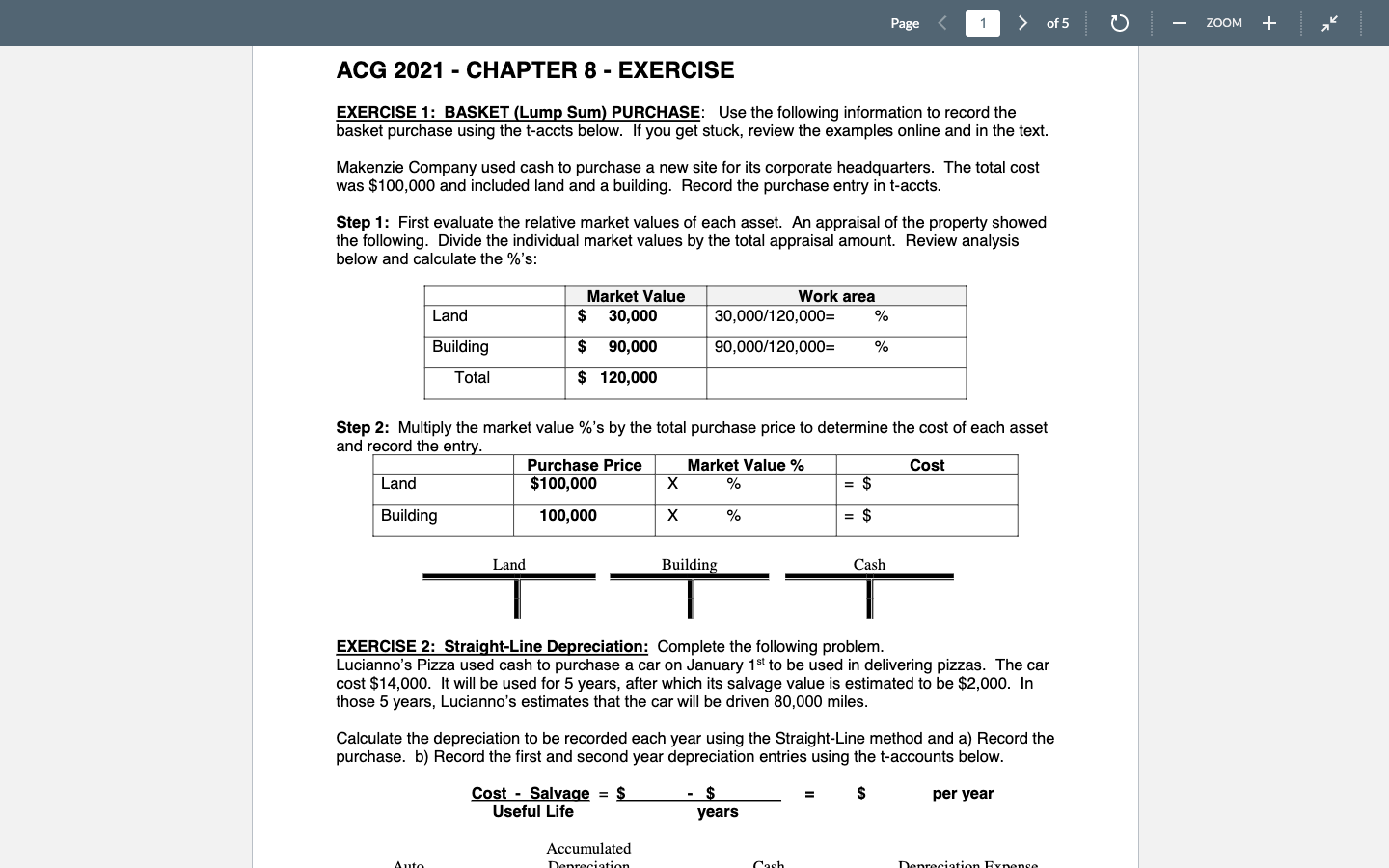

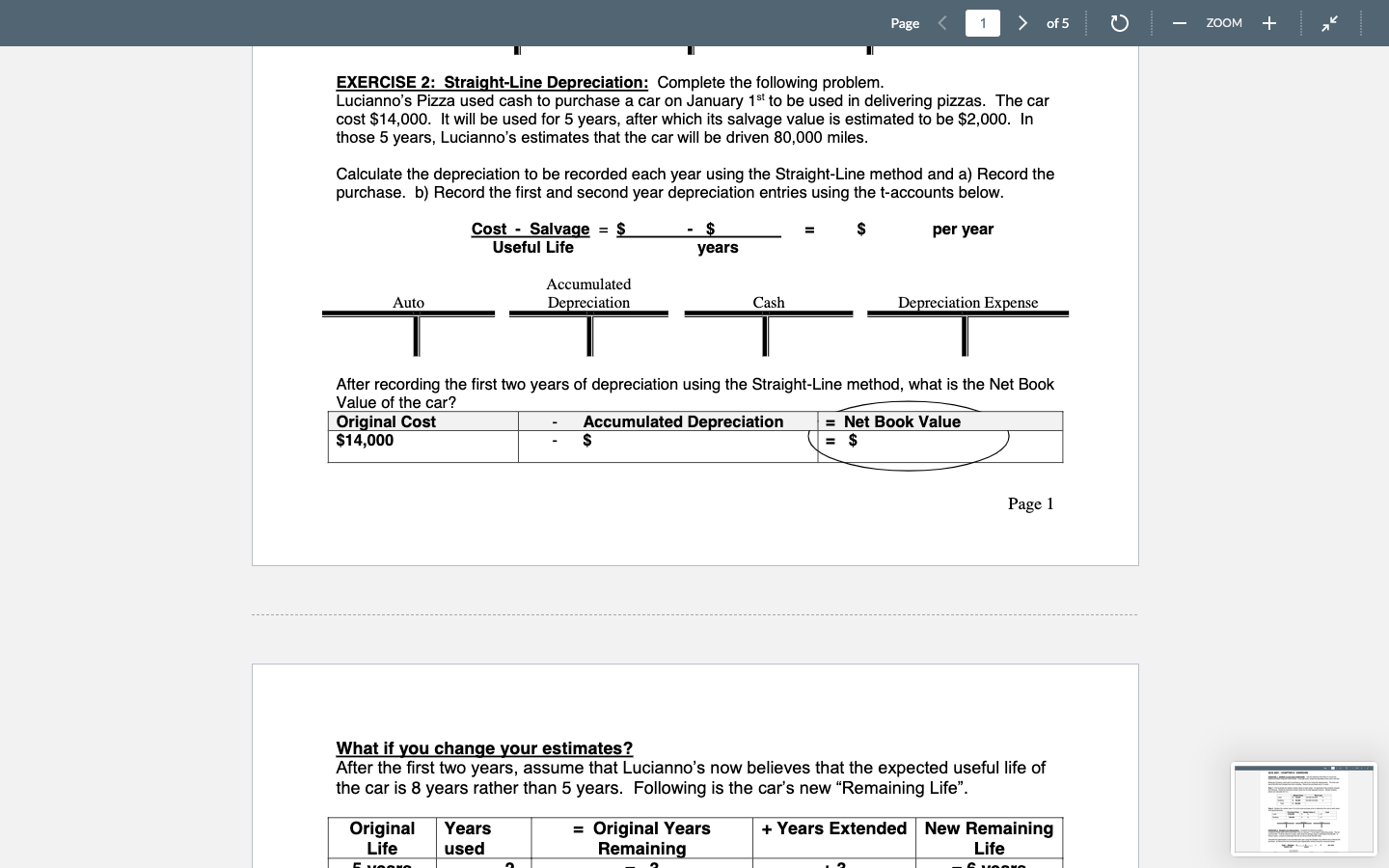

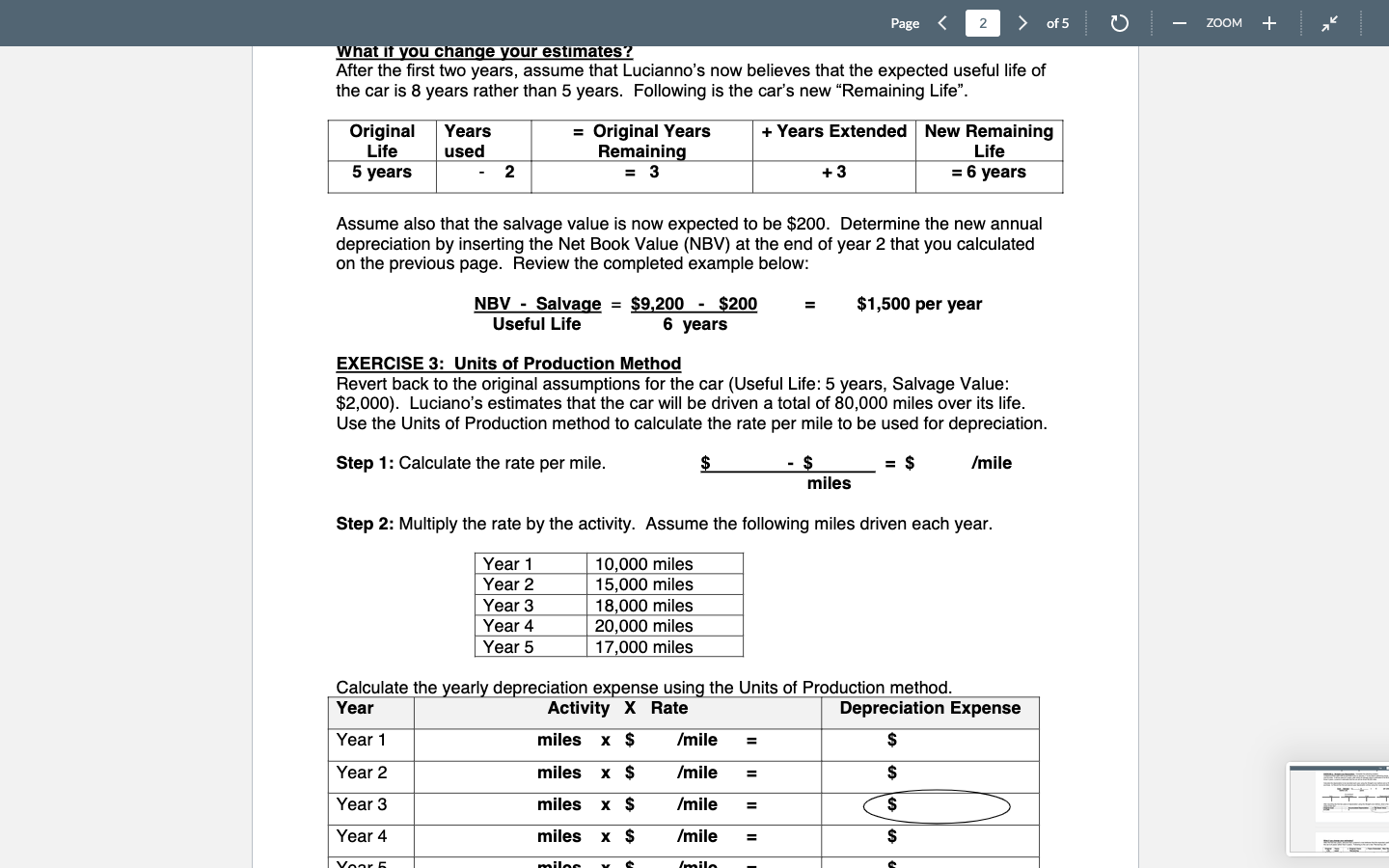

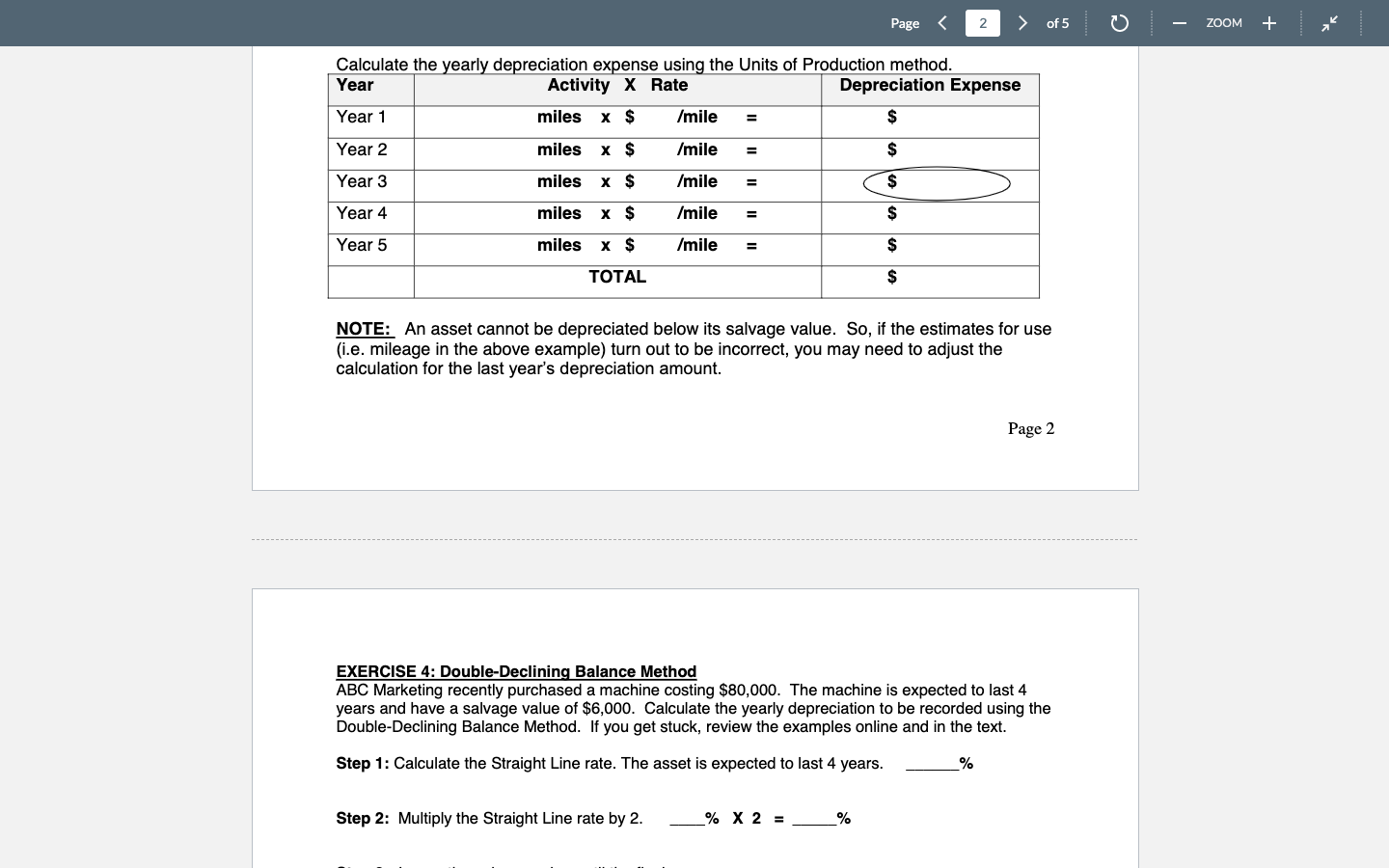

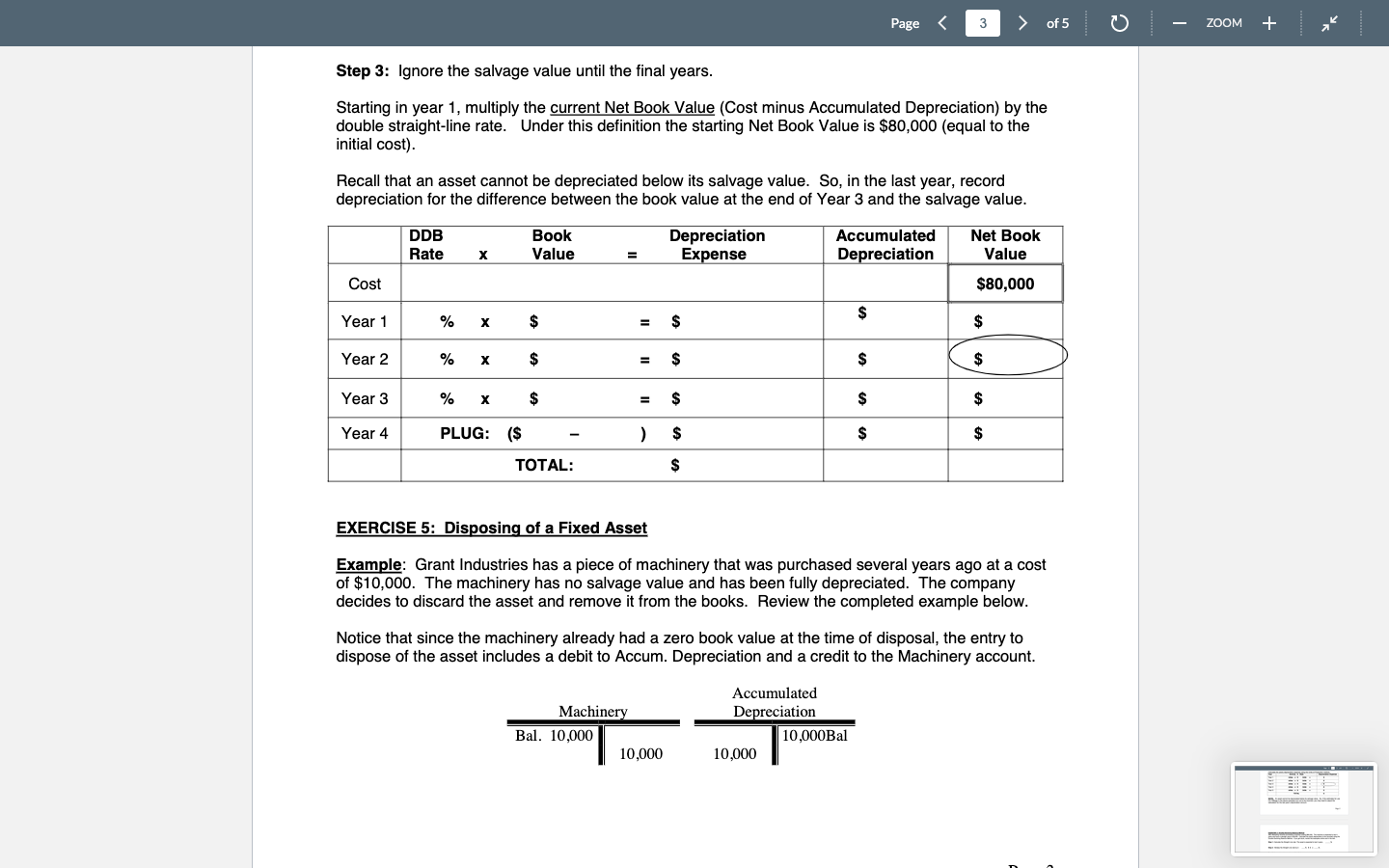

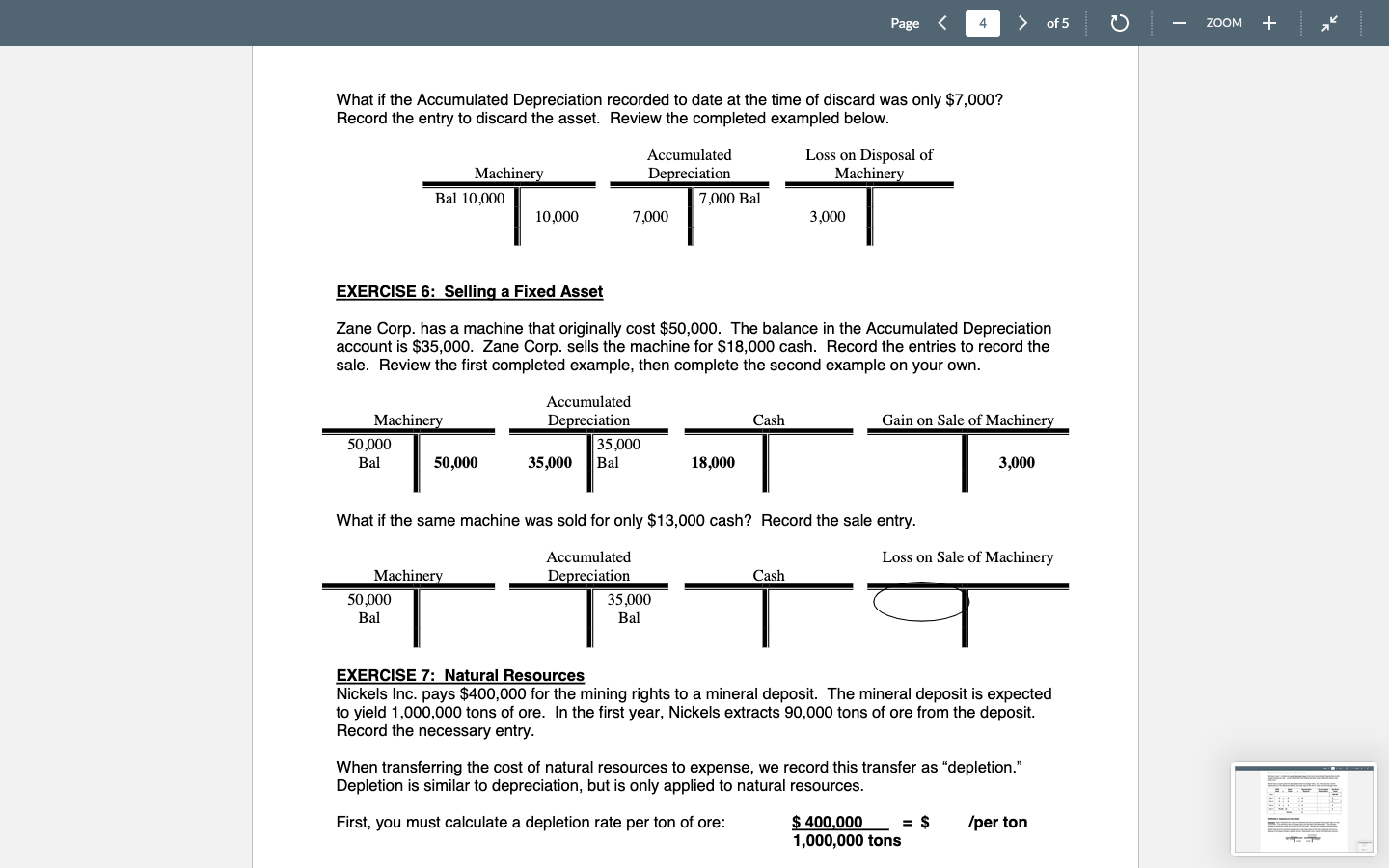

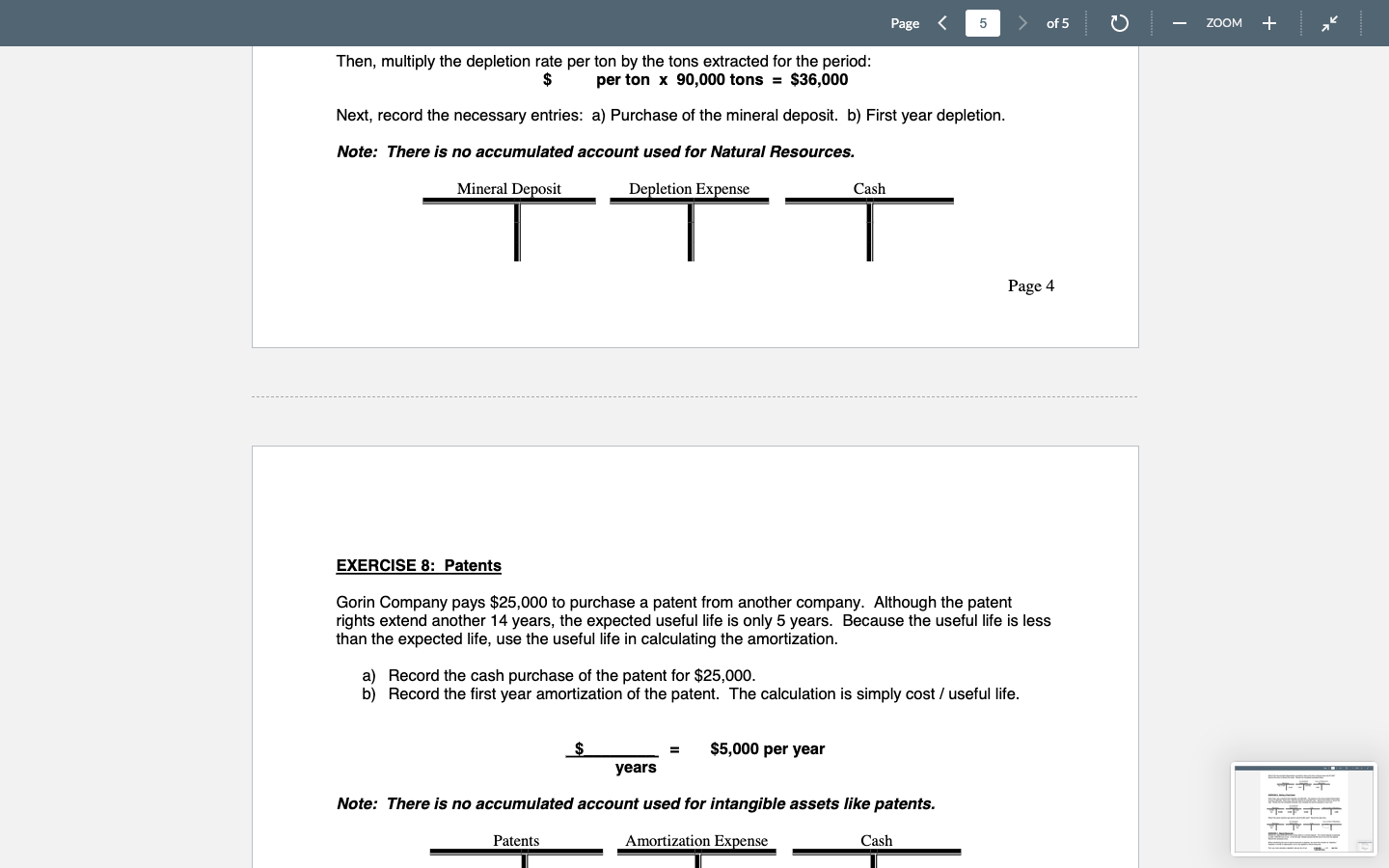

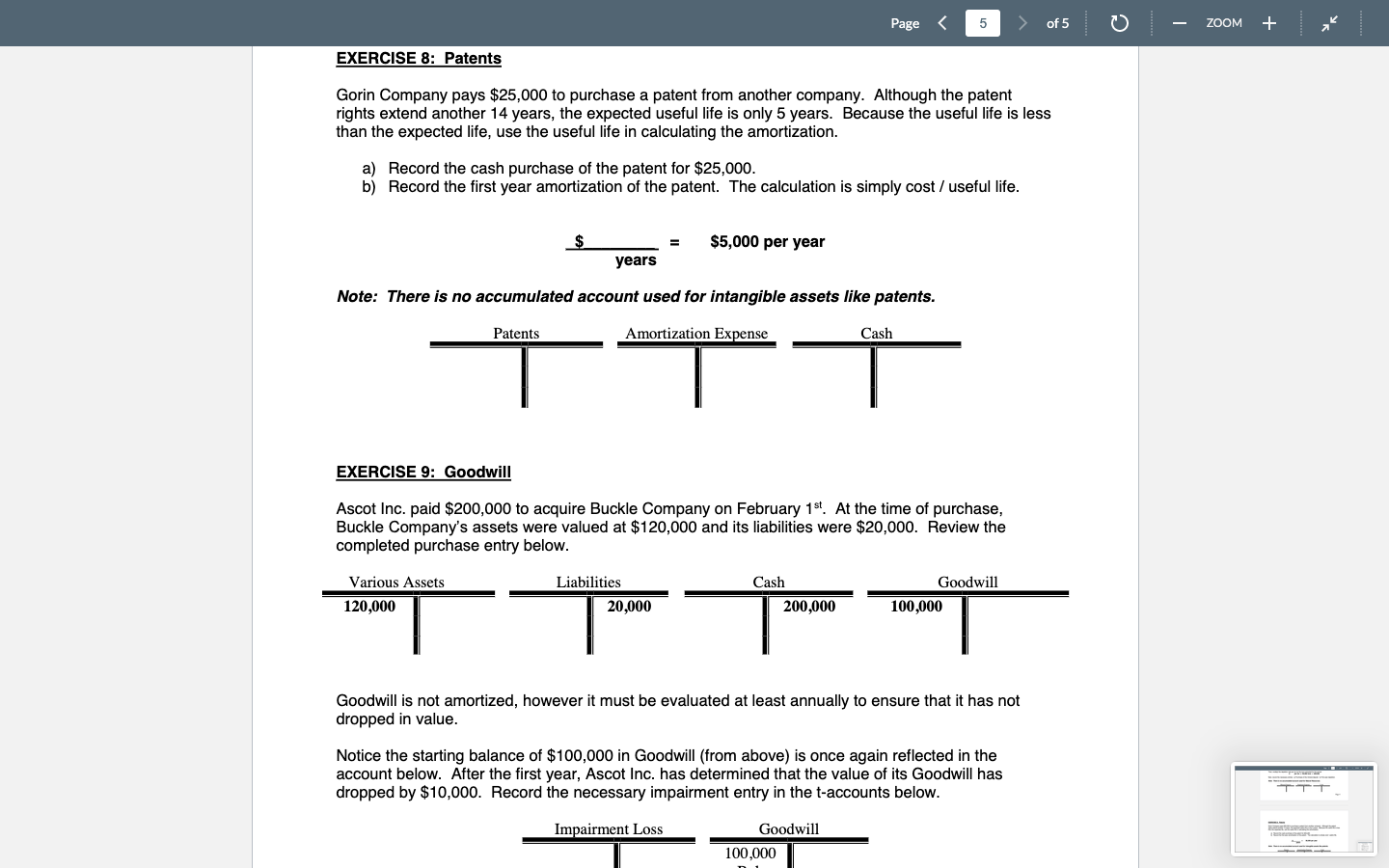

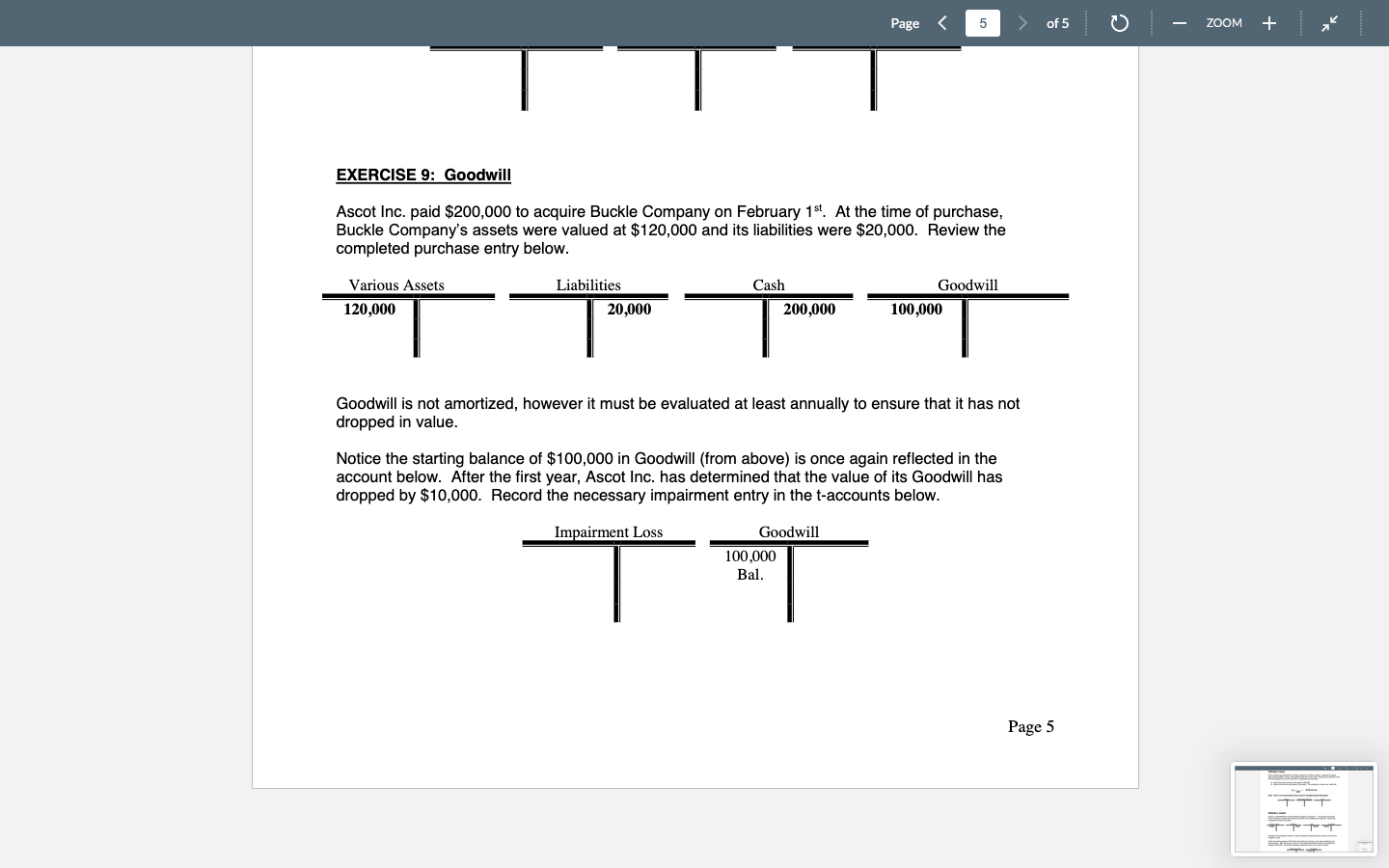

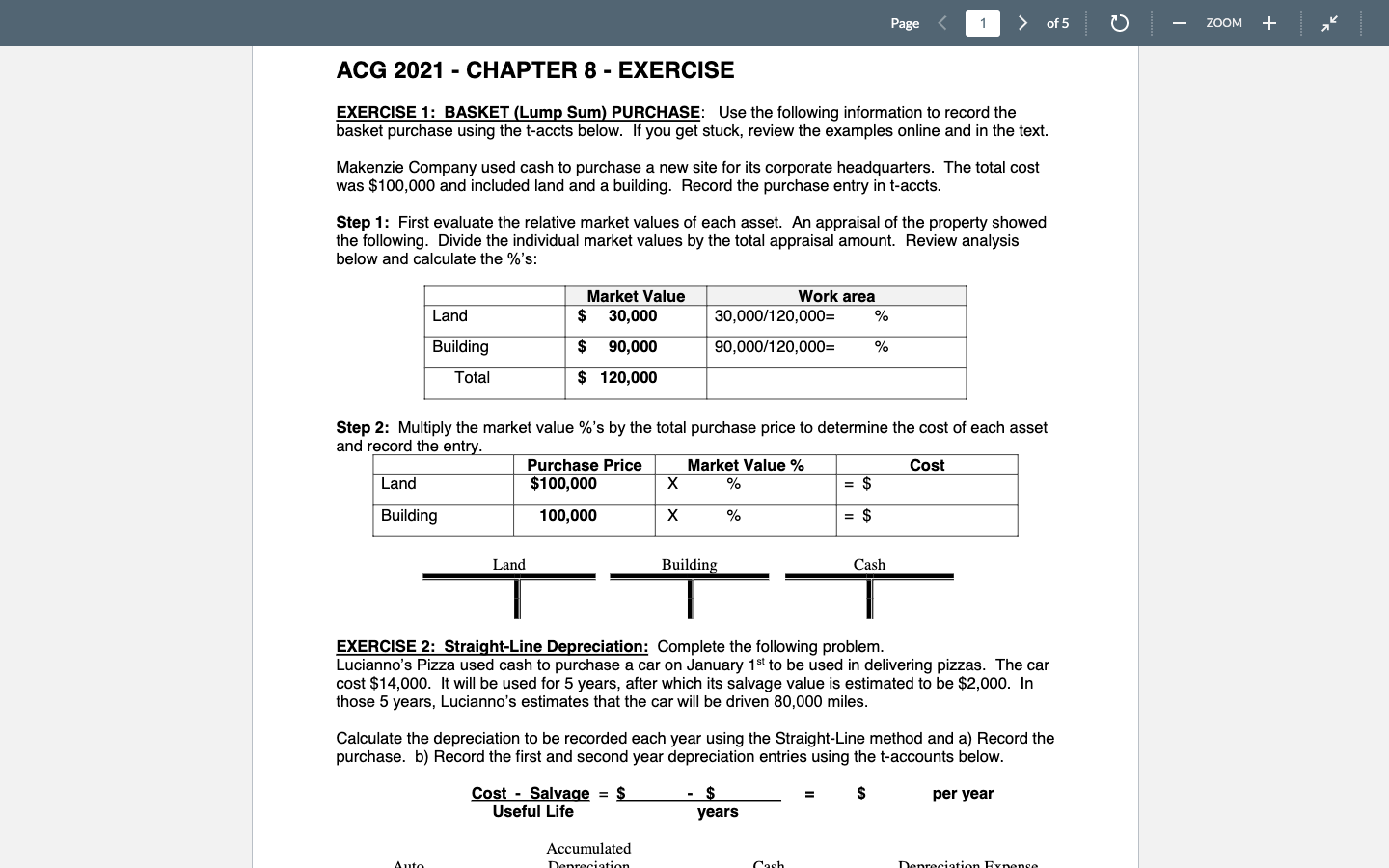

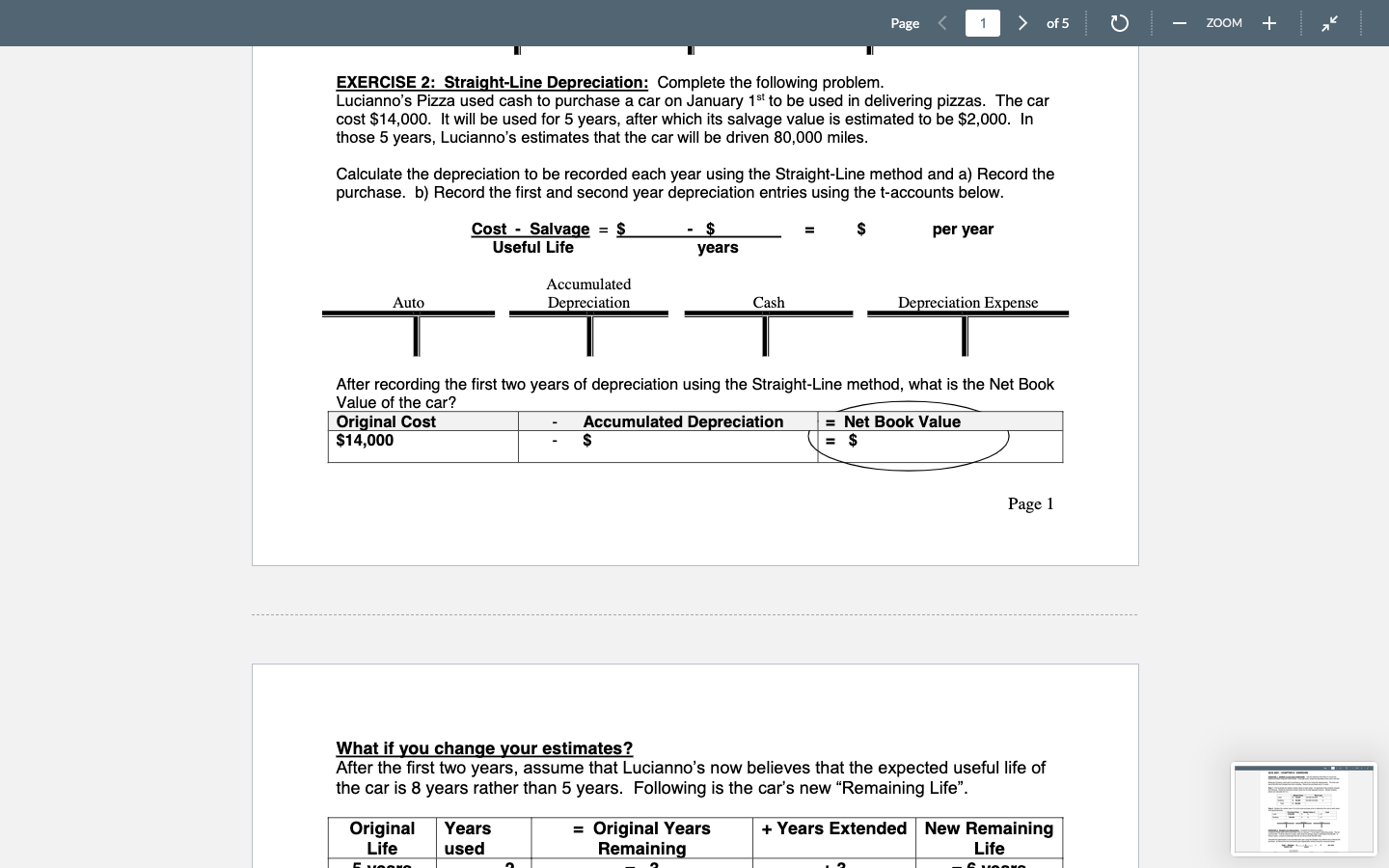

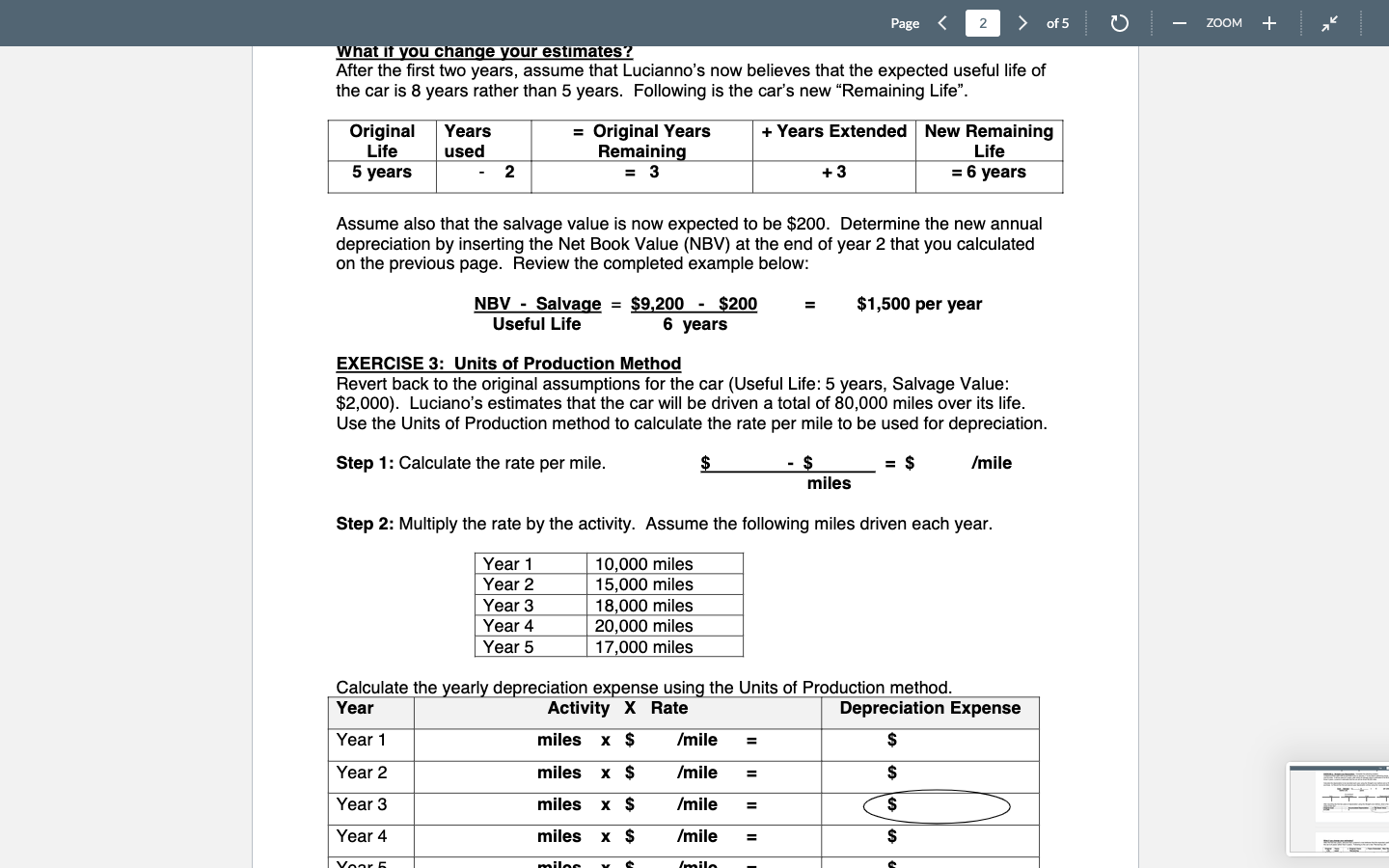

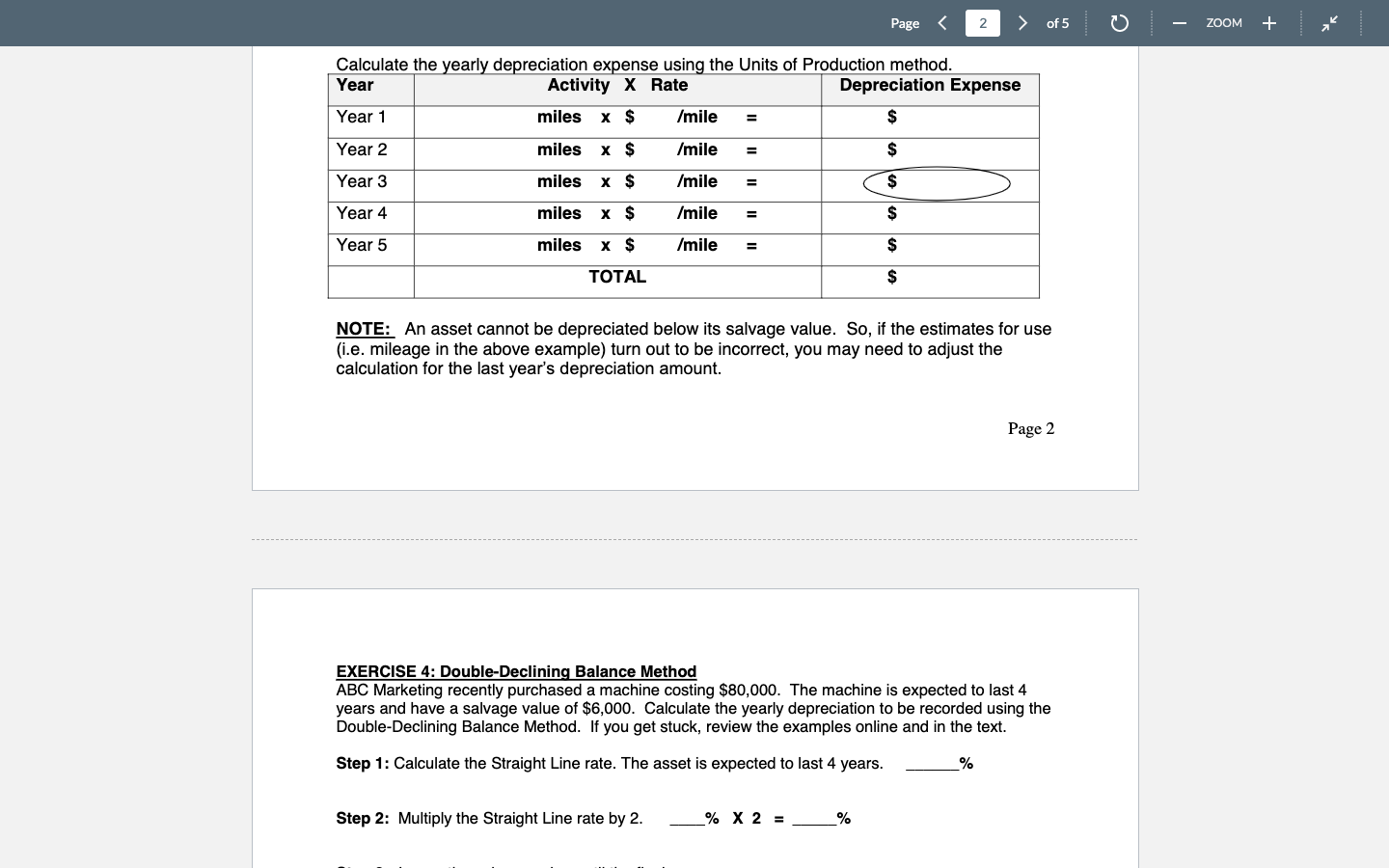

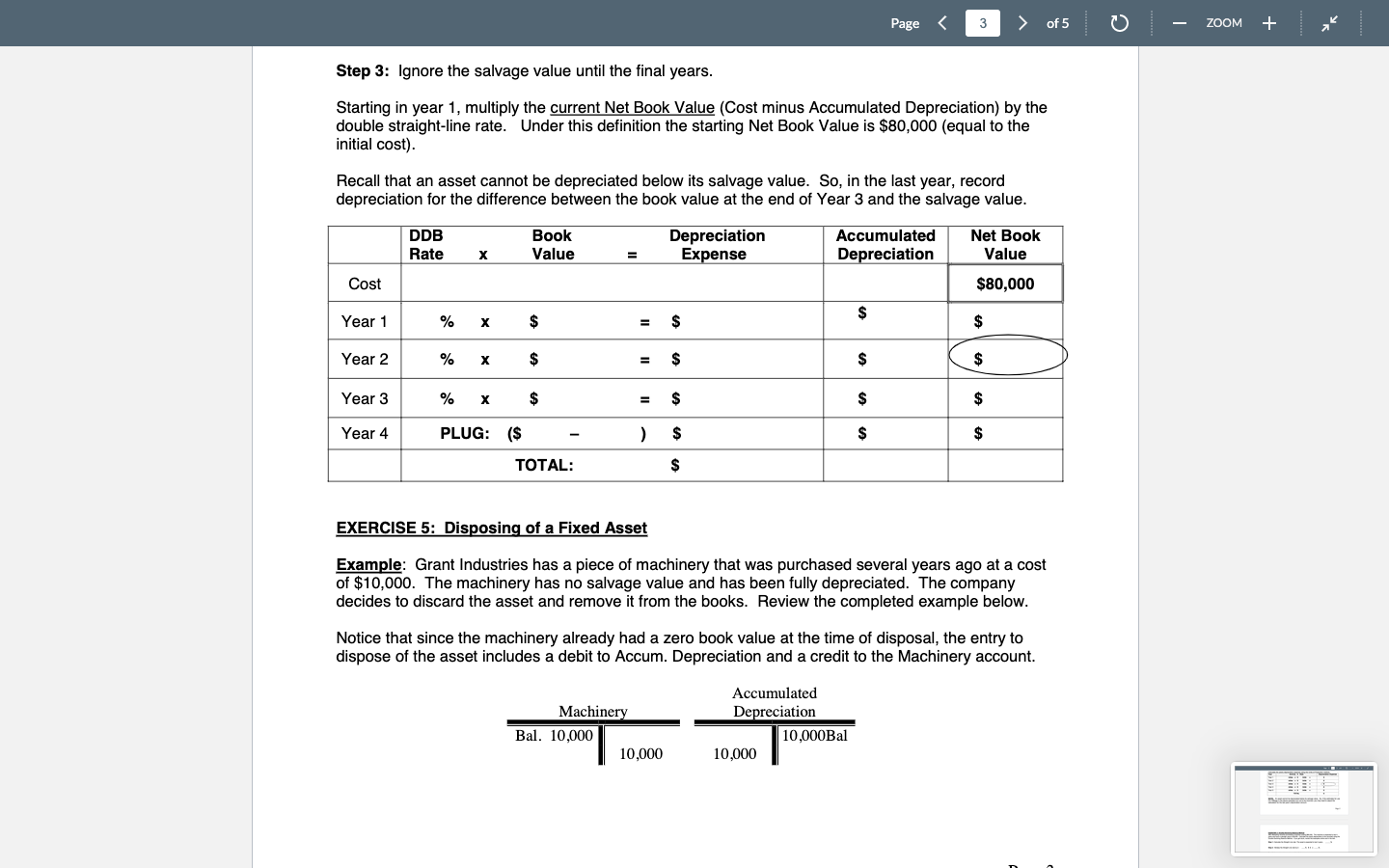

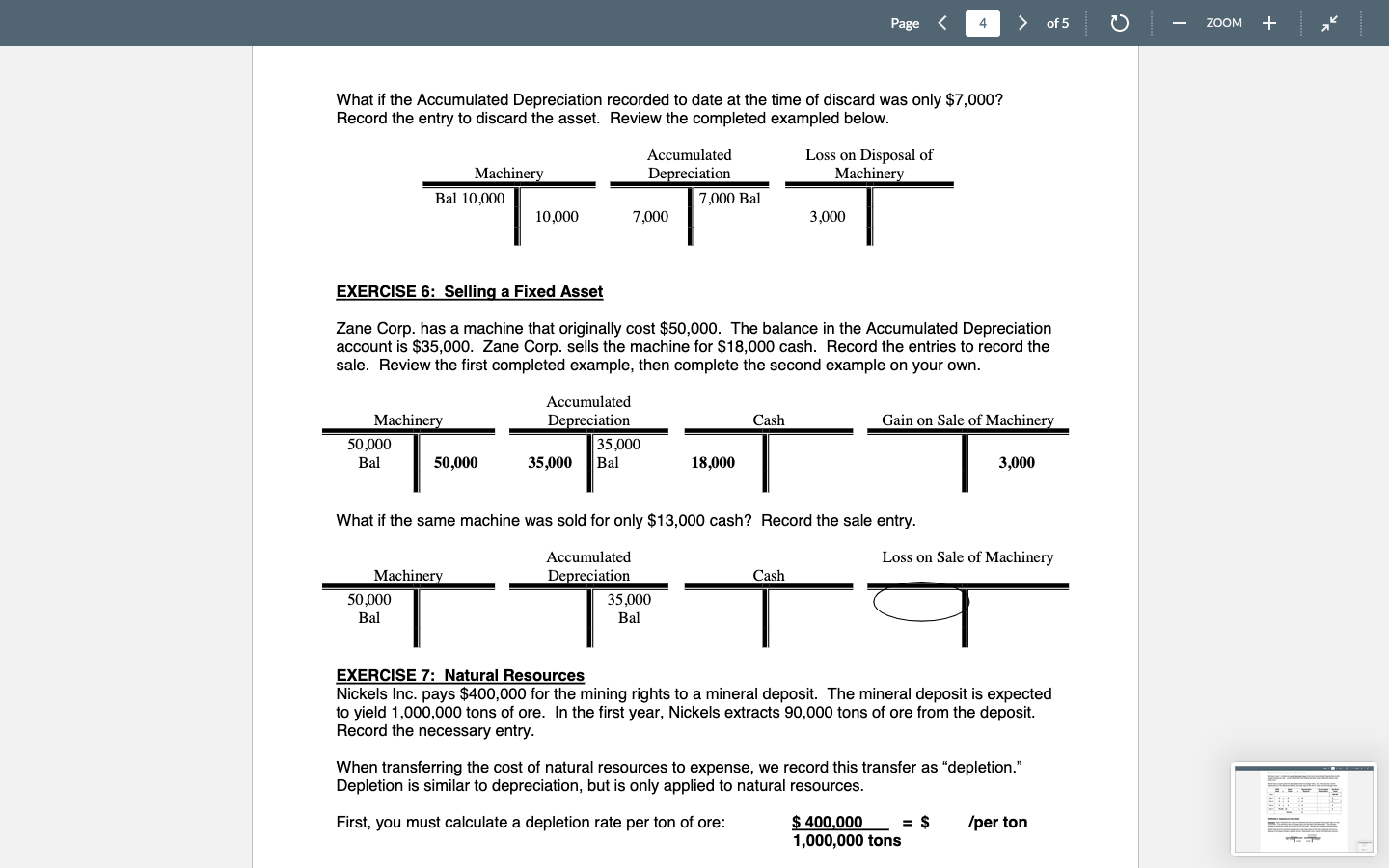

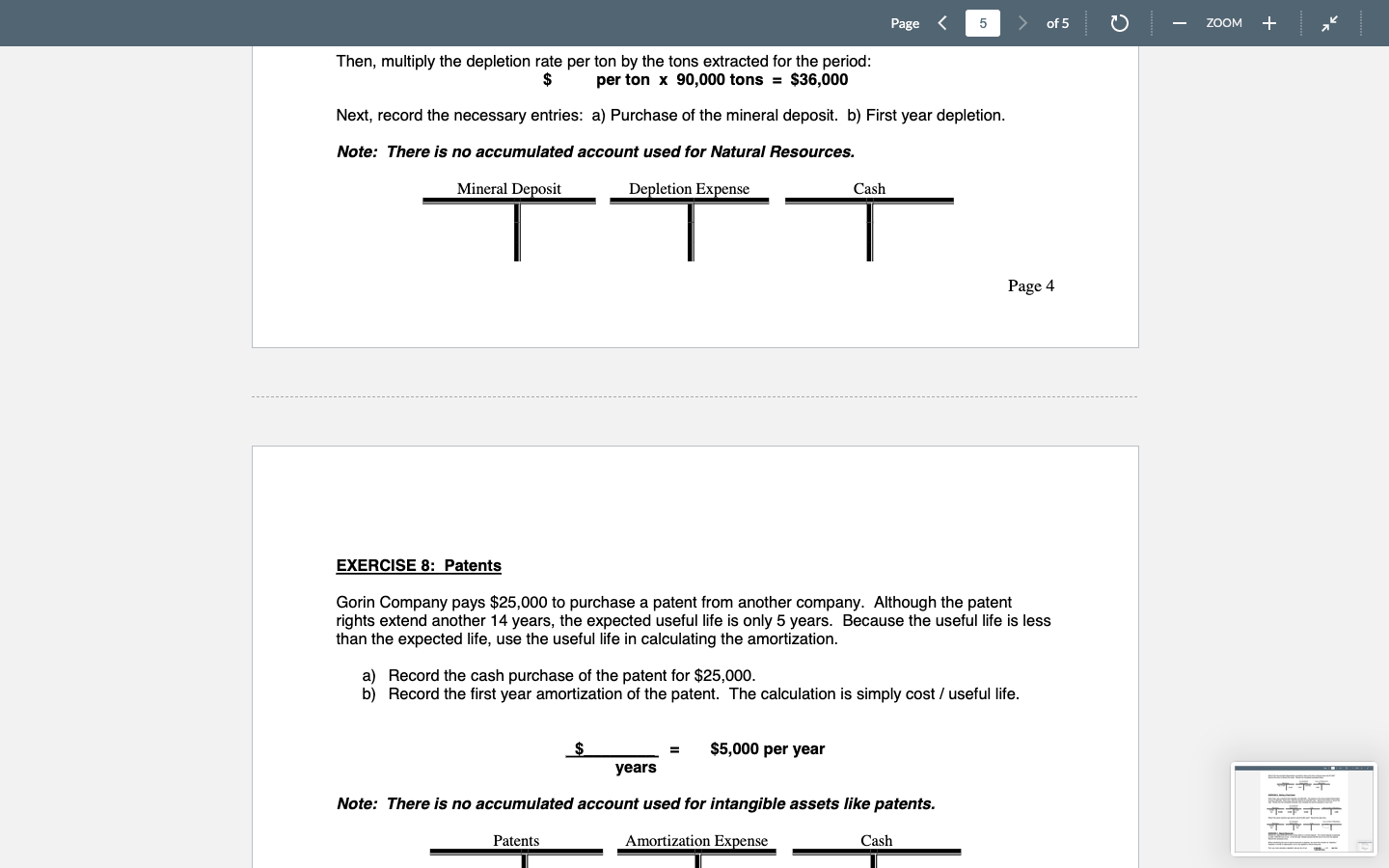

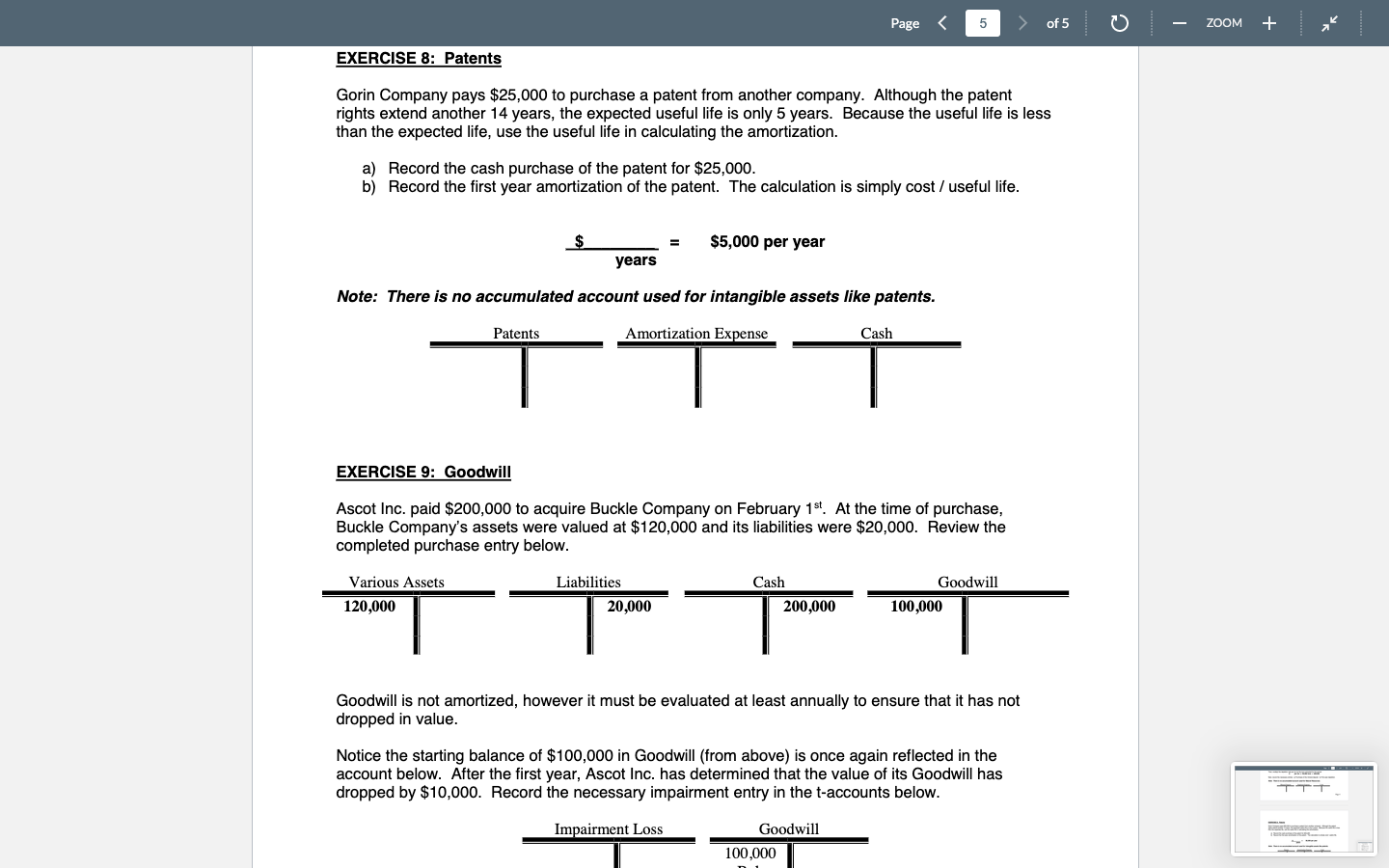

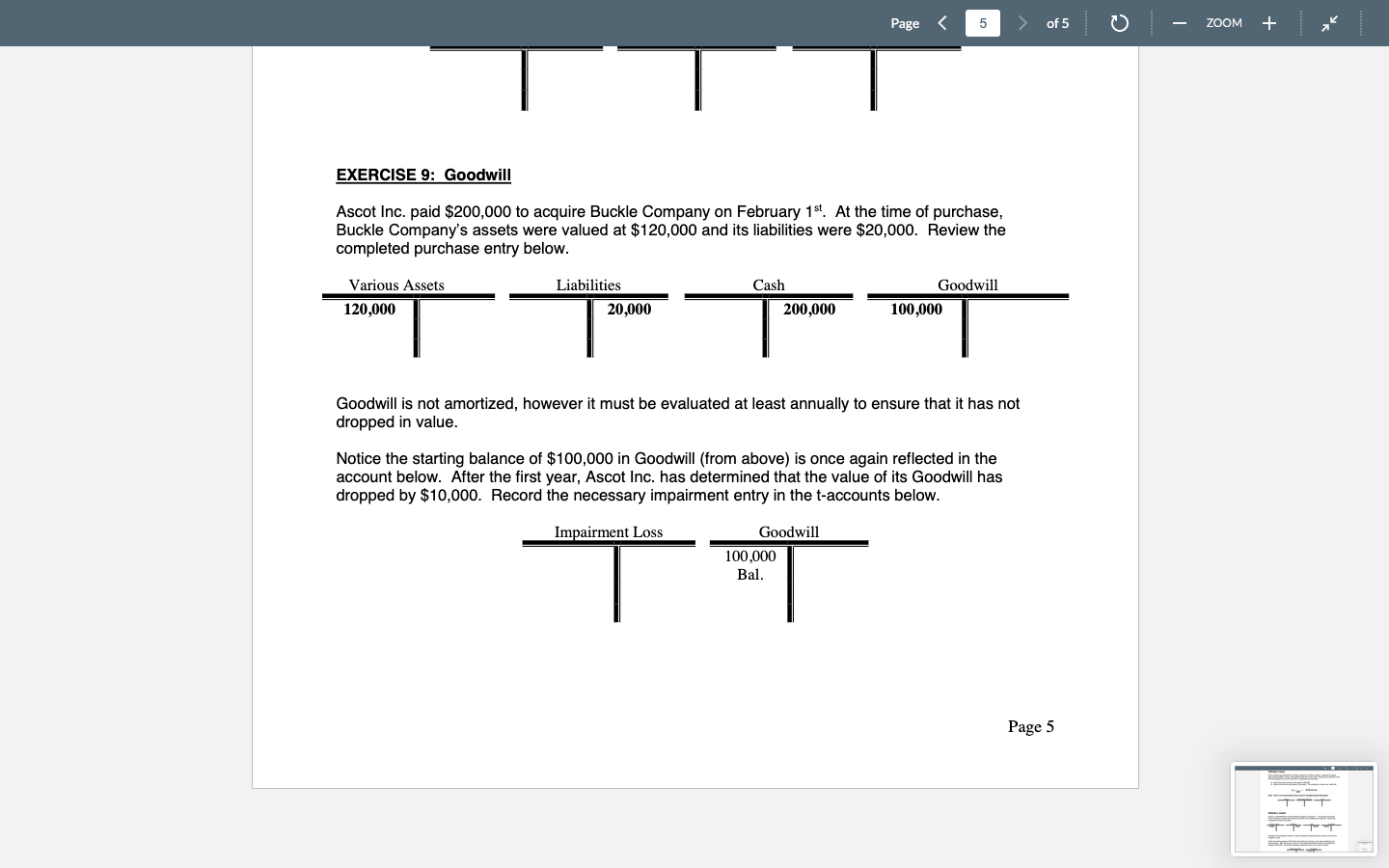

ACG 2021 - CHAPTER 8 - EXERCISE EXERCISE 1: BASKET (Lump Sum) PURCHASE: Use the following information to record the basket purchase using the t-accts below. If you get stuck, review the examples online and in the text. Makenzie Company used cash to purchase a new site for its corporate headquarters. The total cost was $100,000 and included land and a building. Record the purchase entry in t-accts. Step 1: First evaluate the relative market values of each asset. An appraisal of the property showed the following. Divide the individual market values by the total appraisal amount. Review analysis below and calculate the %'s: Land Building Total Land Building Market Value $ 30,000 $ 90,000 $ 120,000 Land Auto Purchase Price $100,000 100,000 Step 2: Multiply the market value %'s by the total purchase price to determine the cost of each asset and record the entry. Cost X X Cost Salvage = $ Useful Life 30,000/120,000= 90,000/120,000= Accumulated Depreciation Market Value % % Building Work area % % - $ years Page of 5 = Cash per year Depreciation Expense - ZOOM + EXERCISE 2: Straight-Line Depreciation: Complete the following problem. Lucianno's Pizza used cash to purchase a car on January 1st to be used in delivering pizzas. The car cost $14,000. It will be used for 5 years, after which its salvage value is estimated to be $2,000. In those 5 years, Lucianno's estimates that the car will be driven 80,000 miles. Calculate the depreciation to be recorded each year using the Straight-Line method and a) Record the purchase. b) Record the first and second year depreciation entries using the t-accounts below. $ per year Auto Original Cost $14,000 Cost Salvage = $ Useful Life Original Life 5 vooro Accumulated Depreciation Years used - $ years $ Cash After recording the first two years of depreciation using the Straight-Line method, what is the Net Book Value of the car? Accumulated Depreciation Page of 5 = Depreciation Expense = Net Book Value = $ What if you change your estimates? After the first two years, assume that Lucianno's now believes that the expected useful life of the car is 8 years rather than 5 years. Following is the car's new "Remaining Life". 