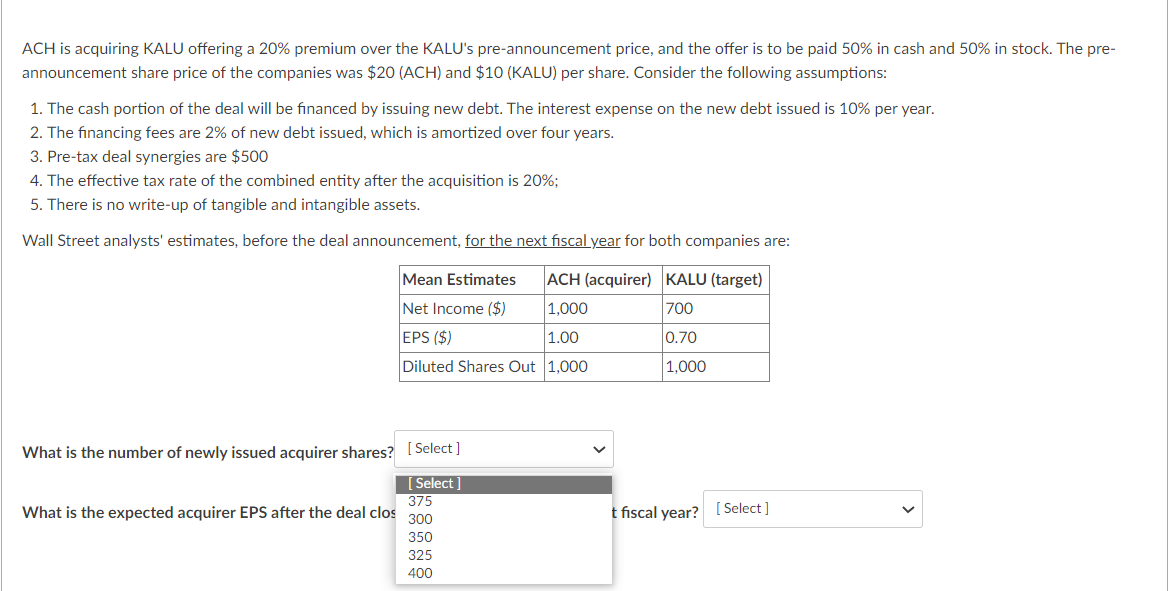

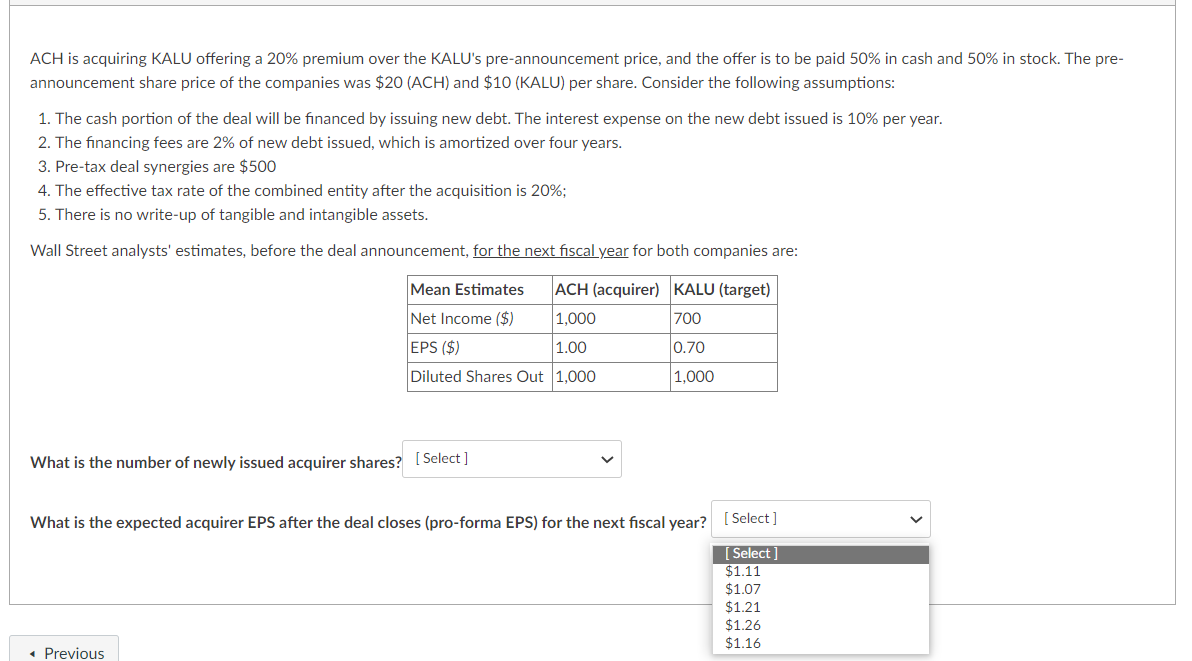

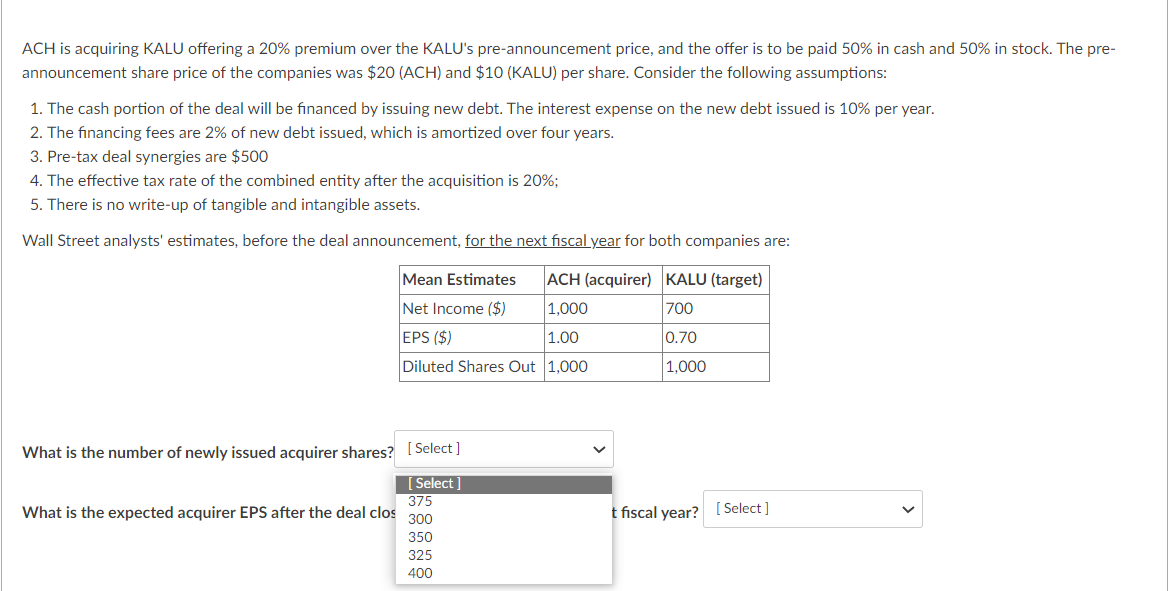

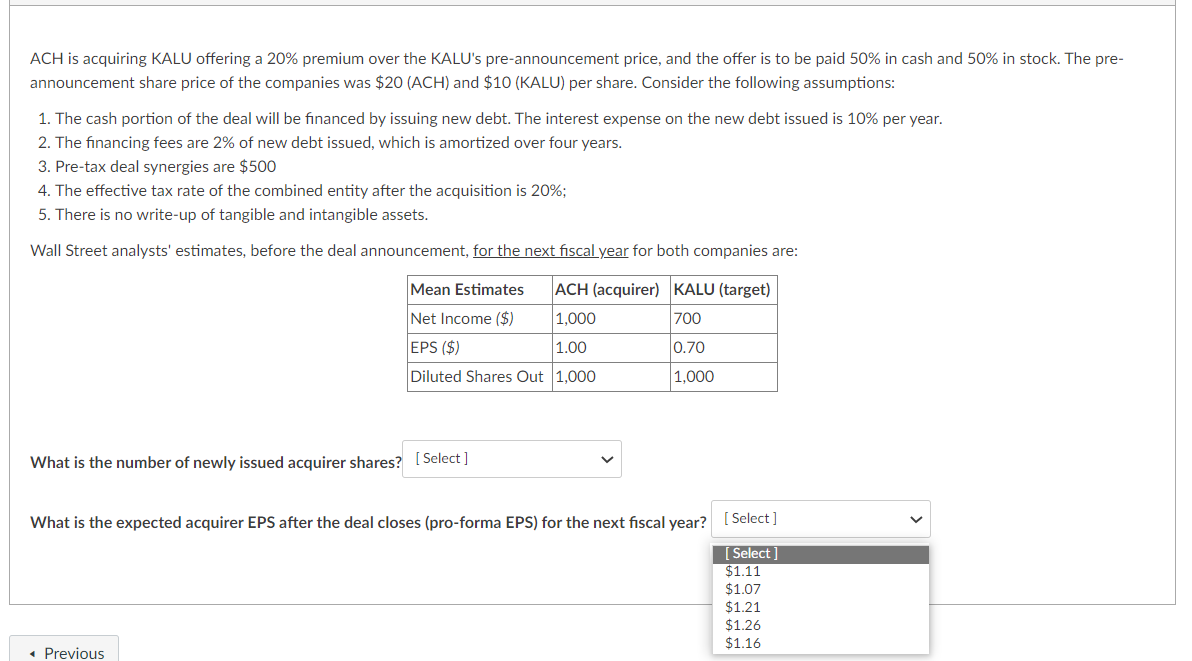

ACH is acquiring KALU offering a 20% premium over the KALU's pre-announcement price, and the offer is to be paid 50% in cash and 50% in stock. The pre- announcement share price of the companies was $20 (ACH) and $10 (KALU) per share. Consider the following assumptions: 1. The cash portion of the deal will be financed by issuing new debt. The interest expense on the new debt issued is 10% per year. 2. The financing fees are 2% of new debt issued, which is amortized over four years. 3. Pre-tax deal synergies are $500 4. The effective tax rate of the combined entity after the acquisition is 20%; 5. There