Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acme Mutual Fund is a broadly diversified portfolio of stocks which has an expected return of 12.00% and a volatility of 20.86%. The risk free

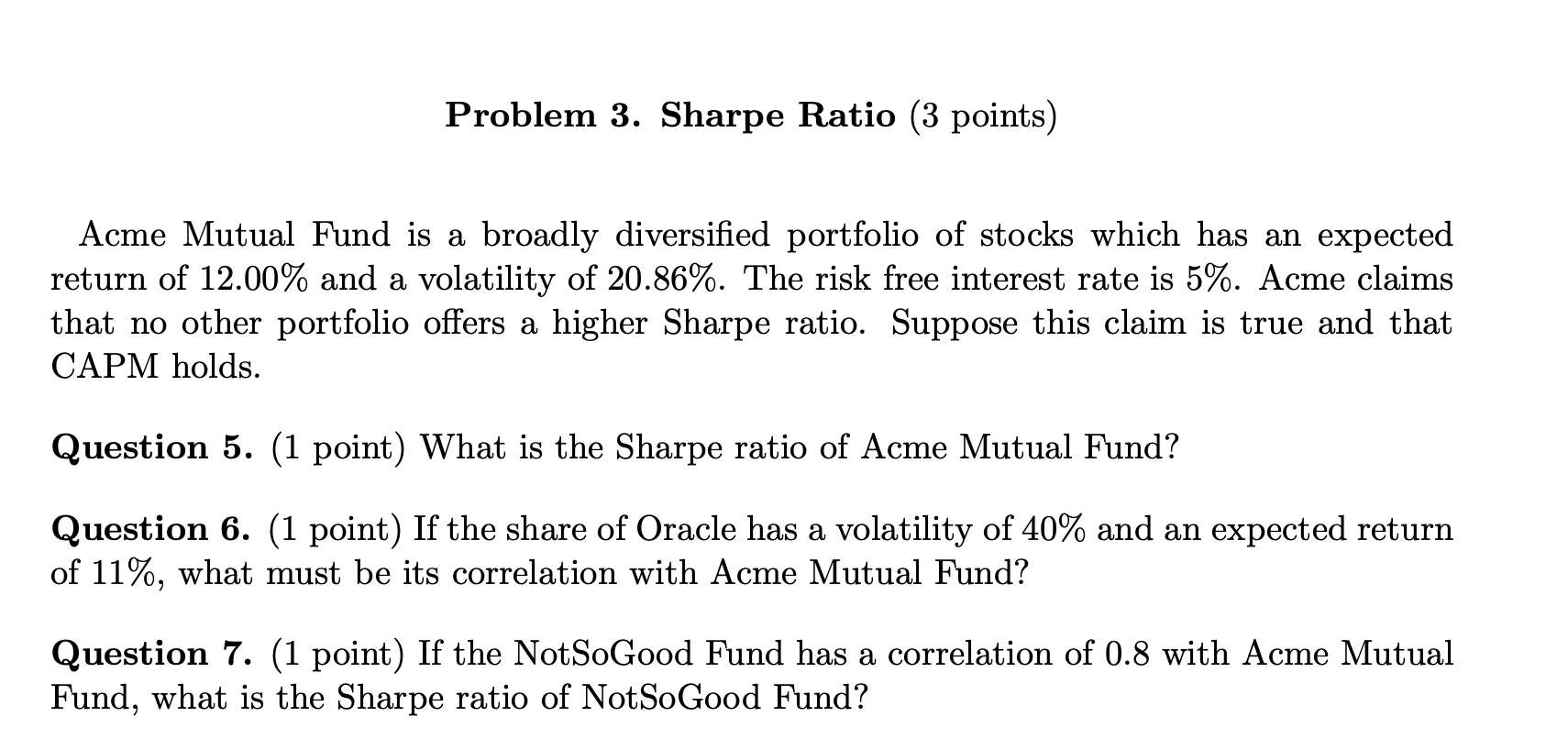

Acme Mutual Fund is a broadly diversified portfolio of stocks which has an expected return of 12.00% and a volatility of 20.86%. The risk free interest rate is 5%. Acme claims that no other portfolio offers a higher Sharpe ratio. Suppose this claim is true and that CAPM holds. Question 5. (1 point) What is the Sharpe ratio of Acme Mutual Fund? Question 6. (1 point) If the share of Oracle has a volatility of 40% and an expected return of 11%, what must be its correlation with Acme Mutual Fund? Question 7. (1 point) If the NotSoGood Fund has a correlation of 0.8 with Acme Mutual Fund, what is the Sharpe ratio of NotSoGood Fund

Acme Mutual Fund is a broadly diversified portfolio of stocks which has an expected return of 12.00% and a volatility of 20.86%. The risk free interest rate is 5%. Acme claims that no other portfolio offers a higher Sharpe ratio. Suppose this claim is true and that CAPM holds. Question 5. (1 point) What is the Sharpe ratio of Acme Mutual Fund? Question 6. (1 point) If the share of Oracle has a volatility of 40% and an expected return of 11%, what must be its correlation with Acme Mutual Fund? Question 7. (1 point) If the NotSoGood Fund has a correlation of 0.8 with Acme Mutual Fund, what is the Sharpe ratio of NotSoGood Fund Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started