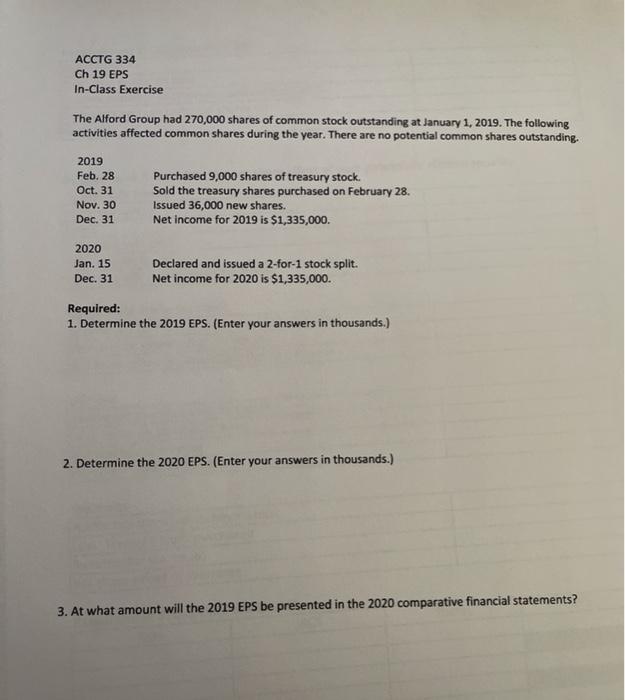

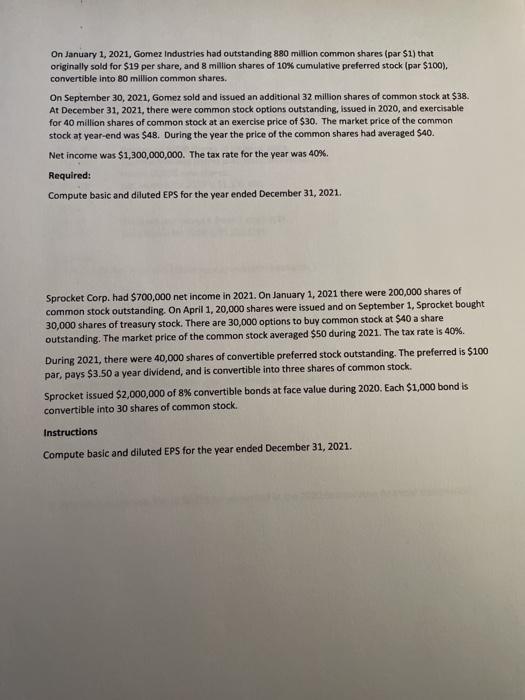

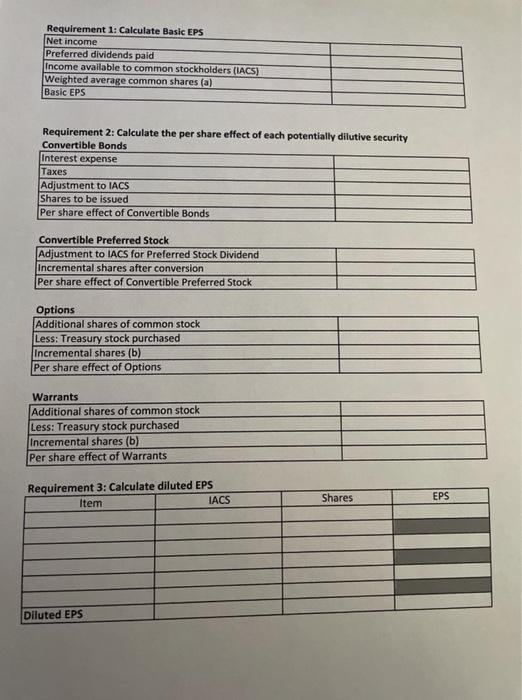

ACCTG 334 Ch 19 EPS In-Class Exercise The Alford Group had 270,000 shares of common stock outstanding at January 1, 2019. The following activities affected common shares during the year. There are no potential common shares outstanding. 2019 Feb. 28 Oct. 31 Nov. 30 Dec. 31 Purchased 9,000 shares of treasury stock. Sold the treasury shares purchased on February 28. Issued 36,000 new shares. Net income for 2019 is $1,335,000. 2020 Jan. 15 Dec. 31 Declared and issued a 2-for-1 stock split. Net income for 2020 is $1,335,000. Required: 1. Determine the 2019 EPS. (Enter your answers in thousands.) 2. Determine the 2020 EPS. (Enter your answers in thousands.) 3. At what amount will the 2019 EPS be presented in the 2020 comparative financial statements? On January 1, 2021, Gomez Industries had outstanding 880 million common shares (par $l) that originally sold for $19 per share, and 8 milion shares of 10% cumulative preferred stock (par $100), convertible into 80 million common shares. On September 30, 2021, Gomez sold and issued an additional 32 million shares of common stock at $38. At December 31, 2021, there were common stock options outstanding, issued in 2020, and exercisable for 40 million shares of common stock at an exercise price of $30. The market price of the common stock at year-end was $48. During the year the price of the common shares had averaged $40. Net Income was $1,300,000,000. The tax rate for the year was 40%. Required: Compute basic and diluted EPS for the year ended December 31, 2021. Sprocket Corp. had $700,000 net income in 2021. On January 1, 2021 there were 200,000 shares of common stock outstanding. On April 1, 20,000 shares were issued and on September 1, Sprocket bought 30,000 shares of treasury stock. There are 30,000 options to buy common stock at $40 a share outstanding. The market price of the common stock averaged $50 during 2021. The tax rate is 40%. During 2021, there were 40,000 shares of convertible preferred stock outstanding. The preferred is $100 par, pays $3.50 a year dividend, and is convertible into three shares of common stock. Sprocket issued $2,000,000 of 8% convertible bonds at face value during 2020. Each $1,000 bond is convertible into 30 shares of common stock Instructions Compute basic and diluted EPS for the year ended December 31, 2021. Requirement 1: Calculate Basic EPS Net income Preferred dividends paid Income available to common stockholders (LACS) Weighted average common shares (a) Basic EPS Requirement 2: Calculate the per share effect of each potentially dilutive security Convertible Bonds Interest expense Taxes Adjustment to IACS Shares to be issued Per share effect of Convertible Bonds Convertible Preferred Stock Adjustment to IACS for Preferred Stock Dividend Incremental shares after conversion Per share effect of Convertible Preferred Stock Options Additional shares of common stock Less: Treasury stock purchased Incremental shares (b) Per share effect of Options Warrants Additional shares of common stock Less: Treasury stock purchased Incremental shares (b) Per share effect of Warrants Requirement 3: Calculate diluted EPS Item IACS Shares EPS Diluted EPS