Answered step by step

Verified Expert Solution

Question

1 Approved Answer

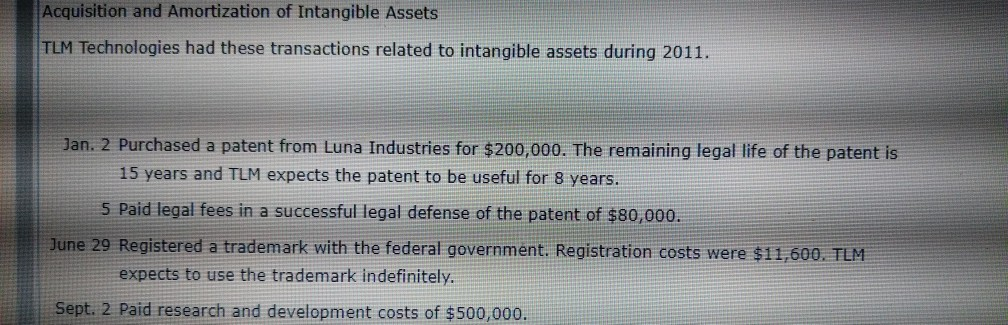

Acquisition and Amortization of Intangible Assets TLM Technologies had these transactions related to intangible assets during 2011. Jan. 2 Purchased a patent from Luna Industries

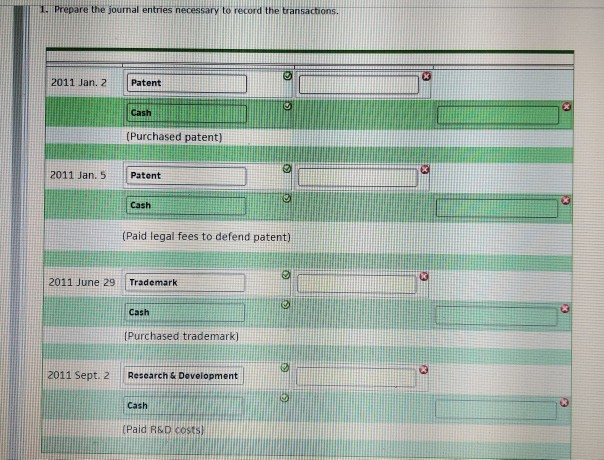

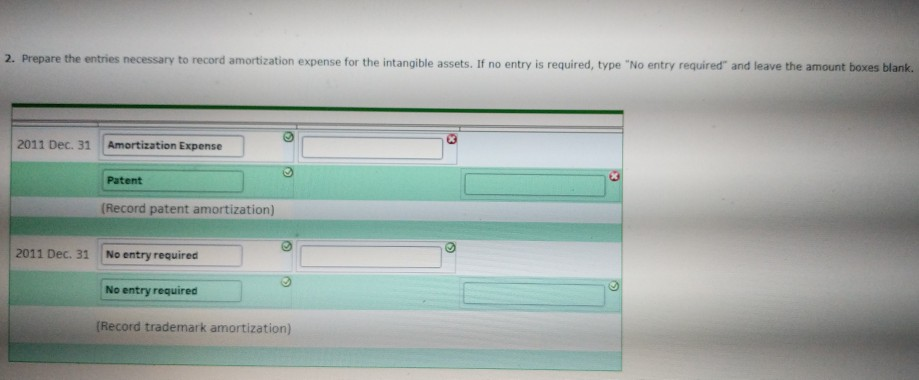

Acquisition and Amortization of Intangible Assets TLM Technologies had these transactions related to intangible assets during 2011. Jan. 2 Purchased a patent from Luna Industries for $200,000. The remaining legal life of the patent is 15 years and TLM expects the patent to be useful for 8 years. 5 Paid legal fees in a successful legal defense of the patent of $80,000. June 29 Registered a trademark with the federal government. Registration costs were $11,600. TLM expects to use the trademark indefinitely. Sept. 2 Paid research and development costs of $500,000. 1. Prepare the journal entries necessary to record the transaction 2011 Jan. 2 Patent Cash (Purchased patent) 2011 Jan. 5 Patent Cash (Paid legal fees to defend patent) 2011 June 29 Trademark Cash (Purchased trademark) 2011 Sept. 2 Research & Development Cash (Paid R&D costs) 2. Prepare the entries necessary to record amortization expense for the intangible assets. If no entry is required, type "No entry required and leave the amount boxes blank. 2011 Dec. 31 Amortization Expense Patent (Record patent amortization) 2011 Dec. 31 No entry required No entry required (Record trademark amortization) 3. What is the balance of the intangible assets at the end of 2011? Patent $ Trademark 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started