Accurate Builders construction company was incorporated by John Davis. Assume the following activities occurred during the year:

-

Received from three investors $60,000 cash and land valued at $35,000; each investor was issued 1,000 shares of common stock with a par value of $0.10 per share.

-

Purchased construction equipment for use in the business at a cost of $36,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months).

-

Lent $2,500 to one of the investors, who signed a note due in six months.

-

John Davis purchased a truck for personal use; paid $5,000 down and signed a one-year note for $22,000.

-

Paid $12,000 on the note for the construction equipment in (b) (ignore interest).

Required:

1. For each of the preceding transactions, record the effects of the transaction in the appropriate T-accounts.

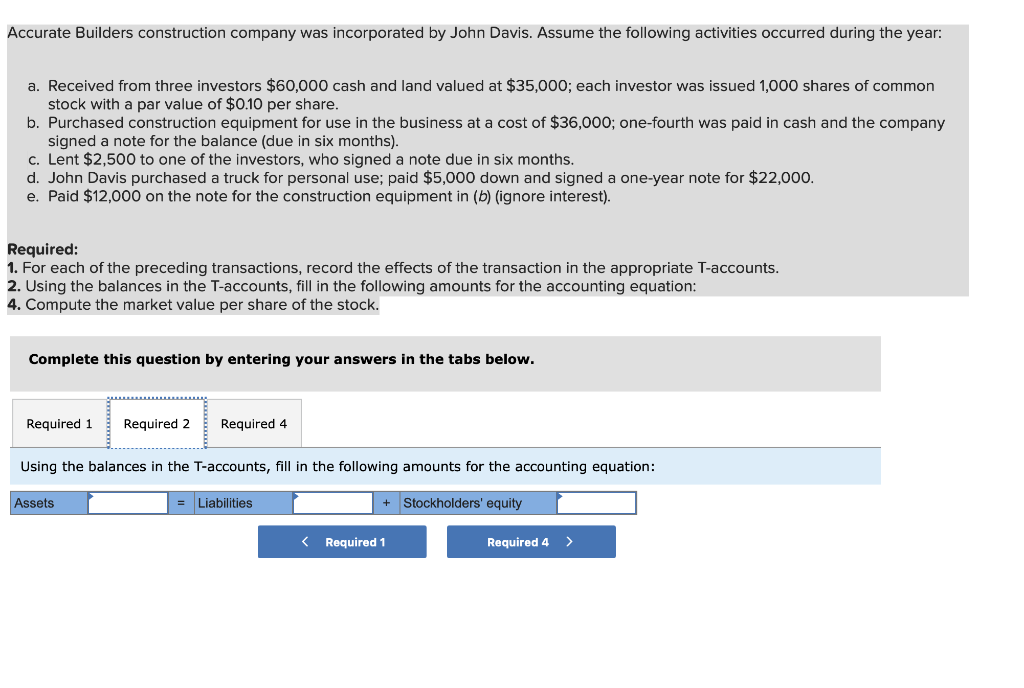

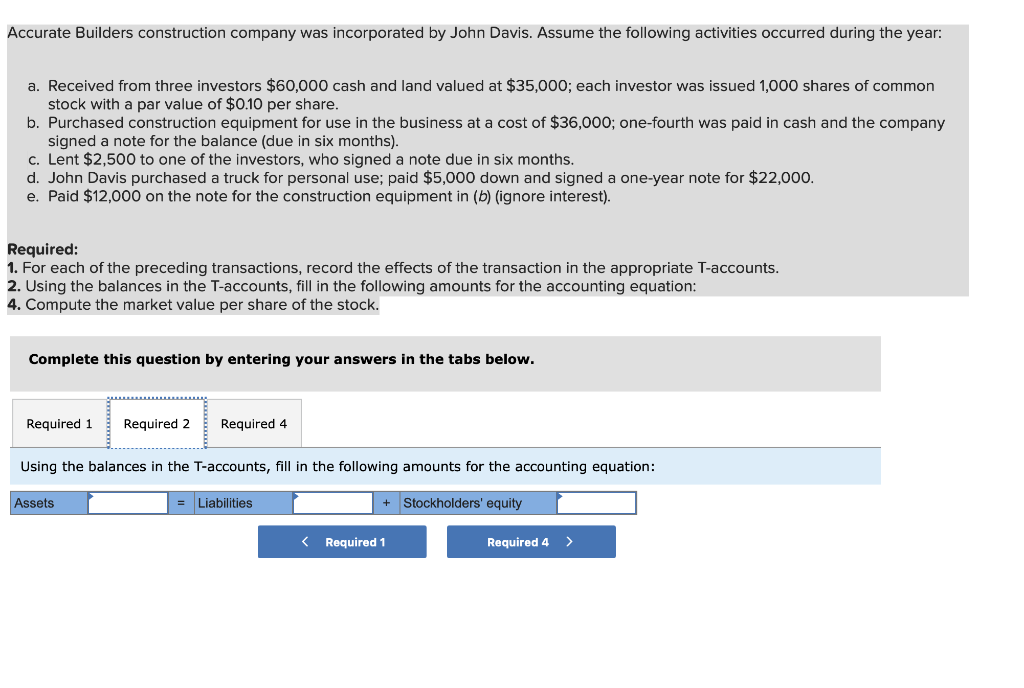

2. Using the balances in the T-accounts, fill in the following amounts for the accounting equation:

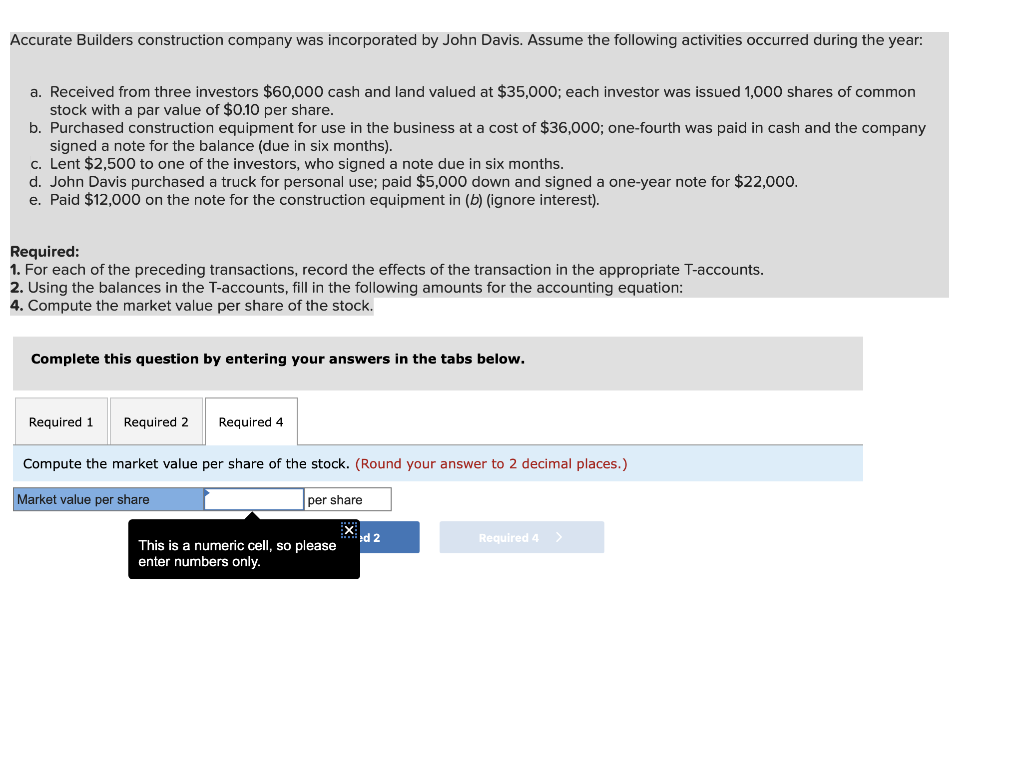

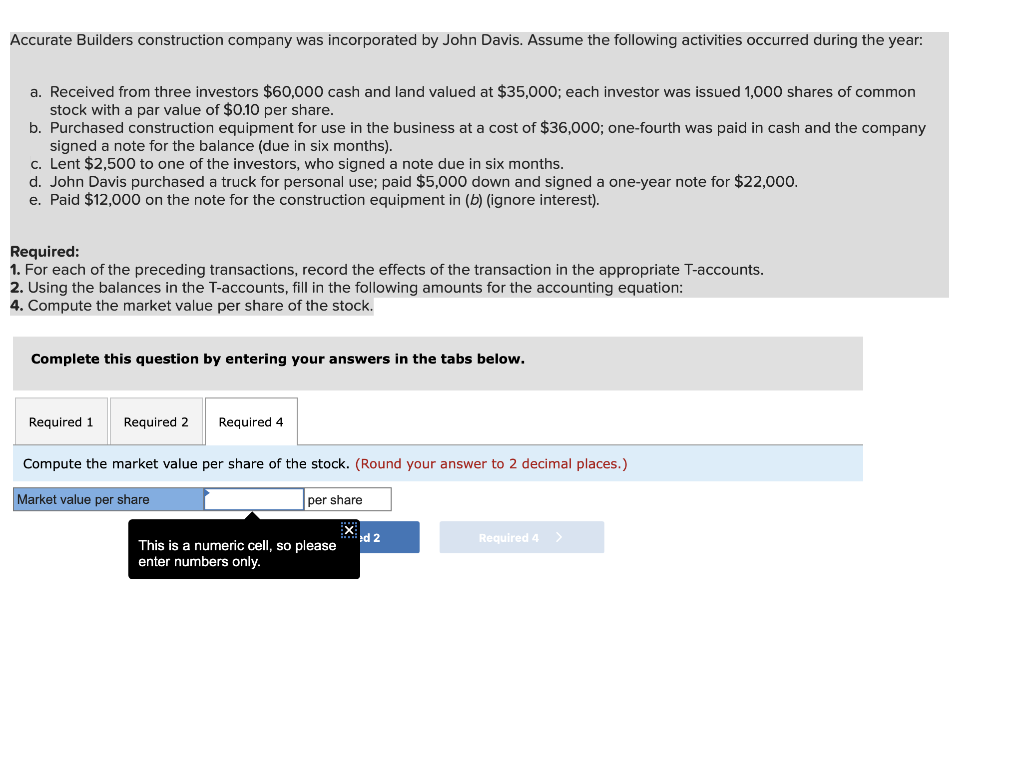

4. Compute the market value per share of the stock.

