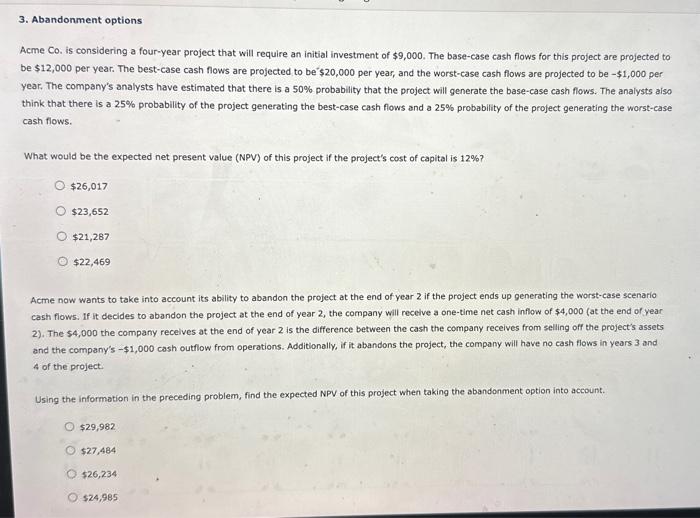

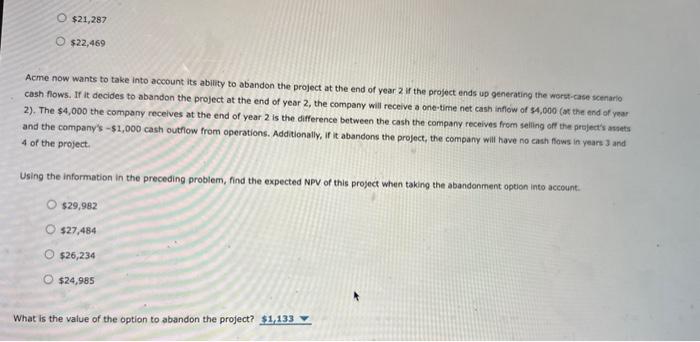

Acme Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are projected to be $12,000 per year. The best-case cash flows are projected to be' $20,000 per year, and the worst-case cash flows are projected to be $1,000 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts aiso think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project's cost of capital is 12% ? $26,017$23,652$21,287$22,469 Acme now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end of year 2 , the company will recelve a one-time net cash inflow of $4,000 (at the end of year 2). The 54,000 the company recelves at the end of year 2 is the difference between the cash the company receives from selling off the project's assets and the company's $1,000 cosh outflow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and 4 of the project. Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. $29,982$27,484$26,234$24,985 $21,287 $22,469 Acme now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario. cash flows. If it decides to abandon the project at the end of year 2 , the company will receive a one.time net cash inflow of s4,000 (at the end of yerar 2). The $4,000 the company receives at the end of year 2 is the difference between the cash the company receives from seiling off the preject's asaets and the company's 51,000 cash outfiow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and 4 of the project. Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. $29,982$27,484$26,234$24,965 What is the value of the option to abandon the project