12 Page 1 = Original Years + Years Extended New Remaining Remaining Life GYOONO - ZOOM + TTT CERITAVE Page of 5 What if you change your estimates? After the first two years, assume that Lucianno's now believes that the expected useful life of the car is 8 years rather than 5 years. Following is the car's new "Remaining Life". Original Life 5 years Years used -2 = Original Years Remaining = 3 Yoar 5 Assume also that the salvage value is now expected to be $200. Determine the new annual depreciation by inserting the Net Book Value (NBV) at the end of year 2 that you calculated on the previous page. Review the completed example below: NBV - Salvage = $9,200 - $200 = Useful Life 6 years EXERCISE 3: Units of Production Method Revert back to the original assumptions for the car (Useful Life: 5 years, Salvage Value: $2,000). Luciano's estimates that the car will be driven a total of 80,000 miles over its life. Use the Units of Production method to calculate the rate per mile to be used for depreciation. /mile Step 1: Calculate the rate per mile. $ = $ 18,000 miles 20,000 miles 17,000 miles + Years Extended New Remaining Life = 6 years Step 2: Multiply the rate by the activity. Assume the following miles driven each year. 10,000 miles Year 1 Year 2 Year 3 15,000 miles Year 4 Year 5 /mile /mile /mile = /mile /milo +3 = Calculate the yearly depreciation expense using the Units of Production method. Year Activity X Rate Year 1 miles x $ Year 2 miles x $ Year 3 miles x $ Year 4 miles x $ milos Y = = $1,500 per year - $ miles Depreciation Expense $ $ $ $ - ZOOM + www.me TTTT A Page of 5 Depreciation Expense $ $ $ $ $ $ EXERCISE 4: Double-Declining Balance Method ABC Marketing recently purchased a machine costing $80,000. The machine is expected to last 4 years and have a salvage value of $6,000. Calculate the yearly depreciation to be recorded using the Double-Declining Balance Method. If you get stuck, review the examples online and in the text. Step 1: Calculate the Straight Line rate. The asset is expected to last 4 years. _% % Page 2 - ZOOM + Step 3: Ignore the salvage value until the final years. Starting in year 1, multiply the current Net Book Value (Cost minus Accumulated Depreciation) by the double straight-line rate. Under this definition the starting Net Book Value is $80,000 (equal to the initial cost). Recall that an asset cannot be depreciated below its salvage value. So, in the last year, record depreciation for the difference between the book value at the end of Year 3 and the salvage value. Cost Year 1 Year 2 Year 3 Year 4 DDB Rate X % x $ % x $ $ % X Book Value PLUG: ($ TOTAL: = Machinery Bal. 10,000 = Depreciation Expense $ ) $ $ $ $ 10,000 Accumulated Depreciation Page of 5 Accumulated Depreciation EXERCISE 5: Disposing of a Fixed Asset Example: Grant Industries has a piece of machinery that was purchased several years ago at a cost of $10,000. The machinery has no salvage value and has been fully depreciated. The company decides to discard the asset and remove it from the books. Review the completed example below. 10,000 $ Notice that since the machinery already had a zero book value at the time of disposal, the entry to dispose of the asset includes a debit to Accum. Depreciation and a credit to the Machinery account. $ $ $ 10,000Bal Net Book Value $80,000 $ $ $ $ - ZOOM + What if the Accumulated Depreciation recorded to date at the time of discard was only $7,000? Record the entry to discard the asset. Review the completed exampled below. 50,000 Bal IT 10,000 7,000 Machinery Bal 10,000 Machinery 50,000 Bal 50,000 Machinery Accumulated Depreciation Accumulated 35,000 EXERCISE 6: Selling a Fixed Asset Zane Corp. has a machine that originally cost $50,000. The balance in the Accumulated Depreciation account is $35,000. Zane Corp. sells the machine for $18,000 cash. Record the entries to record the sale. Review the first completed example, then complete the second example on your own. 35,000 Bal Depreciation 7,000 Bal 35,000 Bal 18,000 Cash Page of 5 Gain on Sale of Machinery 3,000 Loss on Sale of Machinery $ 400,000 = $ 1,000,000 tons EXERCISE 7: Natural Resources Nickels Inc. pays $400,000 for the mining rights to a mineral deposit. The mineral deposit is expected to yield 1,000,000 tons of ore. In the first year, Nickels extracts 90,000 tons of ore from the deposit. Record the necessary entry. When transferring the cost of natural resources to expense, we record this transfer as "depletion." Depletion is similar to depreciation, but is only applied to natural resources. First, you must calculate a depletion rate per ton of ore: /per ton - ZOOM + .... TH Mineral Deposit Then, multiply the depletion rate per ton by the tons extracted for the period: $ per ton x 90,000 tons = $36,000 Next, record the necessary entries: a) Purchase of the mineral deposit. b) First year depletion. Note: There is no accumulated account used for Natural Resources. Depletion Expense $ Patents Page Cash years EXERCISE 8: Patents Gorin Company pays $25,000 to purchase a patent from another company. Although the patent rights extend another 14 years, the expected useful life is only 5 years. Because the useful life is less than the expected life, use the useful life in calculating the amortization. = $5,000 per year a) Record the cash purchase of the patent for $25,000. b) Record the first year amortization of the patent. The calculation is simply cost / useful life. 5 Note: There is no accumulated account used for intangible assets like patents. Amortization Expense > of 5 Cash Page 4 ZOOM + TTT TTTT TTTT EXERCISE 8: Patents Gorin Company pays $25,000 to purchase a patent from another company. Although the patent rights extend another 14 years, the expected useful life is only 5 years. Because the useful life is less than the expected life, use the useful life in calculating the amortization. a) Record the cash purchase of the patent for $25,000. b) Record the first year amortization of the patent. The calculation is simply cost / useful life. $ Patents Various Assets 120,000 years Note: There is no accumulated account used for intangible assets like patents. Amortization Expense $5,000 per year Liabilities EXERCISE 9: Goodwill Ascot Inc. paid $200,000 to acquire Buckle Company on February 1st. At the time of purchase, Buckle Company's assets were valued at $120,000 and its liabilities were $20,000. Review the completed purchase entry below. 20,000 Page of 5 100,000 Goodwill is not amortized, however it must be evaluated at least annually to ensure that it has not dropped in value. Notice the starting balance of $100,000 in Goodwill (from above) is once again reflected in the account below. After the first year, Ascot Inc. has determined that the value of its Goodwill has dropped by $10,000. Record the necessary impairment entry in the t-accounts below. Impairment Loss - ZOOM + RESTAN TTT H - Various Assets 120,000 EXERCISE 9: Goodwill the time of purchase, Ascot Inc. paid $200,000 to acquire Buckle Company on February 1st. Buckle Company's assets were valued at $120,000 and its liabilities were $20,000. Review the completed purchase entry below. Liabilities 20,000 Cash 200,000 Page Goodwill 100,000 Bal. 5 Goodwill 100,000 Goodwill is not amortized, however it must be evaluated at