Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ace is deciding whether or not to Invest in stock at Bankable bank or at The Big Bank. The total cost of stock is R1

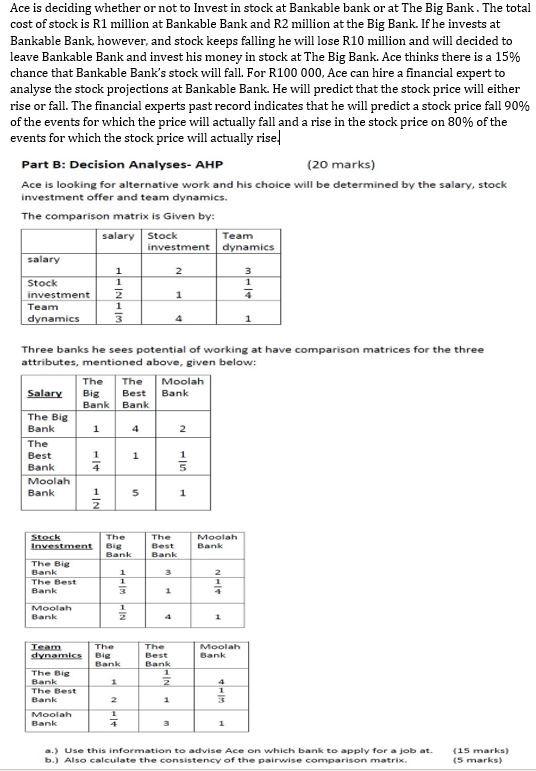

Ace is deciding whether or not to Invest in stock at Bankable bank or at The Big Bank. The total cost of stock is R1 million at Bankable Bank and R2 million at the Big Bank. If he invests at Bankable Bank, however, and stock keeps falling he will lose R10 million and will decided to leave Bankable Bank and invest his money in stock at The Big Bank. Ace thinks there is a 15% chance that Bankable Bank's stock will fall. For R100 000, Ace can hire a financial expert to analyse the stock projections at Bankable Bank. He will predict that the stock price will either rise or fall. The financial experts past record indicates that he will predict a stock price fall 90% of the events for which the price will actually fall and a rise in the stock price on 80% of the events for which the stock price will actually rise! Part B: Decision Analyses- AHP (20 marks) Ace is looking for alternative work and his choice will be determined by the salary, stock investment offer and team dynamics. The comparison matrix is given by: salary Stock Team investment dynamics salary 1 2 3 Stock 1 1 4 investment 1 Team WIN- dynamics 4 1 Three banks he sees potential of working at have comparison matrices for the three attributes, mentioned above, given below: The The Moolah Bank Salary Best Big Bank Bank The Big Bank 1 4 4 2. The Best 1 1 1 4 Bank 5 Moolah Bank 5 1 1 2 Moolah Stock Investment The Big Bank The Best Bank Bank 1 3 2 The Big Bank The Best Bank NHI 1 1 Moolah Bank NWI 1 The Team dynamics Moolah Bank Bie Bank The Best Bank 1 2 The Big Bank The Best Bank 1 4 WIM 1 Moolah IN Bank 3 1 a.) Use this information to advise Ace on which bank to apply for a job at. b.) Also calculate the consistency of the pairwise comparison matrix. (15 marks) (5 marks) Ace is deciding whether or not to Invest in stock at Bankable bank or at The Big Bank. The total cost of stock is R1 million at Bankable Bank and R2 million at the Big Bank. If he invests at Bankable Bank, however, and stock keeps falling he will lose R10 million and will decided to leave Bankable Bank and invest his money in stock at The Big Bank. Ace thinks there is a 15% chance that Bankable Bank's stock will fall. For R100 000, Ace can hire a financial expert to analyse the stock projections at Bankable Bank. He will predict that the stock price will either rise or fall. The financial experts past record indicates that he will predict a stock price fall 90% of the events for which the price will actually fall and a rise in the stock price on 80% of the events for which the stock price will actually rise! Part B: Decision Analyses- AHP (20 marks) Ace is looking for alternative work and his choice will be determined by the salary, stock investment offer and team dynamics. The comparison matrix is given by: salary Stock Team investment dynamics salary 1 2 3 Stock 1 1 4 investment 1 Team WIN- dynamics 4 1 Three banks he sees potential of working at have comparison matrices for the three attributes, mentioned above, given below: The The Moolah Bank Salary Best Big Bank Bank The Big Bank 1 4 4 2. The Best 1 1 1 4 Bank 5 Moolah Bank 5 1 1 2 Moolah Stock Investment The Big Bank The Best Bank Bank 1 3 2 The Big Bank The Best Bank NHI 1 1 Moolah Bank NWI 1 The Team dynamics Moolah Bank Bie Bank The Best Bank 1 2 The Big Bank The Best Bank 1 4 WIM 1 Moolah IN Bank 3 1 a.) Use this information to advise Ace on which bank to apply for a job at. b.) Also calculate the consistency of the pairwise comparison matrix. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started