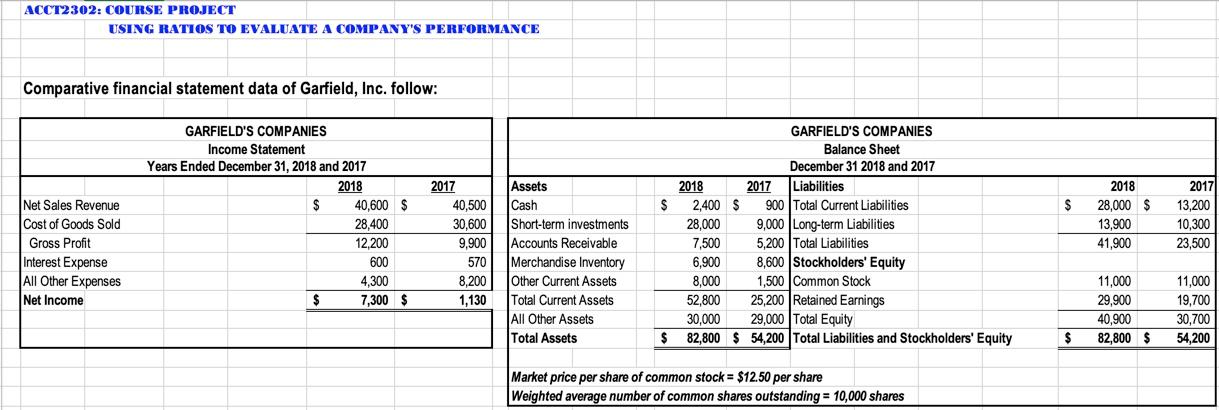

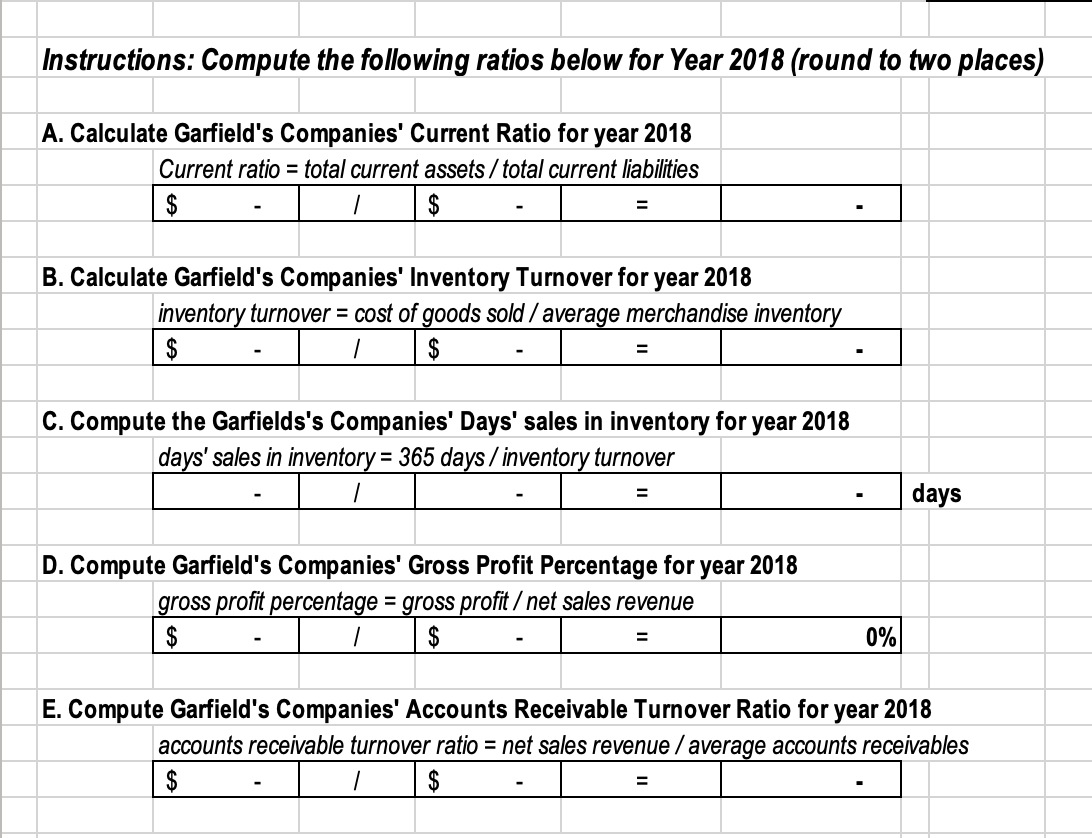

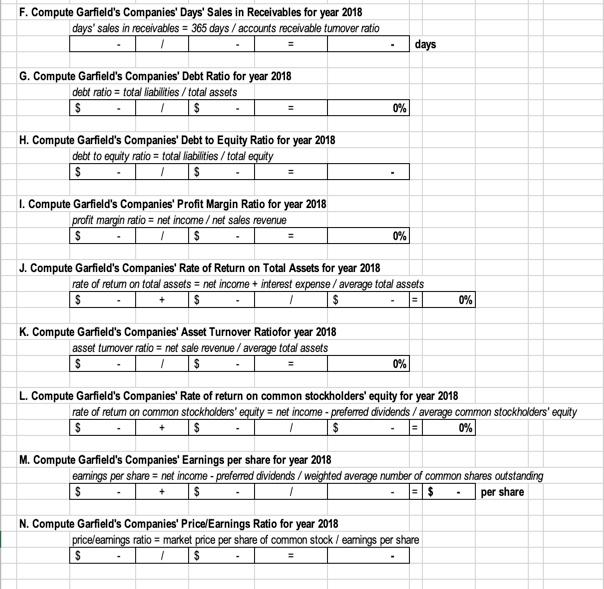

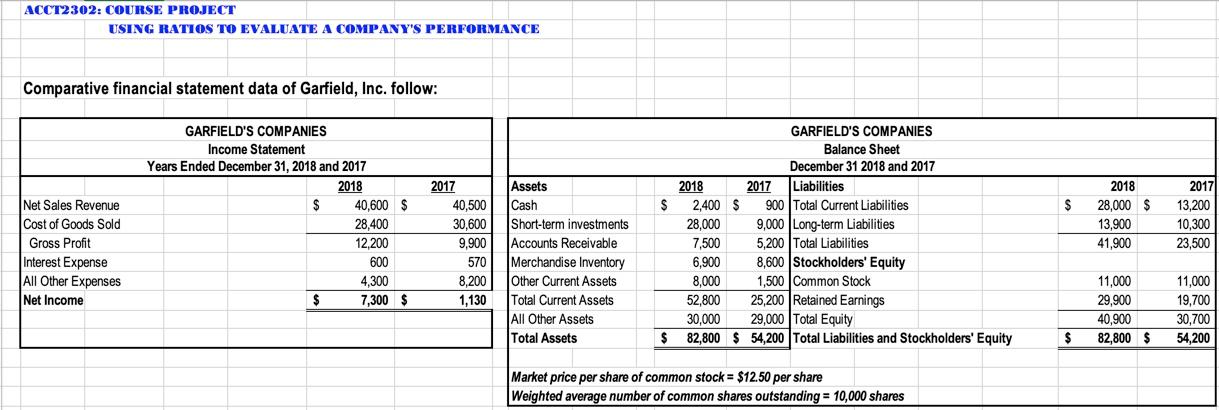

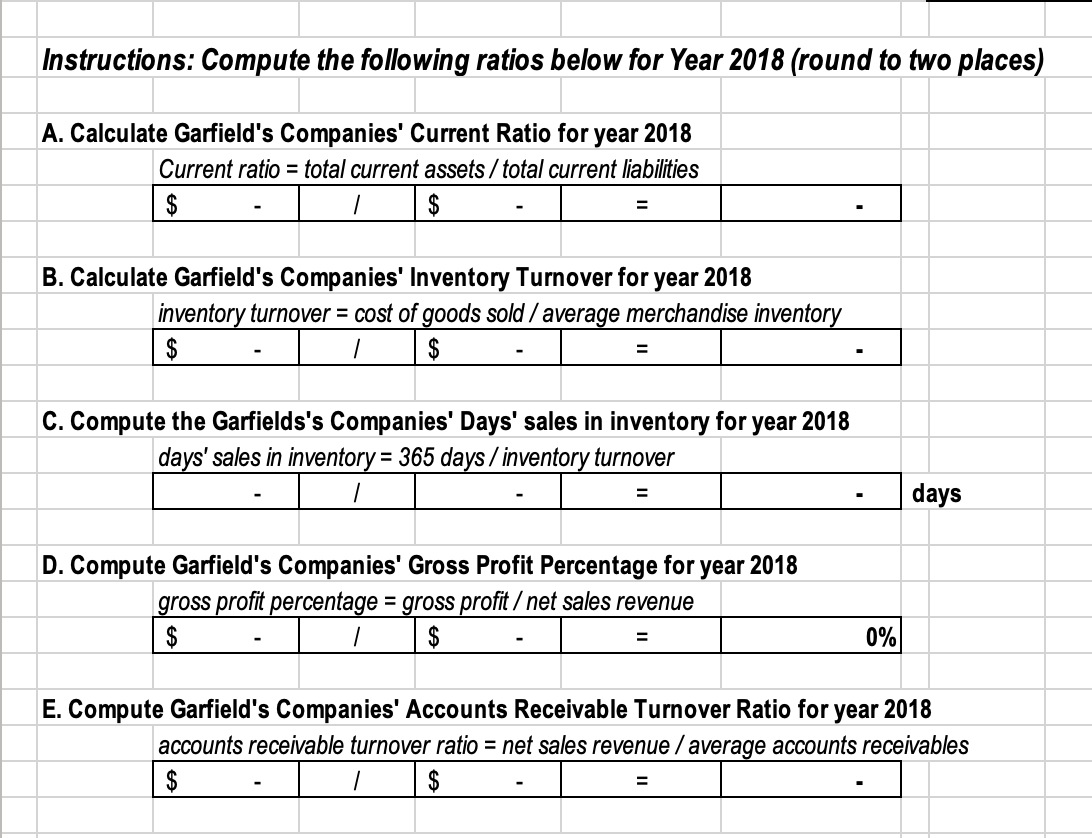

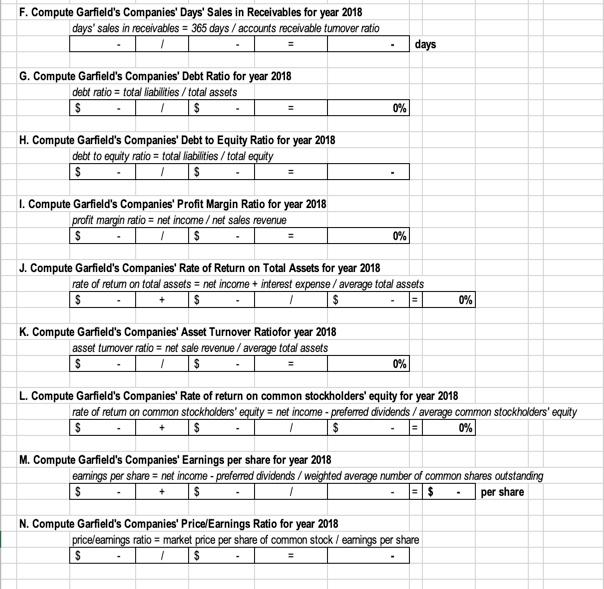

ACCT2302: COURSE PROJECT USING RATIOS TO EVALUATE A COMPANY'S PERFORMANCE Comparative financial statement data of Garfield, Inc. follow: $ $ GARFIELD'S COMPANIES Income Statement Years Ended December 31, 2018 and 2017 2018 $ 40,600 $ 28,400 12,200 600 4,300 $ 7,300 $ 2017 40,500 30,600 9,900 570 8.200 1,130 Net Sales Revenue Cost of Goods Sold Gross Profit Interest Expense All Other Expenses Net Income 2018 28,000 $ 13,900 41,900 GARFIELD'S COMPANIES Balance Sheet December 31 2018 and 2017 2018 2017 Liabilities 2,400 $ 900 Total Current Liabilities 28,000 9,000 Long-term Liabilities 7,500 5,200 Total Liabilities 6,900 8,600 Stockholders' Equity 8,000 1,500 Common Stock 52.800 25,200 Retained Earnings 30.000 29,000 Total Equity 82,800 $ 54,200 Total Liabilities and Stockholders' Equity 2017 13,200 10,300 23,500 Assets Cash Short-term investments Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets All Other Assets Total Assets 