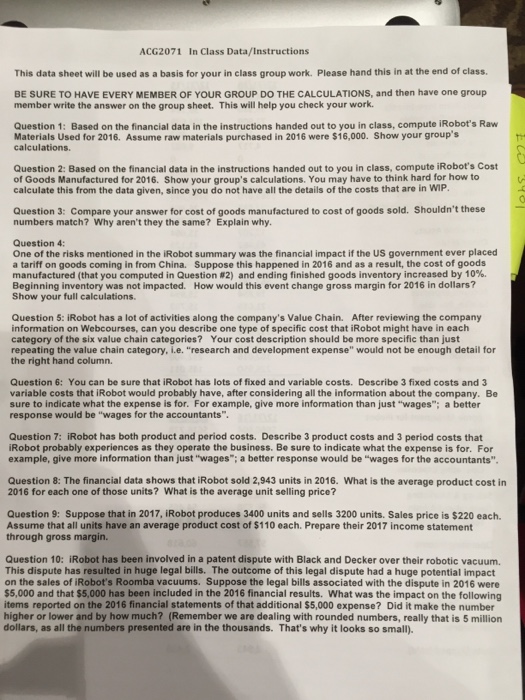

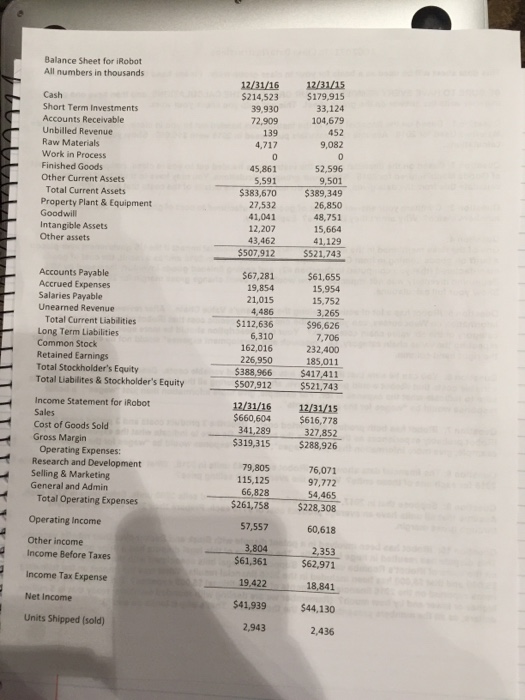

ACG2071 In Class Data/Instructions This data sheet will be used as a basis for your in class group work. Please hand this in at the end of class. BE SURE TO HAVE EVERY MEMBER OF YOUR GROUP DO THE CALCULATIONS, and then have one group member write the answer on the group sheet. This will help you check your work. Question 1: Based on the financial data in the instructions handed out to you in class, compute iRobot's Raw Materials Used for 2016. Assume raw materials purchased in 2016 were $16,000. Show your group's calculations. Question 2: Based on the financial data in the instructions handed out to you in class, compute iRobot's Cost of Goods Manufactured for 2016. Show your group's calculations. You may have to think hard for how to calculate this from the data given, since you do not have all the details of the costs that are in WIF Question 3: Compare your answer for cost of goods manufactured to cost of goods sold. Shouldn't these numbers match? Why aren't they the same? Explain why Question 4: One of the risks mentioned in the iRobot summary was the financial impact if the US government ever placed a tariff on goods coming in from China. Suppose this happened in 2016 and as a result, the cost of goods manufactured (that you computed in Question #2) and ending finished goods inventory increased by 10%. Beginning inventory was not impacted. How would this event change gross margin for 2016 in dollars? Show your full calculations Question 5: iRobot has a lot of activities along the company's Value Chain. After reviewing the company information on Webcourses, can you describe one type of specific cost that iRobot might have in each category of the six value chain categories? Your cost description should be more specific than just repeating the value chain category, i.e. "research and development expense" would not be enough detail for the right hand column. Question 6: You can be sure that iRobot has lots of fixed and variable costs. Describe 3 fixed costs and 3 variable costs that iRobot would probably have, after considering all the information about the company. Be ure to indicate what the expense is for. For example, give more information than just "wages"; a better response would be "wages for the accountants" Question 7: iRobot has both product and period costs. Describe 3 product costs and 3 period costs that iRobot probably experiences as they operate the business. Be sure to indicate what the expense is for. For example, give more information than just "wages"; a better response would be "wages for the accountants Question 8: The financial data shows that iRobot sold 2,943 units in 2016. What is the average product cost in 2016 for each one of those units? What is the average unit selling price? Question 9: Suppose that in 2017, iRobot produces 3400 units and sells 3200 units. Sales price is $220 each. Assume that all units have an average product cost of $110 each. Prepare their 2017 income statement through gross margin. Question 10: iRobot has been involved in a patent dispute with Black and Decker over their robotic vacuum. This dispute has resulted in huge legal bills. The outcome of this legal dispute had a huge potential impact on the sales of iRobot's Roomba vacuums. Suppose the legal bills associated with the dispute in 2016 were $5,000 and that $5,000 has been included in the 2016 financial results. What was the impact on the following items reported on the 2016 financial statements of that additional $5,000 expense? Did it make the number higher or lower and by how much? (Remember we are dealing with rounded numbers, really that is 5 million dollars, as all the numbers presented are in the thousands. That's why it looks so small)