Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acquisition Case Study: Please put together a 2~3 pages summary that covers: 1. Background information of the deal 2. Potential opportunity 3. Potential Issue 4.

Acquisition Case Study:

Please put together a 2~3 pages summary that covers:

1. Background information of the deal 2. Potential opportunity 3. Potential Issue 4. Your reasoning of why X made a bid for A 5. Your reasoning of why UBS is against X bid of A

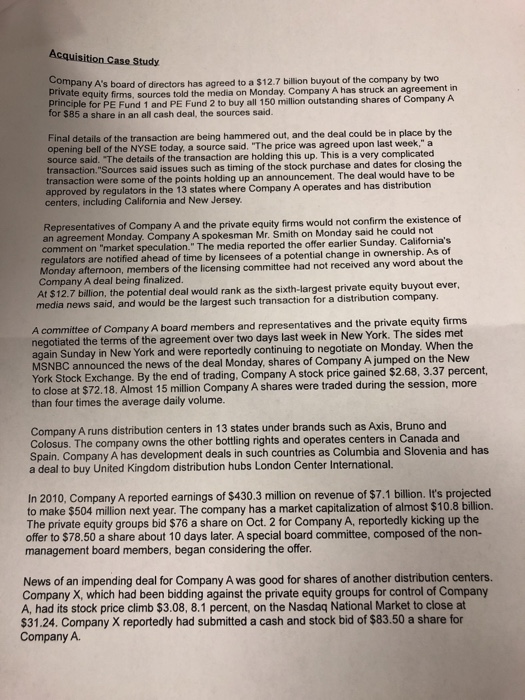

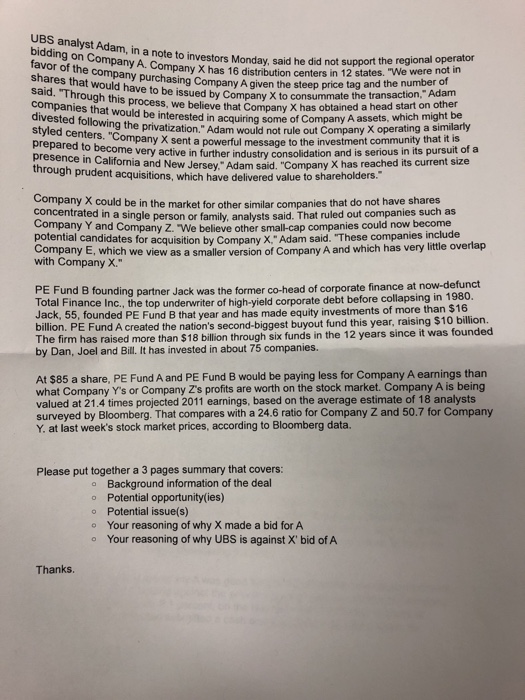

Acquisition Case Study brompany A's board of directors has agreed to a $12.7 billion buyout of the company by two t in private equity firms, sources told the media on Monday, Company A has struck an agreemen principle for PE Fund 1 and PE Fund 2 to buy all 150 million outstanding shares of Company A for $85 a share in an all cash deal, the sources said Final details of the transaction are being hammered out, and the deal could be in place by the opening bell of the NYSE today, a source said. "The price was agreed upon last week," a source said. "The details of the transaction are holding this up. This is a very complicated transaction. "Sources said issues such as timing of the stock purchase and dates for closing the transaction were some of the points holding up an announcement. The deal would have to be A operates and has distribution approved by regulators in the 13 states where Company centers, including California and New Jersey Representatives of Company A and the private equity firms would not confirm the existence of an agreement Monday. Company A spokesman Mr. Smith on Monday said he could not t on "market speculation." The media reported the offer earlier Sunday. California's ees of a potential change in ownership. As of commen regulators are notified ahead of time by licens onday afternoon, members of the licensing committee had not received any word about the At $12.7 billion, the potential deal would rank as the sixth-largest private equity media news said, and would be the largest A committee of Company A board members and representatives and the private equity firms negotiated the terms of the agreement over two days last week in New York. The sides met again Sunday in New York and were reportedly continuing to negotiate on Monday. When the MSNBC announced the news York Stock Exchange. By the end of trading, Company A stock price gained $2.68, 3.37 percent, of the deal Monday, shares of Company A jumped on the New to close at $72.18. Almost 15 million Company A shares were traded during the session, more than four times the average daily volume. Company A runs distribution centers in 13 states under brands such as Axis, Bruno and Colosus. The company owns the other bottling rights and operates centers in Canada and Spain. Company A has development deals in such countries as Columbia and Slovenia and has a deal to buy United Kingdom distribution hubs London Center International. In 2010, Company A reported earnings of $430.3 million on revenue of $7.1 billion. It's projected to make $504 million next year. The company has a market capitalization of almost $10.8 bilion. The private equity groups bid $76 a share on Oct. 2 for Company A, reportedly kicking up the offer to $78.50 a share about 10 days later. A special board committee, composed of the non- management board members, began considering the offer News of an impending deal for Company A was good for shares of another distribution centers. Company X, which had been bidding against the private equity groups for control of Company A, had its stock price climb $3.08, 8.1 percent, on the Nasdaq National Market to close at $31.24. CompanyX reportedly had submited a cash and stock bid of $83.50 a share for Company A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started