Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACG 2021 - CHAPTER 4 - EXERCISE INVENTORY TRANSACTIONS Product vs. Period Costs a. PRODUCT COSTS- Include all costs to acquire the inventory and

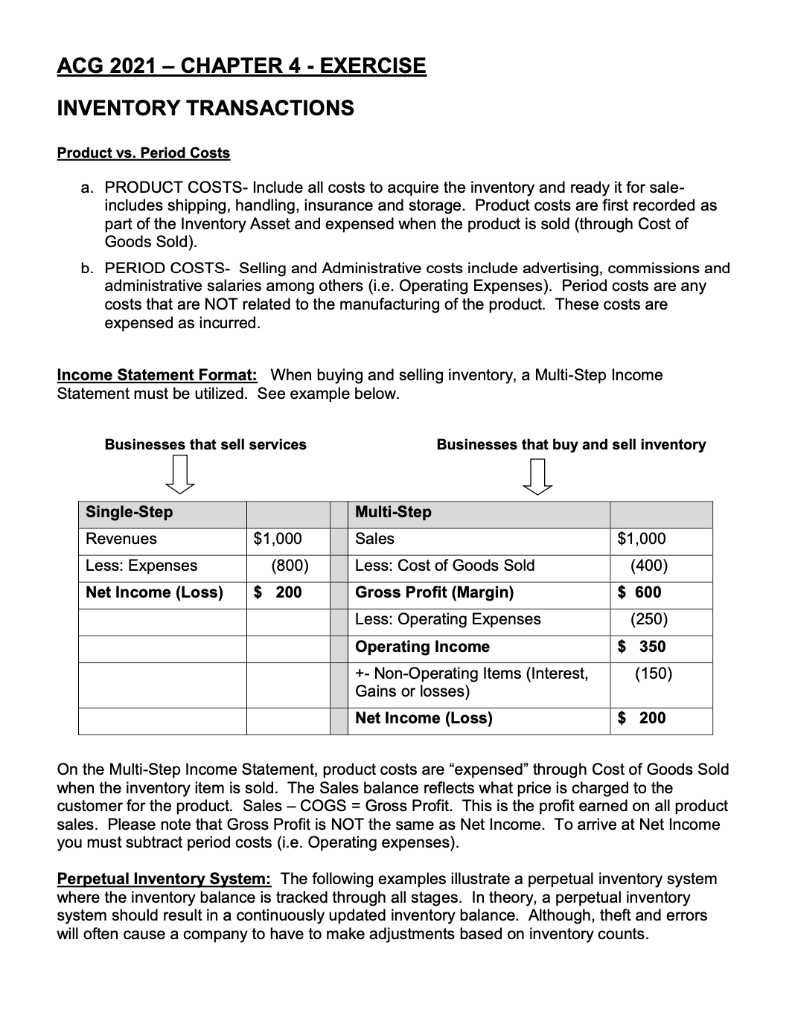

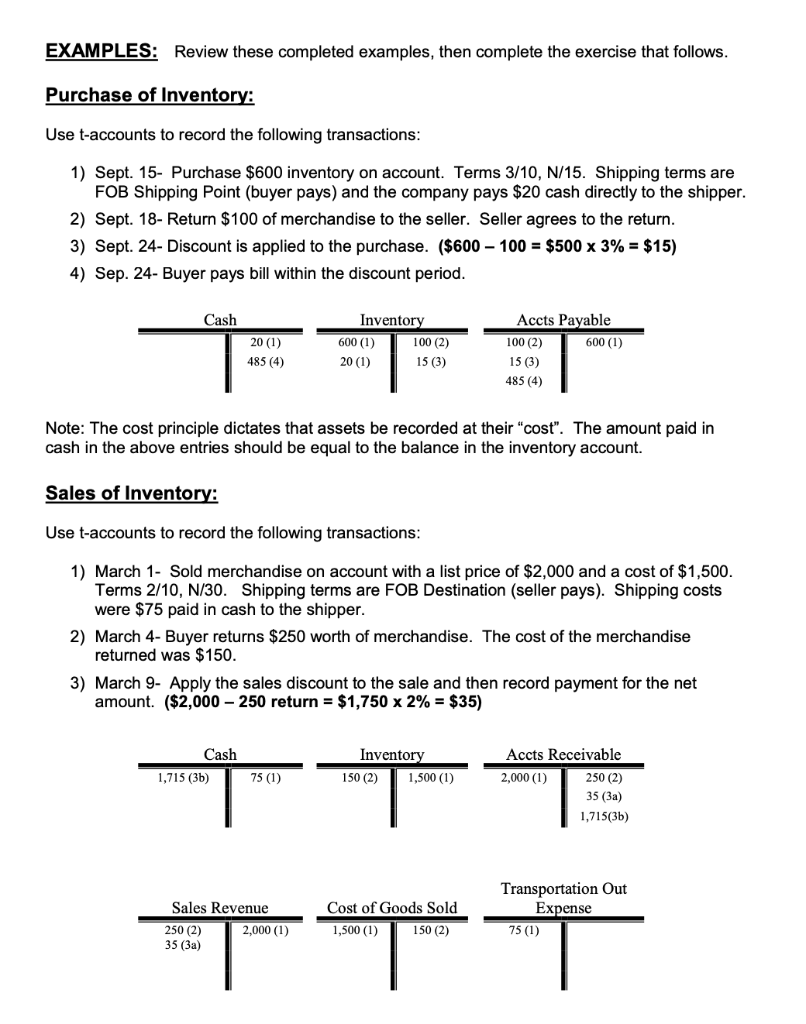

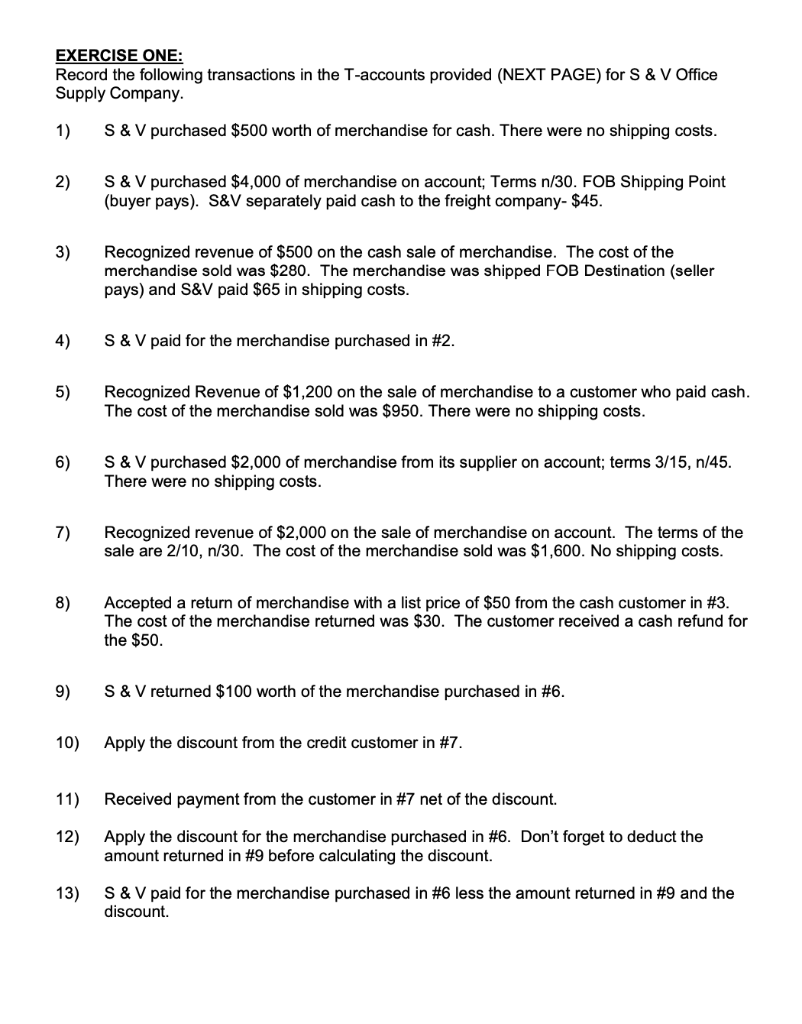

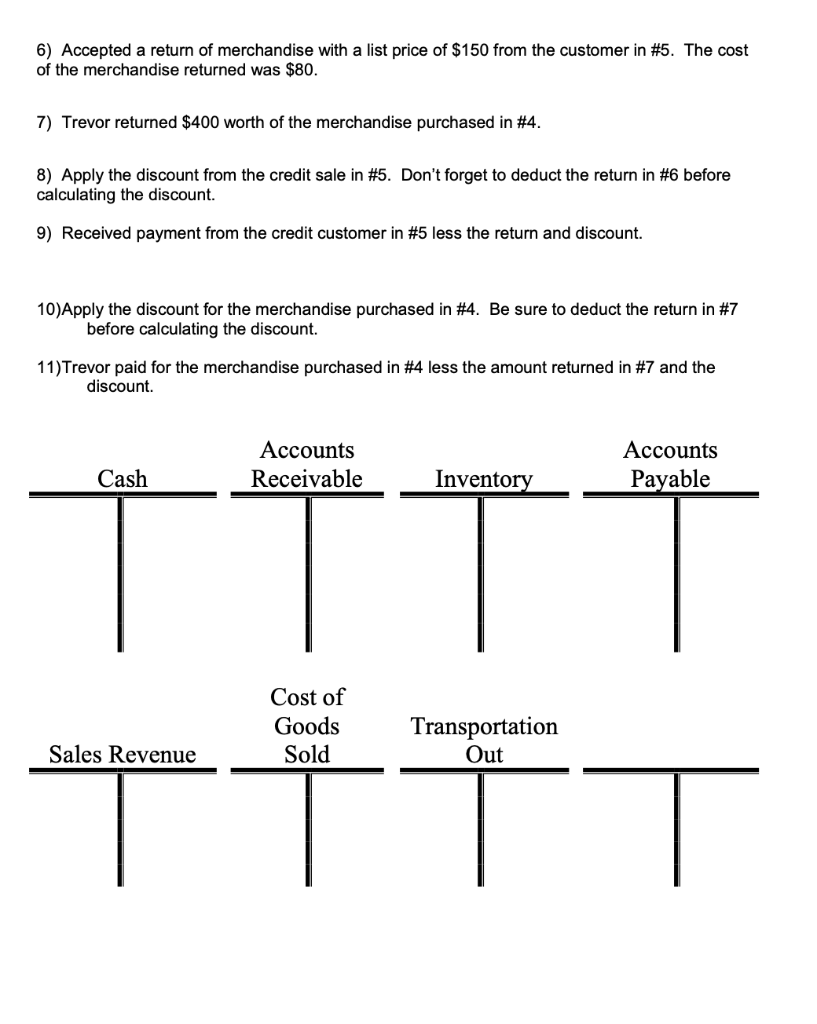

ACG 2021 - CHAPTER 4 - EXERCISE INVENTORY TRANSACTIONS Product vs. Period Costs a. PRODUCT COSTS- Include all costs to acquire the inventory and ready it for sale- includes shipping, handling, insurance and storage. Product costs are first recorded as part of the Inventory Asset and expensed when the product is sold (through Cost of Goods Sold). b. PERIOD COSTS- Selling and Administrative costs include