is no write-up of tangible and intangible assets. Wall Street analysts' estimates, before the deal announcement, for the next fiscal year for both companies are: Mean Estimates ACH (acquirer) KALU (target) 1,000 700 Net Income ($) EPS ($) 1.00 0.70 Diluted Shares Out 1,000 1,000 What is the number of newly issued acquirer shares? [Select] What is the expected acquirer EPS after the deal clos t fiscal year? (Select] [ Select ] 375 300 350 325 400 ACH is acquiring KALU offering a 20% premium over the KALU's pre-announcement price, and the offer is to be paid 50% in cash and 50% in stock. The pre- announcement share price of the companies was $20 (ACH) and $10 (KALU) per share. Consider the following assumptions: 1. The cash portion of the deal will be financed by issuing new debt. The interest expense on the new debt issued is 10% per year. 2. The financing fees are 2% of new debt issued, which is amortized over four years. 3. Pre-tax deal synergies are $500 4. The effective tax rate of the combined entity after the acquisition is 20%; 5. There is no write-up of tangible and intangible assets. Wall Street analysts' estimates, before the deal announcement, for the next fiscal year for both companies are: Mean Estimates ACH (acquirer) KALU (target) 1,000 700 Net Income ($) EPS ($) 1.00 0.70 Diluted Shares Out 1,000 1,000 WI is the number of newly issued acquirer shares? (Select] What is the expected acquirer EPS after the deal closes (pro-forma EPS) for the next fiscal year? [Select] [ Select ] $1.11 $1.07 $1.21 $1.26 $1.16