Answered step by step

Verified Expert Solution

Question

1 Approved Answer

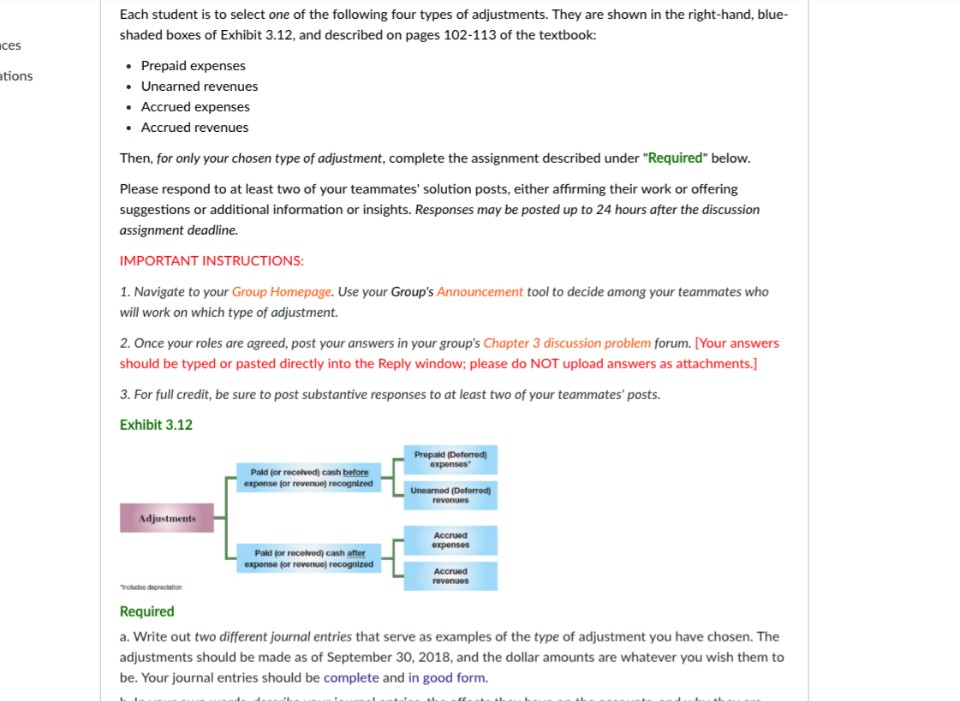

Accurued revenues a. Write out two different journal entries that serve as examples of the type of adjustment you have chosen. The adjustments should be

Accurued revenues

a. Write out two different journal entries that serve as examples of the type of adjustment you have chosen. The adjustments should be made as of September 30, 2018, and the dollar amounts are whatever you wish them to be. Your journal entries should be completeand in good form.

b. In your own words, describe your journal entries, the effects they have on the accounts, and why they are necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started