advertising, commissions and administrative salaries among others (i.e. Operating Expenses). Period costs are any costs that are NOT related to the manufacturing of the product. These costs are expensed as incurred. Income Statement Format: When buying and selling inventory, a Multi-Step Income Statement must be utilized. See example below. Businesses that sell services Businesses that buy and sell inventory Single-Step Revenues $1,000 Multi-Step Sales $1,000 Less: Expenses (800) Less: Cost of Goods Sold (400) Net Income (Loss) $ 200 Gross Profit (Margin) $ 600 Less: Operating Expenses (250) Operating Income $ 350 +- Non-Operating Items (Interest, (150) Gains or losses) Net Income (Loss) $ 200 On the Multi-Step Income Statement, product costs are "expensed" through Cost of Goods Sold when the inventory item is sold. The Sales balance reflects what price is charged to the customer for the product. Sales - COGS = Gross Profit. This is the profit earned on all product sales. Please note that Gross Profit is NOT the same as Net Income. To arrive at Net Income you must subtract period costs (i.e. Operating expenses). Perpetual Inventory System: The following examples illustrate a perpetual inventory system where the inventory balance is tracked through all stages. In theory, a perpetual inventory system should result in a continuously updated inventory balance. Although, theft and errors will often cause a company to have to make adjustments based on inventory counts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started