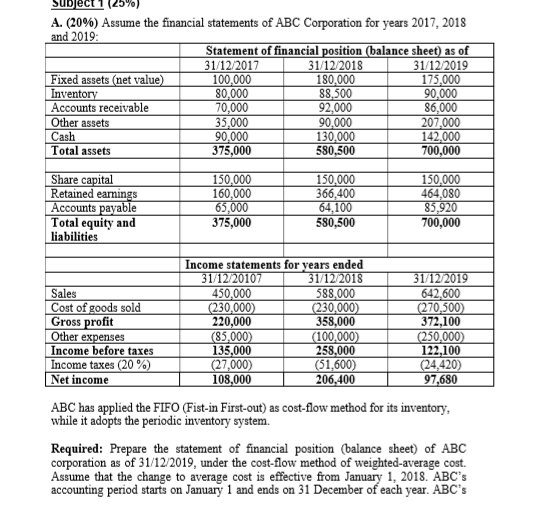

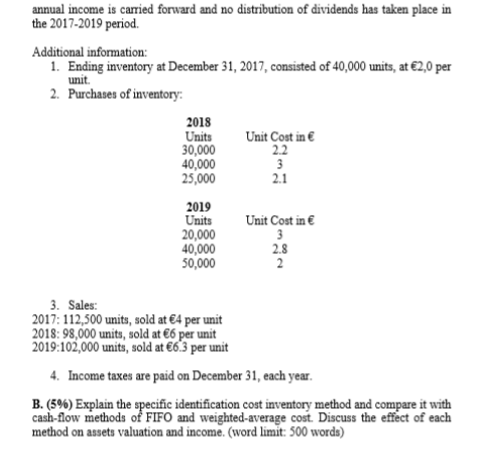

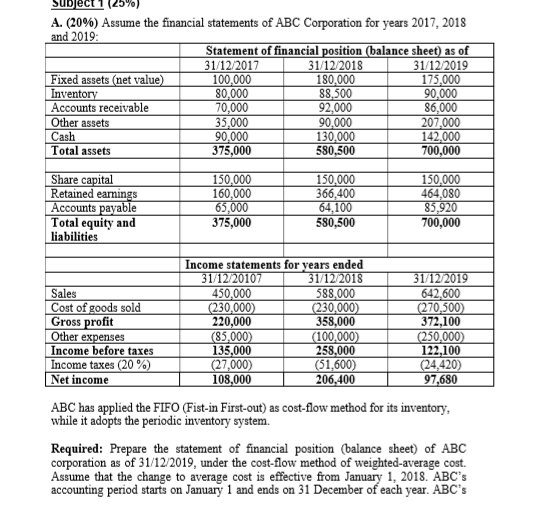

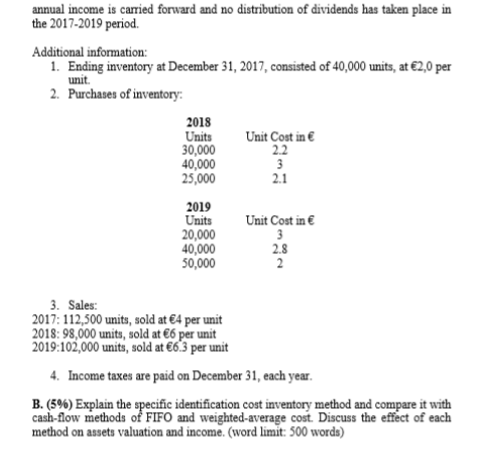

Subject 1 (2970) A. (2096) Assume the financial statements of ABC Corporation for years 2017, 2018 and 2019 Statement of financial position (balance sheet) as of 31/12/2017 31/12/2018 31/12/2019 Fixed assets (net value) 100.000 180.000 175.000 Inventory 80.000 88,500 90,000 Accounts receivable 70,000 92.000 86,000 Other assets 35,000 90.000 207.000 Cash 90.000 130,000 142,000 Total assets 375,000 580.500 700.000 Share capital Retained earnings Accounts payable Total equity and liabilities 150,000 160.000 65,000 375,000 150,000 366,400 64,100 580,500 150,000 464.080 85,920 700,000 Sales Cost of goods sold Gross profit Other expenses Income before taxes Income taxes (20%) Net income Income statements for years ended 31/12/20107 31/12/2018 450.000 588.000 (230.000) (230.000) 220,000 358,000 (85.000) (100.000) 135,000 258,000 (27,000) (51,600) 108,000 206.400 31/12/2019 642,600 (270.500 372,100 (250,000 122,100 (24,420) 9 7,680 ABC has applied the FIFO (Fist-in First-out) as cost-flow method for its inventory, while it adopts the periodic inventory system. Required: Prepare the statement of financial position (balance sheet) of ABC corporation as of 31/12/2019, under the cost-flow method of weighted average cost. Assume that the change to average cost is effective from January 1, 2018. ABC's accounting period starts on January 1 and ends on 31 December of each year. ABC's annual income is carried forward and no distribution of dividends has taken place in the 2017-2019 period Additional information: 1. Ending inventory at December 31, 2017, consisted of 40,000 units, at 2,0 per unit. 2. Purchases of inventory: Unit Cost in 2018 Units 30,000 40,000 25,000 Unit Cost in 2019 Units 20,000 40,000 50,000 3. Sales: 2017: 112,500 units, sold at 4 per unit 2018: 98,000 units, sold at E6 per unit 2019:102,000 units, sold at 6.3 per unit 4. Income taxes are paid on December 31, each year. B. (596) Explain the specific identification cost inventory method and compare it with cash flow methods of FIFO and weighted-average cost Discuss