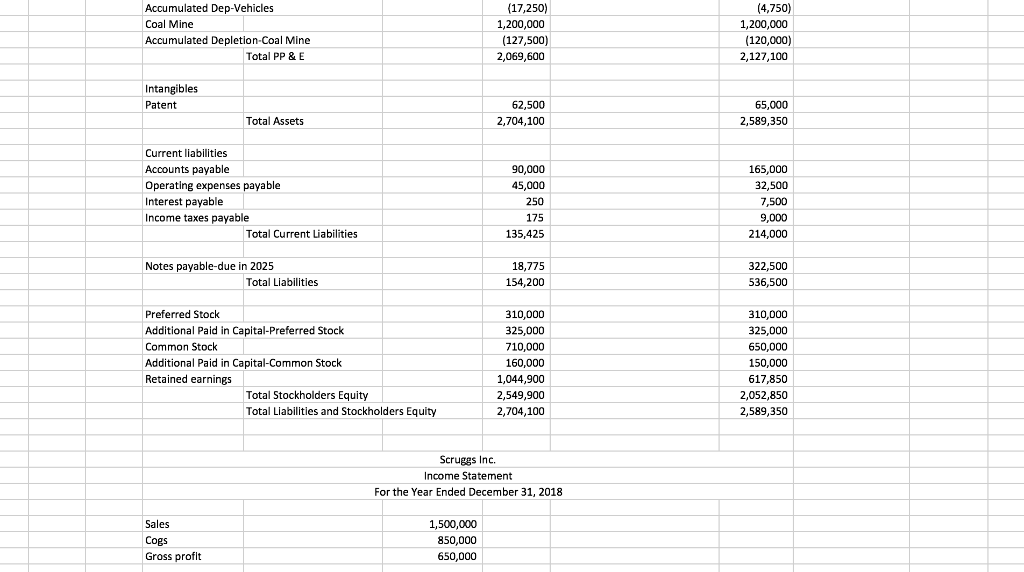

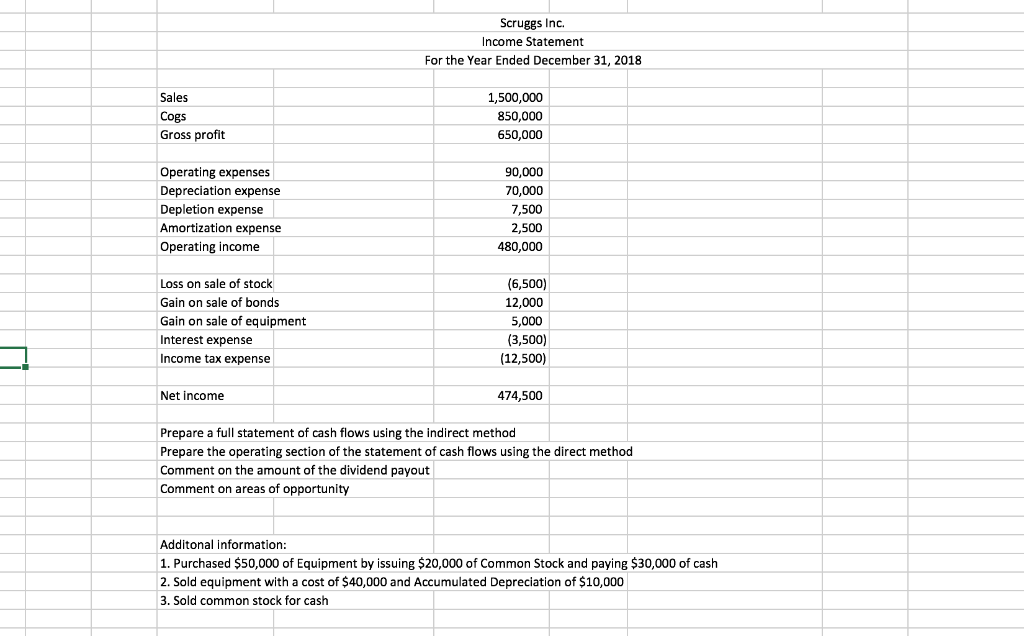

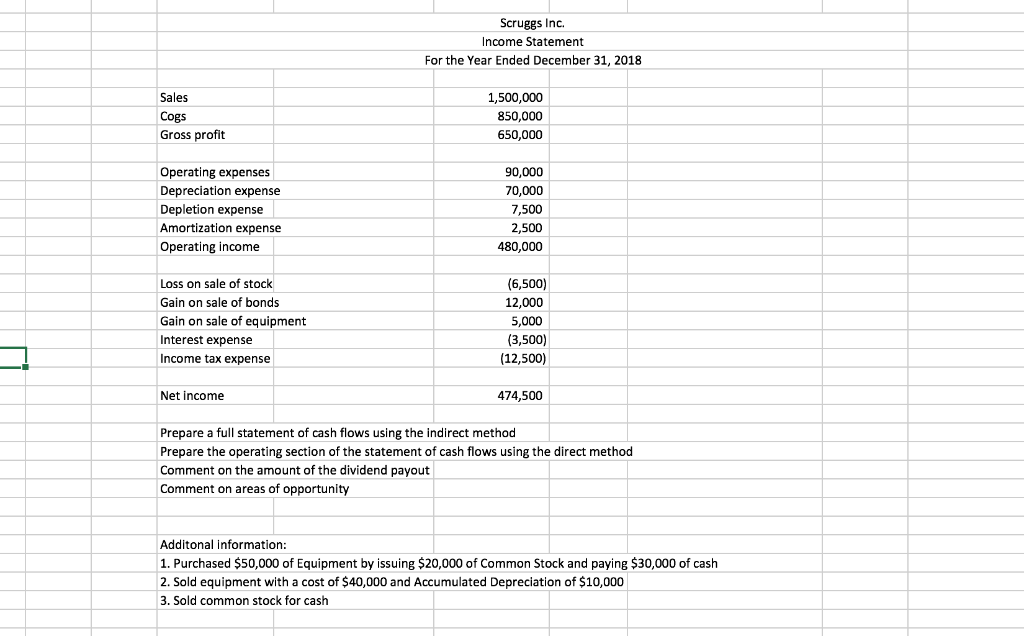

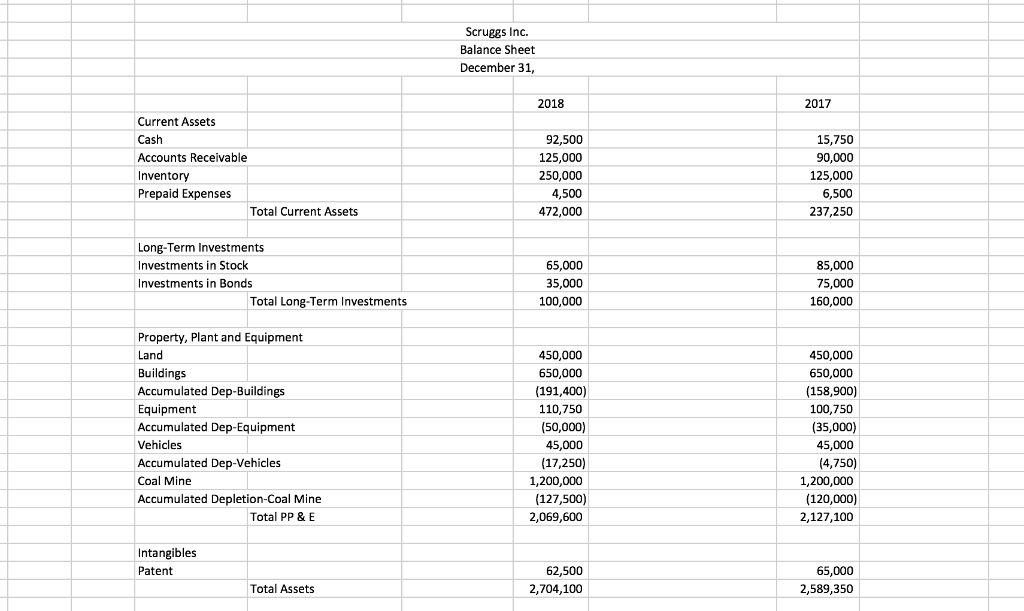

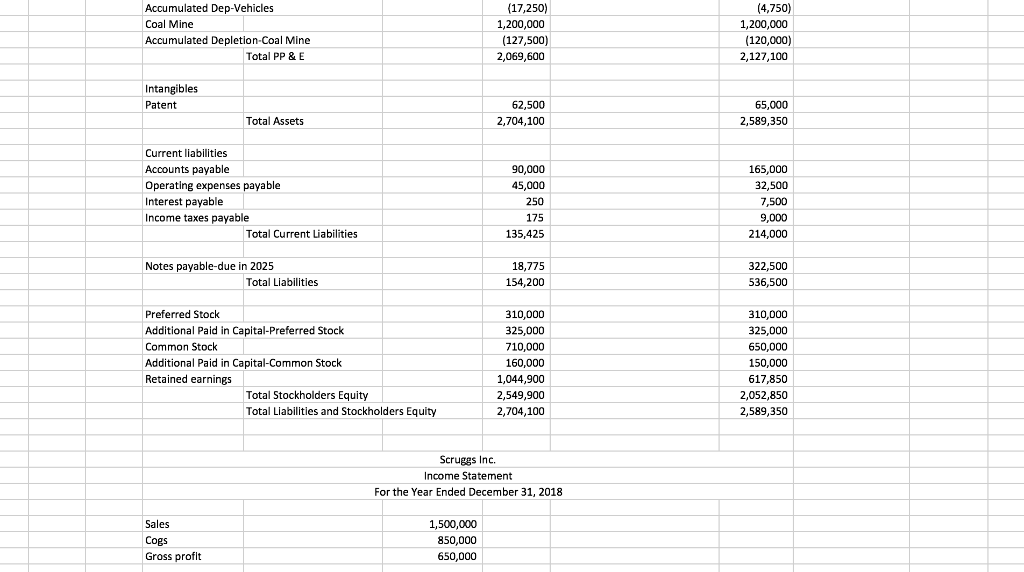

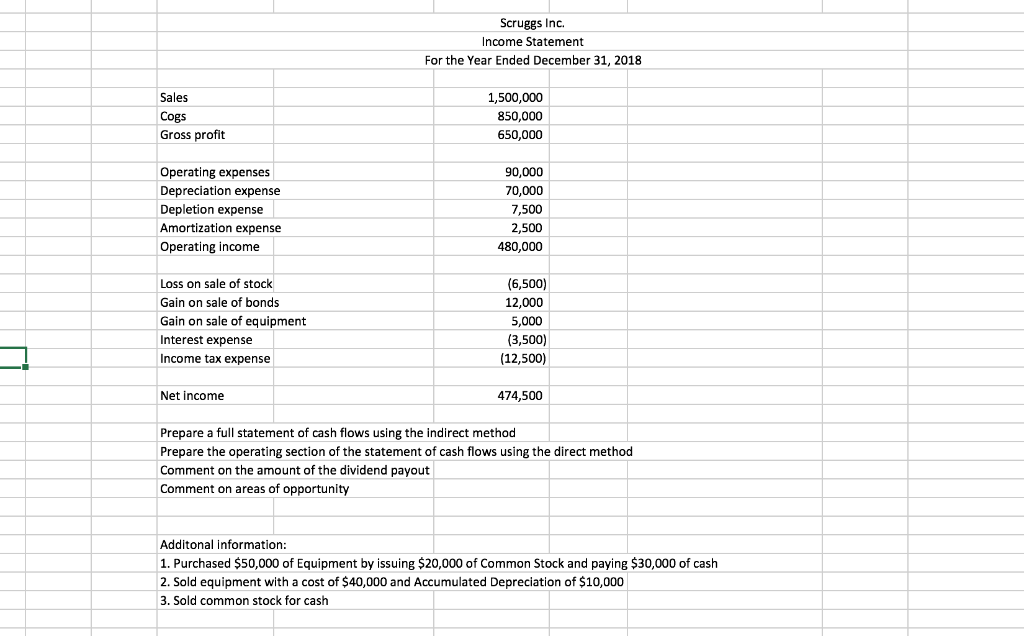

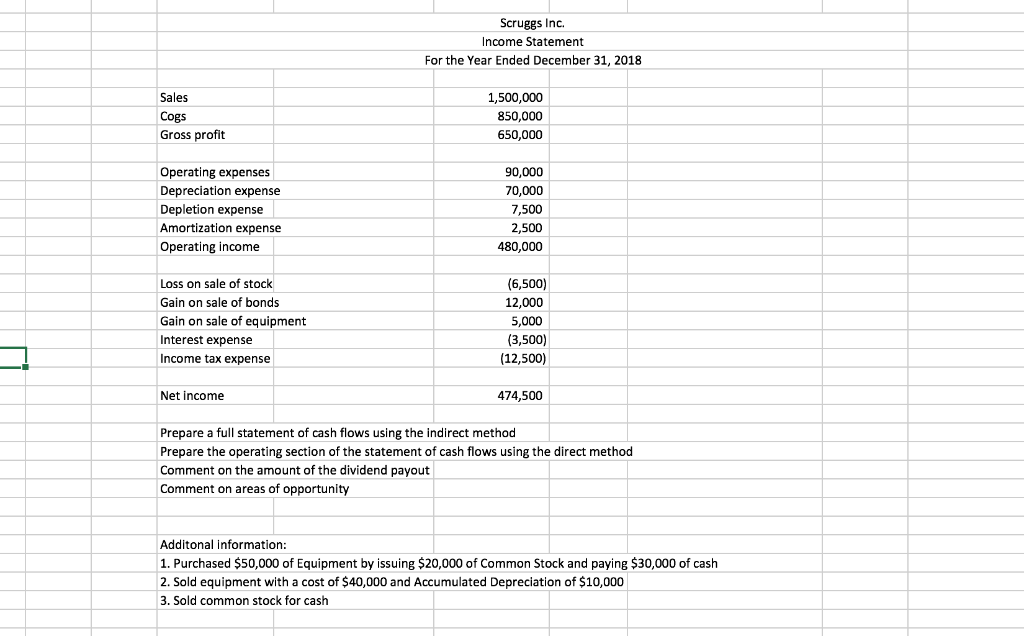

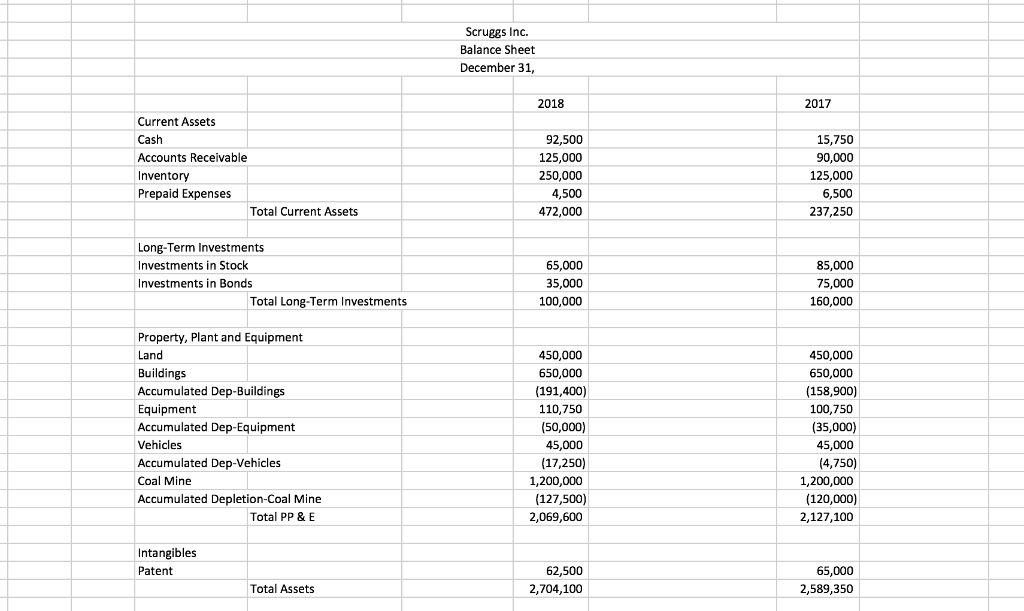

Accumulated Dep-Vehicles Coal Mine Accumulated Depletion-Coal Mine (17,250) 1,200,000 (127,500) 2,069,600 (4,750) 1,200,000 (120,000) 2,127,100 Total PP & E Intangibles Patent 62,500 2,704,100 65,000 Total Assets 2,589,350 Current liabilities Accounts payable Operating expenses payable Interest payable Income taxes payable 90,000 45,000 250 175 135,425 165,000 32,500 7,500 9,000 214,000 Total Current Liabilities 322,500 536,500 Notes payable-due in 2025 18,775 154,200 Total Liabilities Preferred Stock Additional Paid in Capital-Preferred Stock Common Stock Additional Paid in Capital-Common Stock Retained earnings 310,000 325,000 710,000 160,000 1,044,900 2,549,900 2,704,100 310,000 325,000 650,000 150,000 617,850 2,052,850 2,589,350 Total Stockholders Equity Total Liabilities and Stockholders Equity Scruggs Inc Income Statement For the Year Ended December 