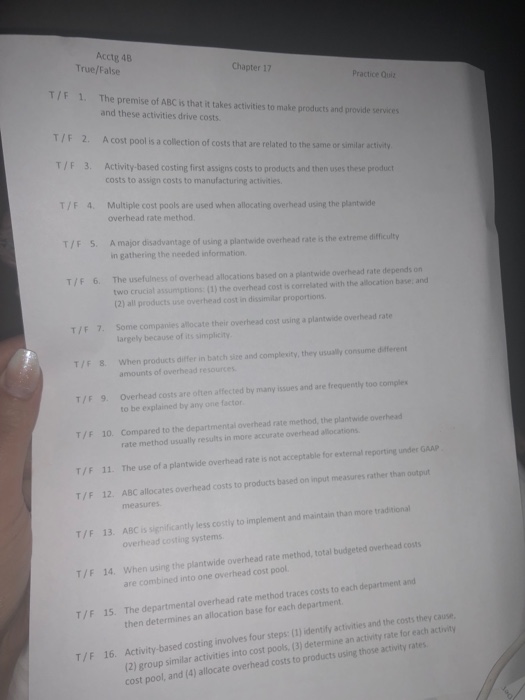

Acctg 48 True/False Chapter 17 Practice Quz T/F 1. The premise of ABC is that it takes activities to make products and provide services and these activities drive costs A cost pool is a collection of costs that are related to the same or similar activity T/F 3. Activity-based costing first assigns costs to products and then uses these product T/F 4 Multiple cost pools are used when allocating overhead using the plantwide T/F S. Amajor dsasdvantage of using a plantwide overhead rate is the extreme diffiuty costs to assign costs to manufacturing activities overhead rate method in gathering the needed information T/F 6. The usefulness of overhead allocations based on a plantwide overhead rate depends on two crucial assumptions: (1) the overhead cost is correlated with the allocation base, ansd (2) all products use overhead cost in dissimilar proportions T/F 7 Some companies allocate their overhead cost using a plantwide overhead rate T/F 8 When products differ in batch sice and complesity, they sually consume different T/F 9. Overhead costs are often affected by many issues and are frequently too comples T/F 10 Compared to the departmental overhead rate method, the plantwide overhead largely because of its simplicity amounts of overhead resources to be explained by any one factor rate method usually results in more accurate overhead allocations T/F The use of a plantwide overhead rate is not accept 11. T/F 12. ABC allocates overhead costs to products based on input measures rather than output measures ABC is significantly less costly to implement and maintain than more traditional overhead costing systems T/F 13. When using the plantwide overhead rate method, total budgeted overhead costs are combined into one overhead cost pool T/F 14. The departmental overhead rate method traces costs to each department and then determines an allocation base for each department T/F 15. (2) group similar activities into cost pools, (3) determine an actvity rate for each activity cost pool, and (4) allocate overhead costs to products using those actvity rates 16. Activity-based costing involves four steps: (1) identily activities and the costs they caue Acctg 48 True/False Chapter 17 Practice Quz T/F 1. The premise of ABC is that it takes activities to make products and provide services and these activities drive costs A cost pool is a collection of costs that are related to the same or similar activity T/F 3. Activity-based costing first assigns costs to products and then uses these product T/F 4 Multiple cost pools are used when allocating overhead using the plantwide T/F S. Amajor dsasdvantage of using a plantwide overhead rate is the extreme diffiuty costs to assign costs to manufacturing activities overhead rate method in gathering the needed information T/F 6. The usefulness of overhead allocations based on a plantwide overhead rate depends on two crucial assumptions: (1) the overhead cost is correlated with the allocation base, ansd (2) all products use overhead cost in dissimilar proportions T/F 7 Some companies allocate their overhead cost using a plantwide overhead rate T/F 8 When products differ in batch sice and complesity, they sually consume different T/F 9. Overhead costs are often affected by many issues and are frequently too comples T/F 10 Compared to the departmental overhead rate method, the plantwide overhead largely because of its simplicity amounts of overhead resources to be explained by any one factor rate method usually results in more accurate overhead allocations T/F The use of a plantwide overhead rate is not accept 11. T/F 12. ABC allocates overhead costs to products based on input measures rather than output measures ABC is significantly less costly to implement and maintain than more traditional overhead costing systems T/F 13. When using the plantwide overhead rate method, total budgeted overhead costs are combined into one overhead cost pool T/F 14. The departmental overhead rate method traces costs to each department and then determines an allocation base for each department T/F 15. (2) group similar activities into cost pools, (3) determine an actvity rate for each activity cost pool, and (4) allocate overhead costs to products using those actvity rates 16. Activity-based costing involves four steps: (1) identily activities and the costs they caue