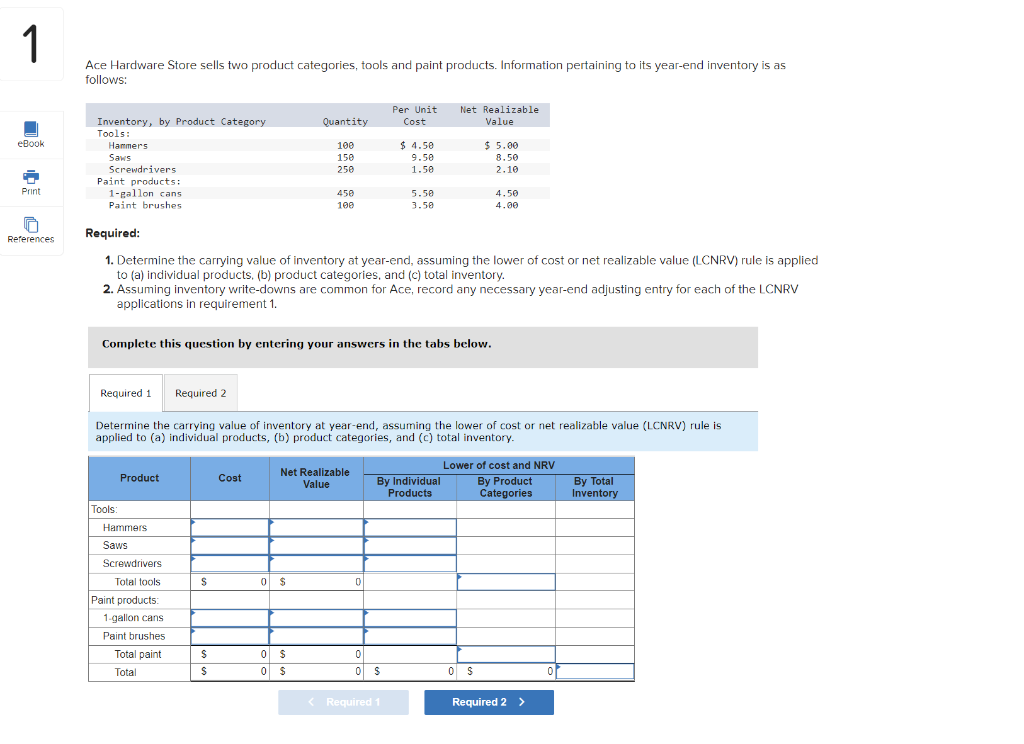

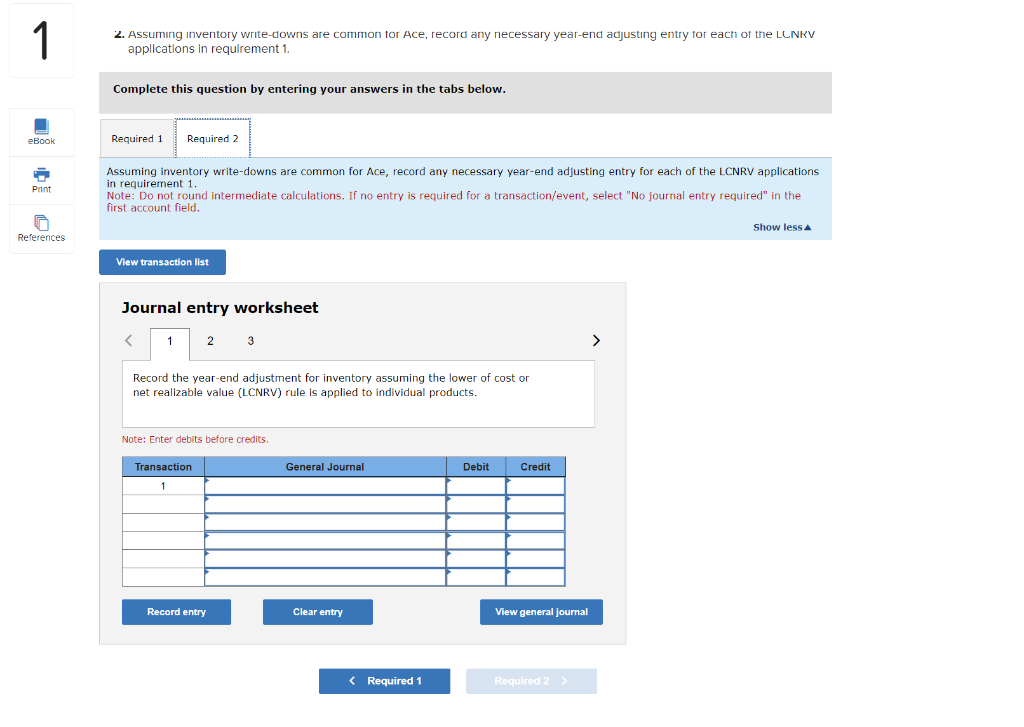

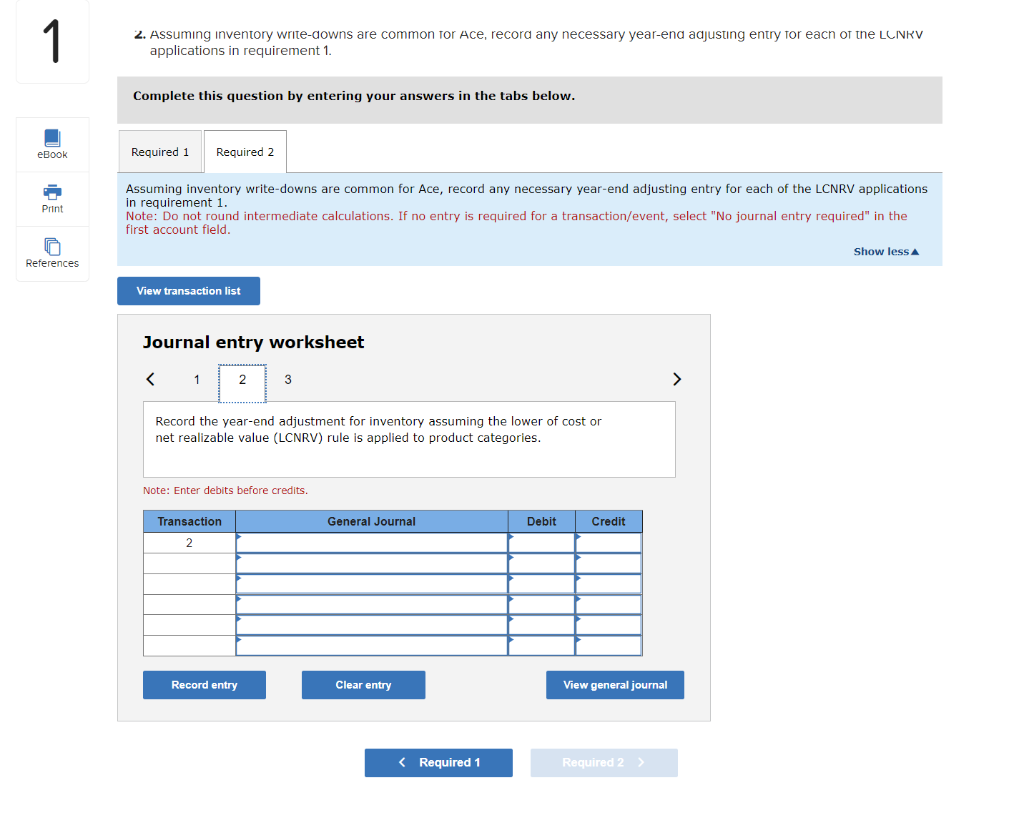

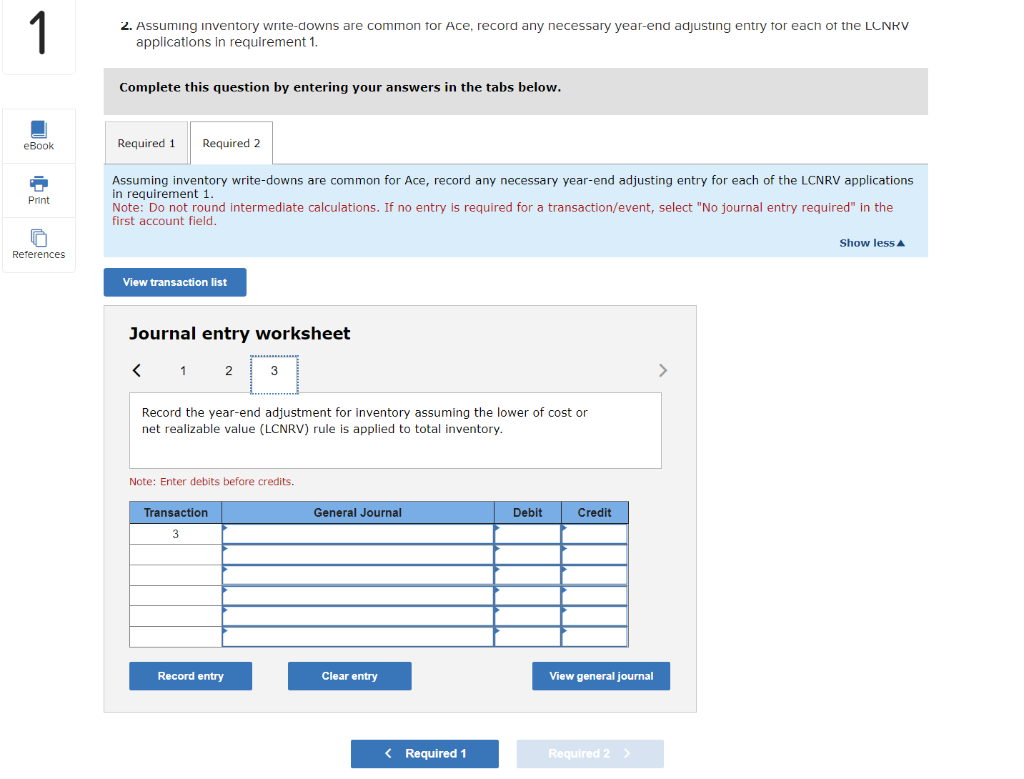

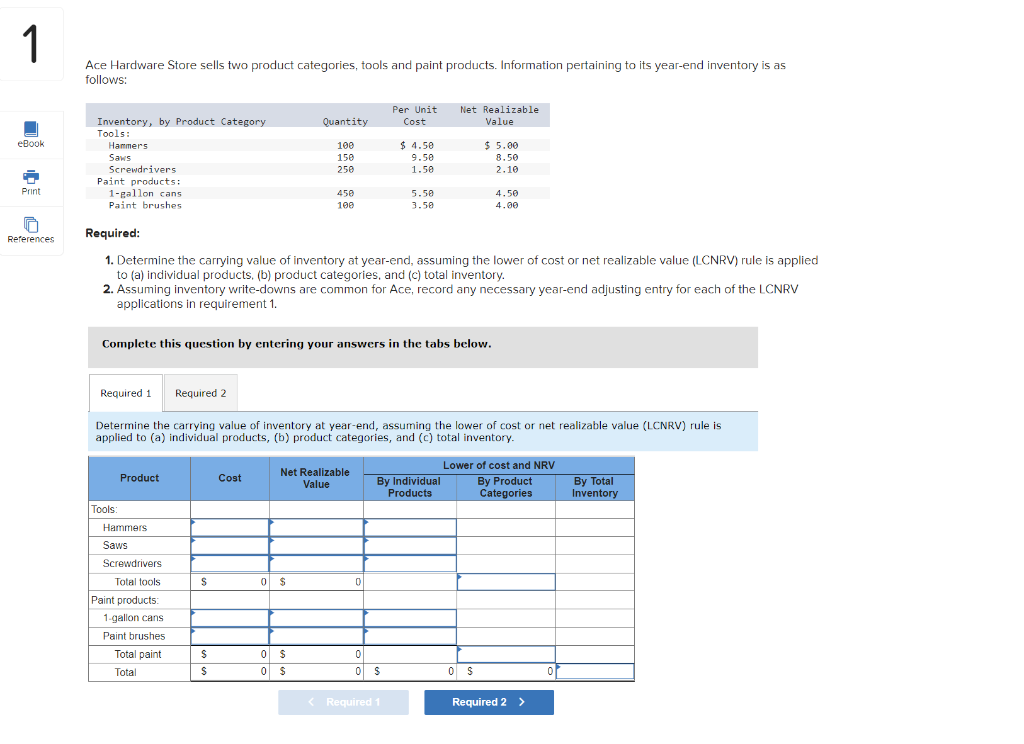

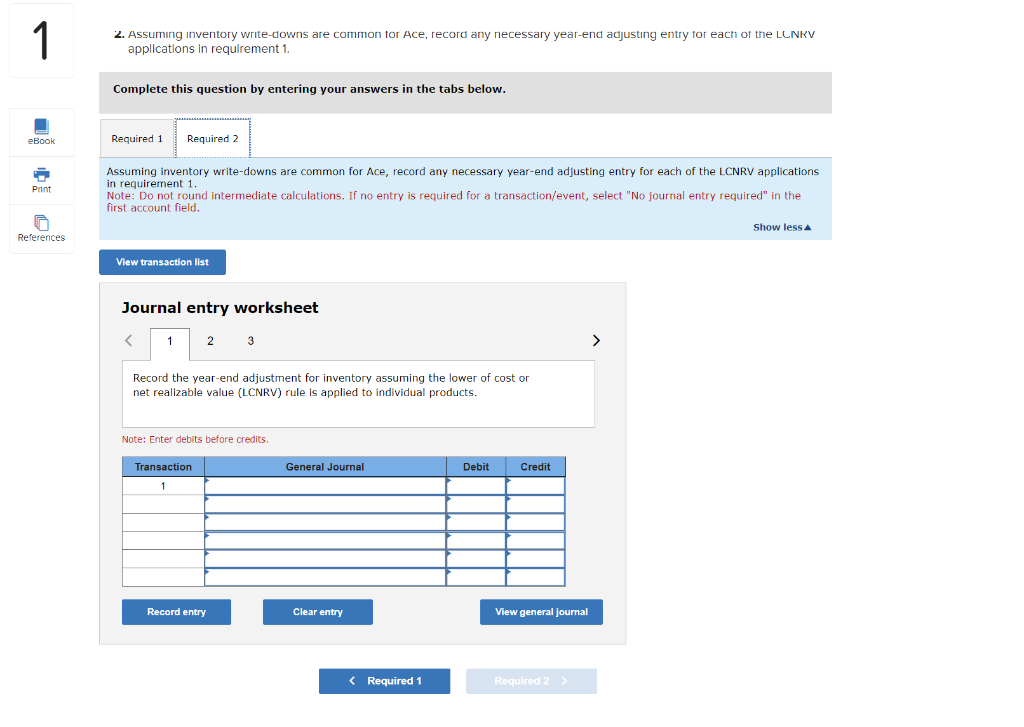

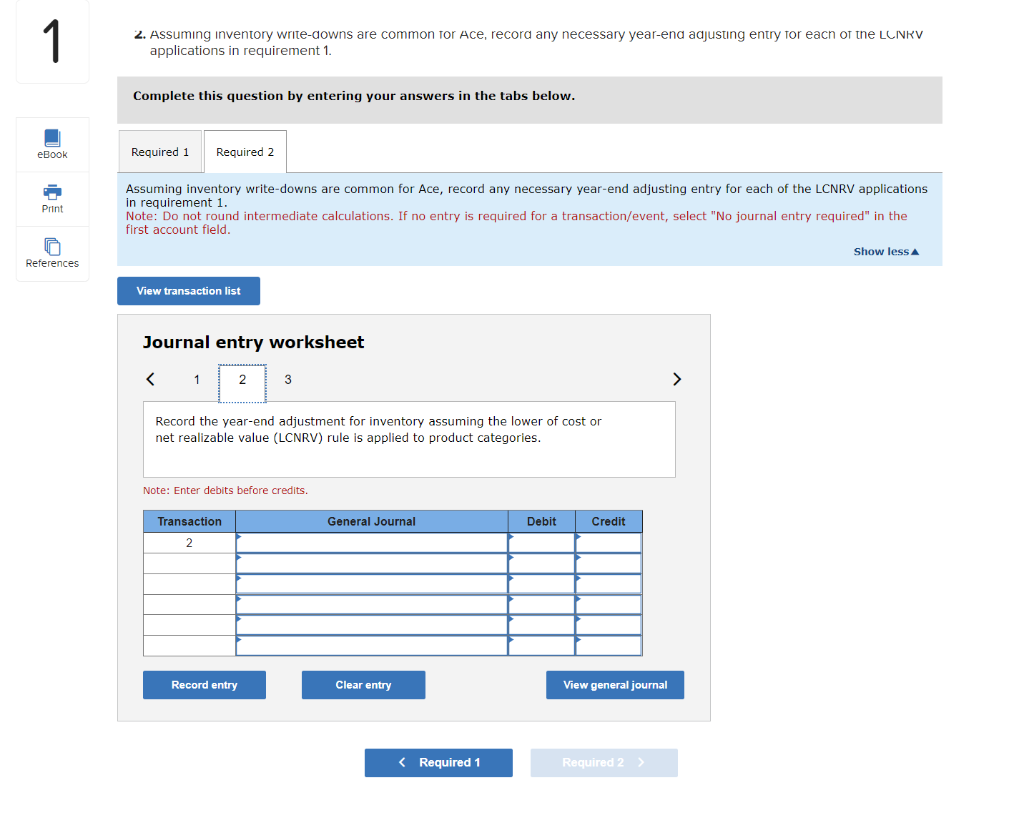

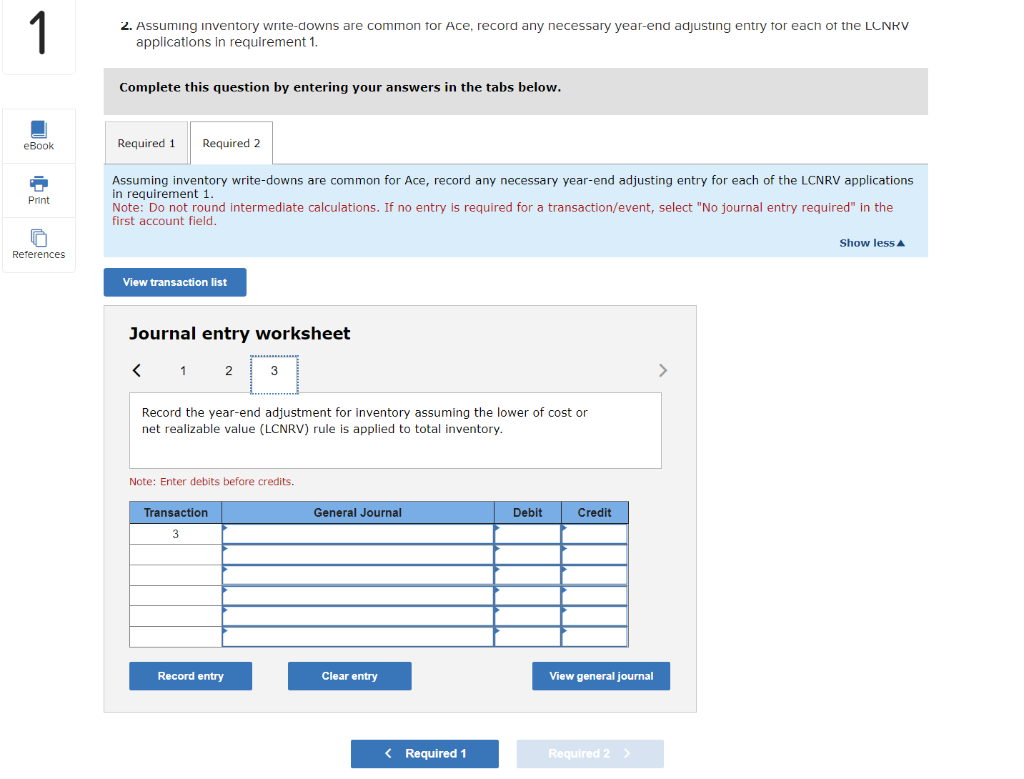

Ace Hardware Store sells two product categories, tools and paint products. Information pertaining to its year-end inventory is as follows: Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Ace, record any necessary year-end adjusting entry for each of the LCNRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Determine the carrying value of inventory at year-end, assuming the lower of cost or net realizable value (LCNRV) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common tor Ace, record any necessary year-end adjusting entry tor each of the LLNRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Assuming inventory write-downs are common for Ace, record any necessary year-end adjusting entry for each of the LCNRV applications in requirement 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Show less Journal entry worksheet Record the year-end adjustment for inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Note: Enter debits before credits. 2. Assuming inventory write-downs are common tor Ace, record any necessary year-end adjusting entry tor eacn or the LCINRV applications in requirement 1. Complete this question by entering your answers in the tabs below. Assuming inventory write-downs are common for Ace, record any necessary year-end adjusting entry for each of the LCNRV applications in requirement 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Journal entry worksheet Record the year-end adjustment for inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to product categories. Note: Enter debits before credits. 2. Assumng inventory write-downs are common tor Ace, record any necessary year-end adjusting entry tor each ot the LCNKV applications in requirement 1. Complete this question by entering your answers in the tabs below. Assuming inventory write-downs are common for Ace, record any necessary year-end adjusting entry for each of the LCNRV applications in requirement 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the year-end adjustment for inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to total inventory. Note: Enter debits before credits