least annually to ensure that it has not dropped in value. Notice the starting balance of $100,000 in Goodwill (from above) is once again reflected in the account below. After the first year, Ascot Inc. has determined that the value of its Goodwill has dropped by $10,000. Record the necessary impairment entry in the t-accounts below. Impairment Loss > of 5 Page 5 ZOOM + PELLICO ACG 2021 - CHAPTER 8 - EXERCISE EXERCISE 1: BASKET (Lump Sum) PURCHASE: Use the following information to record the basket purchase using the t-accts below. If you get stuck, review the examples online and in the text. Makenzie Company used cash to purchase a new site for its corporate headquarters. The total cost was $100,000 and included land and a building. Record the purchase entry in t-accts. Step 1: First evaluate the relative market values of each asset. An appraisal of the property showed the following. Divide the individual market values by the total appraisal amount. Review analysis below and calculate the %'s: Land Building Total Land Building Market Value $ 30,000 $ 90,000 $ 120,000 Land Auto Purchase Price $100,000 100,000 Step 2: Multiply the market value %'s by the total purchase price to determine the cost of each asset and record the entry. Cost X X Cost Salvage = $ Useful Life 30,000/120,000= 90,000/120,000= Accumulated Depreciation Market Value % % Building Work area % % - $ years Page of 5 = Cash per year Depreciation Expense - ZOOM + EXERCISE 2: Straight-Line Depreciation: Complete the following problem. Lucianno's Pizza used cash to purchase a car on January 1st to be used in delivering pizzas. The car cost $14,000. It will be used for 5 years, after which its salvage value is estimated to be $2,000. In those 5 years, Lucianno's estimates that the car will be driven 80,000 miles. Calculate the depreciation to be recorded each year using the Straight-Line method and a) Record the purchase. b) Record the first and second year depreciation entries using the t-accounts below. $ per year Auto Original Cost $14,000 Cost Salvage = $ Useful Life Original Life 5 vooro Accumulated Depreciation Years used - $ years $ Cash After recording the first two years of depreciation using the Straight-Line method, what is the Net Book Value of the car? Accumulated Depreciation Page of 5 = Depreciation Expense = Net Book Value = $ What if you change your estimates? After the first two years, assume that Lucianno's now believes that the expected useful life of the car is 8 years rather than 5 years. Following is the car's new "Remaining Life". 