Question

Acme, Inc., is preparing its financial statements for Year 10. Acme's income tax rate for all relevant years is 30%, and Acme will issue financial

Acme, Inc., is preparing its financial statements for Year 10. Acme's income tax rate for all relevant years is 30%, and Acme will issue financial statements for Year 10 only. You are adding correcting entries to the general ledger.

Prepare the journal entries for each of the following events/transactions. If no entry is required, state, 'No entry required'

1. On January 1, Year 10, Acme changed inventory methods from LIFO to FIFO for both financial and income tax reporting purposes. The change resulted in a $500,000 increase in the January 1, Year 10, Inventory

2. On January 1, Year 7, Acme purchased a machine for $528,000 and depreciated it by the straight-line method using an estimated useful life of 8 years with no salvage value. On January 1, Year 10, Acme determined that the machine had a useful life of 6 years from the date of acquisition and would have a salvage value of $48,000. An accounting change was made in Year 10 to reflect the additional data.

3. In August Year 10, Acme's accountant discovered that insurance premiums of $60,000 for the 3-year period beginning January 1, Year 9, had been paid and fully expensed in Year 9.

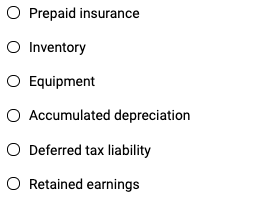

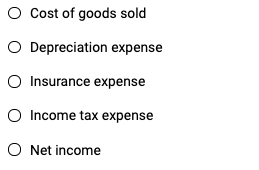

List of Account Names:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started