Answered step by step

Verified Expert Solution

Question

1 Approved Answer

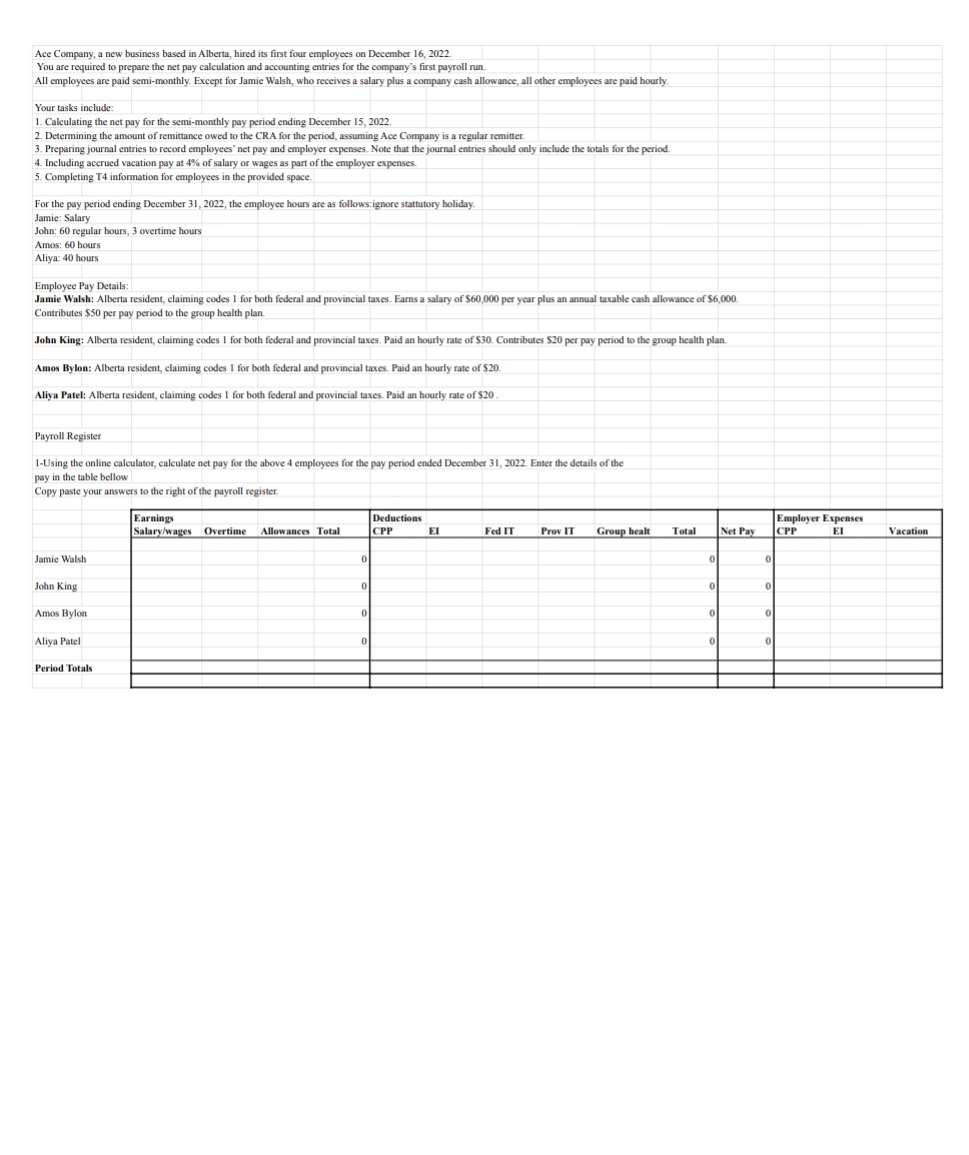

Ace Company, a new business based in Alberta, hired its first four employees on December 1 6 , 2 0 2 2 . You are

Ace Company, a new business based in Alberta, hired its first four employees on December

You are required to prepare the net pay calculation and accounting entries for the company's first payroll run.

All employees are paid semimonthly. Except for Jamie Walsh, who receives a salary plus a company cash allowance, all other employees are paid hourly.

Your tasks include:

Calculating the net pay for the semimonthly pay period ending December

Determining the amount of remittance owed to the CRA for the period, assuming Ace Company is a regular remitter.

Preparing journal entries to record employees' net pay and employer expenses. Note that the journal entries should only include the totals for the period.

Including accrued vacation pay at of salary or wages as part of the employer expenses.

Completing T information for employees in the provided space.

For the pay period ending December the employee hours are as follows ignore stattutory holiday.

Jamic: Salary

John: regular hours, overtime hours

Amos: hours

Aliya: hours

Employee Pay Details:

Jamie Walsh: Alberta resident, claiming codes I for both federal and provincial taxes. Earns a salary of $ per year plus an annual taxable cash allowance of $

Contributes $ per pay period to the group health plan.

John King: Alberta resident, claiming codes I for both federal and provincial taxes. Paid an hourly rate of $ Contributes $ per pay period to the group health plan.

Amos Bylon: Alberta resident, claiming codes I for both federal and provincial taxes. Paid an hourly rate of $

Aliya Patel: Alberta resident, claiming codes for both federal and provincial taxes. Paid an hourly rate of $

Payroll Register

Using the online calculator, calculate net pay for the above employees for the pay period ended December Enter the details of the pay in the table bellow

Copy paste your answers to the right of the payroll register.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started