12 Page 1 = Original Years + Years Extended New Remaining Remaining Life GYOONO - ZOOM + TTT CERITAVE Page of 5 What if you change your estimates? After the first two years, assume that Lucianno's now believes that the expected useful life of the car is 8 years rather than 5 years. Following is the car's new "Remaining Life". Original Life 5 years Years used -2 = Original Years Remaining = 3 Yoar 5 Assume also that the salvage value is now expected to be $200. Determine the new annual depreciation by inserting the Net Book Value (NBV) at the end of year 2 that you calculated on the previous page. Review the completed example below: NBV - Salvage = $9,200 - $200 = Useful Life 6 years EXERCISE 3: Units of Production Method Revert back to the original assumptions for the car (Useful Life: 5 years, Salvage Value: $2,000). Luciano's estimates that the car will be driven a total of 80,000 miles over its life. Use the Units of Production method to calculate the rate per mile to be used for depreciation. /mile Step 1: Calculate the rate per mile. $ = $ 18,000 miles 20,000 miles 17,000 miles + Years Extended New Remaining Life = 6 years Step 2: Multiply the rate by the activity. Assume the following miles driven each year. 10,000 miles Year 1 Year 2 Year 3 15,000 miles Year 4 Year 5 /mile /mile /mile = /mile /milo +3 = Calculate the yearly depreciation expense using the Units of Production method. Year Activity X Rate Year 1 miles x $ Year 2 miles x $ Year 3 miles x $ Year 4 miles x $ milos Y = = $1,500 per year - $ miles Depreciation Expense $ $ $ $ - ZOOM + www.me TTTT A Page of 5 Depreciation Expense $ $ $ $ $ $ EXERCISE 4: Double-Declining Balance Method ABC Marketing recently purchased a machine costing $80,000. The machine is expected to last 4 years and have a salvage value of $6,000. Calculate the yearly depreciation to be recorded using the Double-Declining Balance Method. If you get stuck, review the examples online and in the text. Step 1: Calculate the Straight Line rate. The asset is expected to last 4 years. _% % Page 2 - ZOOM + Step 3: Ignore the salvage value until the final years. Starting in year 1, multiply the current Net Book Value (Cost minus Accumulated Depreciation) by the double straight-line rate. Under this definition the starting Net Book Value is $80,000 (equal to the initial cost). Recall that an asset cannot be depreciated below its salvage value. So, in the last year, record depreciation for the difference between the book value at the end of Year 3 and the salvage value. Cost Year 1 Year 2 