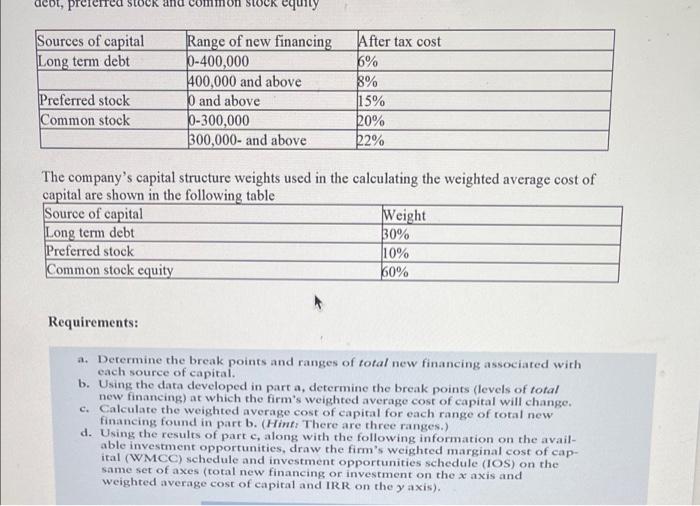

acot, precht CR and equity Sources of capital Long term debt Range of new financing 0-400,000 400,000 and above and above 0-300,000 300,000- and above After tax cost 6% 8% 15% 20% 52% Preferred stock Common stock The company's capital structure weights used in the calculating the weighted average cost of capital are shown in the following table Source of capital Weight Long term debt 30% Preferred stock 110% Common stock equity 60% Requirements: a. Determine the break points and ranges of total new financing associated with each source of capital. b. Using the data developed in part a, determine the break points (levels of total new financing) at which the firm's weighted average cost of capital will change. c. Calculate the weighted average cost of capital for each range of total new financing found in part b. (Hint: There are three ranges.) d. Using the results of parte, along with the following information on the avail able investment opportunities, draw the firm's weighted marginal cost of cap- ital (WMCC) schedule and investment opportunities schedule (IOS) on the same set of axes (total new financing or investment on the x axis and weighted average cost of capital and IRR on the y axis), acot, precht CR and equity Sources of capital Long term debt Range of new financing 0-400,000 400,000 and above and above 0-300,000 300,000- and above After tax cost 6% 8% 15% 20% 52% Preferred stock Common stock The company's capital structure weights used in the calculating the weighted average cost of capital are shown in the following table Source of capital Weight Long term debt 30% Preferred stock 110% Common stock equity 60% Requirements: a. Determine the break points and ranges of total new financing associated with each source of capital. b. Using the data developed in part a, determine the break points (levels of total new financing) at which the firm's weighted average cost of capital will change. c. Calculate the weighted average cost of capital for each range of total new financing found in part b. (Hint: There are three ranges.) d. Using the results of parte, along with the following information on the avail able investment opportunities, draw the firm's weighted marginal cost of cap- ital (WMCC) schedule and investment opportunities schedule (IOS) on the same set of axes (total new financing or investment on the x axis and weighted average cost of capital and IRR on the y axis)