the effect of each method on assets valuation and income. (word limit: 500 words) Subject 1 (2970) A. (2096) Assume the financial statements of ABC Corporation for years 2017, 2018 and 2019 Statement of financial position (balance sheet) as of 31/12/2017 31/12/2018 31/12/2019 Fixed assets (net value) 100.000 180.000 175.000 Inventory 80.000 88,500 90,000 Accounts receivable 70,000 92.000 86,000 Other assets 35,000 90.000 207.000 Cash 90.000 130,000 142,000 Total assets 375,000 580.500 700.000 Share capital Retained earnings Accounts payable Total equity and liabilities 150,000 160.000 65,000 375,000 150,000 366,400 64,100 580,500 150,000 464.080 85,920 700,000 Sales Cost of goods sold Gross profit Other expenses Income before taxes Income taxes (20%) Net income Income statements for years ended 31/12/20107 31/12/2018 450.000 588.000 (230.000) (230.000) 220,000 358,000 (85.000) (100.000) 135,000 258,000 (27,000) (51,600) 108,000 206.400 31/12/2019 642,600 (270.500 372,100 (250,000 122,100 (24,420) 9 7,680 ABC has applied the FIFO (Fist-in First-out) as cost-flow method for its inventory, while it adopts the periodic inventory system. Required: Prepare the statement of financial position (balance sheet) of ABC corporation as of 31/12/2019, under the cost-flow method of weighted average cost. Assume that the change to average cost is effective from January 1, 2018. ABC's accounting period starts on January 1 and ends on 31 December of each year. ABC's annual income is carried forward and no distribution of dividends has taken place in the 2017-2019 period Additional information: 1. Ending inventory at December 31, 2017, consisted of 40,000 units, at 2,0 per unit. 2. Purchases of inventory: Unit Cost in 2018 Units 30,000 40,000 25,000 Unit Cost in 2019 Units 20,000 40,000 50,000 3. Sales: 2017: 112,500 units, sold at 4 per unit 2018: 98,000 units, sold at E6 per unit 2019:102,000 units, sold at 6.3 per unit 4. Income taxes are paid on December 31, each year. B. (596) Explain the specific identification cost inventory method and compare it with cash flow methods of FIFO and weighted-average cost Discuss the effect of each method on assets valuation and income. (word limit: 500 words)