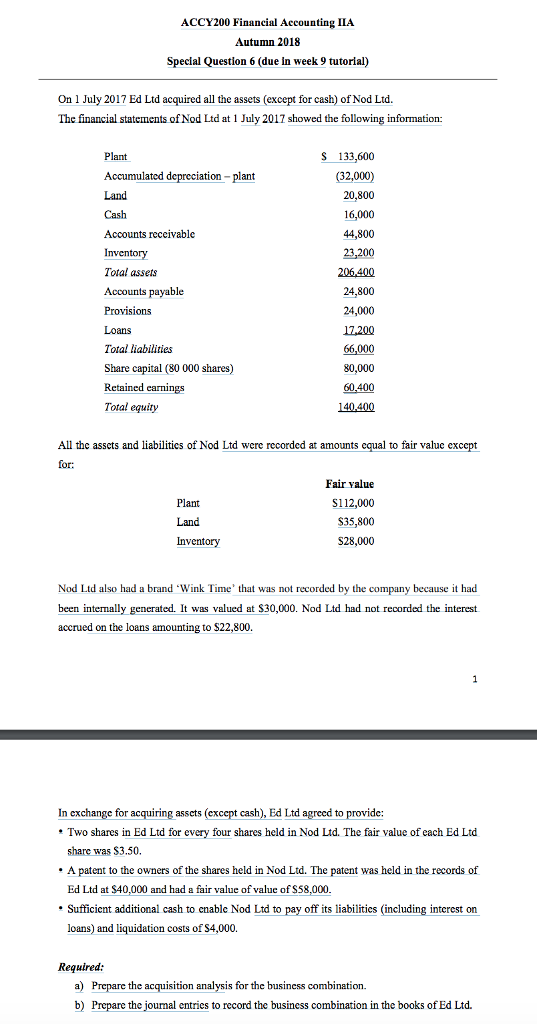

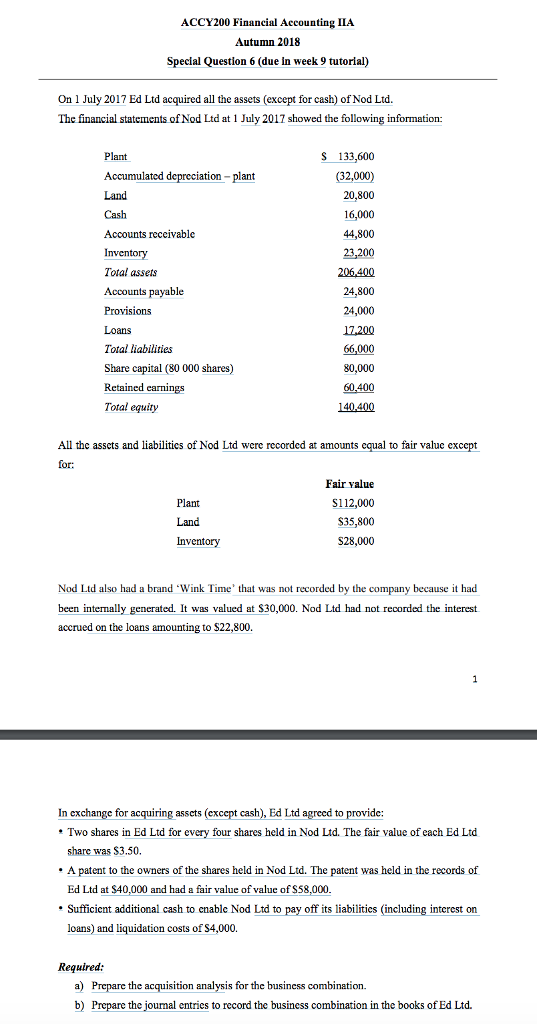

ACCY200 Financial Accounting IIA Autumn 2018 Special Question 6 (due in week 9 tutorial) On 1 July 2017 Ed Ltd acquired all the assets (except for cash) of Nod Ltd. The financial statements of Nod Ltd at 1 July 2017 showed the following information: S 133,600 (32,000) 20,800 16,000 44,800 23,200 206.400 24,800 24,000 17,200 66,000 80,000 60,400 Plant Accumulated depreciation-plant Land Cash Accounts receivable Total assets ts payable Loans Total liabilities Share capital (80 000 shares) Retained earnings Total equity All the assets and liabilities of Nod Ltd were recorded at amounts equal to fair value except for: Plant Land Inventory Fair value S112,000 $35,800 S28,000 Nod Ltd also had a brand Wink Time' that was not recorded by the company because it had been internally generated. It was valued at $30,000. Nod Ltd had not recorded the interest accrued on the loans amounting to $22,800. In exchange for acquiring assets (except cash), Ed Ltd agreed to provide: * Two shares in Ed Ltd for every four shares held in Nod Ltd. The fair value of each Ed Ltd share was S3.50. . A patent to the owners of the shares held in Nod Ltd. The patent was held in the records of Ed Ltd at $40,000 and had a fair value of value of S58,000 Sufficient additional cash to enable Nod Ltd to pay off its liabiliies (including interest on loans) and liquidation costs of S4,000 Required a) Prepare the acquisition analysis for the business combination. b) Prepare the jounal entries to record the business combination in the books of Ed Ltd. ACCY200 Financial Accounting IIA Autumn 2018 Special Question 6 (due in week 9 tutorial) On 1 July 2017 Ed Ltd acquired all the assets (except for cash) of Nod Ltd. The financial statements of Nod Ltd at 1 July 2017 showed the following information: S 133,600 (32,000) 20,800 16,000 44,800 23,200 206.400 24,800 24,000 17,200 66,000 80,000 60,400 Plant Accumulated depreciation-plant Land Cash Accounts receivable Total assets ts payable Loans Total liabilities Share capital (80 000 shares) Retained earnings Total equity All the assets and liabilities of Nod Ltd were recorded at amounts equal to fair value except for: Plant Land Inventory Fair value S112,000 $35,800 S28,000 Nod Ltd also had a brand Wink Time' that was not recorded by the company because it had been internally generated. It was valued at $30,000. Nod Ltd had not recorded the interest accrued on the loans amounting to $22,800. In exchange for acquiring assets (except cash), Ed Ltd agreed to provide: * Two shares in Ed Ltd for every four shares held in Nod Ltd. The fair value of each Ed Ltd share was S3.50. . A patent to the owners of the shares held in Nod Ltd. The patent was held in the records of Ed Ltd at $40,000 and had a fair value of value of S58,000 Sufficient additional cash to enable Nod Ltd to pay off its liabiliies (including interest on loans) and liquidation costs of S4,000 Required a) Prepare the acquisition analysis for the business combination. b) Prepare the jounal entries to record the business combination in the books of Ed Ltd