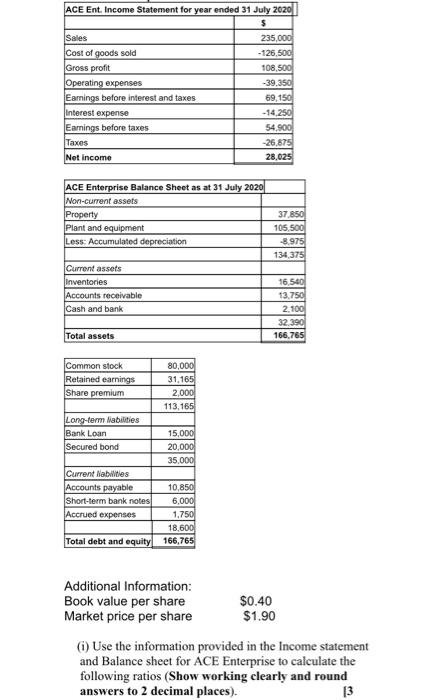

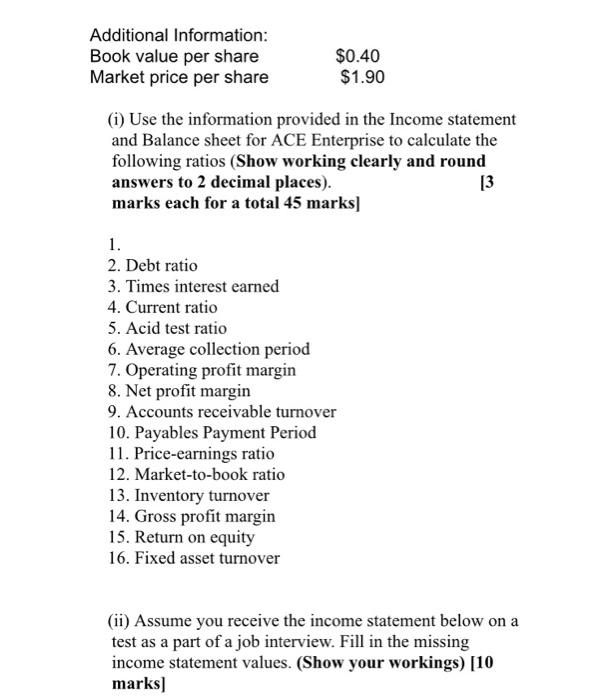

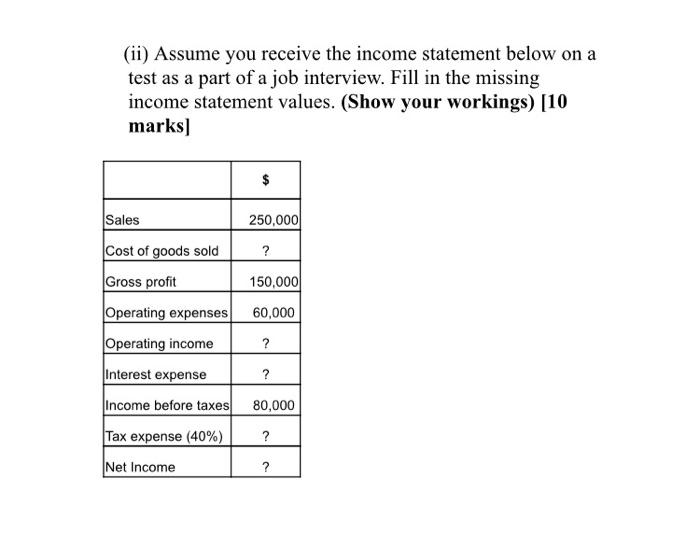

ACE Ent. Income Statement for year ended 31 July 2020 $ Sales 235,000 Cost of goods sold -126,500 Gross profit 108,500 Operating expenses -39.350 Earnings before interest and taxes 69,150 Interest expense -14,250 Earnings before taxes 54.900 Taxes -26.875 Net Income 28,025 ACE Enterprise Balance Sheet as at 31 July 2020 Non-current assets Property Plant and equipment Less: Accumulated depreciation 37.850 105,500 8.975 134 375 Current assets Inventories Accounts receivable Cash and bank 16.540 13.750 2.100 32.390 166.765 Total assets Common stock 80,000 Retained earnings 31.165 Share premium 2.000 113,165 Long-term Mabilities Bank Loan 15,000 Secured bond 20,000 35.000 Current abilities Accounts payable 10,850 Short-term bank notes 6,000 Accrued expenses 1.750 18,600 Total debt and equity 166,765 Additional Information: Book value per share $0.40 Market price per share $1.90 (1) Use the information provided in the Income statement and Balance sheet for ACE Enterprise to calculate the following ratios (Show working clearly and round answers to 2 decimal places). 13 Additional Information: Book value per share Market price per share $0.40 $1.90 (i) Use the information provided in the Income statement and Balance sheet for ACE Enterprise to calculate the following ratios (Show working clearly and round answers to 2 decimal places). [3 marks each for a total 45 marks] 1. 2. Debt ratio 3. Times interest earned 4. Current ratio 5. Acid test ratio 6. Average collection period 7. Operating profit margin 8. Net profit margin 9. Accounts receivable turnover 10. Payables Payment Period 11. Price-earnings ratio 12. Market-to-book ratio 13. Inventory turnover 14. Gross profit margin 15. Return on equity 16. Fixed asset turnover (ii) Assume you receive the income statement below on a test as a part of a job interview. Fill in the missing income statement values. (Show your workings) [10 marks] (ii) Assume you receive the income statement below on a test as a part of a job interview. Fill in the missing income statement values. (Show your workings) [10 marks] $ Sales 250,000 ? 150,000 60,000 Cost of goods sold Gross profit Operating expenses Operating income Interest expense Income before taxes ? ? 80,000 Tax expense (40%) ? Net Income