Question

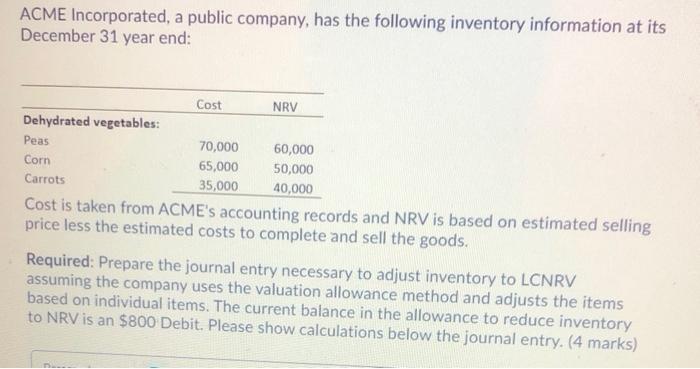

ACME Incorporated, a public company, has the following inventory information at its December 31 year end: Dehydrated vegetables: Peas Corn Carrots Cost 70,000 65,000

ACME Incorporated, a public company, has the following inventory information at its December 31 year end: Dehydrated vegetables: Peas Corn Carrots Cost 70,000 65,000 35,000 NRV 60,000 50,000 40,000 Cost is taken from ACME's accounting records and NRV is based on estimated selling price less the estimated costs to complete and sell the goods. Required: Prepare the journal entry necessary to adjust inventory to LCNRV assuming the company uses the valuation allowance method and adjusts the items based on individual items. The current balance in the allowance to reduce inventory to NRV is an $800 Debit. Please show calculations below the journal entry. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Peas Corn Carrots Totals Product Requirement a Cost Requirement b Gener...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul K. Chaney

7th edition

1119373204, 9781119373254 , 978-1119373209

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App