Answered step by step

Verified Expert Solution

Question

1 Approved Answer

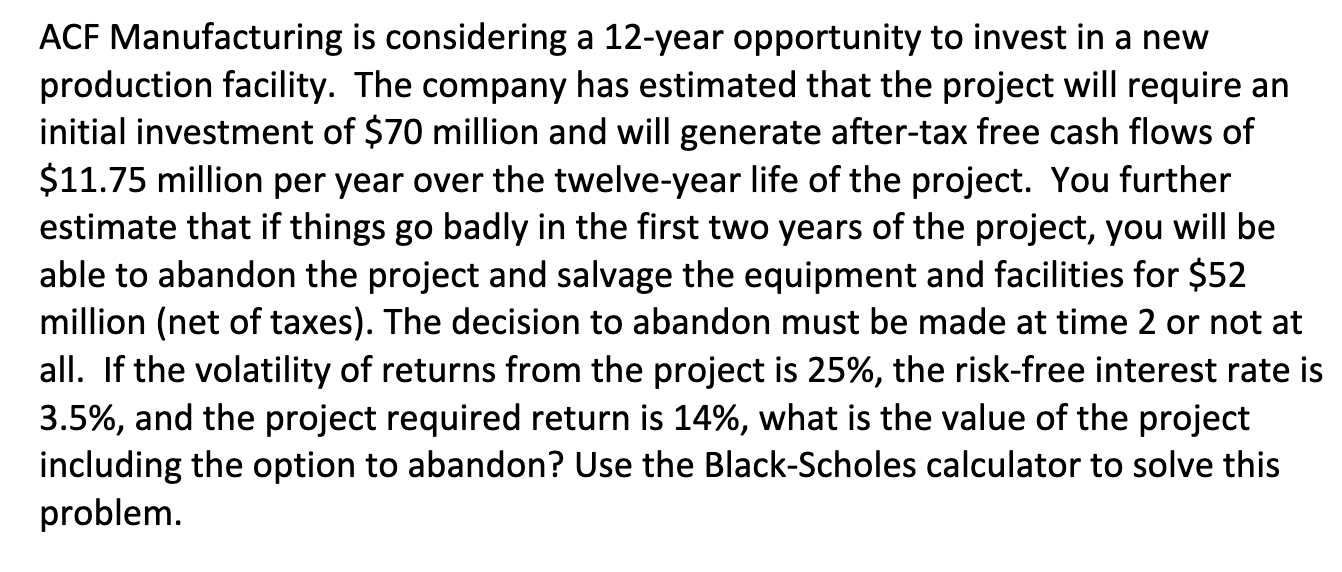

ACF Manufacturing is considering a 1 2 - year opportunity to invest in a new production facility. The company has estimated that the project will

ACF Manufacturing is considering a year opportunity to invest in a new

production facility. The company has estimated that the project will require an

initial investment of $ million and will generate aftertax free cash flows of

$ million per year over the twelveyear life of the project. You further

estimate that if things go badly in the first two years of the project, you will be

able to abandon the project and salvage the equipment and facilities for $

million net of taxes The decision to abandon must be made at time or not at

all. If the volatility of returns from the project is the riskfree interest rate is

and the project required return is what is the value of the project

including the option to abandon? Use the BlackScholes calculator to solve this

problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started