31, 2018 Cogs Gross profit 1,500,000 850,000 650,000 Scruggs Inc. Income Statement For the Year Ended December 31, 2018 Sales Cogs Gross profit 1,500,000 850,000 650,000 Operating expenses Depreciation expense Depletion expense Amortization expense Operating income 90,000 70,000 7,500 2,500 480,000 Loss on sale of stock Gain on sale of bonds Gain on sale of equipment Interest expense Income tax expense (6,500) 12,000 5,000 (3,500) (12,500) Net income 474,500 Prepare a full statement of cash flows using the indirect method Prepare the operating section of the statement of cash flows using the direct method Comment on the amount of the dividend payout Comment on areas of opportunity Additonal information: 1. Purchased $50,000 of Equipment by issuing $20,000 of Common Stock and paying $30,000 of cash 2. Sold equipment with a cost of $40,000 and Accumulated Depreciation of $10,000 3. Sold common stock for cash Scruggs Inc. Income Statement For the Year Ended December 31, 2018 Sales Cogs Gross profit 1,500,000 850,000 650,000 Operating expenses Depreciation expense Depletion expense Amortization expense Operating income 90,000 70,000 7,500 2,500 480,000 Loss on sale of stock Gain on sale of bonds Gain on sale of equipment Interest expense Income tax expense (6,500) 12,000 5,000 (3,500) (12,500) Net income 474,500 Prepare a full statement of cash flows using the indirect method Prepare the operating section of the statement of cash flows using the direct method Comment on the amount of the dividend payout Comment on areas of opportunity Additonal information: 1. Purchased $50,000 of Equipment by issuing $20,000 of Common Stock and paying $30,000 of cash 2. Sold equipment with a cost of $40,000 and Accumulated Depreciation of $10,000 3. Sold common stock for cash Scruggs Inc. Balance Sheet December 31, 2018 2017 Current Assets Cash Accounts Receivable Inventory Prepaid Expenses 92,500 125,000 250,000 4,500 472,000 15,750 90,000 125,000 6,500 237,250 Total Current Assets Long-Term Investments Investments in Stock Investments in Bonds 65,000 35,000 100,000 85,000 75,000 160,000 Total Long-Term Investments Property, Plant and Equipment Land Buildings Accumulated Dep-Buildings Equipment Accumulated Dep-Equipment Vehicles Accumulated Dep-Vehicles Coal Mine Accumulated Depletion-Coal Mine 450,000 650,000 (191,400) 110,750 (50,000) 45,000 (17,250) 1,200,000 (127,500) 2,069,600 