Question

ACME Real Estate (ARE) provides real estate services including property sales, leasing, and management; corporate services, facilities, and project management; mortgage banking; investment management and

ACME Real Estate (ARE) provides real estate services including property sales, leasing, and management; corporate services, facilities, and project management; mortgage banking; investment management and capital markets; appraisal and valuation; and research and consulting. Headquartered in Chicago, ARE has nearly 1,000 employees in more than 25 offices in 7 countries. The company reported net revenues of $500 million in 2013.

Calculating the ROl

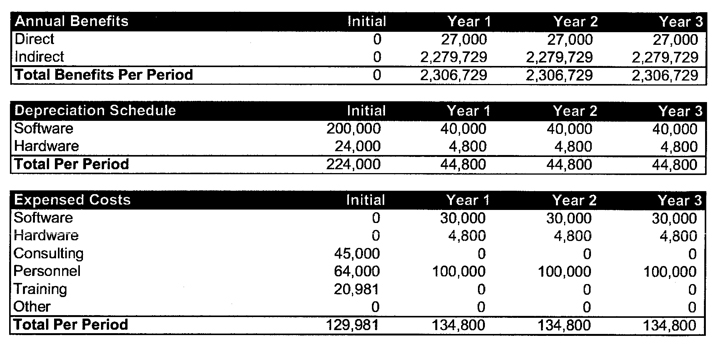

Three main benefit areas were quantified in calculating the ROI from ARE?s investment in the Microsoft Content Management Server: reduced administrative overhead, increased IT staff productivity, increased general employee productivity, and improved customer satisfaction. One person responsible for managing international content was eliminated, reducing administrative overhead. IT and general employee productivity savings were calculated based on the fully-loaded employee cost. ARE calculated IT and general employee time savings associated with the new content management solution and compared them to the former one. Customer satisfaction was captured in a post-web use survey.

Assumptions: 15% discount rate

Calculate the following:

a. Annual ROI (don?t worry about tax consequences)

b. Total Cost of ownership

c. Average annual cost of ownership

d. Net present value in year 3

e. Payback period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started