Answered step by step

Verified Expert Solution

Question

1 Approved Answer

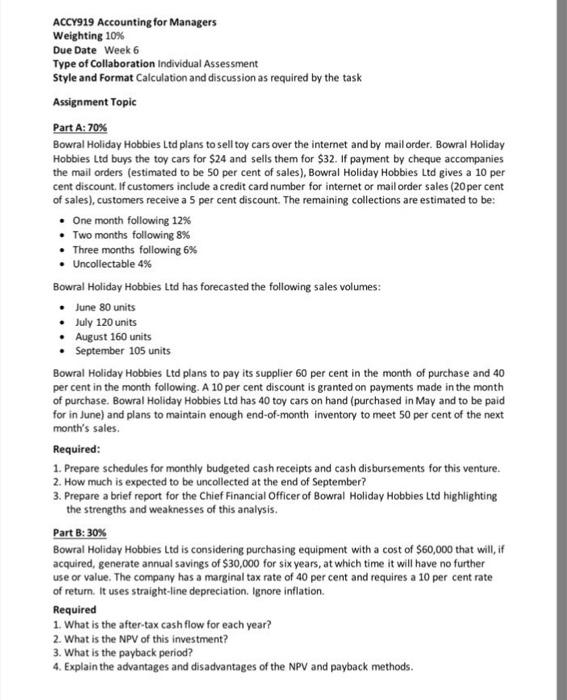

ACCY919 Accounting for Managers Weighting 10% Due Date Week 6 Type of Collaboration Individual Assessment Style and Format Calculation and discussion as required by

ACCY919 Accounting for Managers Weighting 10% Due Date Week 6 Type of Collaboration Individual Assessment Style and Format Calculation and discussion as required by the task Assignment Topic Part A: 70% Bowral Holiday Hobbies Ltd plans to sell toy cars over the internet and by mail order. Bowral Holiday Hobbies Ltd buys the toy cars for $24 and sells them for $32. If payment by cheque accompanies the mail orders (estimated to be 50 per cent of sales), Bowral Holiday Hobbies Ltd gives a 10 per cent discount. If customers include a credit card number for internet or mail order sales (20 per cent of sales), customers receive a 5 per cent discount. The remaining collections are estimated to be: One month following 12% Two months following 8% Three months following 6% Uncollectable 4% Bowral Holiday Hobbies Ltd has forecasted the following sales volumes: June 80 units July 120 units August 160 units September 105 units Bowral Holiday Hobbies Ltd plans to pay its supplier 60 per cent in the month of purchase and 40 per cent in the month following. A 10 per cent discount is granted on payments made in the month of purchase. Bowral Holiday Hobbies Ltd has 40 toy cars on hand (purchased in May and to be paid for in June) and plans to maintain enough end-of-month inventory to meet 50 per cent of the next month's sales. Required: 1. Prepare schedules for monthly budgeted cash receipts and cash disbursements for this venture. 2. How much is expected to be uncollected at the end of September? 3. Prepare a brief report for the Chief Financial Officer of Bowral Holiday Hobbies Ltd highlighting the strengths and weaknesses of this analysis. Part B: 30% Bowral Holiday Hobbies Ltd is considering purchasing equipment with a cost of $60,000 that will, if acquired, generate annual savings of $30,000 for six years, at which time it will have no further use or value. The company has a marginal tax rate of 40 per cent and requires a 10 per cent rate of return. It uses straight-line depreciation. Ignore inflation. Required 1. What is the after-tax cash flow for each year? 2. What is the NPV of this investment? 3. What is the payback period? 4. Explain the advantages and disadvantages of the NPV and payback methods.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

PART A 1 Sales Budget June July August September Expected sales in units 80 120 160 105 Unit selling price 32 32 32 32 Budgeted dollar sales 2560 3840 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started