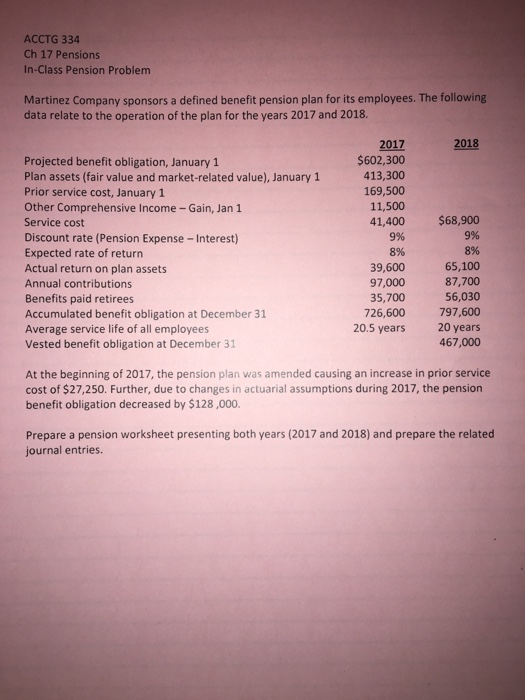

ACCTG 334 Ch 17 Pensions In-Class Pension Problem Martinez Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2017 and 2018. 2018 Projected benefit obligation, January 1 Plan assets (fair value and market-related value), January 1 Prior service cost, January 1 Other Comprehensive Income - Gain, Jan 1 Service cost Discount rate (Pension Expense -Interest) Expected rate of return Actual return on plan assets Annual contributions Benefits paid retirees Accumulated benefit obligation at December 31 Average service life of all employees Vested benefit obligation at December 31 2017 $602,300 413,300 169,500 11,500 41,400 9% 8% 39,600 97,000 35,700 726,600 20.5 years $68,900 9% 8% 65,100 87,700 56,030 797,600 20 years 467,000 At the beginning of 2017, the pension plan was amended causing an increase in prior service cost of $27,250. Further, due to changes in actuarial assumptions during 2017, the pension benefit obligation decreased by $128,000. Prepare a pension worksheet presenting both years (2017 and 2018) and prepare the related journal entries. ACCTG 334 Ch 17 Pensions In-Class Pension Problem Martinez Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2017 and 2018. 2018 Projected benefit obligation, January 1 Plan assets (fair value and market-related value), January 1 Prior service cost, January 1 Other Comprehensive Income - Gain, Jan 1 Service cost Discount rate (Pension Expense -Interest) Expected rate of return Actual return on plan assets Annual contributions Benefits paid retirees Accumulated benefit obligation at December 31 Average service life of all employees Vested benefit obligation at December 31 2017 $602,300 413,300 169,500 11,500 41,400 9% 8% 39,600 97,000 35,700 726,600 20.5 years $68,900 9% 8% 65,100 87,700 56,030 797,600 20 years 467,000 At the beginning of 2017, the pension plan was amended causing an increase in prior service cost of $27,250. Further, due to changes in actuarial assumptions during 2017, the pension benefit obligation decreased by $128,000. Prepare a pension worksheet presenting both years (2017 and 2018) and prepare the related journal entries