Answered step by step

Verified Expert Solution

Question

1 Approved Answer

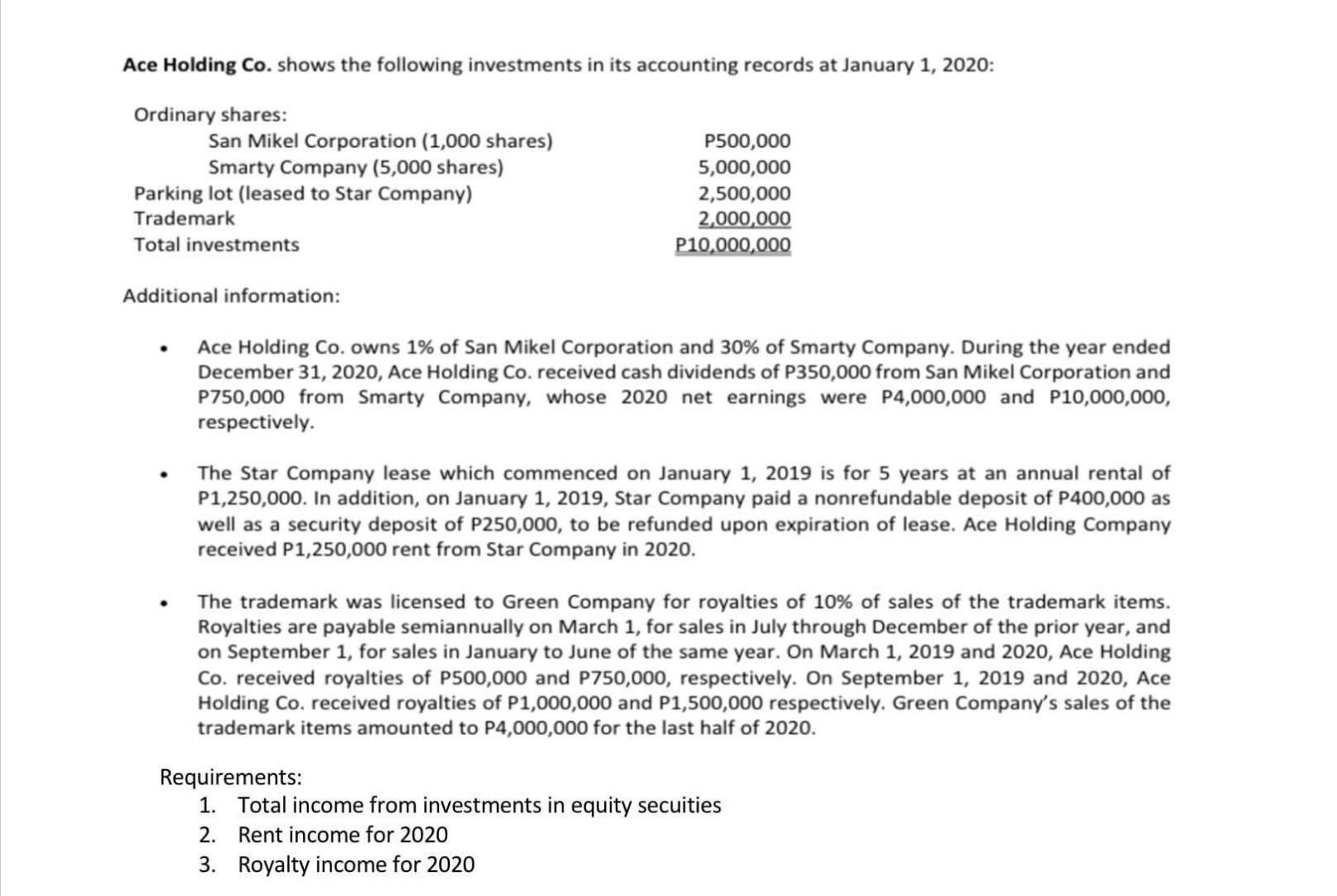

Ace Holding Co. shows the following investments in its accounting records at January 1, 2020: Ordinary shares: San Mikel Corporation (1,000 shares) P500,000 Smarty Company

Ace Holding Co. shows the following investments in its accounting records at January 1, 2020: Ordinary shares: San Mikel Corporation (1,000 shares) P500,000 Smarty Company (5,000 shares) 5,000,000 Parking lot (leased to Star Company) 2,500,000 Trademark 2,000,000 Total investments P10,000,000 Additional information: Ace Holding Co. owns 1% of San Mikel Corporation and 30% of Smarty Company. During the year ended December 31, 2020, Ace Holding Co. received cash dividends of P350,000 from San Mikel Corporation and P750,000 from Smarty Company, whose 2020 net earnings were P4,000,000 and P10,000,000, respectively. The Star Company lease which commenced on January 1, 2019 is for 5 years at an annual rental of P1,250,000. In addition, on January 1, 2019, Star Company paid a nonrefundable deposit of P400,000 as well as a security deposit of P250,000, to be refunded upon expiration of lease. Ace Holding Company received P1,250,000 rent from Star Company in 2020. The trademark was licensed to Green Company for royalties of 10% of sales of the trademark items. Royalties are payable semiannually on March 1, for sales in July through December of the prior year, and on September 1, for sales in January to June of the same year. On March 1, 2019 and 2020, Ace Holding Co. received royalties of P500,000 and P750,000, respectively. On September 1, 2019 and 2020, Ace Holding Co. received royalties of P1,000,000 and P1,500,000 respectively. Green Company's sales of the trademark items amounted to P4,000,000 for the last half of 2020. Requirements: 1. Total income from investments in equity secuities 2. Rent income for 2020 3. Royalty income for 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started