Question

? ACME Manufacturing management is considering replacing an existing production line with a new line that has a greater output capacity and operates with less

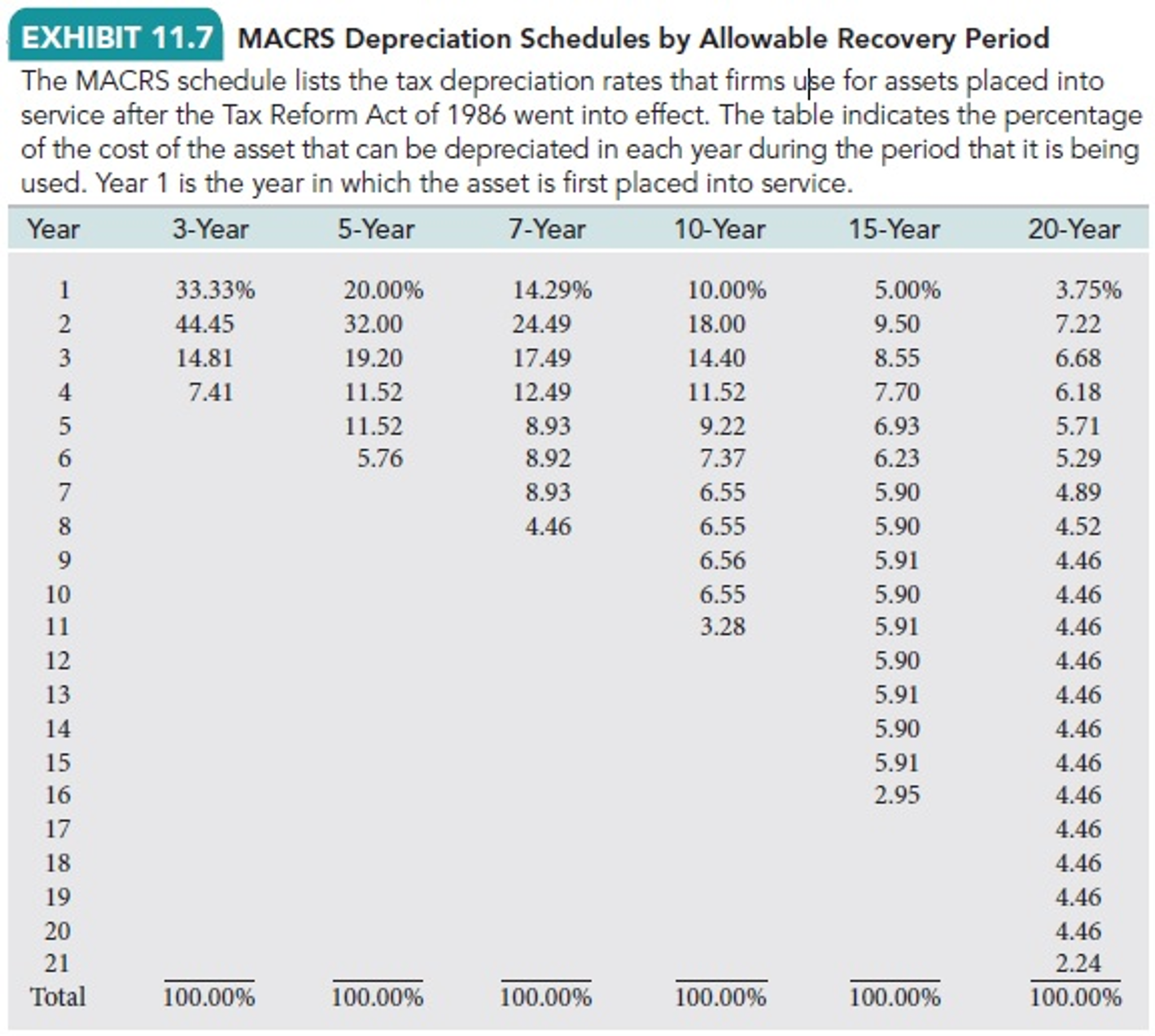

?ACME Manufacturing management is considering replacing an existing production line with a new line that has a greater output capacity and operates with less labor than the existing line. The new line would cost $1 million, have a five-year life, and be depreciated using MACRS over three years. At the end of five years, the new line could be sold as scrap for $150,000 (in Year 5 dollars). Because the new line is more automated, it would require fewer operators, resulting in a savings of $30,000 per year before tax and unadjusted for inflation (in today's dollars). Additional sales with the new machine are expected to result in additional net cash inflows, before tax, of $45,000 per year (in todays dollars). If ACME invests in the new line, a one-time investment of $10,000 in additional working capital will be required. The tax rate is 35 percent, the opportunity cost of capital is 10 percent, and the annual rate of inflation is 4.70 percent. What is the NPV of the new production line? (Round intermediate calculations and final answer to the nearest whole dollar, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started