Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acme Manufacturing wants to raise $ 1 0 0 million of 3 - year debt in the Euromarket ( where interest is quoted and paid

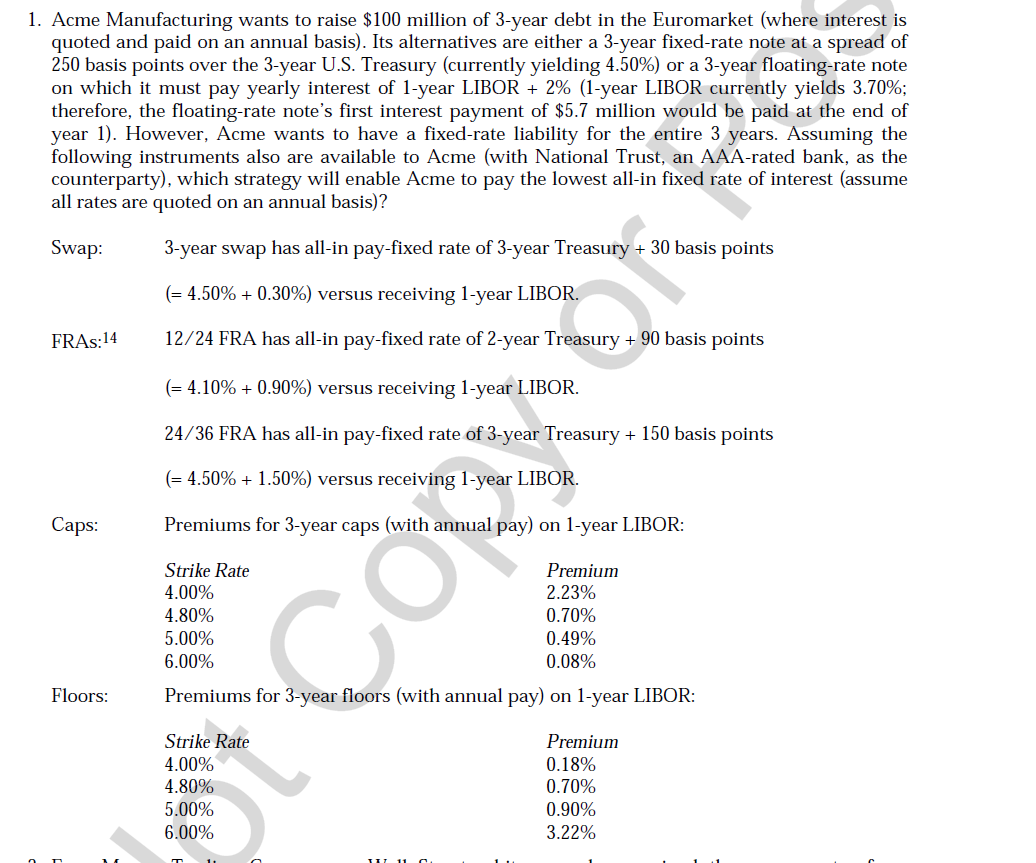

Acme Manufacturing wants to raise $ million of year debt in the Euromarket where interest is

quoted and paid on an annual basis Its alternatives are either a year fixedrate note at a spread of

basis points over the year US Treasury currently yielding or a year floatingrate note

on which it must pay yearly interest of year LIBOR year LIBOR currently yields ;

therefore, the floatingrate note's first interest payment of $ million would be paid at the end of

year However, Acme wants to have a fixedrate liability for the entire years. Assuming the

following instruments also are available to Acme with National Trust, an AAArated bank, as the

counterparty which strategy will enable Acme to pay the lowest allin fixed rate of interest assume

all rates are quoted on an annual basis

Swap: year swap has allin payfixed rate of year Treasury basis points

versus receiving year LIBOR.

FRAs: FRA has allin payfixed rate of year Treasury basis points

versus receiving year LIBOR.

FRA has allin payfixed rate of year Treasury basis points

versus receiving year LIBOR.

Caps: Premiums for year caps with annual pay on year LIBOR:

Floors: Premiums for year floors with annual pay on year LIBOR:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started