Answered step by step

Verified Expert Solution

Question

1 Approved Answer

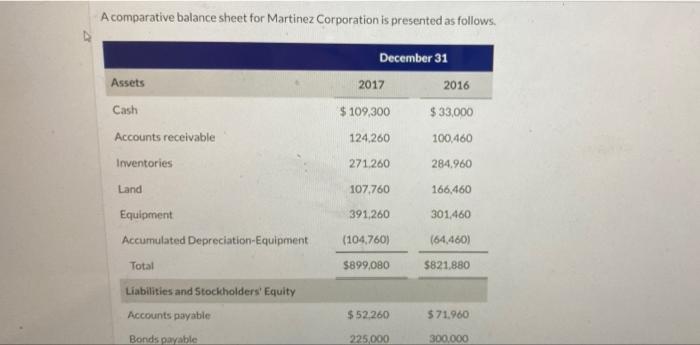

Acomparative balance sheet for Martinez Corporation is presented as follows. December 31 Assets 2017 2016 Cash $ 109,300 $ 33,000 Accounts receivable 124.260 100,460

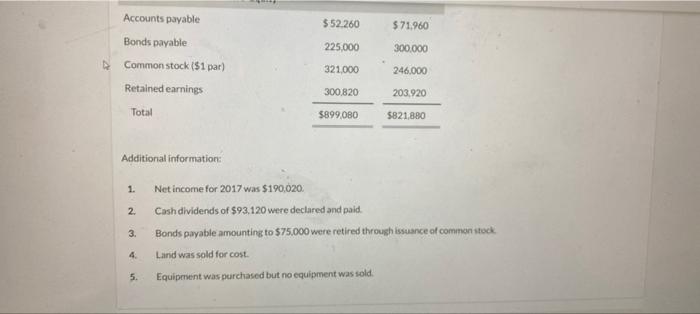

Acomparative balance sheet for Martinez Corporation is presented as follows. December 31 Assets 2017 2016 Cash $ 109,300 $ 33,000 Accounts receivable 124.260 100,460 Inventories 271.260 284,960 Land 107,760 166,460 Equipment 391,260 301,460 Accumulated Depreciation-Equipment (104,760) (64,460) Total $899,080 $821.880 Liabilities and Stockholders' Equity Accounts payable $ 52,260 $71.960 Bonds payable 225,000 300.000 Accounts payable $ 52.260 $71.960 Bonds payable 225,000 300.000 * Common stock ($1 par) 321,000 246.000 Retained earnings 300,820 203,920 Total $899,080 $821.880 Additional information: 1. Net income for 2017 was $190,020. 2. Cash dividends of $93,120 were declared and paid. 3. Bonds payable amounting to $75,000 were retired through issuance of common stock 4. Land was sold for cost. 5. Equipment was purchased but no equipment was sold. (a) Prepare a statement of cash flows for 2017 for Martinez Corporation. (Show amounts that decrease cash flow with either a-signeg -15,000 or in parenthesis es. (15,000)J MARTINEZ CORPORATION Statement of Cash Flows Adjustments to reconcile net income to

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow statement Particulars Amount Cash flow from oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started