Year 3 Year 4 DDB Rate X % x $ % x $ $ % X Book Value PLUG: ($ TOTAL: = Machinery Bal. 10,000 = Depreciation Expense $ ) $ $ $ $ 10,000 Accumulated Depreciation Page of 5 Accumulated Depreciation EXERCISE 5: Disposing of a Fixed Asset Example: Grant Industries has a piece of machinery that was purchased several years ago at a cost of $10,000. The machinery has no salvage value and has been fully depreciated. The company decides to discard the asset and remove it from the books. Review the completed example below. 10,000 $ Notice that since the machinery already had a zero book value at the time of disposal, the entry to dispose of the asset includes a debit to Accum. Depreciation and a credit to the Machinery account. $ $ $ 10,000Bal Net Book Value $80,000 $ $ $ $ - ZOOM + What if the Accumulated Depreciation recorded to date at the time of discard was only $7,000? Record the entry to discard the asset. Review the completed exampled below. 50,000 Bal IT 10,000 7,000 Machinery Bal 10,000 Machinery 50,000 Bal 50,000 Machinery Accumulated Depreciation Accumulated 35,000 EXERCISE 6: Selling a Fixed Asset Zane Corp. has a machine that originally cost $50,000. The balance in the Accumulated Depreciation account is $35,000. Zane Corp. sells the machine for $18,000 cash. Record the entries to record the sale. Review the first completed example, then complete the second example on your own. 35,000 Bal Depreciation 7,000 Bal 35,000 Bal 18,000 Cash Page of 5 Gain on Sale of Machinery 3,000 Loss on Sale of Machinery $ 400,000 = $ 1,000,000 tons EXERCISE 7: Natural Resources Nickels Inc. pays $400,000 for the mining rights to a mineral deposit. The mineral deposit is expected to yield 1,000,000 tons of ore. In the first year, Nickels extracts 90,000 tons of ore from the deposit. Record the necessary entry. When transferring the cost of natural resources to expense, we record this transfer as "depletion." Depletion is similar to depreciation, but is only applied to natural resources. First, you must calculate a depletion rate per ton of ore: /per ton - ZOOM + .... TH Mineral Deposit Then, multiply the depletion rate per ton by the tons extracted for the period: $ per ton x 90,000 tons = $36,000 Next, record the necessary entries: a) Purchase of the mineral deposit. b) First year depletion. Note: There is no accumulated account used for Natural Resources. Depletion Expense $ Patents Page Cash years EXERCISE 8: Patents Gorin Company pays $25,000 to purchase a patent from another company. Although the patent rights extend another 14 