Answered step by step

Verified Expert Solution

Question

1 Approved Answer

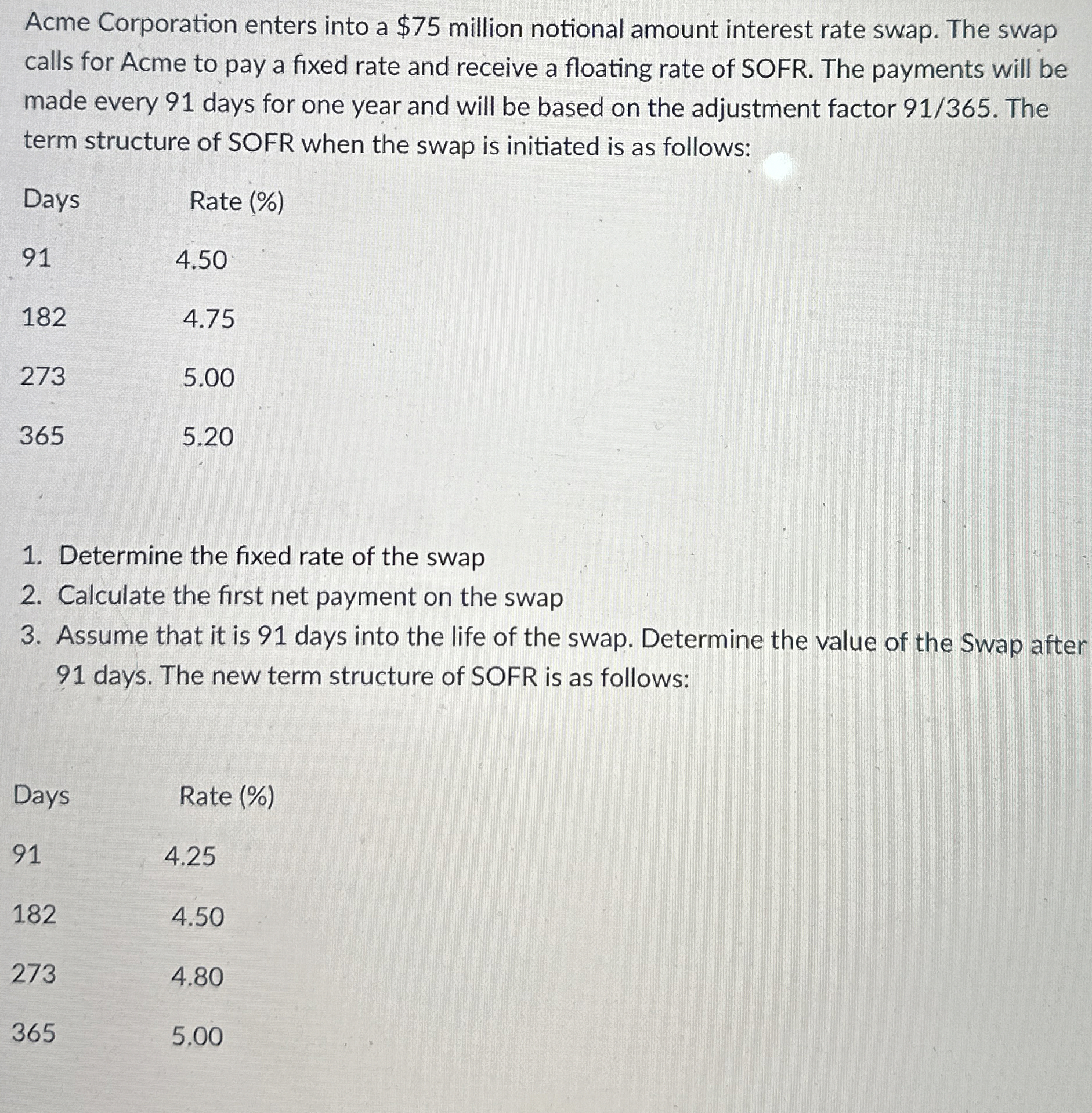

Acme Corporation enters into a $ 7 5 million notional amount interest rate swap. The swap calls for Acme to pay a fixed rate and

Acme Corporation enters into a $ million notional amount interest rate swap. The swap calls for Acme to pay a fixed rate and receive a floating rate of SOFR. The payments will be made every days for one year and will be based on the adjustment factor The term structure of SOFR when the swap is initiated is as follows:

tableDaysRate

Determine the fixed rate of the swap

Calculate the first net payment on the swap

Assume that it is days into the life of the swap. Determine the value of the Swap after days. The new term structure of SOFR is as follows:

tableDaysRate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started