Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Allowance for Doubtful Accounts Bad Debt Expense Bond Issue Expense Bonds Payable Buildings Cash Common Stock Debt Investments Depreciation Expense Discount

Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Allowance for Doubtful Accounts Bad Debt Expense Bond Issue Expense Bonds Payable Buildings Cash Common Stock Debt Investments Depreciation Expense Discount on Bonds Payable Discount on Notes Payable Discount on Notes Receivable Equipment Equity Investments Gain on Disposal of Machinery Gain on Disposal of Land Gain on Disposal of Plant Assets Gain on Redemption of Bonds Gain on Restructuring of Debt Gain on Sale of Machinery Interest Expense Interest Payable Interest Receivable Interest Revenue Land Loss on Disposal of Land Loss on Redemption of Bonds Machinery Mortgage Payable No Entry Notes Payable Notes Receivable Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Premium on Bonds Payable Sales Revenue Unamortized Bond Issue Costs Unearned Revenue Unearned Sales Revenue Unrealized Holding Gain or Loss - Income

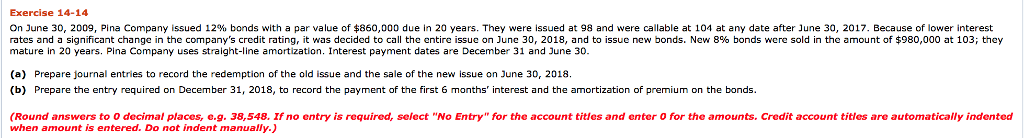

Exercise 14-14 On June 30, 2009, Pina Company issued 12% bonds with a par value of $860,000 due in 20 years. They were issued at 98 and were callable at 104 at any date after June 30, 2017, Because of lower interest rates and a significant change in the company's credit rating, it was decided to call the entire issue on June 30, 2018, and to issue new bonds. New 896 bonds were sold in the mount of $980,000 at 103; they mature in 20 years. Pina Company uses straight-line amortization. Interest payment dates are December 31 and June 30 (a) Prepare journal entries to record the redemption of the old issue and the sale of the new issue on June 30, 2018. (b) Prepare the entry required on December 31, 2018, to record the payment of the first 6 months' interest and the amortization of premium on the bonds (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started