Answered step by step

Verified Expert Solution

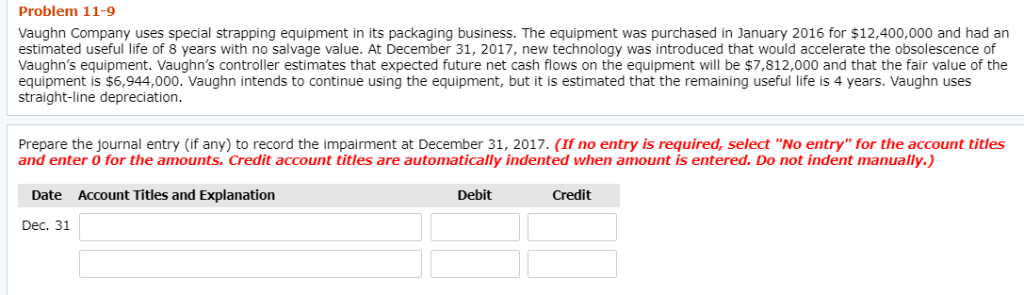

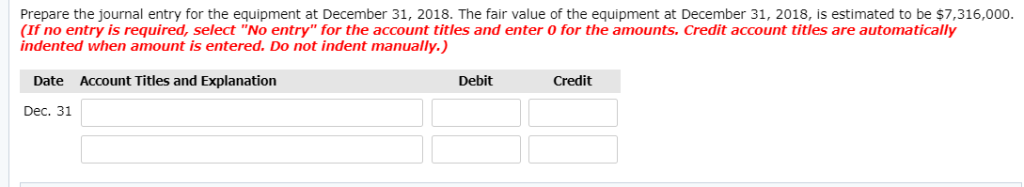

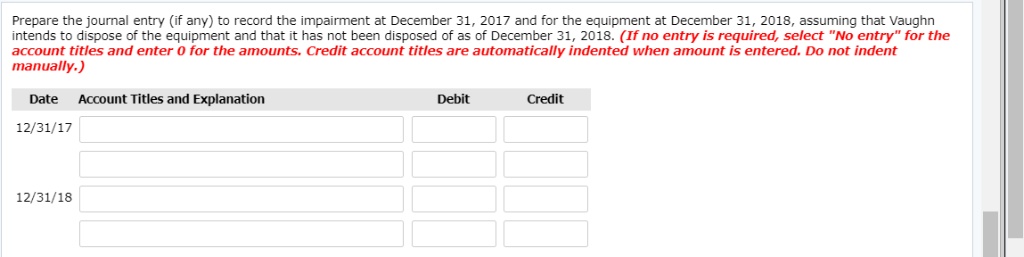

Question

1 Approved Answer

Accumulated Depreciation-Building Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant Assets Accumulated Depreciation-Trucks Buildings Cash Coal Mine Depreciation Expense Equipment Gain on Disposal of Machinery Inventory Loss

Accumulated Depreciation-Building Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant Assets Accumulated Depreciation-Trucks Buildings Cash Coal Mine Depreciation Expense Equipment Gain on Disposal of Machinery Inventory Loss on Disposal of Plant Assets Loss on Impairment Machinery Maintenance and Repairs Expense No Entry Paid-in Capital in Excess of Par - Common Stock Plant Assets Recovery of Loss from Impairment Retained Earnings Timber Trucks

Accumulated Depreciation-Building Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant Assets Accumulated Depreciation-Trucks Buildings Cash Coal Mine Depreciation Expense Equipment Gain on Disposal of Machinery Inventory Loss on Disposal of Plant Assets Loss on Impairment Machinery Maintenance and Repairs Expense No Entry Paid-in Capital in Excess of Par - Common Stock Plant Assets Recovery of Loss from Impairment Retained Earnings Timber Trucks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started