years, the expected useful life is only 5 years. Because the useful life is less than the expected life, use the useful life in calculating the amortization. = $5,000 per year a) Record the cash purchase of the patent for $25,000. b) Record the first year amortization of the patent. The calculation is simply cost / useful life. 5 Note: There is no accumulated account used for intangible assets like patents. Amortization Expense > of 5 Cash Page 4 ZOOM + TTT TTTT TTTT EXERCISE 8: Patents Gorin Company pays $25,000 to purchase a patent from another company. Although the patent rights extend another 14 years, the expected useful life is only 5 years. Because the useful life is less than the expected life, use the useful life in calculating the amortization. a) Record the cash purchase of the patent for $25,000. b) Record the first year amortization of the patent. The calculation is simply cost / useful life. $ Patents Various Assets 120,000 years Note: There is no accumulated account used for intangible assets like patents. Amortization Expense $5,000 per year Liabilities EXERCISE 9: Goodwill Ascot Inc. paid $200,000 to acquire Buckle Company on February 1st. At the time of purchase, Buckle Company's assets were valued at $120,000 and its liabilities were $20,000. Review the completed purchase entry below. 20,000 Page of 5 100,000 Goodwill is not amortized, however it must be evaluated at least annually to ensure that it has not dropped in value. Notice the starting balance of $100,000 in Goodwill (from above) is once again reflected in the account below. After the first year, Ascot Inc. has determined that the value of its Goodwill has dropped by $10,000. Record the necessary impairment entry in the t-accounts below. Impairment Loss - ZOOM + RESTAN TTT H - Various Assets 120,000 EXERCISE 9: Goodwill the time of purchase, Ascot Inc. paid $200,000 to acquire Buckle Company on February 1st. Buckle Company's assets were valued at $120,000 and its liabilities were $20,000. Review the completed purchase entry below. Liabilities 20,000 Cash 200,000 Page Goodwill 100,000 Bal. 5 Goodwill 100,000 Goodwill is not amortized, however it must be evaluated at least annually to ensure that it has not dropped in value. Notice the starting balance of $100,000 in Goodwill (from above) is once again reflected in the account below. After the first year, Ascot Inc. has determined that the value of its Goodwill has dropped by $10,000. Record the necessary impairment entry in the t-accounts below. Impairment Loss > of 5 Page 5 ZOOM + PELLICO