Answered step by step

Verified Expert Solution

Question

1 Approved Answer

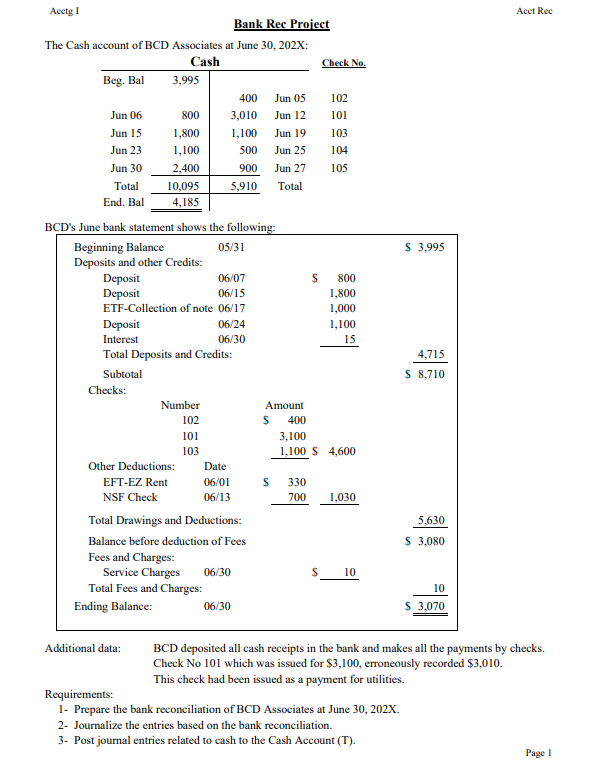

Acctg I Bank Rec Project The Cash account of BCD Associates at June 30, 202X: Beg. Bal Cash 3,995 Check No. 400 Jun 05

Acctg I Bank Rec Project The Cash account of BCD Associates at June 30, 202X: Beg. Bal Cash 3,995 Check No. 400 Jun 05 102 Jun 06 800 3,010 Jun 12 101 Jun 15 1,800 1,100 Jun 19 103 Jun 23 1,100 500 Jun 25 104 Jun 30 2,400 900 Jun 27 105 Total 10,095 5,910 Total End. Bal 4,185 BCD's June bank statement shows the following: Beginning Balance 05/31 $ 3,995 Deposits and other Credits: Deposit 06/07 S 800 Deposit 06/15 1,800 ETF-Collection of note 06/17 1,000 Deposit 06/24 1,100 Interest 06/30 15 Total Deposits and Credits: Subtotal Checks: Number Amount 102 $ 400 101 3,100 103 1,100 $ 4,600 Other Deductions: Date EFT-EZ Rent 06/01 $ 330 NSF Check 06/13 700 1,030 Total Drawings and Deductions: Balance before deduction of Fees Fees and Charges: Service Charges 06/30 Total Fees and Charges: Ending Balance: 06/30 Additional data: 10 4,715 $ 8,710 5,630 $ 3,080 10 $ 3,070 Acct Rec Requirements: BCD deposited all cash receipts in the bank and makes all the payments by checks. Check No 101 which was issued for $3,100, erroneously recorded $3,010. This check had been issued as a payment for utilities. 1- Prepare the bank reconciliation of BCD Associates at June 30, 202X. 2- Journalize the entries based on the bank reconciliation. 3- Post journal entries related to cash to the Cash Account (T). Page 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started