11,000 29.900 40.900 82,800 11,000 19,700 30,700 54,200 $ $ $ Market price per share of common stock = $12.50 per share Weighted average number of common shares outstanding = 10,000 shares Instructions: Compute the following ratios below for Year 2018 (round to two places) A. Calculate Garfield's Companies' Current Ratio for year 2018 Current ratio = total current assets / total current liabilities $ | $ = B. Calculate Garfield's Companies' Inventory Turnover for year 2018 inventory turnover = cost of goods sold / average merchandise inventory $ | $ C. Compute the Garfields's Companies' Days' sales in inventory for year 2018 days' sales in inventory = 365 days / inventory turnover days D. Compute Garfield's Companies' Gross Profit Percentage for year 2018 gross profit percentage = gross profit / net sales revenue $ $ 0% E. Compute Garfield's Companies' Accounts Receivable Turnover Ratio for year 2018 accounts receivable turnover ratio = net sales revenue / average accounts receivables $ $ F. Compute Garfield's Companies' Days' Sales in Receivables for year 2018 days' sales in receivables = 365 days / accounts receivable tumover ratio days G. Compute Garfield's Companies' Debt Ratio for year 2018 debt ratio = total liabilities / total assets S 0% H. Compute Garfield's Companies' Debt to Equity Ratio for year 2018 debt to equity ratio = total liabilities / total equity S 1. Compute Garfield's Companies' Profit Margin Ratio for year 2018 profit margin ratio = net income / net sales revenue S $ 0% J. Compute Garfield's Companies' Rate of Return on Total Assets for year 2018 rate of return on total assets = net income + interest expense / average total assets $ $ 0% K. Compute Garfield's Companies' Asset Turnover Ratiofor year 2018 asset turnover ratio = net sale revenue / average total assets $ $ 0% L. Compute Garfield's Companies' Rate of return on common stockholders' equity for year 2018 rate of return on common stockholders' equity = net income - preferred dividends / average common stockholders' equity S $ $ 0% M. Compute Garfield's Companies' Earnings per share for year 2018 earnings per share = net income - preferred dividends / weighted average number of common shares outstanding S $ = $ per share N. Compute Garfield's Companies' Price/Earnings Ratio for year 2018 price/earnings ratio = market price per share of common stock leamings per share $ $