450,000 650,000 (158,900) 100,750 (35,000) 45,000 (4,750) 1,200,000 (120,000) 2,127,100 Total PP & E Intangibles Patent 62,500 2,704,100 65,000 2,589,350 Total Assets Accumulated Dep-Vehicles Coal Mine Accumulated Depletion-Coal Mine (17,250) 1,200,000 (127,500) 2,069,600 (4,750) 1,200,000 (120,000) 2,127,100 Total PP & E Intangibles Patent 62,500 2,704,100 65,000 Total Assets 2,589,350 Current liabilities Accounts payable Operating expenses payable Interest payable Income taxes payable 90,000 45,000 250 175 135,425 165,000 32,500 7,500 9,000 214,000 Total Current Liabilities 322,500 536,500 Notes payable-due in 2025 18,775 154,200 Total Liabilities Preferred Stock Additional Paid in Capital-Preferred Stock Common Stock Additional Paid in Capital-Common Stock Retained earnings 310,000 325,000 710,000 160,000 1,044,900 2,549,900 2,704,100 310,000 325,000 650,000 150,000 617,850 2,052,850 2,589,350 Total Stockholders Equity Total Liabilities and Stockholders Equity Scruggs Inc Income Statement For the Year Ended December 31, 2018 Cogs Gross profit 1,500,000 850,000 650,000 Scruggs Inc. Income Statement For the Year Ended December 31, 2018 Sales Cogs Gross profit 1,500,000 850,000 650,000 