Answered step by step

Verified Expert Solution

Question

1 Approved Answer

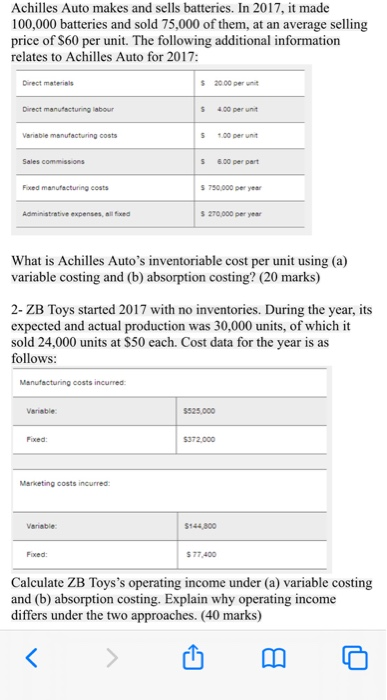

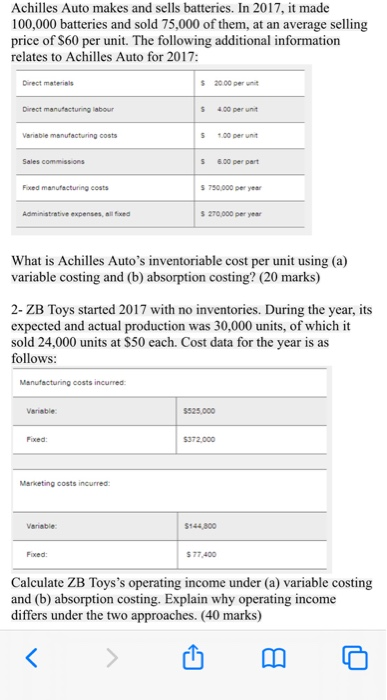

Achilles Auto makes and sells batteries. In 2017, it made 100,000 batteries and sold 75,000 of them, at an average selling price of $60 per

Achilles Auto makes and sells batteries. In 2017, it made 100,000 batteries and sold 75,000 of them, at an average selling price of $60 per unit. The following additional information relates to Achilles Auto for 2017: Direct materials $20.00 per unit Direct manufacturing labour $ 4.00 per unit Variable manufacturing costs $1.00 per unit Sales commissions 5 5.00 per part Fored manufacturing costs $ 750.000 per year Administrative expenses, all find $ 270,000 per year What is Achilles Auto's inventoriable cost per unit using (a) variable costing and (b) absorption costing? (20 marks) 2- ZB Toys started 2017 with no inventories. During the year, its expected and actual production was 30,000 units, of which it sold 24,000 units at $50 each. Cost data for the year is as follows: Manufacturing costs incurred: $325,000 Variable: Fixed 5372.000 Marketing costs incurred: Variable: $144,300 Fixed 577400 Calculate ZB Toys's operating income under (a) variable costing and (b) absorption costing. Explain why operating income differs under the two approaches. (40 marks)

Achilles Auto makes and sells batteries. In 2017, it made 100,000 batteries and sold 75,000 of them, at an average selling price of $60 per unit. The following additional information relates to Achilles Auto for 2017: Direct materials $20.00 per unit Direct manufacturing labour $ 4.00 per unit Variable manufacturing costs $1.00 per unit Sales commissions 5 5.00 per part Fored manufacturing costs $ 750.000 per year Administrative expenses, all find $ 270,000 per year What is Achilles Auto's inventoriable cost per unit using (a) variable costing and (b) absorption costing? (20 marks) 2- ZB Toys started 2017 with no inventories. During the year, its expected and actual production was 30,000 units, of which it sold 24,000 units at $50 each. Cost data for the year is as follows: Manufacturing costs incurred: $325,000 Variable: Fixed 5372.000 Marketing costs incurred: Variable: $144,300 Fixed 577400 Calculate ZB Toys's operating income under (a) variable costing and (b) absorption costing. Explain why operating income differs under the two approaches. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started