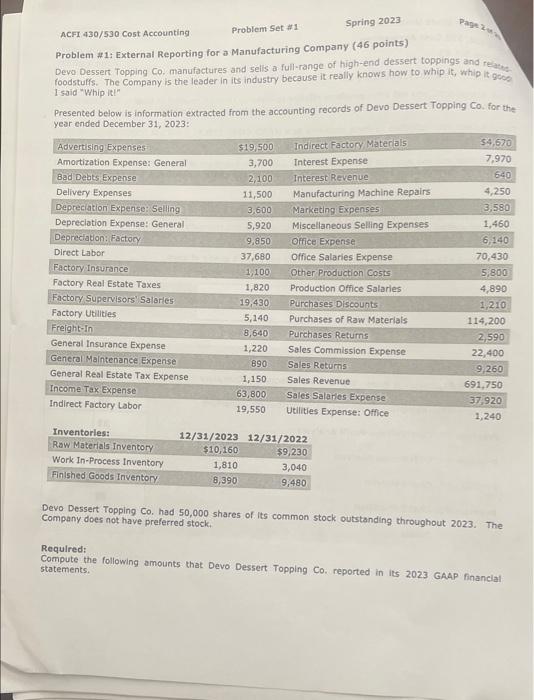

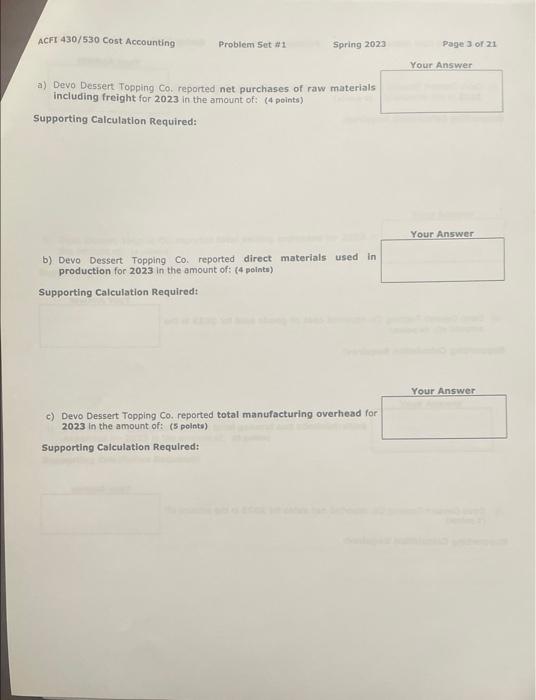

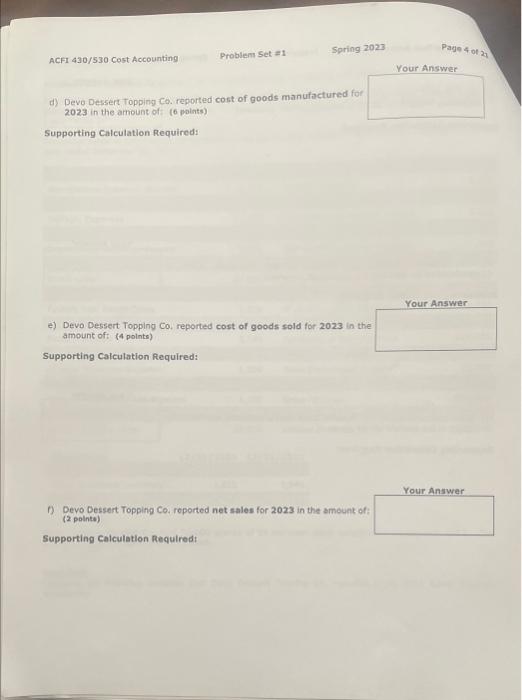

ACFI 430/530 Cost Accounting Problem \#1: External Reporting for a Manufacturing Company (46 points) foodstulfs. The Company is the leader in its industry because it really knows how to whip it, why- toses 1 soid "Whip itl" Presented below is information extracted from the accounting records of Devo Dessert Topping Co. for the year ended December 31,2023 : Devo Dessert Topping Co. had 50,000 shares of its common stock outstanding throughout 2023. The Company does not have preferred stock. Required: Compute the following amounts that Devo Dessert Topping Co. reported in its 2023 GAAP financlal statements. ACFI 430/530 Cost Accounting Problem 5et 41 Spring 2023 Page 3 of 21 a) Devo Dessert. Topping Co, reported net purchases of raw materials including freight for 2023 in the amount of: (4 points) Supporting Calculatlon Required: b) Devo Dessert Topping Co. reported direct materials used in production for 2023 in the amount of: (4 points) Supporting Calculation Requiredt c) Devo Dessert Topping Co. reported total manufacturing overhead for 2023 in the amount of: (5 pointe) Supporting Calcuiation Requlred: d) Devo Dessert Topping Co. reported cont of goods manufactured for: 2023 in the amount of: (6 polats). Supporting Calculation Requiredi e) Devo Dessert Topping Co, reported cost of goods sold for 2023 in the amount of: (4 points) Supporting Calculation Required: f) Devo Dessert Topping Co. reported net sales for 2023 in the amount of: (2 polnte) Supporting Caiculation Requiredi ACFI 430/530 Cost Accounting Problem \#1: External Reporting for a Manufacturing Company (46 points) foodstulfs. The Company is the leader in its industry because it really knows how to whip it, why- toses 1 soid "Whip itl" Presented below is information extracted from the accounting records of Devo Dessert Topping Co. for the year ended December 31,2023 : Devo Dessert Topping Co. had 50,000 shares of its common stock outstanding throughout 2023. The Company does not have preferred stock. Required: Compute the following amounts that Devo Dessert Topping Co. reported in its 2023 GAAP financlal statements. ACFI 430/530 Cost Accounting Problem 5et 41 Spring 2023 Page 3 of 21 a) Devo Dessert. Topping Co, reported net purchases of raw materials including freight for 2023 in the amount of: (4 points) Supporting Calculatlon Required: b) Devo Dessert Topping Co. reported direct materials used in production for 2023 in the amount of: (4 points) Supporting Calculation Requiredt c) Devo Dessert Topping Co. reported total manufacturing overhead for 2023 in the amount of: (5 pointe) Supporting Calcuiation Requlred: d) Devo Dessert Topping Co. reported cont of goods manufactured for: 2023 in the amount of: (6 polats). Supporting Calculation Requiredi e) Devo Dessert Topping Co, reported cost of goods sold for 2023 in the amount of: (4 points) Supporting Calculation Required: f) Devo Dessert Topping Co. reported net sales for 2023 in the amount of: (2 polnte) Supporting Caiculation Requiredi