Answered step by step

Verified Expert Solution

Question

1 Approved Answer

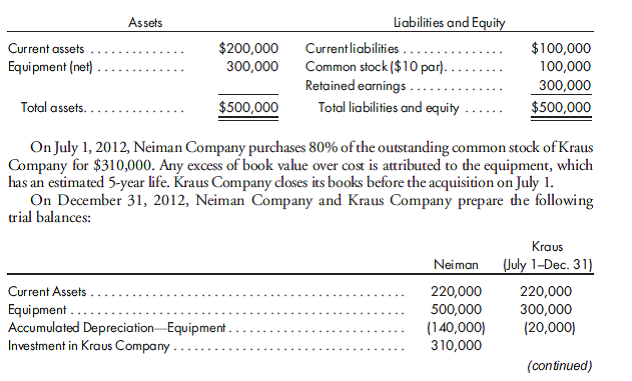

Acquisition during the year, elimination entries, income statement. Kraus Company has the following balance sheet on July 1, 2012: 1. Prepare a determination and distribution

Acquisition during the year, elimination entries, income statement. Kraus Company has the following balance sheet on July 1, 2012:

1. Prepare a determination and distribution of excess schedule for the investment (a value analysis is not needed).

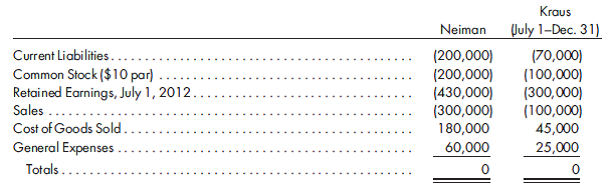

2. Prepare all the eliminations and adjustments that would be made on the December 31, 2012, consolidated worksheet.

3. Prepare the 2012 consolidated income statement and its related income distribution schedules.

On July 1, 2012, Neiman Company purchases 80% of the outstanding common stock of Kraus Company for $310,000. Any excess of book value over cost is attributed to the equipment, which has an estimated 5-year life. Kraus Company closes its books before the acquisition on July 1. On December 31, 2012, Neiman Company and Kraus Company prepare the following trial balances: KrausStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started