Operating expenses Depreciation expense Depletion expense Amortization expense Operating income 90,000 70,000 7,500 2,500 480,000 Loss on sale of stock Gain on sale of bonds Gain on sale of equipment Interest expense Income tax expense (6,500) 12,000 5,000 (3,500) (12,500) Net income 474,500 Prepare a full statement of cash flows using the indirect method Prepare the operating section of the statement of cash flows using the direct method Comment on the amount of the dividend payout Comment on areas of opportunity Additonal information: 1. Purchased $50,000 of Equipment by issuing $20,000 of Common Stock and paying $30,000 of cash 2. Sold equipment with a cost of $40,000 and Accumulated Depreciation of $10,000 3. Sold common stock for cash Scruggs Inc. Income Statement For the Year Ended December 31, 2018 Sales Cogs Gross profit 1,500,000 850,000 650,000 Operating expenses Depreciation expense Depletion expense Amortization expense Operating income 90,000 70,000 7,500 2,500 480,000 Loss on sale of stock Gain on sale of bonds Gain on sale of equipment Interest expense Income tax expense (6,500) 12,000 5,000 (3,500) (12,500) Net income 474,500 Prepare a full statement of cash flows using the indirect method Prepare the operating section of the statement of cash flows using the direct method Comment on the amount of the dividend payout Comment on areas of opportunity Additonal information: 1. Purchased $50,000 of Equipment by issuing $20,000 of Common Stock and paying $30,000 of cash 2. Sold equipment with a cost of $40,000 and Accumulated Depreciation of $10,000 3. Sold common stock for cash Scruggs Inc. Balance Sheet December 31, 2018 2017 Current Assets Cash Accounts Receivable Inventory Prepaid Expenses 92,500 125,000 250,000 4,500 472,000 15,750 90,000 125,000 6,500 237,250 Total Current Assets Long-Term Investments Investments in Stock Investments in Bonds 65,000 35,000 100,000 85,000 75,000 160,000 Total Long-Term Investments Property, Plant and Equipment Land Buildings Accumulated Dep-Buildings Equipment Accumulated Dep-Equipment Vehicles Accumulated Dep-Vehicles Coal Mine Accumulated Depletion-Coal Mine 450,000 650,000 (191,400) 110,750 (50,000) 45,000 (17,250) 1,200,000 (127,500) 2,069,600 450,000 650,000 (158,900) 100,750 (35,000) 45,000 (4,750) 1,200,000 (120,000) 2,127,100 Total PP & E Intangibles Patent 62,500 2,704,100 65,000 2,589,350 Total Assets