Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a)Compute the following financial ratios for 2020 and 2021. (i) Gross profit margin (ii) Inventories turnover period (iii) Settlement period for trade receivables (iv) Settlement

(a)Compute the following financial ratios for 2020 and 2021.

(i) Gross profit margin

(ii) Inventories turnover period

(iii) Settlement period for trade receivables

(iv) Settlement period for trade payables

(v) Gearing ratio

(vi) Cash operating cycle

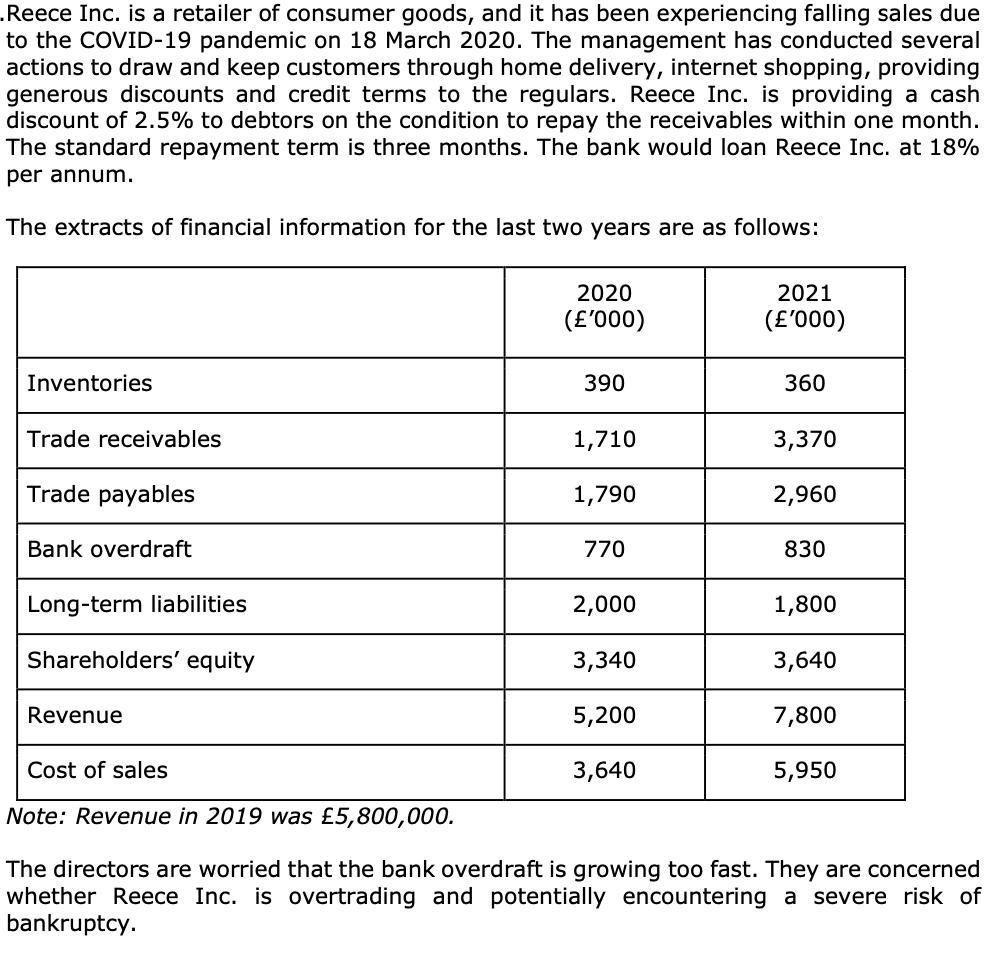

Reece Inc. is a retailer of consumer goods, and it has been experiencing falling sales due to the COVID-19 pandemic on 18 March 2020. The management has conducted several actions to draw and keep customers through home delivery, internet shopping, providing generous discounts and credit terms to the regulars. Reece Inc. is providing a cash discount of 2.5% to debtors on the condition to repay the receivables within one month. The standard repayment term is three months. The bank would loan Reece Inc. at 18% per annum. The extracts of financial information for the last two years are as follows: Note: Revenue in 2019 was 5,800,000. The directors are worried that the bank overdraft is growing too fast. They are concerned whether Reece Inc. is overtrading and potentially encountering a severe risk of bankruptcyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started