Accurate Builders construction company was incorporated by John Davis. Assume the following activities occurred during the year: a. Received from three investors $60,000 cash and land valued at $35,000; each investor was issued 1,000 shares of common stock with a par value of $0.10 per share. b. Purchased construction equipment for use in the business at a cost of $36,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). c. Lent $2,500 to one of the investors, who signed a note due in six months. d. John Davis purchased a truck for personal use; paid $5,000 down and signed a one-year note for $22,000. e. Paid $12,000 on the note for the construction equipment in (b) (ignore interest). Required: 1. For each of the preceding transactions, record the effects of the transaction in the appropriate T-accounts. 2. Using the balances in the T-accounts, fill in the following amounts for the accounting equation: 4. Compute the market value per share of the stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 4 Compute the market value per share of the stock. (Round your answer to 2 decimal places.) Market value per share per share d 2 Required 4 This is a numeric cell, so please enter numbers only. Accurate Builders construction company was incorporated by John Davis. Assume the following activities occurred during the year: a. Received from three investors $60,000 cash and land valued at $35,000; each investor was issued 1,000 shares of common stock with a par value of $0.10 per share. b. Purchased construction equipment for use in the business at a cost of $36,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). c. Lent $2,500 to one of the investors, who signed a note due in six months. d. John Davis purchased a truck for personal use; paid $5,000 down and signed a one-year note for $22,000. e. Paid $12,000 on the note for the construction equipment in (b) (ignore interest). Required: 1. For each of the preceding transactions, record the effects of the transaction in the appropriate T-accounts. 2. Using the balances in the T-accounts, fill in the following amounts for the accounting equation: 4. Compute the market value per share of the stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 4 Using the balances in the T-accounts, fill in the following amounts for the accounting equation: Assets = Liabilities + Stockholders' equity Required 1 Required 4 >